Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Friday, 13 March 2020 00:10 - - {{hitsCtrl.values.hits}}

Poor governance is a key issue hurting Brand Sri Lanka

Sri Lanka is at a crossroads with its economy registering 2.7% GDP growth last year and being ranked the poorest performing economy in South Asia. We are now confronted with the COVID-19 outbreak, which will affect the life of every Sri Lankan while also impacting key revenue earners like tourism, which is reeling at -7.7%, tea exports, which are declining at -9.9%, apparel exports at -0.5% and Rubber-based exports at -12.6% while remittances also declined by 2%, which means that we are hit on all fronts of our revenue earnings.

Sri Lanka is at a crossroads with its economy registering 2.7% GDP growth last year and being ranked the poorest performing economy in South Asia. We are now confronted with the COVID-19 outbreak, which will affect the life of every Sri Lankan while also impacting key revenue earners like tourism, which is reeling at -7.7%, tea exports, which are declining at -9.9%, apparel exports at -0.5% and Rubber-based exports at -12.6% while remittances also declined by 2%, which means that we are hit on all fronts of our revenue earnings.

On the other hand, on the cost side, the price of oil declining to an all-time low will not offset the revenue hit from major earning sources. So in my view, Sri Lanka will be severely challenged over the next three months.

Sri Lanka focus

With COVID-19 spreading, most governments are taking precautions through the closure of schools and the prevention of large gatherings in neighborhoods in the Maldives, Pakistan and India but Sri Lanka continues to go about business as usual, with the Big Match fever at its peak, the Colombo cocktail circuit continuing and the focus of the political realm firmly planted on the forthcoming General Elections scheduled for 25 April. While all this is taking place, the stock market is reeling at pre-2009 levels while country ratings are at B-, factors which the country continues to overlook.

The beauty of this situation is that a man who has lost the elections 13 times in a row continues to sit on his chair as he is under legal cover. The slogan ‘So Sri Lanka’ sure does suit our country.

In today’s competitive world, a country’s image is its most important asset. The quality of the investments that a nation can attract, its potential export markets and incoming tourists all hinge on the image a country has in the global marketplace

37 years RI for stealing Rs. 12 million

Against this backdrop, my mind goes back to a case a few years ago which I am sure some of you will remember. A former accountant at the Kelaniya office of the National Water Supply and Drainage Board (NWSDB) was sentenced by the Colombo High Court to 37 years’ rigorous imprisonment for financial irregularities. The accused was ordered to pay NWSDB Rs. 13 million as compensation and Rs. 4 million as fines and he would face an additional 23-year jail term if he did not pay the stipulated amounts. What was his mistake? Embezzling Rs. 12 million by forging the signature of the Manager of NWSDB’s Kelaniya office.

Rs. 364 million fraud - Culprits on bail

On the other hand, the prime suspects accused of accepting a bribe of $ 2 million or Rs. 364 million from French company Airbus SE in connection with the purchase of 14 Airbuses in 2013, and the subsequent laundering of this money, are roaming free on the streets of Colombo after spending a few weeks in remand custody.

According to investigations, in 2013, SriLankan Airlines was supposed to purchase 14 Airbuses. During this transaction, one of the suspects had formed a company called ‘Biz Solution’ in Brunei under her name. The bank account of this institution was maintained at a bank in Singapore. Investigators said that on 27 December 2013, Biz Solution’s bank account in Singapore had received a sum of $ 2 million from Airbus’ holding company EADS. The Criminal Investigation Department had obtained this information by requesting the bank details of the Singaporean bank account through the Mutual Assistance Act. According to these details, it was further revealed that a sum of $ 2 million was then remitted to another bank account belonging to the second suspect at an Australian bank on four occasions.

The Court observed that this whole process may involve more culprits operating internationally and locally, hence it is an investigation of global dimensions. While the man who stole Rs. 12 million got a jail term of 37 years’ rigorous imprisonment, the culprits in the Airbus case are on bail enjoying the luxury of living in their own sprawling homes. The CID had obtained a travel ban against the two prime suspects, but not even two weeks after their release, they applied for a motion requesting that this travel ban be lifted. I guess only time will reveal the truth.

The latest revelation is that Transparency International Sri Lanka (TISL) has written to the Director of the Serious Fraud Office (SFO) in the UK on 6 March 2020, posing a series of queries pertaining to Sri Lanka’s entitlement to compensation in the € 3.6 billion settlement reached with Airbus SE. This letter forms part of TISL’s ongoing work to aid in the recovery of the $ 116 million loss incurred by SriLankan Airlines as a result of the corrupt re-fleeting deal with Airbus SE.

TISL had previously written a joint letter to the SFO, the Parquet National Financier in France and the US Department of Justice in June 2018, flagging allegations of corruption with Airbus SE’s conduct and highlighting the need to ensure compensation for those harmed by any wrongdoing. Therefore, it will be tough for either party to avoid the ramifications due to the fact that a global investigation has been initiated. But then again, the slogan for Sri Lanka, ‘So Sri Lanka’, hails supreme.

Rs. 51.9 billion bond scam arrests

Another interesting development occurred with the now infamous Rs. 51.9 billion bond scam. Arrest warrants were issued for 10 individuals on charges of criminal misappropriation, fraud and market manipulation. The Attorney General had instructed to charge the suspects with conspiracy to misappropriate Rs. 51.98 billion in Central Bank bond auctions on 29 March and 31 March 2016 but authorities have been unable to locate the suspects for almost four days. Ironically, the man who stole just Rs. 12 million is serving 37 years’ rigorous imprisonment.

