Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Wednesday, 28 January 2026 00:02 - - {{hitsCtrl.values.hits}}

By Ceylon Tea Brokers PLC

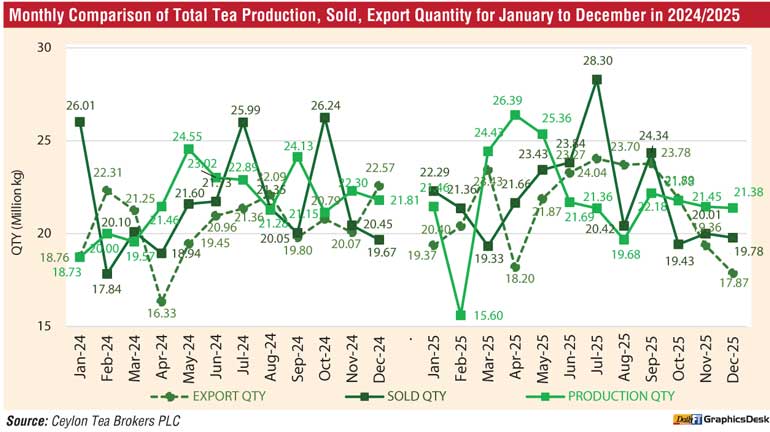

The Sri Lankan tea industry experienced an increase in Production, Exports whilst recording a decrease in National Average for the period January to December 2025 compared to the corresponding period in 2024.

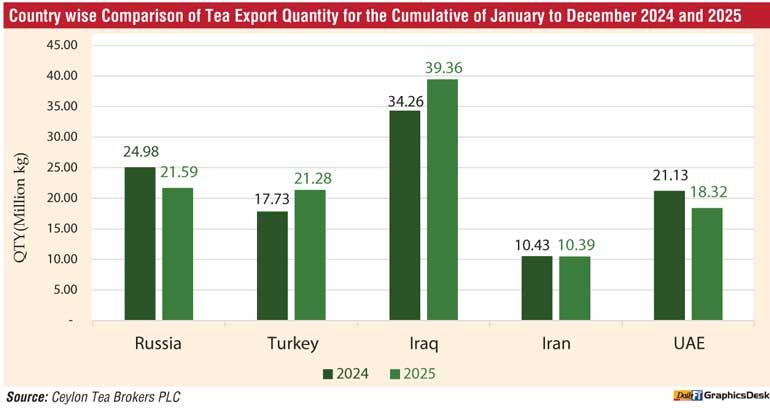

Iraq, Russia and Turkey continued with strong demand for Sri Lankan tea and were the top 03 importers for the period January to December 2025.

Macro-economic factors continued in fundamentally challenging the tea industry framework, with variations in supply and demand, currencies, and the political climate in importing countries.

Production

Total tea production of Sri Lankan Tea for the period January to December 2025 was 264.12 Mn/Kgs, as compared to 262.69 Mn/Kgs in 2024 (+1.43 Mn/Kgs). All three elevations recorded an increase in volume compared to the corresponding period last year.

Furthermore, the CTC Low Grown experienced a drop in volume whereas, High & Medium categories recorded an increase when compared to the corresponding period in 2024. Production & Exports showed an increase of +1.43 Mn/Kgs, and +11.65 Mn/Kgs respectively when compared to the corresponding period in 2024.

National Average of Teas

The total National Average of Teas sold for the period January to December 2025 was Rs.1,167.72 (USD 3.88) per kg in comparison to Rs.1,225.17 (USD 4.06) for the same period in 2024, which recorded a decrease of -Rs.57.45 in Rupee value and -USD 0.18 in Dollar Value. Low Growns averaged Rs.1,235.26 (USD 4.1); Mid Growns recorded Rs.1,025.82 (USD 3.41) with High Growns at Rs.1,100.86 (USD 3.66). All three elevations recorded a drop in Rupee and Dollar value when compared to the corresponding period in 2024.

Low Growns with the largest market share at 60.40% of production, recorded a decrease of -Rs.69.12. Meanwhile, High and Medium Growns recorded a drop of -Rs.40.77 and -Rs.38.66 respectively in comparison to the corresponding period in 2024.

