Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Tuesday, 7 November 2023 00:02 - - {{hitsCtrl.values.hits}}

Significant losses were recorded only by the Ceylon Petroleum Corporation, Ceylon Electricity Board, and SriLankan Airlines out of the 287 SOEs currently in operation

Advocata’s promotion of the privatisation of SOEs is a remedy that would amplify, not alleviate, Government corruption. It was after all colossal tax evasions and illicit capital flows of the private sector hand in hand with the political establishment and the Government bureaucracy that were central to Sri Lanka’s economic collapse

Advocata Institute is leading Sri Lanka’s privatisation bandwagon. Luckily for the developed capitalist economies of the West, and those that industrially transformed in the 20th century in Asia, the ultra-pro market policy of Advocata, never held sway in Government decision making. The unelected President Ranil Wickremesinghe’s false propaganda campaign around a subsidiary investment of the German automobile firm Volkswagen in Sri Lanka in 2015, would not have even been possible if the German state was so unfortunate to follow Advocata policies. Volkswagen commenced operations as a fully state owned enterprise (SOE) in 1934.

Advocata Institute is leading Sri Lanka’s privatisation bandwagon. Luckily for the developed capitalist economies of the West, and those that industrially transformed in the 20th century in Asia, the ultra-pro market policy of Advocata, never held sway in Government decision making. The unelected President Ranil Wickremesinghe’s false propaganda campaign around a subsidiary investment of the German automobile firm Volkswagen in Sri Lanka in 2015, would not have even been possible if the German state was so unfortunate to follow Advocata policies. Volkswagen commenced operations as a fully state owned enterprise (SOE) in 1934.

The German government partially divested the firm heavily in favour of small owners as opposed to major investors only in 1961. This article takes a closer look at some of the think tank’s claims on Government spending and SOE losses, debts and profits as well as its obfuscation of private sector corruption to show how its privatisation agenda is rooted in neoliberal dogma far removed from reality.

Did big governments brew corruption and collapse in the West and Asia?

The foundational claim of Advocata behind its privatisation push is that “big governments inevitably lead to corruption and failure”. However, contrarily, the state primarily led the economic transformation of the developed capitalist economies in the West and Asia (Japan, South Korea, Taiwan and China) in the 20th century, due to the apparent incapability of the market system by itself to industrially transform an underdeveloped economy and to maintain economic welfare and equilibrium in the developed economies, which is the central guiding principle of a social-market economy. It should also be noted that Western economies, most of which have similar population densities to Sri Lanka, increased state-led industrial undertakings to expand capital accumulation and employment precisely when the region was mired in its worst economic fallout under the Great Depression.

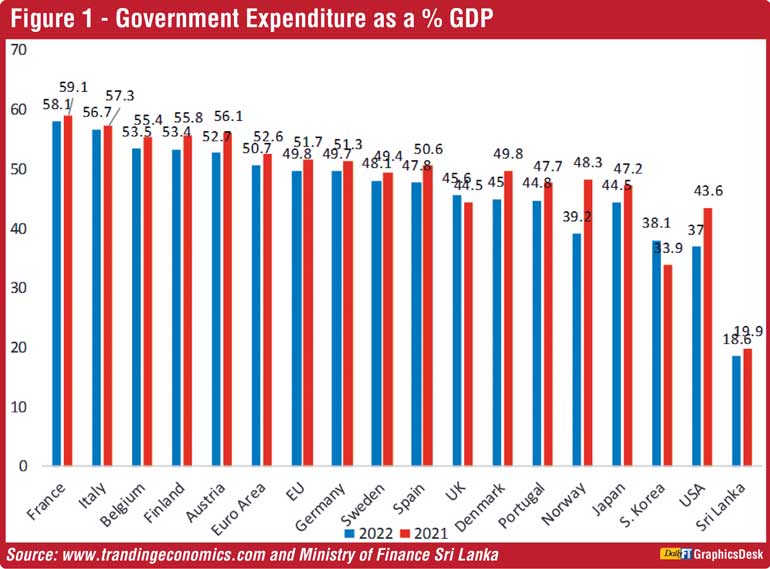

It would hence be imprudent to say that Sri Lankan Government cannot achieve the same due to current state of the economy and Government finance. Figure 1 shows that the most developed capitalist economies maintain the highest government expenditure as a ratio of the GDP while the opposite is true for underdeveloped economies. Government spending accounts for nearly half of the GDP in the European Union (EU), which is 2.7 times greater than Sri Lanka’s 18.6%. Hence, Advocata’s crusade against Government thus appears to be stemming from a spiritual belief in markets that is the opposite of reality.

