Saturday Feb 21, 2026

Saturday Feb 21, 2026

Monday, 30 June 2025 02:07 - - {{hitsCtrl.values.hits}}

Dr. W.A. Wijewardena delivering keynote

Colombo forum on road to recovery

Colombo forum on road to recovery

In a recent forum in Colombo on Sri Lanka’s road to recovery with special reference to debt and governance participated by the country’s top policy leaders, IMF’s leading managers and select private sector top brass, President Anura Kumara Disanayake is reported to have stressed his Government’s commitment to continue with the ongoing reforms to improve economic conditions and assure lasting stability, while expressing his desire to make the current IMF program the last one in Sri Lanka’s history.1

Offering IMF’s response to this, its First Deputy Managing Director Gita Gopinath is said to have appreciated the country’s commitment to reforms, while cautioning against the possibility of reverting to policy errors, a pitfall to which a country falls due to its failure to manage successfully the ailment known as ‘policy fatigue’.2

This forum was timely because it helped the country to assess its gains, identify policy errors, and make the necessary amends to keep the recovery program on track. It also provided an open forum for the three parties to meet and discuss the issues faced by the country when it takes the next step for consolidating the gains so far made to ensure sustained economic growth and stability. However, the wishes expressed will become a tall order in a background of adverse global shocks over which Sri Lanka does not have control.

External shocks

I wish to emphasise on two such external shocks which Sri Lanka should tackle immediately to keep the recovery program on track. One is the unilateral tariff hike by USA which is Sri Lanka’s largest export destination. The other is the sudden breakout of the military conflict between Israel and Iran dragging USA also as an active party to the conflict. Sri Lanka is not a party to either one, but these shocks have far-reaching implications on the country’s road to recovery.

Origin of tariff issue

The harsh tariff rates imposed by US President Donald Trump on all exporters to USA have squarely hit the poor countries that export mainly items like apparels and rubber products. The list is long, but the main victims are in Asia like Bangladesh, Sri Lanka, Myanmar, Vietnam, and Cambodia. Trump had imposed very high reciprocal tariff rates on these countries because they had been running a trade surplus with USA. Though the tariffs so imposed have been given a pause for 90 days, it has not removed the uncertainty surrounding Trump’s tariff reforms. The apparel buyers have first asked the exporters to absorb the high tariffs. Since the high tariff rates were above the exporters’ affordability, they could not accede to that request. Then, the orders have been cancelled, or placement of new orders have been postponed by buyers until the situation becomes clearer.3

In Sri Lanka, both the apparels and rubber products that had been exported to USA in large volumes have suffered from this pause in buying. Trump has created uncertainty in the global markets by his flip-flop tariff revisions and that has pushed the market participants to keep wondering what will happen next. While small voiceless poor countries are suffering in silence, the large exporters to USA like China, Canada, and EU have chosen to fight’s Trump’s tariff policy with equally unaffordable retaliatory tariff rates. This has led to a never-ending tariff war.

Issues with Trump’s tariff policy

I have two issues with Trump’s tariff revision plan. One relates to his wrong interpretation of the trade deficit which USA is having with most of its trading partners. The other is the irrelevant and misleading formula he has used to calculate the magnitude of the amount alleged to have been robbed from US citizens by countries which have a trade surplus with USA.

Wrong reading of trade deficits

Trump has claimed that the trade surplus which many countries have with USA is an indicator of the extent of plundering of US citizens by those countries through higher tariff rates. As I have pointed out earlier,4 USA being the unofficial central banker nation to the world since 1971 has been able to command real goods from the rest of the world by exchanging a worthless piece of paper called the dollar. If that dollar returns to USA, the holder is promised that he could get a basket of real goods and services worth one dollar. If it is circulated as a reserve or exchange currency through the globe, the holder can command a dollar’s worth of real goods and services from the rest of the world.

Falling value of dollar

Falling value of dollar

But these two promises are broken if the domestic value of the dollar falls due to domestic inflation in USA, on one side, and the fall in the international value of dollar due to loss of trust about the issuer of the dollar, namely, the US government, on the other side. USA’s Consumer Price Index or CPI which stood at 100 in 1982-4 has increased to 321 in May 20255 meaning that a dollar in 1982 is worth only 31 US cents today. The international value of the dollar should be gauged by reference to the price of gold since gold is the best substitute asset for the dollar. In 1982, a fine ounce of gold was traded at $ 376 in the world markets. The price of same gold has sharply increased to $ 3,324 in May 20256, implying that a dollar’s value in the international markets in 1982 has fallen to 11 US cents.