Exports

Sri Lanka Tea Exports for the period January – December 2025 amounted to 257.44 Mn/Kgs vis-à-vis 245.79 Mn/Kgs recorded for the same period last year (+11.65 Mn/Kgs). The FOB average price per kilo for this period stood at Rs. 1,760.70 (USD 5.85) in contrast to Rs. 1,763.61 (USD 5.84), which shows a decrease in the Rupee term (-Rs.2.91) and increase in Dollar value (+USD 0.01) when compared to the corresponding period in 2024. The FOB value of Tea Bags has improved in comparison to the same period in 2024.

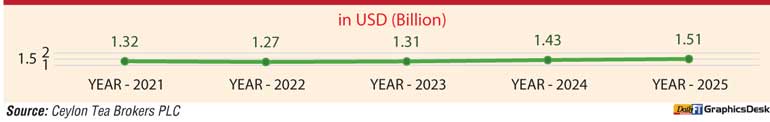

The Total revenue realized for the period January – December 2025 from Tea Exports was Rs.453.28 Bn (USD 1.51Bn) compared with Rs.433.47 Bn (USD 1.43 Bn) recorded for the period January to December 2024. It’s an increase in Rupee terms (+Rs. 19.80 Bn) and Dollar value (+USD 71.38 Mn) compared to the same period in 2024. Teas in Packets and Teas in bulk showed a decrease in FOB Value.

Iraq emerged as the top importer of Sri Lankan tea for January – December 2025, followed by Russia and Turkey. Tea exports to Iraq increased by +5.10 Mn/Kgs, whilst exports to Russia dropped by +3.39 Mn/Kgs. Meanwhile, exports to Turkey rose by +3.54 Mn/Kgs. Exports to Libya saw an increase of +8.64 Mn/Kgs and U.A.E recorded a drop of 2.81 Mn/Kgs.

In terms of the USD equivalent, based on the respective weighted average exchange rates, export earnings amounted to USD 1.51 Bn in 2025 compared to USD 1.43 Bn in 2024, USD 1.31 Bn in 2023, USD 1.27 Bn in 2022, USD 1.32 Bn in 2021.

World Tea Production, Export, and Import Statistics

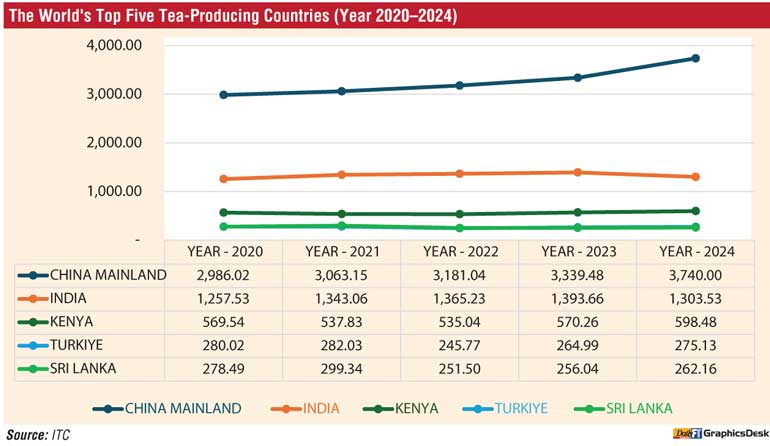

China, the world’s largest tea producer, continued to dominate global production with a clear upward trend from 2020 to 2024. Tea Production increased steadily from 2,986.02 Mn/Kgs in 2020 to 3,063.15 Mn/Kgs in 2021, 3,181.04 Mn/Kgs in 2022, and 3,339.48 Mn/Kgs in 2023, reaching a peak of 3,740.00 Mn/Kgs in 2024. This consistent growth highlights China’s strong production capacity and expanding tea sector.

India, the second-largest producer, recorded relatively stable production levels with minor fluctuations during the period. Production rose from 1,257.53 Mn/Kgs in 2020 to 1,343.06 in 2021 and 1,365.23 in 2022, peaking at 1,393.66 Mn/Kgs in 2023. However, a slight decline was observed in 2024, with output falling to 1,303.53 Mn/Kgs.