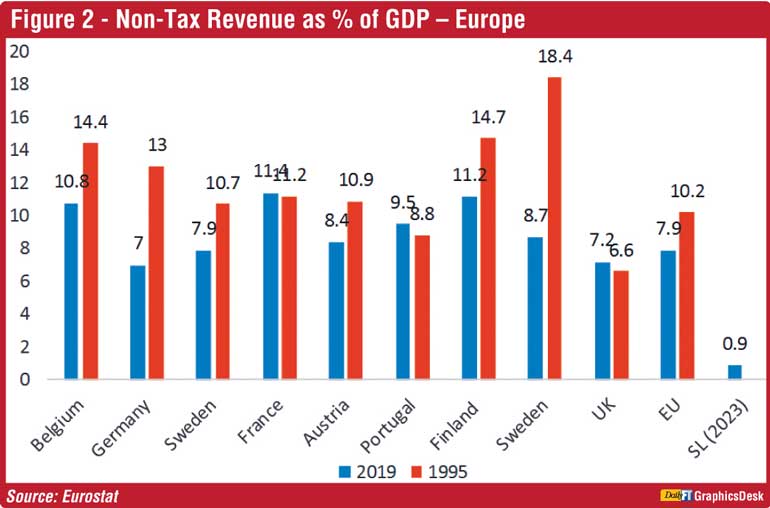

Further, developed capitalist economies accumulate significant revenue through SOEs compared to underdeveloped economies. Figure 2 indicates that non-tax revenue of the EU averaged 10.2% of the GDP in 1995 and 7.2% in 2019. In Sri Lanka the non-tax revenue was as low as 0.9% in 2023, eight times lesser than the EU average. The fate of the developed world would have come to match Sri Lanka’s if it had executed Advocata’s delusions, and the world would have been completely different as we know it now.

The IMF’s belated consideration of tax evasion and illicit financial flows in Sri Lanka

Further, Advocata’s promotion of the privatisation of SOEs is a remedy that would amplify, not alleviate, Government corruption. It was after all colossal tax evasions and illicit capital flows of the private sector hand in hand with the political establishment and the Government bureaucracy that were central to Sri Lanka’s economic collapse. The International Monetary Fund (IMF) in its latest preliminary review of Sri Lanka’s Extended Fund Facility (EFF) asserts that tax evasion is causing debt unsustainability and a lack of provisions to supply essential public services. The ongoing EFF is Sri Lanka’s 17th IMF program since the first agreement in 1965. Therefore, it has taken almost half a century for the IMF to realise that colossal tax evasion, illicit capital flows and foreign debt misappropriation have locked Sri Lanka into economic catastrophe. A key IMF demand in approving the second EFF disbursement is addressing tax evasion, removing tax holidays granted to Board of Investment firms and rationalising tax administration. These three measures are expected to raise tax revenue by a further 15% or by around Rs. 420 billion in 2023. This demonstrates the absurdity of Advocata’s argument that private sector corruption does not impair the collective welfare but will only have a limited impact on the private individuals involved, which is restricted by the competitive price system.

In its executive summary of the Governance Diagnostic on Sri Lanka, the first of its kind in Asia, the IMF further demands that Sri Lanka enacts proceeds of crime legislation that is fully aligned with the United Nations Convention Against Corruption (UNCAC) by April 2024. Asset recovery is one of the four fundamental principles of the UNCAC. Yet, as the IMF goes on to note, “current governance arrangements have not pursued individuals and stolen public funds that have exited the country.” The IMF therefore recognises that misappropriated public funds including the Government’s foreign debt have exited the economy through illicit channels. The current unelected Government, with the blessings of the Central Bank, has not pursued any litigation against perpetrators and has done nothing to retrieve such funds.

