Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Friday, 8 January 2016 00:00 - - {{hitsCtrl.values.hits}}

With the newly-elected committee assuming duties at Sri Lanka Cricket (SLC) and given the challenges the game has encountered in recent years (both on and off the field), the time is now to revisit and restructure the entire eco-system of the game.

While recognising that industry (cricket in this case), appreciation and experience are essential, MTI is of the professional opinion that, given the multi-faceted nature this industry (with the game at the core), it also requires strong strategic and managerial competencies which can benefit from non-cricketing brains as well.

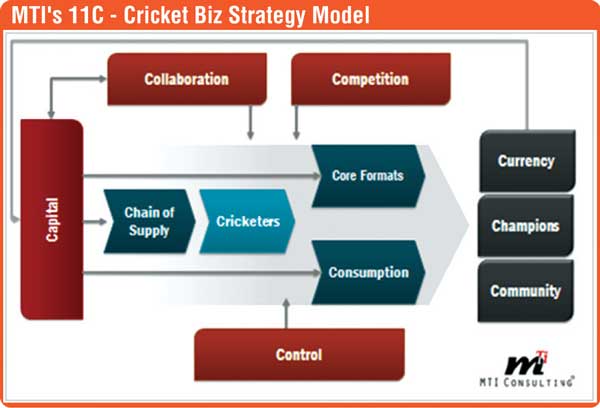

Based on a pioneering research and thought leadership assignment, MTI had developed ‘MTI’s 11 Cricket Model’, which can be an effective framework for the newly-elected body to shape their direction and strategies.

The business of cricket is estimated at $ 11.7 billion globally, growing at 15% per annum and could be easily classified as a ‘FMCG’ (Fast Moving Consumer Good). Not only does it touch the hearts and minds of over two billion consumers worldwide, it accounts for a significant proportion of the consumers’ television and web surfing time, not discounting the enormous amount of casual consumer chat. It is argued that this form of unscripted entertainment is capturing share from other forms of leisure and entertainment. It is now opening up new frontiers, from Afghanistan to Argentina, from Canada to China and from Namibia to Netherlands. The innovation curve now in high growth mode, with multiple international T20 tournaments, and it is expected to capture an increased percentage of the consumers and the advertisers’ wallet. Many in the industry still see it as a competitive sport, consumers see it as a form of entertainment, cricketers see it a viable career, above all, it is among the most competitive and dynamic industries, that rivals many conventional industries. Given the many facets of the cricket industry (players, spectators, TV viewers, sponsors, advertisers, boards etc.), it requires a holistic business strategy framework, that can benefit from proven strategy formulation models, yet captures the very essence of cricket.

MTI’s 11C Cricket Business Model has been developed as a framework (with relevant tools) to help cricket authorities to analyse, strategise and realise greater heights for cricket as a business.

Currency, Community and Champions

The strategy formulation process starts by analysing cricket’s performance (in a given country or territory) – based on the end results by which the success of the industry must be measured. In the case of cricket, this includes three equally important success criteria i.e.:

· Currency: How much funds has cricket been able to attract from consumers via ticket sales, television viewing, sponsorships and endorsements and converging segments like memorabilia, coaching etc. The argument being that the more satisfied the consumers are, the more time they will spend ‘consuming’ cricket and this in turn means a greater share of their wallet towards cricket.

· Champions: How has the country performed in this globally competitive industry, as measured by the team and individual performances, which influenced the ‘currency’? There is a direct co-relation between a country’s performance at sports and the ‘currency factor’ it attracts.

· Community: Unlike some conventional industries, cricket (and most sports for that matter) has a strong social aspect that is interwoven into it. Therefore, it needs to play a role in linking citizens and different cultures and promote healthy values.

At this stage of the strategy formulation process, based on specific KPIs (Key Performance Indicators), the country’s historical performance is analysed and provides the basis of setting the vision and goals for the next 1-3 years (which is done at the end of the process, where by these three components of the model are revisited).

Competition and collaboration

The consumer has a finite amount of time, discretionary income (and passion) that different types of leisure activities compete for. Some of these could be between sports and some from other forms of entertainment.