Kenya’s tea production showed moderate variations over the five years. After recording 569.54 Mn/Kgs in 2020, production declined to 537.53 in 2021 and 535.04 in 2022. It then recovered to 570.26 Mn/Kgs in 2023 and further increased to 598.48 Mn/Kgs in 2024, indicating a strong rebound.

Türkiye’s tea production remained moderately stable, peaking at 282.03 Mn/Kgs in 2021. Production declined to 245.77 Mn/Kgs in 2022 but recovered slightly to 264.99 Mn/Kgs in 2023, followed by a further increase to 275.13 Mn/Kgs in 2024.

Sri Lanka experienced a decline in tea production over the period. Production increased from 278.49 Mn/Kgs in 2020 to 299.34 in 2021. However, it dropped sharply to 251.50 Mn/Kgs in 2022. Although a slight recovery was seen in 2023 (256.04 Mn/Kgs) and 2024 (262.16 Mn/Kgs), production remains below earlier levels.

Overall, the data reflects diverse trends among major tea-producing countries. China shows consistent growth, Kenya demonstrates recovery and expansion, while Sri Lanka continues to face production challenges. These patterns highlight the varying strengths and constraints within the global tea industry.

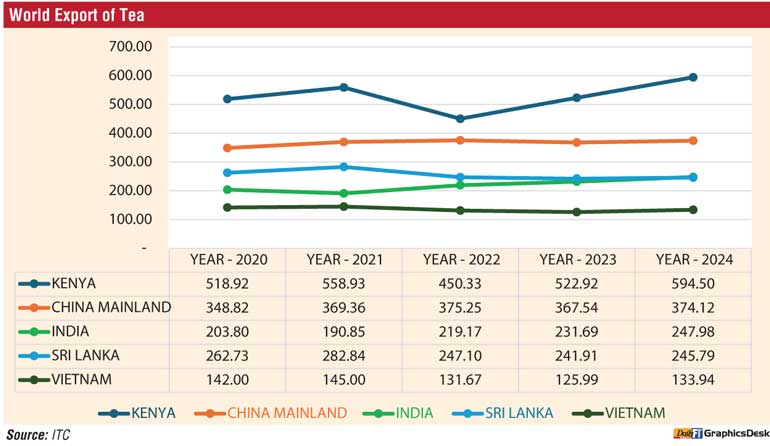

World's Top Five Tea-Exporting Countries

Kenya continued to be the world’s leading tea exporter over the five-year period, recording the highest volumes among major exporting countries. Exports increased from 518.92 Mn/Kgs in 2020 to 558.93 Mn/Kgs in 2021, before dropping sharply to 450.33 Mn/Kgs in 2022. This decline was followed by a strong recovery, with exports rising to 522.92 Mn/Kgs in 2023 and reaching a peak of 594.50 Mn/Kgs in 2024, the highest level during the period.

China Mainland showed a relatively stable export performance. Volumes grew steadily from 348.82 Mn/Kgs in 2020 to 369.36 Mn/Kgs in 2021, peaking at 375.25 Mn/Kgs in 2022. Exports dropped to 367.54 Mn/Kgs in 2023 before increasing again to 374.12 Mn/Kgs in 2024, indicating consistent export strength.

India’s tea exports reflected a gradual upward trend after an initial decline. Exports fell from 203.80 Mn/Kgs in 2020 to 190.85 Mn/Kgs in 2021 but then improved to 219.17 Mn/Kgs in 2022, 231.69 Mn/Kgs in 2023, and further to 247.98 Mn/Kgs in 2024, showing steady recovery and growth.

Sri Lanka’s exports experienced noticeable fluctuations. Volumes rose from 262.73 Mn/Kgs in 2020 to 282.84 Mn/Kgs in 2021, followed by a significant drop to 247.10 Mn/Kgs in 2022. The decline continued in 2023 to 241.91 Mn/Kgs, before a slight recovery to 245.79 Mn/Kgs in 2024.