It is the independent Trade Union movement in Sri Lanka that has been raising public awareness of illicit capital flows and tax evasion with the support and endorsement of international and local academics (see https://debtjustice.org.uk/press-release/ghosh-piketty-and-varoufakis-among-182-experts-calling-for-sri-lanka-debt-cancellation; https://www.ft.lk/opinion/Open-letter-to-IMF-and-IMF-mission-in-to-Sri-Lanka/14-747321;https://www.ft.lk/opinion/SL-debt-justice-collective-writes-open-letter-to-IMF-on-DDO/14-753219). It was the voice of the people that forced the IMF to recognise these crimes and impose their conditions on the Government accordingly.

Privatisation will reduce Government revenue in the long run, worsen the country’s fiscal position, and increase the likelihood of corruption. The claims Advocata makes in support of privatisation are demonstrably false – following it will only accelerate Sri Lanka’s economic ruin, and deepen the Sri Lankan people’s suffering

However, it remains to be seen whether the IMF would strictly enforce these demands in approving future loan disbursements under the ongoing EFF. For instance, the 2024 Appropriation Bill is proposing to slash social security spending (Samurdhi and Aswasuma schemes) by as much as 48% to Rs. 55 billion, slashing the allocation on agriculture by around 15% to Rs. 100 billion while increasing the defence budget by around Rs. 15 billion and the allocation on transport and highways, a sector mired in corruption is increased by nearly 10%.

These draconian budget proposals are in place when poverty and food insecurity have gruesomely gripped well over half of the population in the country while the IMF demands social security spending of 0.6% of the GDP or Rs. 180 billion in 2023. This indicates that the illegitimate regime has no intention of relieving the public of its economic oppression and the IMF is merely proposing higher social security spending without binding it as a criterion to approve loan disbursement. This means that it is more concerned about the foreign debt repayment capacity of the Government and the interest of the international creditors, and do not distress over living condition of the masses. This is, of course, contrary to the flowery public rhetoric spouted by IMF officials.

SOE losses destabilise the economy

On the other hand, Advocata is proposing to further appease a business elite that’s at the centre of this misappropriation, by framing privatisation as a collective destiny, with talk of ‘private sector efficiencies’, ‘improved investment’, ‘lower prices’, and a host of other misleading descriptors. In neoclassical welfare economics private ownership of the means of production is a competitive equilibrium and Pareto optimal (no one can be made better off without making someone else worse off) only if: there are no externalities in production or consumption; the product is not a public good; the market is not monopolistic in structure; and information costs are low (William Megginson and Jeffery Netter, Journal of Economic Literature, 2001). The Sri Lankan economy features imperfectly competitive markets and the presence of externalities, which therefore justifies State intervention in production even under the neoclassical economic paradigm. This is reflected empirically by the experience of the developed capitalist economies discussed briefly thus far. Advocata’s assertion that governments are incapable of doing business while playing the role of the regulator therefore rests on theoretically and historically flawed ideological perversions that hold no water.

