Monday Feb 16, 2026

Monday Feb 16, 2026

Friday, 18 June 2021 00:00 - - {{hitsCtrl.values.hits}}

The trade deficit widened more in April to $ 889 million as against $ 832 million in March as robust imports despite restrictions dwarfed the best-ever April export performance.

The trade deficit widened more in April to $ 889 million as against $ 832 million in March as robust imports despite restrictions dwarfed the best-ever April export performance.

The April figure is also higher from a year ago deficit of $ 840 million, whilst Sri Lanka began a year-on-year (YOY) increase of trade deficit in March first time since April 2020.

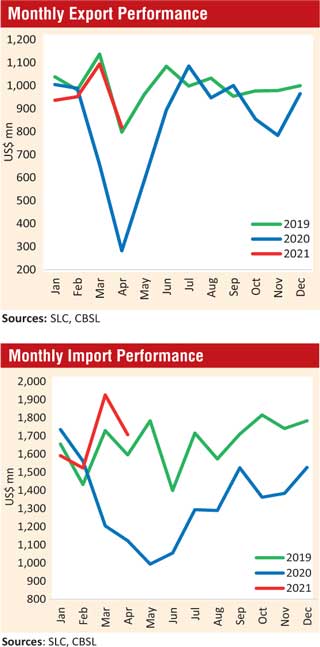

Central Bank said both exports and imports were significantly higher in April, compared to the lockdown period in April 2020, although both were lower compared to March.

Cumulatively, exports were up 29.6% to $ 3.8 billion in the first four months of 2021, whilst imports were up 20% to $ 6.7 billion of which non-fuel imports were up 17.6% to $ 5.35 billion.

The cumulative deficit in the trade account during January – April widened to $ 2.94 billion from $ 2.69 billion recorded over the same period in 2020.

Central Bank said the major contributory factors for this outcome were sharp rise in value of fuel imports, machinery and equipment, textiles and textile articles, chemical products and plastics and articles thereof.

Recording the highest ever value for a month of April, earnings from merchandise exports in April increased by 189.8% to $ 818 million, from a significantly low value of $ 282 million recorded in April 2020 amidst the island wide lockdown measures due to the first wave of the COVID-19 pandemic.

Earnings from exports in April, however, were 25.2% lower than the export earnings of $ 1,094 million recorded in March, reflecting the impact of the beginning of the third wave of the pandemic and the festive holiday-related developments in April.

Earnings from all subsectors of industrial goods exports improved substantially by 302.5% to $ 647 million in April, YOY. On a month-on-month basis, earnings from industrial exports declined by 22.0%, except for the subsector of petroleum products; leather, travel goods and footwear (mainly footwear); animal fodder (mainly dog/cat food); and printing industry products (mainly currency notes). Earnings from textiles and garments; rubber products; machinery and mechanical appliances; and gems, diamonds and jewellery mainly recorded declines compared to March.

Meanwhile, earnings from the export of petroleum products improved in April over the preceding month due to higher exports of naphtha, while earnings from bunker and aviation fuel declined with the significant reduction in volumes of aviation fuel and bunkering fuel supplied to aircraft and ship arrivals, despite the increase in the average prices of these export products.

Export earnings from all subsectors related to agricultural goods increased by 37.7% to $ 165.6 million in April, compared to a year ago, though contracted by 35.6% compared to March. Despite higher export prices, export earnings from tea declined substantially compared to the previous month due to lower export volumes.

In addition, export earnings from spices (mainly cinnamon, pepper and cloves), coconut (both kernel and non-kernel products), seafood and minor agricultural products declined notably in April over March.

Earnings from all subsectors under mineral exports were also higher in April (by 332.9%) than export earnings in April 2020, but lower (by 10.3%) than export earnings in March. The decline in April over March reflected lower earnings from subsectors of earths and stone (mainly quartz), and ores, slag and ash (mainly titanium ores).

The export volume index and the unit value index increased by 182.0% and 2.8%, respectively, on a YOY basis, in April. This indicates that the increase in export earnings was due to the combined impact of higher export volumes and prices.

Expenditure on merchandise imports in April increased by 52.1% to $ 1.7 billion from low import expenditure of $ 1.12 billion in April 2020, when the effects of the first wave of the pandemic and low global petroleum prices were present.

The YOY increase in the import expenditure was driven by the increase in imports of intermediate and investment goods. However, import expenditure in April was considerably lower (by 11.4%) compared to March ($ 1.92 billion), although import values in both March and April were higher than pre-pandemic levels.

With declines recorded in both food and beverages and non-food consumer good categories, expenditure on the importation of consumer goods in April declined by 7.9%, compared to April 2020 and by 26.6% compared to March.

Under food and beverages, import expenditure decreased on a month-on-month basis for the items such as sugar and confectionery; vegetables (mainly big onion, lentils and potatoes); dairy products (mainly milk powder); spices (mainly chillies); and oils and fats.

Also, under non-food consumer goods, import expenditure declined on a month-on-month basis on telecommunication devices (mainly mobile phones); medical and pharmaceuticals; and home appliances (mainly refrigerators and fans).

In contrast, import expenditure on seafood (mainly dry fish) and cereals and milling industry products (mainly rice) increased in April compared to March.

Import expenditure on intermediate goods increased by 88.6% in April, compared to a year ago, but declined by 4.9% over the previous month. Import expenditure on many intermediate goods declined in April compared to March, particularly base metals (mainly iron and steel); plastics and articles thereof; textiles and textile articles; food preparations; and rubber and articles thereof. In contrast, expenditure on fuel, fertiliser and mineral products increased on a month-on-month basis.

The average import price of crude oil increased to $ 66.44 per barrel in April compared to $ 64.07 per barrel in February, while there were no crude oil imports in March due to the closure of the refinery for maintenance.

However, expenditure on refined petroleum and coal declined due to reductions in both imported volumes and average import prices compared to March. In addition, import expenditure on fertiliser increased noticeably in April due to higher import prices and volumes over March while the increase in import expenditure on mineral products led by cement clinker imports.

Import expenditure on investment goods increased by 41.4% in April compared to April 2020, but declined by 15.2% compared to March. Import expenditure on all subsectors under investment goods, i.e., machinery and equipment, building material, transport equipment and other investment goods, declined in April compared to March.

Expenditure on machinery and equipment imports declined on a month-on-month basis in April, led by low import expenditure on electric motors and generator sets; office machines; medical and laboratory equipment; and turbines. In addition, lower expenditure on wood products, cement and agricultural tractor imports led to the decline of import expenditure in other subcategories.

In contrast, import expenditure on lorries, pumps, mineral products (such as asbestos and lime), agricultural machinery, insulated wires and cables, and ceramic products increased in April compared to March.

The import volume index and unit value index increased by 39.8% and 8.8%, respectively, on a YOY basis, in April. This indicates that the increase in import expenditure was attributable to the combined impact of both higher import volumes and prices.

Terms of trade, i.e., the ratio of the price of exports to the price of imports, deteriorated by 5.5% in April as the increase in import prices were higher than the increase of export prices, compared to April 2020.