Hence, a foreigner who has acquired a dollar in 1982 by sacrificing a dollar’s worth of a real good or service has been condemned to hold a worthless piece of paper today. Therefore, by having a trade deficit with other countries, it is the US citizens who have got an unfair advantage from the citizens of those countries. Hence, there is a case for USA to compensate those dollar holders, instead of punishing them.

Use of irrelevant formula

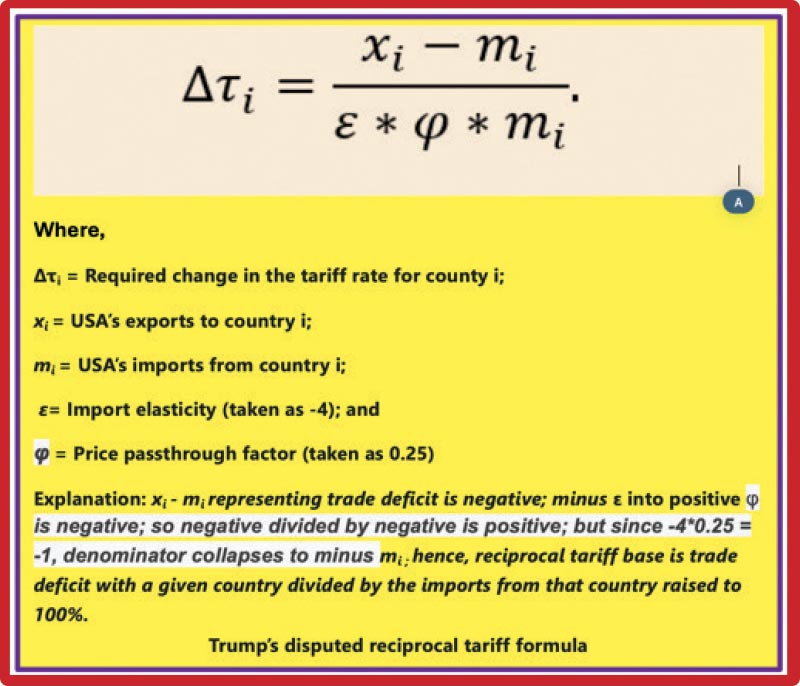

The formula, as given in Figure I, used by Trump’s policy advisors to calculate the extent of the amount plundered by the countries with a trade surplus with USA is irrelevant for the purpose. It simply says that the percent of the amount so plundered is equal to the trade deficit which USA has with those countries is proportionate to the amount which USA has imported from them assuming that the import elasticity of US demand times the price adjustment in US market is equal to 1. To arrive at this result, Trump’s policy advisors have used a general import elasticity of 4 and a price adjustment factor of 0.25. These are two strange numbers since the same have been used for both consumer items like apparels, essential items like chips and pharmaceuticals, and discretionary items like components for producing military items or aircraft.

Naturally, this formula fails when it is applied to countries with a trade deficit with USA. Since the trade deficit is a negative number, and it is divided by a negative import elasticity, the outcome is a positive number for countries which have a trade surplus with USA, the ones which are being punished by the Trump administration. However, when it is applied to countries with which USA has a trade surplus like UK, Singapore, Australia, or the Netherlands, the outcome is a negative number meaning that USA should compensate them for the amount it has taken out from them.

Dispute of formula by a co-author

The formula used by Trump’s policy advisors has been disputed by its co-author, Brent Neiman, Edward Eagle Brown Professor of Economics at the Booth School of Business of the University of Chicago in a recent interview with Erin Burnett of CNN.7 Neiman says that the policy advisors have taken the purpose and meaning of the formula out of context. The purpose of the formula was to identify how a country could determine the appropriate tariff rate to balance a trade gap when there is a difference in tariff rates by about 3 to 4%. It is not a formula to be used on a mass scale for countries. For instance, to a query by Burnett, he confirmed that it is not a formula to be used for a country like Sri Lanka which exports a lot of apparels but does not buy sufficient turbines from USA.

According to him, the application is totally wrong because even if Sri Lanka goes for zero tariff for the imports from USA, the trade gap cannot be eliminated. He also confirmed that the actual price adjustment factor should have been not 0.25 used by Trump’s policy advisors, but 0.95. When that factor is applied, the US’s imports from the respective country should by multiplied by 3.8 and not by 1 as had been done by Trump’s policy advisors. In that scenario, all the calculations made by Trump’s policy advisors to impose the reciprocal tariff on trade surplus countries collapse on themselves. For instance, Sri Lanka’s alleged plundering of Americans is reduced from 88% to 23%. And, a half of that is 12% and not 44% which USA has imposed on Sri Lanka.