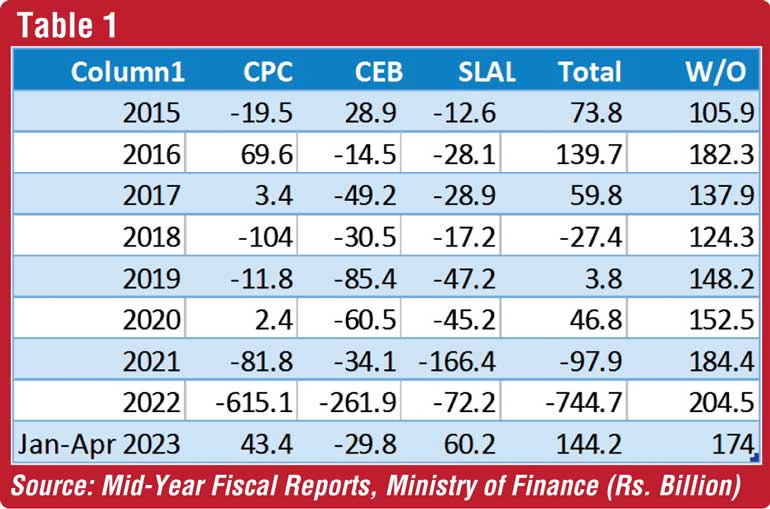

Advocata states that SOE losses are colossal, hence, privatisation will save Government funds thus benefiting the public and also earning revenue through asset sales. However, contrary to these assertions SOEs in general have been profitable. As shown in Table 1, significant losses were recorded only by the Ceylon Petroleum Corporation (CPC), Ceylon Electricity Board (CEB), and SriLankan Airlines (SLAL) out of the 287 SOEs currently in operation. The Table shows that except during 2021 and 2022, Sri Lanka’s SOEs have been generally profitable. If the losses of CPC, CEB and SLAL are discounted, total SOE profitability improves sharply.

Furthermore, abnormal losses in 2022 were due to the collapse of the currency which doubled the cost of imports on top of the increase in world market oil prices and the revaluation of firms’ foreign liabilities. Currency collapse was accelerated by illicit capital outflows and tax evasion on top of debt monetisation by the Central Bank. It is thus illogical and absurd to discredit SOEs when the origin of their losses is beyond their control.

As shown in Table 1, CPC is recording super profits following the increase in domestic oil prices in the first four months of 2023. On the other hand, despite the significant profits during the year, CPC will not be able to reduce prices to ease cost of living and the overall production cost of the economy, and subsequently provide the export sector a competitive edge, as it would eliminate foreign oil suppliers from the local market. Higher domestic oil prices have also increased losses in the CEB, escalating the living costs and cost of production, closing down factories and increasing unemployment, destroying the people’s means of survival.

The lower overall production costs achieved by supplying oil at a breakeven price or incurring marginal losses, should be converted into an increase in production and employment by the private sector. This in turn will raise the tax revenue above the initial drop in Government revenue incurred by discounting the supply price of the CPC. This is called the presence of a positive externality, which cannot be realised through a market mechanism. Hence, in the presence of positive externalities, privatisation is detrimental and sub-optimal to an economy.

Moreover, when the private sector is incapable of achieving this collective aim by exploiting the lower production costs to expand the productive output, as in Sri Lanka where the surplus/savings is destroyed in consumerism and siphoned off into offshore destinations, the government should further intervene to rationalise the capital accumulation process, replicating the experience of the developed capitalist nations.

Advocata fabrications on SOE debts and profits

Advocata points out that lossmaking SOEs are heavily indebted and that privatising them will relieve Government’s debt burden. On the contrary, what we see is that supply price of public utilities like oil, gas, electricity and water is increased multiple fold to ensure the saleability of the institutions while their debt remains a Government liability and is not passed down to private investors. The public will therefore inherit the losses in the form of SOE debt while investors reap super gains from privatisation after raising the supply price of essential utilities to market levels. As opposed to Government monopolies, the market mechanism has increased the supply prices contrary to Advocata’s assertions.

Advocata further states that profitable SOEs, despite recording higher total profits, have total investments that are larger than private sector firms and hence that their net returns are low. This is misleading given that Return on Equity (ROE) and Return on Assets (ROA) of SOEs like Sri Lanka Telecom (SLT) and Sri Lanka Insurance Corporation (SLIC) were higher in 2022 compared to private firms in their respective sectors. Moreover, annual accounts reveal that the ROE and ROA of both SLT and SLIC reduced notably following their initial divestments in the mid-90s, indicating that the new private owners could be underreporting earnings to evade corporate taxes.

Hence, privatising profitable SOEs will reduce the future cash inflows of the Government by both reducing tax incomes and net earnings, thereby worsening the fiscal crisis in the long run. The efficiency of SOEs can instead be ensured by subjecting the terms of contract and benefits of SOE managers to SOE performance.

In sum, privatisation will reduce Government revenue in the long run, worsen the country’s fiscal position, and increase the likelihood of corruption. The claims Advocata makes in support of privatisation are demonstrably false – following it will only accelerate Sri Lanka’s economic ruin, and deepen the Sri Lankan people’s suffering.

(The writer can be reached at [email protected].)