Vietnam recorded an overall declining trend in exports. Volumes increased marginally from 142.00 Mn/Kgs in 2020 to 145.00 Mn/Kgs in 2021, then fell to 131.67 Mn/Kgs in 2022 and 125.99 Mn/Kgs in 2023. A modest rebound was seen in 2024, with exports reaching 133.94 Mn/Kgs.

Overall, the figures illustrate shifting export patterns among major tea-exporting countries, influenced by production changes, market conditions, and evolving global demand.

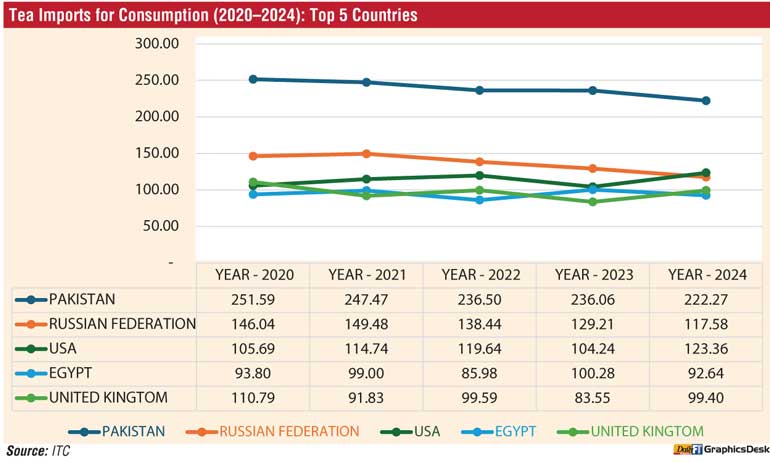

Tea Imports for Consumption

Pakistan remained the largest tea importer during the period, although imports showed a steady decline. Volumes decreased from 251.59 Mn/Kgs in 2020 to 247.47 Mn/Kgs in 2021 and further to 236.50 Mn/Kgs in 2022. This downward trend continued in 2023 with imports at 236.06 Mn/Kgs, before falling further to 222.27 Mn/Kgs in 2024. Despite this reduction, Pakistan continues to hold a leading position in the global tea import market.

Tea imports into the United States showed noticeable fluctuations. Imports increased from 105.69 Mn/Kgs in 2020 to 114.74 Mn/Kgs in 2021 and peaked at 119.64 Mn/Kgs in 2022. However, volumes declined to 104.24 Mn/Kgs in 2023 before rebounding strongly to 123.36 Mn/Kgs in 2024, marking the highest level during the five-year period.

The Russian Federation experienced a gradual decline in tea imports after an initial rise. Imports increased slightly from 146.04 Mn/Kgs in 2020 to 149.48 Mn/Kgs in 2021. However, it dropped to 138.44 Mn/Kgs in 2022. This downward trend continued in 2023 with imports at 129.21 Mn/Kgs and further declined to 117.58 Mn/Kgs in 2024.

The United Kingdom recorded significant fluctuations in tea imports. Volumes dropped from 110.79 Mn/Kgs in 2020 to 91.83 Mn/Kgs in 2021, before recovering to 99.59 Mn/Kgs in 2022. Imports then declined again to 83.55 Mn/Kgs in 2023, followed by a rebound to 99.40 Mn/Kgs in 2024.

Egypt also showed varying import trends over the period. Imports declined from 93.80 Mn/Kgs in 2020 to 89.54 Mn/Kgs in 2021 and further to 86.07 Mn/Kgs in 2022. A sharp increase was observed in 2023, with imports rising to 100.28 Mn/Kgs, before easing slightly to 92.64 Mn/Kgs in 2024.

Overall, the data reflects Pakistan’s continued dominance as a tea importer, while the USA, Russian Federation, United Kingdom, and Egypt showed fluctuating trends influenced by changing demand and market conditions from 2020 to 2024

US growth is projected at 2.2% in 2026, supported by budget measures and the government reopening, before easing to 1.9% in 2027 as tariffs, policy uncertainty, and fading monetary stimulus weigh on activity.