Sunday Feb 15, 2026

Sunday Feb 15, 2026

Wednesday, 23 August 2017 00:00 - - {{hitsCtrl.values.hits}}

There are unconfirmed reports stating that the AG’s Department has cleared 28 files pertaining to corruption and fraud for taking legal action. According to the information the hedging issue is not among them.

There are unconfirmed reports stating that the AG’s Department has cleared 28 files pertaining to corruption and fraud for taking legal action. According to the information the hedging issue is not among them.

It is history now as to how in 2009 the country was shocked with the breaking news of a dubious and illegal deal which had taken place at the CPC, causing huge losses to the country. The issue came to be known as the fraudulent Oil Hedging Deal with the total loss estimated as Rs. 10,200.4 million by COPE in a report submitted to Parliament on 9 August 2016.

The COPE Committee has identified the following in the course of its inquiry:

The following recommendations have been made in the COPE report:

i. Holding a ministerial level formal inquiry again in this regard and reporting.

ii. Submitting a detailed report to the Committee within one months’ time, on the current progress of the investigations carried out by the Attorney Generals Department, CID and the Commission to Investigate Allegations of Bribery or Corruption.

iii. Directing the commission to get a report of the investigations carried out by the Attorney General.

iv. Holding a separate inquiry on this transaction in time to come.

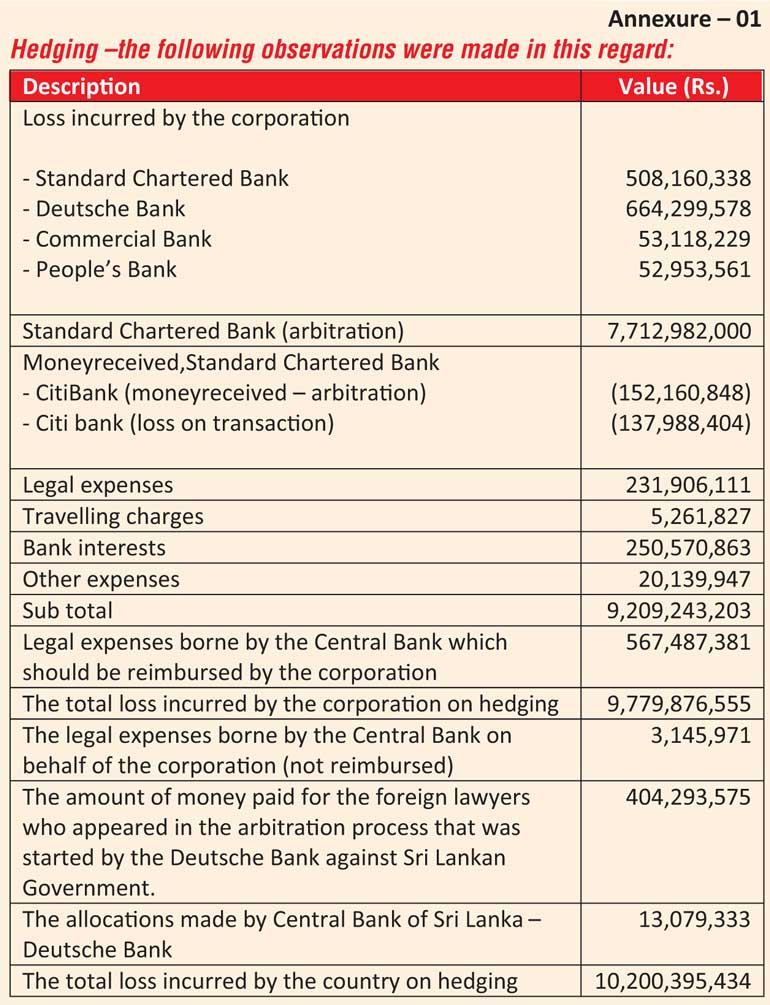

The Committee also made the following observations regarding the losses incurred due to the hedging deal. The report contained the details identified as the losses due to this deal, see annexure 01.

It should be noted that an amount of Rs. 3 billion has been written off from the annual profits of the People’s Bank as losses on account of the hedging transactions.

It is also reported that a deposit in the Commerzbank AG Frankfurt held by the People’s Bank was also confiscated to set off the liabilities on the part of People’s Bank in the hedging deal. These amounts apparently have been accounted in the loss estimation compiled by the COPE.

In the same context it is relevant to consider the following aspects of the transaction:

The public interest activists were more than jubilatant when it was announced that the newly-created investigative arm of the Yahapalana Government, the FCID, had been directed to take over the investigations of the hedging scam. Several persons with different interests went before the FCID and their statements were recorded. Finally it became known that the FCID concluded the investigations and the matter was referred to the AG’s Department for action. This was in 2016.

Alas! It remains a mystery to date as to how the matter remains dormant as a sleeping volcano for such a long time.

The backbenchers of the UNP revolting and moving no-confidence motions today against the delays of action on the part of the Government in dealing with corruption may be unaware that such glaring frauds costing the country several billions as losses remains swept under the carpet!

In the meantime the perpetrators of the crime remain safe and sound with no impending threats of any legal implications.

