Monday Feb 16, 2026

Monday Feb 16, 2026

Thursday, 12 December 2019 03:26 - - {{hitsCtrl.values.hits}}

Dr. Mobius says SL can return to 8% growth with new Govt.

But says Govt. must implement right policies

Low interest rates good for SL debt, suggests debt restructuring

Creating investor-friendly environment, competitive tax regime key to growth

Wants SOEs listed to increase capital, raise efficiency, cut debt

SL stock market offers attractive valuations

Real estate, tourism, financial services his picks for investment

Optimistic US-China trade war will provide opportunities for emerging markets

By Uditha Jayasinghe

Well-known investor and emerging markets guru Dr. Mark Mobius this week placed the odds of Sri Lanka returning to strong growth in its favour, provided the Government moved efficiently to implement policies, which include establishing an investor-friendly environment and competitive tax regime.

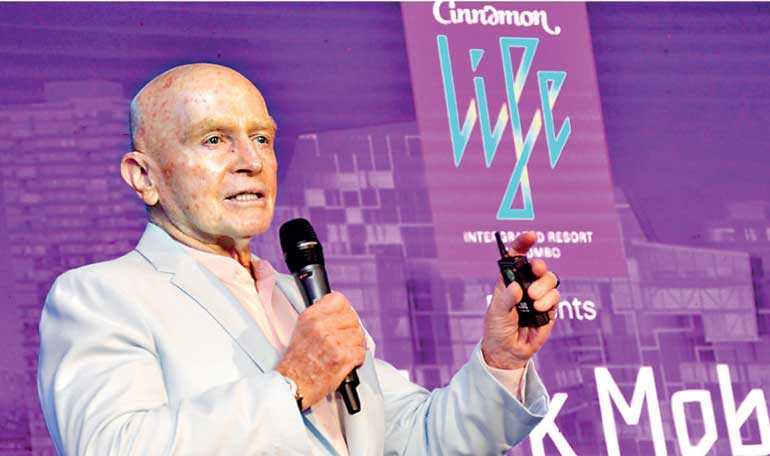

Dr. Mobius, who is a founding partner of the Templeton Emerging Markets Group, which is estimated to be worth $ 50 billion, and is widely recognised as the architect of the emerging markets asset class, gave his assessment of Sri Lanka’s opportunities and challenges as well as an analysis of global prospects to a packed audience at the Cinnamon Grand Hotel this week.

Recalling Sri Lanka’s 8% or more growth just after the end of the ethnic conflict in 2009, Dr. Mobius was optimistic that with the stimulus package introduced by the Government earlier this month, reducing interest rates and overall global economic trends, the country has a window to tap into a strong growth recovery trajectory.

“I believe Sri Lanka can re-achieve that 8% growth if the right policies are followed and the economy is given the freedom to really move ahead and grow. The situation from a historical perspective looks very good for Sri Lanka. With the change in Government I see a resumption in that growth path, the prognosis is good. The question now is how fast the new Government can move to make the changes and improvements that will kick-start the economy and keep it going,” he said.

“The opportunity at this juncture in the global economy is very awesome because of interest rates, which are low and going lower. So we are seeing almost a deflationary environment, which is good for Sri Lanka’s debt repayment needs.”

He recommended Sri Lanka restructure its debt so it was easier to tackle and called on the Government to encourage investment by making bureaucratic processes digitised and streamlined so they could be more easily accessed by the public.

“Tax reform, ease of foreign exchange flows and travel. Make taxes easy to pay and competitive to the region, change procedures for foreign exchange controls by making the way easy for money to come in and go out, and make visa procedures easy for tourism to flow.”

All of this he claimed would easily solve the issues of tax deficits and strengthen the currency as a result.

Dr. Mobius also called on the Government to think of new ways to raise revenue, which in his view should include making State-Owned Enterprises (SOEs) more market friendly and possibly listing them on the stock exchange.

“You don’t have to privatise,” he said. “Just increase the transparency of State-Owned Enterprises by publicly listing the companies. This is a high priority even if they are losing money, because only when issues are made publicly known, can where these losses are coming from be definitively pin-pointed, and as a result, addressed.”

Another boon for entrepreneurs and companies would be developing Sri Lanka’s capital and bond markets, he noted, pointing out that the country should become recognised in the “index game” and listing large SOEs would increase market capitalisation and make them more attractive to foreign investors.

In order to drive growth, Dr. Mobius picked real estate, tourism and financial services as three sectors that he would invest in and where Government focus may lead to the most results quickly. He also suggested that Sri Lanka aim far higher in its tourist arrival targets, saying that 10 million was a possibility given Sri Lanka’s proximity to India and its growing relations with China.

Even though emerging markets have taken a hit in growth this year, Dr. Mobius insisted that he remained bullish on their prospects and opined that even with slower than expected growth these countries remained attractive to investors.

“Sometimes markets have downturns but the key is growth. If you look at GDP growth for 2019, even with all the downgrades we are seeing, we are expecting emerging markets to grow by 4.5% rather than 1.6% for developed markets. India and China’s growth is still good. Emerging markets are becoming more important because of their size, populations, landmass, reserves, exports and GDP that makes up 40% of global GDP.

“When we look at emerging markets we look at value and Sri Lanka looks very good in value terms. Currencies are also cheap and if you look at the currency index against the dollar it has gone right down. That’s beginning to stabilise.”

Dr. Mobius was also upbeat on the trade war between the US and China, which he emphasised would provide opportunities for emerging markets, including Sri Lanka.

“Emerging countries such as Sri Lanka actually stand to benefit from the new re-arrangements of moves in trade and exports. China for instance should be encouraged to invest and manufacture here as should other superpowers such as India while Sri Lanka maintains its independence. Furthermore, with low global interest rates, as it now stands, it is easier for emerging economies, more than established markets, to refinance and restructure debt as rates come down, and then to raise more money at very low rates.”

Dr. Mobius also mused over how investments the world over had been significantly altered by the entry of sophisticated communication, the Internet and Information Technology, and yet maintained that through his four-decade-long tenure, he has learned that the acceptance of new trends and optimism has always paid off as an investor. He also called for reforms in the real estate sector to make it more investor friendly.

“The methodology for property investment is the same around the world,” revealed Dr. Mobius, “and that is the challenge in the development of mortgage markets. Here in Sri Lanka there is a dire need to develop a mortgage market where owning property is made easier for potential investors.”