Friday Feb 20, 2026

Friday Feb 20, 2026

Wednesday, 19 July 2023 00:30 - - {{hitsCtrl.values.hits}}

Brand Finance Lanka, the pioneering brand valuation and strategy firm, has released its much sought after annual review of Sri Lanka’s most valuable brands for the 20th consecutive year.

In what could be considered Sri Lanka’s worst financial crisis, the total value of Sri Lanka’s most valuable brands in the year under review decreased by 16%. The total value of the Sri Lanka 100 brands is lower than what was reported back in 2019.

The disruption in Sri Lanka’s economy resulted in a significant impact on consumer spending power causing major changes in category and brand performance.

How they do it

The brand valuation methodology integrates both consumer market research with financial performance. They combine consumer sentiment measured through what is one of Sri Lanka’s most extensive multi sector market research studies which is combined with financial data found in annual reports of companies listed on the Colombo Stock Exchange to calculate brand value. Some unlisted brands also share their audited financial reports with them.

While consumer research measures a variety of indicators, such as familiarity, consideration, and recommendation (among others), it also understands perceptions related to what is increasingly becoming an important metrics – sustainability.

The brand value report is therefore a holistic review of the brand’s performance across multiple stakeholders including the financial outcome. This enables actionable strategic direction to be provided to brand custodians.

Overview

The year under review was, by all accounts, the most challenging. The subsequent major reforms undertaken as a result of declaring bankruptcy in 2022 has resulted in somewhat of a rebound in mid-2023, with taming of runaway inflation and sky-high interest rates. All of these have challenged business operations and consumer purchasing power.

In such circumstances, brands that a company owns, are, arguably, now even more critical than ever before to recover and get on a path of growth once again.

Brands can take decades to build. However, once built, they are resilient and can sustain a business during difficult times. Their analysis shows that those businesses that have systematically and strategically built strong brands have withstood the vagaries of uncertain times, performing significantly better than their weaker counterparts.

The winning brands

In this highly volatile environment, Dialog has retained its position as the most valuable brand in Sri Lanka for the fifth consecutive year. It is only slightly ahead of the second brand on the index, Bank of Ceylon which in turn is followed by Commercial Bank and People’s Bank in third and fourth places. Sampath Bank’s entry into the fifth spot is highly commendable, driven by the brand’s strong financial performance against all odds. See Figure 1: Top 10 brands.

As part of their methodology, in addition to brand value, they measure brand strength. Dialog has been able to retain its position at the top of the value table because it is the strongest among the 100 brands.

The simple equation is that stronger the brand (which operates in a particular sector) greater the potential growth in future value.

Key sector analysis

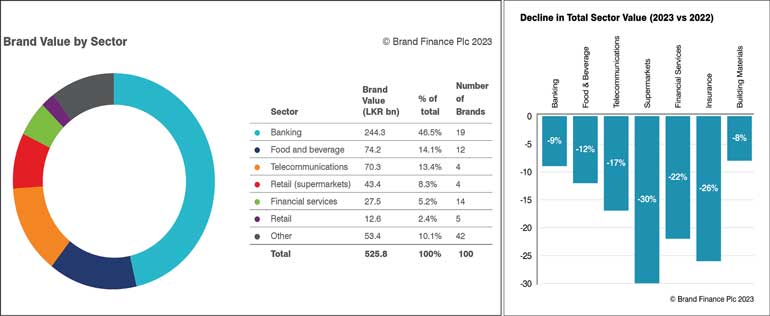

The Most Valuable Brands index is still dominated by banks which contributed 47% of the total value this year. This is an increase in share from last year, where banks contributed 43% of total value. Hence, the decline in value in the other sectors has been far steeper. The second and third largest value contributing sectors are food and beverage, and telecommunications. See Figure 2. The biggest impact of the economic crisis is being borne by Sri Lanka’s consumers and this impact is seen where purchasing power counts most – in the supermarket sector which is an excellent barometer of measurement of the crisis. This sector experienced the biggest decline in brand value of 30%, which is significantly more than the overall average of 16%. Keells dropped in value by as much as 36%, while Cargills Food City also declined, albeit by a lesser amount of 18%, thereby enabling the latter to overtake Keells for the very first time in the recent past on the index.

With disposable income shifting to essential food purchases the insurance sector was hard pressed, and as a result the value of general insurance brands saw a -32% YoY decline, with most brands showing a double-digit drop – with exception being LOLC General Insurance.

Financial services (primarily consisting of finance companies) and the telecommunications sector also showed steep declines while the banking sector was much more resilient, declining by less than the overall average. See Figure 3 for performance of key sectors.

Future challenges

During times of uncertainty, building resilient brands should be what drives marketing decision making. This requires a long-term view by adopting a brand blueprint or a well-defined brand platform and strong brand management processes with strategic decision-making where investments are made in only those areas that will result in superior returns.

One of the major challenges for marketers is to be more accountable to its stakeholders. In a dynamic environment this is difficult due to such significant external changes and it is precisely at these times where effective marketing investment justification is required. By linking marketing investments with financial impact, greater accountability is established at the level of the board.

Although Sri Lanka is no stranger to rough patches, the road to recovery and hopes are now pinned on fiscal consolidation which seem to be on a path of recovery in mid-2023.

Those brands that have survived all the multiple local and global crisis unscathed should be even more resilient in the years ahead.

The complete list of the most valuable brands with more detailed analyses can be found in LMD’s Brands Annual 2023 while the Brand Finance online report is available on: www.brandirectory.com/sri-lanka.

UK headquartered Brand Finance is the world’s leading brand valuation and strategy consultancy. Bridging the gap between marketing and finance, Brand Finance evaluates the strength of brands and quantifies their financial value to help consumer marketing organisations make fact based strategic decisions. The Sri Lanka office established in 2004 and consisting of 25 analysts and consultants is now a key hub in the global network. See www.brandfinance.com for more information.