Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Wednesday, 25 June 2025 00:00 - - {{hitsCtrl.values.hits}}

In emerging markets investing, economic crises represent good entry points into what are fundamentally cyclical markets. At the lows, one is also gifted a free call option on pro-market economic reforms – which in most instances remain out of the money

In emerging markets investing, economic crises represent good entry points into what are fundamentally cyclical markets. At the lows, one is also gifted a free call option on pro-market economic reforms – which in most instances remain out of the money

By Jeremy Hoskins and Django Davidson

At Hosking Partners we have no explicit ‘mandate’ to be invested in emerging markets (EM). But over the past four decades, these markets have regularly presented opportunities to deploy our contrarian ‘go anywhere’ approach. A learning has been how consistently cyclical the economic and investment returns are from EMs. Financial historian Edward Chancellor recently described EM returns as ‘biblical’: “seven years of plenty, followed by seven lean years”.

Despite an ever-present bull case, centred on emerging and developed market convergence, demographics, valuation disparities, sovereign fiscal superiority to developed markets (DM) and so on, a sensible rule of thumb is that the trigger for EM investment work should be a country-level crisis. Likewise, any form of heightened valuation based on a ‘new era’ should be treated sceptically. India, we are watching you carefully!

As global generalists, with the ability to ‘go anywhere’, we thrive on investment contrast. Whilst the past decade has focused on a narrow set of large-cap stock market winners, the global equity opportunity set is vast, with over 20,000 listed companies. Comparing EM crisis orphan stocks against fully valued DM equities is a great exercise in underwriting existing portfolio positions and in formulating ideas on where to allocate new investment dollars.

Country-level capital cycle

From a capital cycle perspective, economic distress, mixed with currency crises and investor pessimism, work to generate what might be termed ‘country-level capital cycles’: periods of capital flight, deleveraging and real wage declines which precipitate high forward-looking returns for the remaining capital stock. During such periods, valuations of long established ‘country champion’ type companies – with strong, structural competitive positions, often built up over multiple decades – can fall well below a conservative ‘replacement value’ calculation.

Historically, this replacement cost framework has been a powerful torch to help illuminate extreme value in these businesses during the dark depths of a crisis. The snap back from deep discounts to more appropriate valuations can be rapid. Longer term, these ‘survivor’ businesses often see a period of high returns on capital as competition erodes during and immediately post crisis. In a dysfunctional economy, if you survive a crisis with your capital intact, pricing power improves dramatically!

Longer term upside is dependent on management teams that are aligned with minority shareholders (it’s all about capital allocation…) and a political class willing to ‘not let the crisis go to waste’. In other words, grasp the nettle of deep supply-side reform and not, like the alcoholic, fall off the wagon. Greece, from the mid-2010s onward, would be an example of the former. Argentina has, historically, been an example of the latter – albeit this time it increasingly looks as if it may be different, as my colleague Luke Bridgeman has written about here.

Three years on from Sri Lanka’s first sovereign debt restructuring, we see what looks to be another text-book style example of a country-level capital cycle. A combination of excessive Government borrowing, poor economic policies, a terrible terrorist attack and an open, tourism-reliant economy which saw Sri Lanka ravaged by COVID travel bans and a tourism slump. The lack of foreign exchange generation during the pandemic exacerbated the Sri Lankan rupee’s decline and accelerated capital flight. Foreign investors, which pre-crisis accounted for 45% of trading volume on the 130-year-old Colombo Stock Exchange (CSE), fell to just 5% in 2021.

In an attempt to tame the 40% inflation rates caused by the plummeting Sri Lankan rupee, the Central Bank raised interest rates to 30%, precipitating a forced deleveraging of the economy. Private credit fell from 40% to 25% of GDP in just two years. At the trough, the total market cap of all shares listed on the CSE collapsed to just $ 9 billion, a fall of 70% in USD terms, representing a stock-market-capitalisation-to-GDP ratio of just 11%. It was around this time that the Government changed its tourism tagline to “You will come back for more,” just as the market was pricing in the fear that no investor would ever put money into Sri Lanka again.

