Monday Feb 02, 2026

Monday Feb 02, 2026

Monday, 2 February 2026 00:12 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

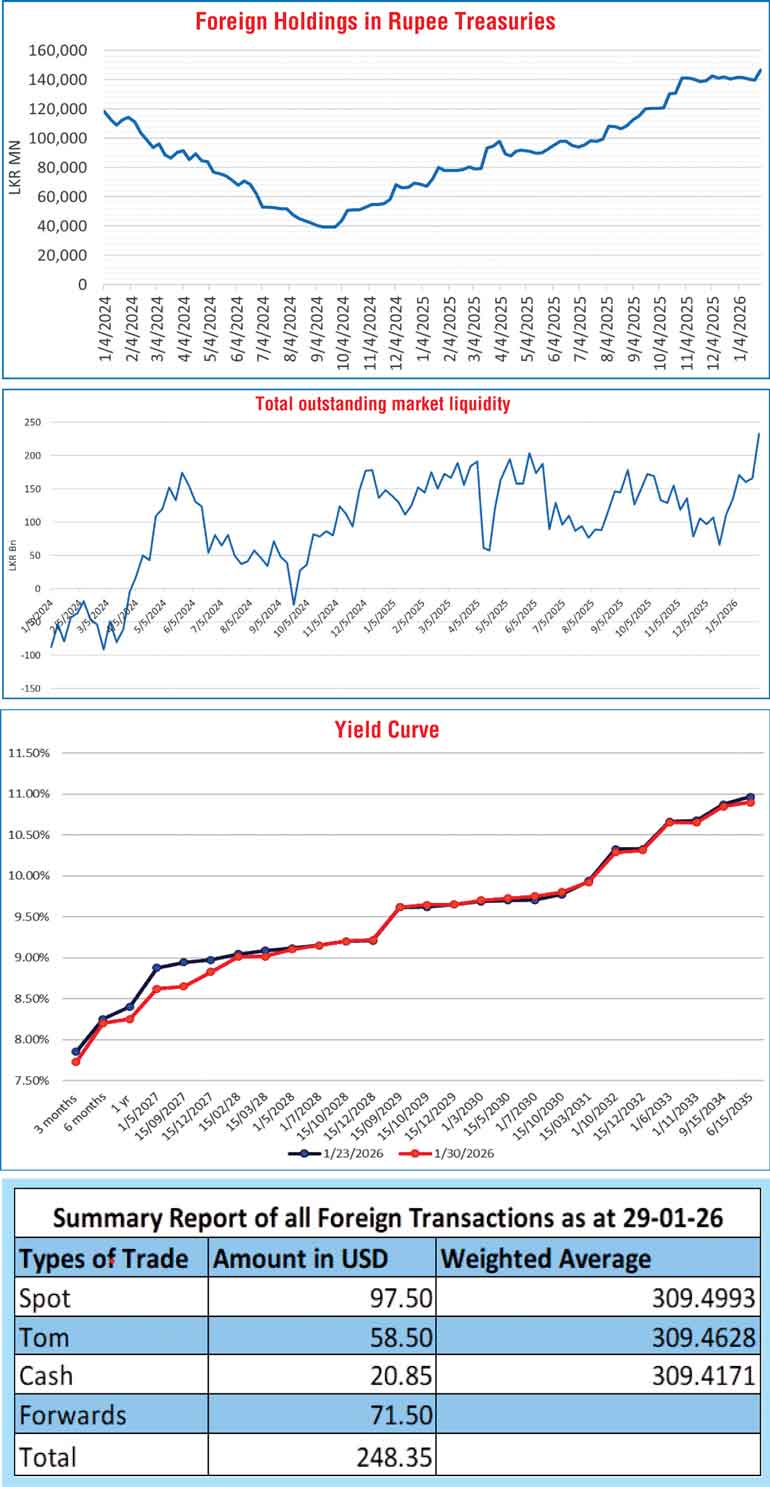

The foreign holdings of rupee-denominated Government Securities surged upwards recording a sizeable a net inflow, amounting to Rs. 6.63 billion. Consequently, the total holdings increased to Rs. 146.56 during the week ending 29 January, reaching the highest level in over a year, since early November 2023.

