Saturday Feb 14, 2026

Saturday Feb 14, 2026

Tuesday, 27 October 2015 01:01 - - {{hitsCtrl.values.hits}}

By Shehana Dain

Government intervention in defending the rupee remains a talking point even as the currency steadied in trading on downward pressure yesterday, with experts voicing concern over moves by officials to excessively oversell the rupee.

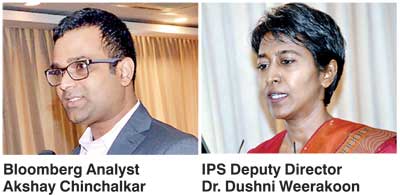

“I don’t think that it’s the correct time for the officials to be bearish about the rupee at the moment. The current rate around 140-141 is far too much overselling. I think they should be bullish and bring it down to 138-139,” opined Bloomberg Analyst Akshay Chinchalkar.

He made these comments at an economic forum organised by DFCC Bank, highlighting that if Sri Lanka continued to think that the  dollar would rally against the rupee, it could be “a very risky move”.

dollar would rally against the rupee, it could be “a very risky move”.

The Central Bank took a decisive move to let the rupee float from 4 September this year in order to boost exports.

Akshay expects the US Federal Reserve to increase interest rates in March and if that situation arises it will significantly impact the debt-ridden Lankan economy. As at June 2015 the country’s external debt amounted to Rs. 3,181,800 m. He added the depreciating rupee had resulted in more expensive debt payments and that the relevant authorities had to closely follow the Federal Reserve’s interest rate decision.

“The world’s debt is in USD. If the Fed hikes rates, the USD will rally because money will yield to an asset which is now fetching higher yield. If the USD rallies, the debt will become more expensive to pay off so there will definitely be a big impact,” he opined.

Institute of Policy Planning Deputy Director Dr. Dushni Weerakoon noted that having a “misaligned exchange rate” for the first eight months of the year fuelled imports, squeezed out exports and also managed to hold back foreign remittances. She said this was mainly due to the anticipation of a revised stance on policy.

Foreign remittance inflow, which is the country’s largest source of income in terms of foreign exchange, showed only 1.8% growth during January-September. Exports were down 3.4% and continued to deteriorate during the year, however imports surged to about 37.3%, according to Central Bank data.

She highlighted that the decision to float the Rupee had constantly been a stop-go policy for years and added that abrupt economic decisions by policymakers were mere short-term solutions for a bigger issue.

“Sri Lanka has always tried to stimulate the economic growth via monetary policy where monetary easing or a misaligned exchange rate is pushed to the economy. What we end up with is consumer demand picking up with imports amplifying, the exchange rate being overvalued and the rupee being pressured, which ultimately leads to inflation. As a result policy corrections are made abruptly, which leads to the rupee floating. The cycle never ends. The next step the Government will opt to take with our experience is further monetary easing.”

She went on to outline the implications of an oversold rupee “If private sector credit financing increases and the rupee continues to depreciate, it’s fair to say that demand side inflation will start to build up in the economy. We may end up with high interest rates or a high inflation regime if the policy adjustments are not taken in time,” she noted.

“The point that we are missing is that monetary easing will work only if money supply is a constraint to growth. If the growth of the economy is consumption led, then the demand for investments by the private sector will not yield the expected results,” Dr. Weerakoon explained.

Dr. Weerakoon insisted that immediate fiscal reforms were a priority.

“This is adding to our fiscal woes. There are systemic risks arising from this, huge build-up in contingent liabilities over the last three years with direct borrowing which involves State banks. Tackling fiscal reforms is a must. People should know that we’re in an economic crisis and strong Parliamentary mandates to push reforms and ownership should be taken in a reform process rather than a perception that it was forced on them from outside,” she added.

Hard decisions by the Government will be looked for in the upcoming Budget. “The only reform today is change of Government; there is no clear mandate aligned with the economic thinking or any preparation if an economic crisis hits the country. Policy clarity and agenda setting are top priority and the starting point is revenue generation. It’s not one-off ad hoc taxes; there has to be a systematic tax reform effort. Tax revenue has to be increased and hard decisions must be taken at this juncture with regard to rationalised spending.”

Rupee little changed amid downward pressure

Reuters: The rupee ended slightly weaker on Monday in dull trade as importer dollar demand outpaced mild exporter sales of the greenback, dealers said.

|