Sunday Feb 22, 2026

Sunday Feb 22, 2026

Wednesday, 19 July 2017 00:00 - - {{hitsCtrl.values.hits}}

Global growth 6%

Global growth 6%

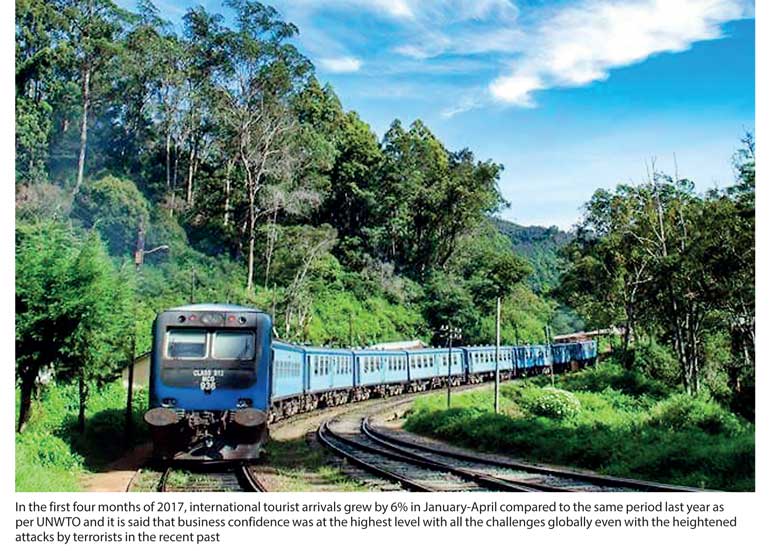

Destinations globally registered 369 million international visitors during the period January to April 2017 with an incremental volume of 21 million travellers registering a growth of 6%, states a latest release of the UNWTO World Tourism Barometer.

Normally the first four months account for 28-30% of the total volume annually. The Middle East recorded 10% growth, Africa 8% and Europe 6% whilst Asia Pacific recorded 6%. Americas trailed with 4% growth even with all the issue related to tourism under Trump’s leadership.

If we analyse the arrivals to Sri Lanka during the same period January-April 2017, the numbers have grown by 6.1% to 765,202 even with the partial closure of the airport ended which means that we are as per the global average. What is worrying was that the top two markets on volume India has increased only by 1.7% to 26,323 whilst the growth has stunted in China to 4.5% which must be addressed with a focused marketing campaign so that we not only just focus on numbers but the quality of the visitor.

The logic is that a recent study revealed that from the two million guests who arrived last year, almost 60% stayed away from the formal sector of graded hotels which is a serious issue that must be addressed.

On the other hand if we analyse the tourist arrivals, in June arrivals registered 4.5% year-on-year to 123,351 visitors with India (2.8% to 27,836); the UK (10.8% to 10,424); Germany (28.6% to 7,024); Australia (10.4% to 6,360); the US (7.2% to 4,200); Canada (5.7% to 4,347); Netherlands (40.2% to 2,399); Saudi Arabia (347.3% to 1,789) and Pakistan (39.5% to 2,035). In the first six months of the year, the number of tourist arrivals increased 4.8% which means growth has stunted and needs to be addressed.

(2.8% to 27,836); the UK (10.8% to 10,424); Germany (28.6% to 7,024); Australia (10.4% to 6,360); the US (7.2% to 4,200); Canada (5.7% to 4,347); Netherlands (40.2% to 2,399); Saudi Arabia (347.3% to 1,789) and Pakistan (39.5% to 2,035). In the first six months of the year, the number of tourist arrivals increased 4.8% which means growth has stunted and needs to be addressed.

Tourist arrivals in Sri Lanka averaged 45139.11 from 1977 until 2017, reaching an all-time high of 224,791 in December of 2016 and a record low of 5,536 in June of 1977. Some of the key issues and trends that Sri Lanka needs to focus on are as follows:

1) Most competitor countries are launching new tourism products at least once in four years so that the country brand is kept contemporary in the eyes of the global traveller. But Sri Lanka is struggling with the last NPD being the elephant orphanage in the 1970s and yet the product has a penetration of only 40% among total arrivals of 2016. This indicates why we keep attracting travellers who are above 50 years whilst the competitor destinations attract the younger and higher income driven tourists into the country who spend more in a market they visit.

2) Whilst digital marketing becomes a way of life for the international traveller who make all bookings online and lead times are shortening to 30-45 days for Sri Lanka the traditional tour operator business remains sizeable. Some companies report a number as high at 75% which is an interesting find.

3) If we do a deep dive on digital we see that around 23 million people Googled Sri Lanka tourism last year but only two million came into the country that means a high dropout to competitors from the global chunk of over a billion travellers. Last month it was seen how the US Googling Sri Lanka tourism increased by 10% but conversion remains very low which explains the need for stronger marketing.

4) A question asked by many is, why did SriLankan Airlines discontinue the key established markets of Germany and France but is now flying to a new market like Melbourne where the profile of the travellers is different? What is the tourism strategy in Australia where the traveller needs are different to a European? Would not have been a focused campaign in India and China been more effective and impactful to the numbers? are questions asked by many.

5) Digital marketing will lead to reaching people at lower costs but this will require a mindset change such as a research-driven approach which is more a scientific approach than the current exhibition-driven approach to marketing that Sri Lankan policymakers are skilled on. Some even call this moving the hypos terminology strictly from a digital marketing professional’s terminology.

Latest research reveals that one must measure conversion (like chat app), 57% of bookings are online, it is done on train or break time and not formally – new technology (Google hotel finder, TripAdvisor, social media to drive snow to sun) FB, Instagram (66% buy travel on videos – video marketing is key according to trends globally. These kinds of marketing purchasing cannot be done via tender process which means the State agency in charge of promotions will have to get more freedom from Government’s policy.

6) This leads to the next question if Sri Lanka is ready for the 4th industrial revolution – digital environment (customer expectation, product innovation, collaborative partnership which are parts of the shared economy). For instance, the brand Uber has achieved a sales performance in two years what Hilton did in 100 years. Are we ready for this change?

7) Sri Lanka must be ready with crisis management strategies so that we address the issues early, like the current epidemic situation on dengue now getting global exposure which is negative.

Whilst the above thoughts needs to be addressed a key point to note is that research reveals that in the next two to three years there will be 25,000 new properties coming into the country which are essentially below three star, this means the same infrastructure each of us Sri Lankans are using in our daily lives will have to be shared with tourists who have higher purchasing power. This will add issues on carrying capacity for Sri Lanka and ultimately a political issue due to inflationary pressure.

(The thoughts are strictly the author’s personal views and he can be reached on email [email protected].)