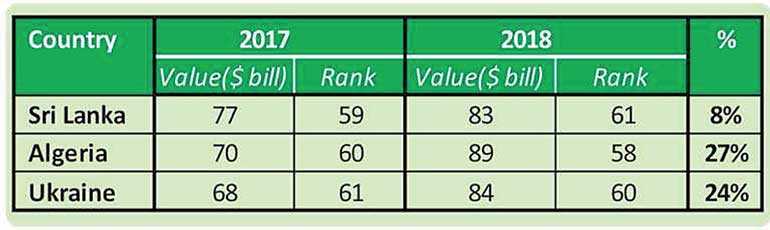

Sri Lanka is grappling with a cycle of fraud taking place at a national level. We see how the world is passing us by – not only Singapore, Malaysia and Bangladesh, but also countries like Ukraine and Algeria have beaten us according to the latest data released by Brand Finance. This performance does not augur well for the country given that Sri Lanka was ranked a top destination to visit by Lonely Planet in 2019 and the majority of citizens are islanders living a simple life making an honest living in the agricultural, industrial and service sectors.

Brand Sri Lanka takes a hit

In today’s competitive world, a country’s image is its most important asset. The quality of the investments that a nation can attract, its potential export markets and incoming tourists all hinge on the image a country has in the global marketplace.

Sri Lanka was ahead of Algeria and Ukraine in 2017 but in 2018 they beat us.

In the above criteria, the performance of Sri Lanka in 2017 was $ 77 billion, ranking Sri Lanka 59th in the world ahead of Algeria and Ukraine, which placed 60th and 61st respectively. The 2018 Brand Finance report reveals that Sri Lanka grew by 7.7% to $ 83 billion and ranked 61st globally while Algeria and Ukraine grew by 27.1% and 23.5% to be ranked 58th and 60th respectively, beating Sri Lanka.

In simple terms, this tells us that the pace at which Sri Lanka is performing is below the global industry average and hence the world is passing us by. Governance plays a key part in this ranking and such incidents like the Airbus case and the bond scam do not help the country in its thrust to be a top 30 country by around 2023.

Sri Lanka’s limited fiscal space

Even if we disregard soft factors such as nation brand value, the fact remains that the total foreign currency debt of the Central Government, State-owned business enterprises and public corporations as a percentage of GDP was 37.5% in 2014. This increased to 42.7% in 2018, thereby increasing the exchange rate risk of public finances.

The rupee depreciated by 19% in 2018 and it directly caused the Debt to GDP ratio to increase in 2018, creating a significant portion of foreign currency debt in the total composition of Sri Lanka’s Government debt. Central Government Debt as a percentage of GDP amounted to 82.9% in 2018 compared to 76.9% in 2017. The average Debt to GDP ratio of peer group countries in the credit rating category of ‘B’ is around 52%.

Sri Lanka’s debt service ratio of 28.9% recorded for 2018 compares with Pakistan’s 19.9%, India’s 11.4%, the Philippines’ 8.7%, Vietnam’s 7.1%, and Bangladesh’s 6.3%. Thus, Sri Lanka is clearly an outlier compared to these countries (the debt service ratio equals to external debt service payments as a percentage of earnings of the export of goods and services). Furthermore, interest payments on Government debt account for about 46% of Government revenue (current peer median of 10.2%). The above facts and figures highlight the weak structure of Sri Lanka’s public finances and the fact that Sri Lanka has very limited fiscal space to drive growth.

Structural reforms?

Hence, attracting Foreign Direct Investment and effecting structural reforms are vital to achieve growth targets. For this, the Government in power requires a two-thirds majority given the reports stating that COVID-19 will vanish over time. But then, with such a bad track record of financial fraud at the highest possible level, and not forgetting the fact that those who were negligent in their duty of possibly halting the Easter Attacks have not been brought to justice, things looks very rough for Sri Lanka in the future.

If we move away from hard economics and focus on the housewife who is struggling to keep the home fires burning, after almost six quarters of negative growth in consumption of household items - starting from Q1 2016, Sri Lanka saw overall general trading conditions recovering to register +4.1% GDP growth in Q1 2019 and +3.7% in Q2 2019, which was a welcome sign for a typical Sri Lanka housewife.

However, the latest data released by top research agency Nielsen reveals that once again the Sri Lankan household is heading into trouble with a -4.2% decline in Q3 2019 on retail off-take and a -7.4% decline in Q4 2019. The consumption of soap has declined by -4%, toothbrushes by -11%, sanitary napkins by -13% and branded hair oil by -34%, which means that things are rough at the household end but in the media we see absolute ruthless robberies which does not augur well for a country which has crossed $ 4,000 upper-middle-income status.

Conclusions

Given that the World Health Organization has now labelled COVID-19 a Pandemic, attention will turn to this new challenge. Going back to the theme of our country ‘So Sri Lanka’, the next few months will determine how Sri Lanka will survive the fallout of the COVID-19 outbreak. But the reality of how people in power are destroying Brand Sri Lanka will not go away. I wonder what the family of the imprisoned man who embezzled Rs. 12 million must be feeling now.

(The author is an alumnus of Harvard University’s Executive Education. The thoughts expressed in this article are strictly his personal views. He can be contacted through [email protected])