Rebuilding assets from scratch

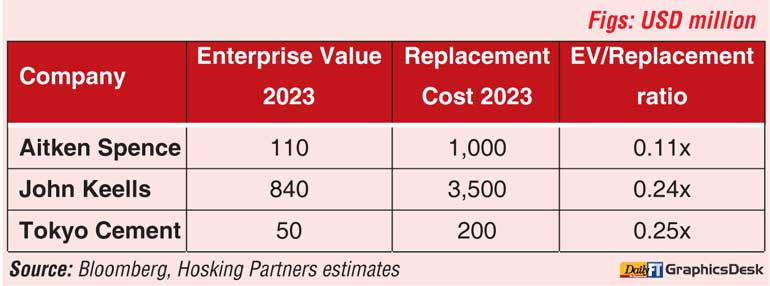

It was during this turmoil in 2023 that we invested tens of millions of USD into Sri Lanka, making Hosking Partners one of, if not the, largest foreign investor in the equity market. We built positions in Sri Lankan stocks trading at 10% to 25% of the cost to rebuild these assets from scratch. For instance, we calculated that the replacement cost for the portfolio of hotels owned by Aitken Spence was approximately $ 1 billion – for which one would own approximately 3,000 rooms in prime locations in Sri Lanka, Oman, India and the Maldives. The enterprise value one paid for these assets in early 2023 was just $ 140 million, which represented just c$45,000 per room, with no value ascribed to the prime land and an earnings valuation of less than 1x historic P/E.

As a yardstick, the newest hotel in Sri Lanka, John Keells’ spectacular Cinnamon Life, has just been completed at a cost of $ 300,000 per room. Aitken Spence, like many of the Sri Lankan conglomerates that dominate the equity market, owns not just hotels but has substantial additional businesses in port management, travel, power and plantations. These businesses offer additional exposure to the now recovering economy, albeit the presence of these business in a conglomerate structure works to obscure the (extreme) value in the hotel business.

Similarly, we bought into asset-heavy Tokyo Cement, Sri Lanka’s number one cement supplier, at approximately one-quarter of the cost to build new cement capacity. At the time, the company’s assets were around 30% utilised, not unsurprising given the economy was at near standstill. We worked through a conservative ‘return to normal’ earnings calculation with management assuming a return to a lower-than-prior peak cement consumption. On this basis we found that the shares were available at less than 1x P/E, an unusual valuation data point generally only available in distressed emerging markets. The P/E of below 1x stood in marked contrast to the above 12x average P/E for Holcim, the world’s leading global cement company, and offers a window into the ‘blue-sky’ type upside that might (or might not) transpire over the longer term.

Runways for dramatic earnings increases

Whilst we expect the discount to replacement cost to unwind, we also see runways for dramatic earnings increases. At another of our holdings, mobile operator Dialog Axiata, a merger with rival Airtel Lanka, has consolidated the mobile telecom market from four to three players. Dialog now has more than double the subscribers of the two smaller players combined. With Bharti Airtel taking shares in the newco, the India mobile consolidation template for improved shareholder returns looks clear. At John Keells, multi-year capex programs in the shape of a new container port and the nation’s first integrated casino-hotel resort are finally at an end. These projects, measured in billions of US dollars, have obscured the underlying earnings power of the group and lead to various emergency fund raises. As the sky clears, we expect these two projects to radically improve the return profile of the group.

Our Sri Lankan holdings have more than doubled in price since the start of 2023, yet we remain bullish. Economic growth is now running at above 5%, and, impressively, inflation has been tamed with the current rate 0%. Economic stability is strengthening the currency, increasing bank lending and, together with tourism revival, animal spirits are reawakening. We are seeing capital spending projects restart and the flow through to the real economy is tangible: GDP per capita, which troughed at $ 3,500 in 2022, is up 30% in USD terms in the past two years to $ 4,500. Whilst politicians can always muck things up, there is substantial momentum behind the economic recovery. Foreign investors are, for now, largely absent. We are two years in to the ‘seven years of plenty’ and with valuations low, the outlook for our Sri Lankan holdings remains bright.

Hosking Partners is authorised and regulated by the Financial Conduct Authority and is registered with the Securities and Exchange Commission as an Investment Adviser.