Thursday Feb 05, 2026

Thursday Feb 05, 2026

Thursday, 5 February 2026 04:44 - - {{hitsCtrl.values.hits}}

The Ceylon Federation of Micro, Small and Medium Enterprises (MSMEs) has accused Sri Lankan banks and the Government of reaping windfall profits and tax revenues from the economic crisis, arguing that the collapse of thousands of MSMEs effectively underwrote record banking profits and Treasury receipts, and that the scale of those gains leaves no justification for delaying relief to distressed borrowers.

In a statement, the Federation said that analysis reveals that while MSMEs collapsed under 30% interest rates, the banking sector and Government Treasury saw exponential revenue growth, justifying immediate relief measures.

The statement in full is as follows.

While Sri Lanka’s MSMEs continue to struggle with the aftermath of the economic collapse, new financial data reveals a stark reality: the crisis for borrowers has generated a massive windfall for the banking sector and the Government.

The trigger

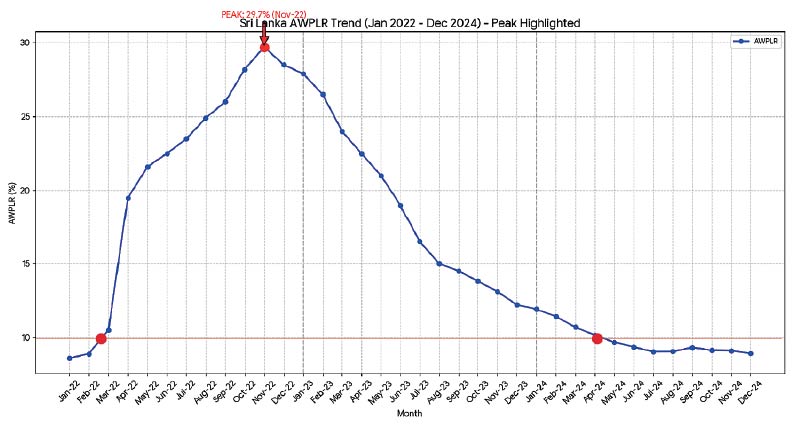

The interest rate shock came In April 2022 when the Central Bank of Sri Lanka (CBSL) increased policy interest rates by over 100% to control inflation. Consequently, the banking sector drove the Average Weighted Prime Lending Rate (AWPLR) to a historic peak of nearly 30% by December 2022. Borrowers who had obtained loans on or before April 2022 when the average AWPLR was a manageable 10% (±) were suddenly forced to pay interest rates exceeding 30%.

This tripling of financial costs triggered a massive wave of defaults and business closures.

The windfall

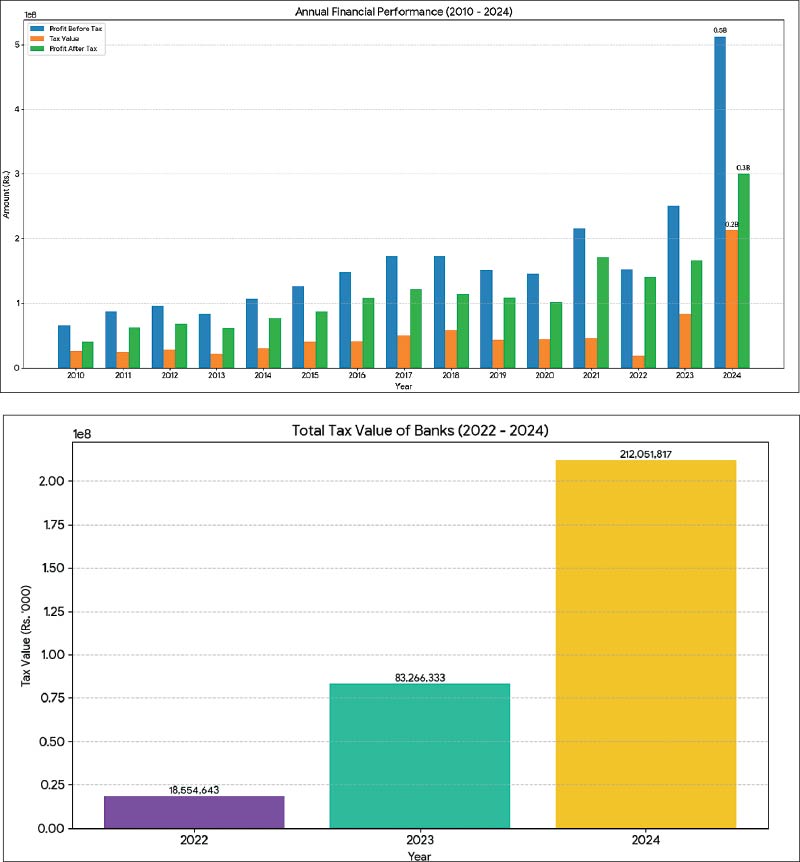

While the productive economy shrank, the financial sector’s numbers exploded. During the 2023/2024 period, the total Profit Before Tax (PBT) for the banking sector reached approximately Rs. 762 billion.

Simultaneously, the Government benefitted from this surge. Data for the 2023/2024 period confirms that the banking sector contributed a massive Rs. 295 billion intaxes.

This proves that the liquidity exists to save the MSME sector. The money has simply been transferred from struggling entrepreneurs to bank balance sheets and the Treasury.

The ‘Moratorium Trap’

The crisis was worsened by regulatory failure. Unlike in other countries, the CBSL announced moratoriums without clear guidelines on interest capitalisation. This created a ‘Moratorium Trap’ where banks and financial institutions rescheduled loans to their maximum advantage, often compounding interest in opaque ways.

When borrowers demanded clarity, many were threatened with Parate Execution or property/vehicle seizure instead of being offered genuine restructuring.

Global precedents for reform

During recent floods, the United Arab Emirates (UAE) Central Bank ordered a six-month deferral of loans without additional fees or interest, acting as a shield for the people. The UK and US Governments replaced bank-manipulated interest benchmarks (like LIBOR) with transparent systems (SONIA/SOFR).

Sri Lanka’s reliance on the AWPLR, which banks can manipulate, must be challenged similarly.

Roadmap for economic justice

With Rs. 295 billion already collected in taxes, the Government has the fiscal space to support the banking sector in granting relief. We propose four non-negotiable demands:

1. Refund excess interest: Banks must refund excess interest collected between May 2022 and November 2024 for loans granted on or before April 2022.

2. Tax credits for refunds: Since the Government earned Rs. 295 billion in taxes (2023/24), it must issue tax credits to banks to offset the cost of these refunds over the next five years.

3. Halt Parate actions: Immediate suspension of Credit Information Bureau of Sri Lanka (CRIB)/Non-Performing Loan (NPL) listings for all borrowers listed as non-performing after the Easter Sunday attacks.

4. Binding legislation: Enact special legislation to ensure these protections are mandatory and legally enforceable.

The data is irrefutable. The funds to save the MSME sector exist, they are currently sitting in the record-breaking taxes collected and bank profit accounts of 2023 and 2024.