In the money market, the total outstanding liquidity surplus in the inter-bank market continued to remain elevated and stood at Rs. 233.13 billion as at the week ending 30 January 2026, increasing from Rs. 166.13 billion recorded in the previous week. Liquidity was seen surging to an over five-year high, hitting the highest figure since 8 January 2021.

This in turn saw the weighted average interest rates on Call Money and Repo reducing to 7.70% and 7.72%, respectively, at the close of the week ending 30 January against its previous week’s closings of 7.76% and 7.77%. This marks a notable decline from the recent highs observed towards the end of December, where Call Money and Repo rates were recorded at 8.04% and 8.06%, respectively.

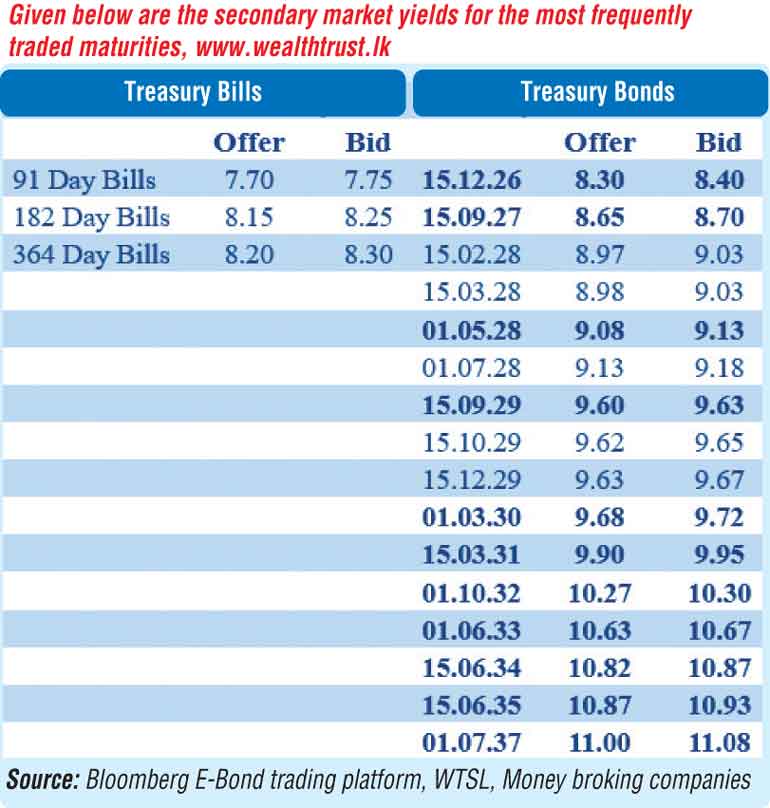

The secondary Bond market delivered a positive performance last week, with yields broadly trending lower as strong liquidity conditions and supportive auction outcomes drove buying interest across the curve.

The week began on a subdued and defensive note, as participants stayed cautious ahead of a heavy event calendar, including the first Monetary Policy Announcement of 2026 and the weekly Treasury Bill auction on 28 Wednesday, followed by a Treasury Bond auction on 29 Thursday and the January CCPI inflation print on the 30th.

From Wednesday onwards, momentum turned bullish, led by a decline in yields along the short end, particularly across the 2026–2028 maturities. Demand was supported by persistently elevated liquidity and lower money market rates. The positive Treasury Bill auction reinforced the move, anchoring the short end and sustaining buying interest, while the medium-to-long end held broadly steady, temporarily steepening the curve.