For instance, TV ratings and tickets sales of Bollywood movies dropped during the IPL. It could also be between different types of sports; for instance, the decline of cricket in the Caribbean attributed to the intensified marketing of baseball and basketball in the Americas. Cricket as a product needs to be constantly researched and evaluated if it is providing value to consumers and if competitive activities and sports are making inroads. Based on these findings, like in conventional industries, the product (in some cases the brand) needs to be fine tuned, this is an ongoing process. As in the case of West Indies Cricket, it may take many years to see the consumer impact on the game. However, once this happens, it will take as many years to reverse the trend. So the key is ongoing research and feeling the pulse of the consumer who consumes this product on a daily basis.

Given that a significant part of cricket consumed is still between countries (unlike soccer), the ‘production’ of cricket requires the collaboration of two or more countries, hence this calls for the need to factor in all the bilateral and multilateral negotiations between boards at this stage of the process. Like in soccer, with the advent of the likes of IPL, the type of collaborations will change, and this needs to be monitored and factored into the strategy formulation process. There is bound to be competition within different formats of cricket – competing for the consumers’ cricket dollar.

Core formats and consumption

This effectively is the way in which Cricket is ‘consumed’ and equates to product development in the conventional sense. It includes everything from six-a-side to Tests and all forms of experimentation with the core product, from referring umpiring decisions to day-night Test matches. The findings from the competitive scan (above) and the expert opinions (effectively the R&D/innovation lab) will be the basis on which existing products are fine tuned and new products developed. If this is carried out on a continuous process, it will signal the challenges well in advance – well before it hits the bottom line of cricket. For instance, the alarming low level of in-stadium spectators for Test cricket could have been signaled by such timely research and analysis.

The module on consumption will focus on how cricket is ‘consumed’, beyond just in-stadium spectators and television viewing. Potentially, it can cover a diverse range of applications, from web applications to degrees in cricket management to a cricket version of an American Idol, where raw talent can emerge outside the formal school and clubs. Put it another way, ‘Slumdog Cricketers’ (no insult meant) – in the words of Steve Waugh.

Cricketers and chain of supply

The modules on core formats and consumption will help determine the demand for cricketers – based on the demand for cricket – very much like a typical manpower planning exercise in a business. Like in the movie industry, the stars (the cricketers) hold the key to ‘cricket-entertaining’ audiences, which determines the financial health of the industry. The module on cricketers will intensively focus on the total development and welfare of the cricketers, applying relevant human resources management principles.

The appearance of your favorite and successful cricket star on ‘stage’ is the end of a long supply chain process that starts with identifying talent as early as when the players are toddlers and grooming them through the process and ensuring their welfare through to retirement. The module on chain of supply will cover all the aspects that support the total development of the cricketers and will include aspects relating to coaching, education, infrastructure and even a cricket culture in the society.

Capital

Given that cricket has no equity investors in the conventional sense, it has to use the power of its brand (this includes that of the country, the authorities, the players, the venue and the cause) to generate capital; the threshold for which substantially increased. At this stage of the strategy formulation process, every opportunity to en-cash the power of cricket is pursued, in addition to the main revenue streams of television rights and sponsorships. A battery of financial analytics will be run at this stage that measures the power of ‘Brand Cricket’ and how it is translated to the bottom line. Cricket authorities can also wear the hat of an investment banker and ask the question: “What do we need to invest to win the World Cup and achieve a quantum increase in revenue (currency) and what will be the ROI?” For instance, a cricket bond or other financial instruments that can be traded on capital markets. The emergence of the Virtual Cricket Stock Exchange of India could well be the forerunner.

Control

Finally, the other ten components of the model need to be proactively and interactively managed, not just administered. The organisations responsible for managing cricket need to align their structures, competencies and processes based on findings from the other 10Cs. Here, there is a case for cross-industry learnings, while recognition of technical specialist with hardcore cricket experience.

MTI Consulting, as part of their thought leadership initiatives, have conceptualised, researched and published MTI’s 11C Cricket Business Strategy Model, which provides a strategic planning model for cricket as a business and is ideally suited for cricket authorities around the world. The development process used a blend of sports business models and best practices in business strategy models, benefiting from strategy work carried out by MTI in over 40 countries. In 2009-10, MTI, along with UK’s Intangible Business, carried out a pioneering study to financially value the eight IPL franchises.