Middle East crisis

The recent conflict in the Middle East arose from the attack by Israel on Iran8 claiming that Iran’s ambitious goal of becoming a nuclear weapons owning nation is a threat to its survival and therefore it should be stopped at the bud. These attacks were overtly and covertly supported by USA.9 It culminated to an irreversible high point when USA decided to neutralise Iran’s nuclear warhead producing capability by bombing its three main uranium processing facilities.10 This led to retaliatory attacks on USA’s airbases in the Gulf region by Iran.11 A ceasefire was announced by President Trump with agreement from Israel,12 but many critics have alleged that it had been limited only to paper and on the ground, there are still battles going on.13

Both Israel and Iran have been slow to embrace the ceasefire wholeheartedly forcing President Trump to express his dissatisfaction openly.14 A ceasefire will be successful only if the underlying reason for the conflict is removed. In the case of the present conflict, the reason, namely, Iran’s desire to further enrich uranium and Israel’s animosity for Iran are still looming over them. Hence, the reigniting of the military conflict can occur at any time dragging the Middle East to a more protracted conflict. This possibility should be assessed every time a country reassesses its global risk profile.

Risks to Sri Lanka

If it is a protracted conflict with USA’s involvement, the global economy, specifically countries like Sri Lanka in the global south, will be subject to immense economic hardships. It will adversely affect Sri Lanka’s exports to the Middle East and USA, its re-growing tourism industry, and adverse impact on the overall balance of payments via increases in oil and cooking gas prices and reduced remittance flows. Therefore, though Sri Lanka is not a party to the Middle East conflict, it is a victim of a high proportion.

These two global shocks were not a subject matter discussed in the recent Colombo forum because it concentrated on debt and governance. But their lingering impact will undoubtedly derail Sri Lanka’s move towards recovery, sustained economic growth, and lasting stability. This is a cautionary message which Sri Lanka’s policymakers’ intent on building a safe road to recovery.

Essential requirements

Global economic shocks, whether favourable or adverse, are unexpected and unavoidable. The best a country can do to tackle them is the development of a space to absorb them painlessly. This space takes the form of ensured potential economic growth, undiminished export capacity and markets, and flexible public finances permitting a country to increase or reduce taxes and expenditure at will. In my view, these essential factors should be the main components of Sri Lanka’s Road to Recovery. They are the main risk factors faced by the country and its policymakers should be ever cognisant of them.

A negative external shock will derail the country from the potential growth path leading to income losses, unemployment, and an undue charge on the external reserves if the market shortages are to be met out of imports. At the same time, it will worsen the existing income gap by offering opportunities for the rich to get more and impoverishing the poor who do not get an equal opportunity to do so. This type of skewed income distribution in which the rich become richer, and the poor become poorer is a fine recipe for the onset of a dangerous economic, social, and political disorder in the country. Hence, measures should be taken by the country to reverse the dent in the growth by the negative external shock as quickly as possible.

The longer it takes to make the adjustment, the bigger the impact of the social disorder. This requires space for policymakers to operate to minimise the social and economic costs. In Sri Lanka when the country was hit by the negative fallout of the COVID-19 pandemic, the authorities did not have the needed space to operate and take the country out of the negative growth that followed. This was the trigger factor for the subsequent unprecedented economic crisis that crippled Sri Lanka’s economy.

(To be continued)

Footnotes:

1https://www.ft.lk/business/Sri-Lanka-s-Road-to-Recovery-Debt-and-Governance-conference-recaps-successes-and-challenges/34-777991

2Ibid.

3https://www.tbsnews.net/world/global-economy/panic-grips-worlds-factory-hubs-after-trump-tariff-whiplash-1114681

4https://www.ft.lk/columns/Trump-dis-order-is-to-hit-Sri-Lanka-very-badly-with-limited-options-available/4-775230

5https://www.bls.gov/news.release/pdf/cpi.pdf

6https://tradingeconomics.com/commodity/gold

7https://youtu.be/XTwNUl-v57s?si=BQ3PX014mrwXiNJQ

8https://apnews.com/live/israel-iran-attack

9https://www.aljazeera.com/news/2025/6/23/israel-iran-conflict-list-of-key-events-june-23-2025

10https://www.bbc.com/news/articles/cvg9r4q99g4o

11https://www.bbc.com/news/articles/cdjxdgjpd48o

12https://us.cnn.com/2025/06/24/middleeast/middle-east-situation-tuesday-intl-hnk

13https://www.washingtonpost.com/world/2025/06/24/iran-israel-us-trump-ceasefire-updates/

14https://www.nbcnews.com/world/middle-east/live-blog/live-updates-iran-israel-trump-ceasefire-rcna214671

(The writer, a former Deputy Governor of the Central Bank of Sri Lanka, can be reached at [email protected].)