Activity picked up notably on Thursday following a positive Treasury Bond auction outcome, with yields declining as the market extended its bullish re-pricing into the belly-to-long end of the curve. Buying interest was centered around the 2029–2037 segment, as traders looked to capitalise on the curve’s steepness by rotating into higher relative value opportunities further along the curve, locking in attractive carry and roll-down potential.

However, by Friday, activity had moderated and yields were seen reversing upwards mainly on the short to mid-tenor bonds on the back of profit taking pressure.

Overall, the week reflected a clear shift from event-driven caution to liquidity-supported momentum, with strong demand across key maturities. The yield curve was seen registering a downward adjustment on a week-on-week basis.

During the week, the 15.05.26 maturity traded down the range of 8.27%–8.20%, while the 01.08.26 maturity traded at 8.25%. The 15.12.26 maturity traded at 8.35%. The 01.05.27 maturity traded down from 8.90% to 8.60% during the week but reversed up to trade at 8.70% at the close of the week, while the 15.09.27 maturity traded down the range of 8.75%–8.70%.

Moving into the 2028 tenors, the 15.02.28 maturity traded down from an intra-week high to a low of 9.05% to 8.99%. The 15.03.28 maturity traded down from 9.08%–9.00%, but later traded back up to 9.02% at the close of the week. The 01.05.28 maturity traded within the range of 9.15%-9.10% during the week while the 15.10.28 and 15.12.28 maturities traded within 9.25%–9.20%.

Further along the curve, the 15.10.29 maturity traded down from intraweek high to a low of 9.65% to 9.60% but later reversed to trade back up to 9.65% at the close of the week, while the 15.12.29 maturity traded down the range of 9.69%–9.60% but later also traded back up to 9.65%.

On the medium-to-long end, the 01.03.30 maturity traded down from 9.72% to 9.68%, while the 01.07.30 maturity traded down the range of 9.75%–9.72%, but traded back up to 9.76% at the close of the week. The 15.03.31 maturity traded at 10.00%, while the 15.12.32 maturity traded within 10.33%–10.32%. The 01.10.32 maturity traded at a low of 10.28%. The 01.06.33 maturity traded down to 10.65%.

At the long end, the 15.06.34 maturity traded at 10.85%, while the 15.06.35 maturity saw a notable decline, trading down from an intraweek high of 10.98% to a low of 10.85%. The 01.07.37 maturity traded at 11.00% post auction.

The weekly Treasury Bill auction held last Wednesday (28), registered a positive outcome as weighted average yields registered declines across all maturities for the second consecutive week. The auction was fully subscribed, raising the full Rs. 125 billion on offer, highlighting strong investor demand.

Demand spilled over to the second phase, where the maximum available amount of Rs. 12.50 billion was raised across all three tenors, out of a total market subscription of a staggering Rs. 54,162 million. Accordingly, the aggregate accepted amount for the issuance increased to Rs. 137.50 billion.

Subsequently, the Bond auctions conducted last Thursday (29) delivered a decisively positive outcome, with the Public Debt Management Office raising Rs. 179.06 billion—equivalent to 87.35% of the Rs. 205 billion on offer—across three maturities. The Bond auction weighted average rates across the board were seen coming below or in-line with market levels.

In terms of inflation data: January CCPI inflation (Base 2021=100) accelerated to +2.3% year-on-year, up from +2.1% in December. Inflation continues to remain moderate and below the Central Bank’s medium-term target of 5% and even below the lower bound of the target range of 3%.

The daily secondary market Treasury Bond/Bill transacted volumes for the first four days of the week averaged at Rs. 41.86 billion.

In the forex market, the USD/LKR rate on spot contracts was seen closing the week appreciating notably at Rs. 309.25/309.35 as against the previous week’s closing level of Rs. 309.76/309.80. This was subsequent to trading at a high of Rs. 309.20 and a low of Rs. 309.80.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 114.92 million.

(References: Public Debt Management Office - Ministry of Finance, Central Bank of Sri Lanka, Bloomberg E-Bond Trading Platform, Money Broking Companies)