In the public interest litigation SC (FR) Application No. 404/2009 then CJ Supreme Court of Sri Lanka on 14 July 2009 made the order under the prayer of the petition as below:

“Make Order to issue Notice on the following Officers of the 3rd Respondent Bank, to provide information within their personal knowledge, in relation to the Agreements referred to as ‘Oil Hedging Agreements’ entered into by the 3rd Respondent Bank, with the 1st Respondent (CPC), as referred to in paragraph 10(f) of the Petition, and also on the following persons, who have been involved in the ‘Oil Hedging Agreements’ and whose Air Travel Costs had been paid for by the 3rd Respondent Bank, as per paragraph 10(e) of the Petition,

i. Clive Haswell, Chief Executive Officer, of the 3rd Respondent Bank (Standard Chartered Bank)

ii. Kimarli Fernando, former Head of Corporate Client Relationships, of the 3rd Respondent Bank (Standard Chartered Bank)

iii. Nigel Beebe – Senior Credit Officer, of the 3rd Respondent Bank (Standard Chartered Bank)

iv. Rukshan Dias, Head of Global Markets, of the 3rd Respondent Bank (Standard Chartered Bank)

v. A. De Mel, former Chairman, Ceylon Petroleum Corporation

vi. P.M.L. Karunarathne, former Finance Manager, Ceylon Petroleum Corporation

vii. K. Ariyaratne, of the 7th Respondent, People’s Bank/Member, Committee on ‘Oil Hedging’

viii. Vasantha Kumar, of the 7th Respondent, People’s Bank.”

In response all parties except those stated below have submitted affidavits to Courts and according to these, certain roles played by some of them, demand immediate disciplinary action, in the ordinary course of matters relating to their duties as public officers.

Affidavits were not filed by SCB CEO Clive Haswell, Senior Credit Officer of SCB Nigel Beebe, and SCB Head of Global Markets Rukshan Dias.

N. Vasantha Kumar, Snr. Deputy General Manager (Treasury and Investment Banking) of 7th Respondent People’s Bank admits in  his Statement stated that:

his Statement stated that:

a) He had executed a Hedging Contract with 1st Respondent CPC on 15 August 2008 for People’s Bank on a back-to-back basis with Commercial Bank of Ceylon, and that a similar transaction had been done by him on 9 October 2009 with 1st Respondent CPC for People’s Bank on a back-to-back basis with Commerzbank AG Frankfurt.

b)He had been invited and financed on foreign trips by the 3rd Respondent, SCB.

Kapila Ariyaratne, Deputy General Manager (Corporate and International Banking) of 7th Respondent People’s Bank in his Statement has stated that:

a) He was a Member of the Oil Hedging Study Group appointed by the 2nd Respondent, Secretary to the Treasury, and that to his knowledge, the Committee had met only on three occasions, and that he had not attended any one of those meetings, but that the draft Reports of the Committee were exchanged electronically by e-mail, and the final Report submitted on 16 November 2006 to 2nd Respondent Secretary to the Treasury.

b) He had been invited and financed on foreign trips by the 3rd Respondent, SCB.

Ashantha de Mel, former Chairman of 1st Respondent, CPC, in his Affidavit has stated that:

a) These oil hedging deals had been carried out at the initiation of the Governor, Central Bank, and upon a Study Group Report submitted to the 2nd Respondent, Secretary to the Treasury, and after Cabinet approval had been granted to 1st Respondent CPC to ‘hedge purchase of petroleum products’.

b) He had been invited and financed on foreign trips by the 3rd Respondent, SCB, 4th Respondent, Citibank and 5th Respondent, Deutsche Bank.

P.M.L.K. Karunaratne, former Finance Manager of 1st Respondent, CPC, who had jointly signed for the oil hedging deals with former Chairman, 1st Respondent CPC, Ashantha de Mel, in his Affidavit states that:

a) The oil hedging deals had been entered into on the same premise as set out by the former Chairman, 1st Respondent CPC, Ashantha de Mel.

b) He had been a Member of the Study Group comprising of Y.M.W.B. Weerasekere, Asst. Governor, Central Bank of Sri Lanka; H.N. Thenuwara, Asst. Governor, Central Bank of Sri Lanka; Saliya Rajakaruna, Chief Financial Officer, Bank of Ceylon; Kapila Ariyaratne, Head of Corporate and Institutional Banking, People’s Bank; Kanthi Wijetunga, Addl. Secretary, Ministry of Petroleum and Petroleum Resources Development; and Lalith Karunaratne, Deputy General Manager Finance, CPC, 1st Respondent.

c) He had been invited and financed on foreign trips by the 3rd Respondent, SCB.

We are yet to see any action being taken. The perpetrators have been protected under the previous regime as well as under the new ‘Yahapalana’ Government that came to power with the promise of bringing the culprits to book. Are they all protected by some godfather more powerful than the Government or having strong influence over both Governments, previous as well as current?

People’s Bank in its Annual Report of accounts for the year 2010 (Page 153) stated as follows:

Other Provisions – This provision is pertaining to oil derivative transactions entered into in late 2008. The bank is currently pursuing legal redress with regard to one agreement amounting to around Rs. 2.1 billion for which a local Government bank is the counter party. This provision was made in line with the Central Bank stipulated guidelines on assets without movements over a specific time and hence will not compromise the bank’s legal position on these transactions, without prejudice to legal proceedings.

In the Annual Report of the bank for 2009 – Page 133 – An amount of Rs. 3.1 b appears described as hedging under the item titled ‘Reconciliation of net profit to net cash flows from operating activities’. This amount is shown under the adjustment for non-cash transaction. Both these amounts (Rs. 5.2 billion) appears to have been written off the profits of the bank, resulting in a huge loss to the State.

It is strange how no one has been found responsible for these huge losses yet!