Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Wednesday, 31 August 2022 00:00 - - {{hitsCtrl.values.hits}}

|

| President and Finance Minister Ranil Wickremesinghe presents the interim Budget yesterday in Parliament

|

President Ranil Wickremesinghe yesterday rolled out sweeping reforms and relief via the mini-Budget to appease crisis-hit vulnerable groups as well as kick-start recovery in the economy.

The interim Budget was replete with reforms, especially in the public sector and included mandatory exit by December by all Government and semi-Government employees who are over 60 years old, from 65 reducing the retirement age to 60; restructuring of State-Owned Enterprises and consolidation of identified Local Government Authorities.

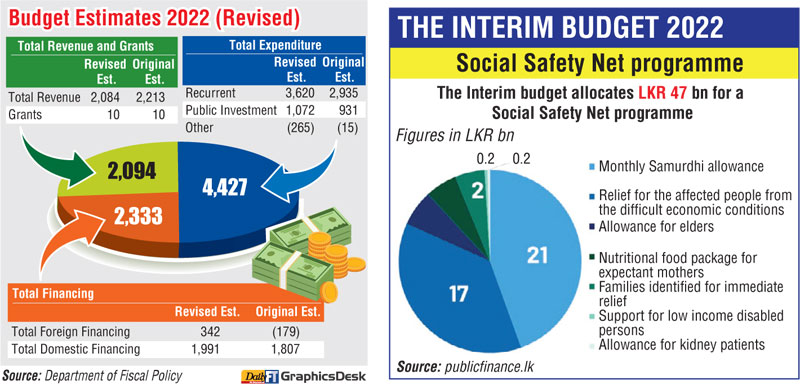

It also included provisions to accommodate the policy package introduced in January 2022, provisions for strengthening social safety net programs (Rs. 163 billion inclusive of Rs. 133 billion loan from the World Bank), additional cost (Rs. 263 billion) due to increased interest payments in 2022, provisions (Rs. 250 billion) for financing obtained through the Indian Line of Credit and increased cost of fertiliser subsidy (Rs. 63 billion), among others.

The Government has also directed around Rs. 300 billion out of capital expenditure and less priority spending allocated in the original budget 2022 for these purposes, including the provision of relief to those who are affected by the economic crisis.

“I am well aware of the difficulties faced by many due to the ongoing crisis. That’s why I decided to cut some of the capital expenditure and find room to provide enhanced support for vulnerable communities,” President told Parliament.

Safety net for the poor

He recalled that the Government spent additional Rs. 31 billion from May to July 2022 to provide an additional monthly allowance as urgent assistance to those who have been affected due to loss of employment, decline in agriculture output and inability to cultivate due to many reasons. He proposed to continue this program for further four months to reduce the pressure of the economic crisis on the affected people.

The President also said that there are about 61,000 food insecure families needing urgent assistance and the Government will offer Rs. 10,000 per family for a period of further four months.

Another proposal is to provide an additional monthly allowance of Rs. 2,500 for pregnant mothers in addition to Rs. 20,000 already provided for them.

“For all the above programs, I will allocate Rs. 46,600 million for a period of four months,” the President said.

Noting that the recent increase in the kerosene prices has created difficulties for the owners of small fishing boats and those in the plantation areas that have no electricity services, a subsidy has been proposed. He also said Rs. 133 billion has been allocated under the World Bank loan assistance for the implementation of programs with the view of reducing the impact of the current economic crisis and restoring social stability.

The President said approval has been obtained through the Supplementary Estimate presented to Parliament before presenting the interim Budget to provide immediate relief to around 3.2 million people affected by the current economic situation.

Under this, monthly Samurdhi allowance has been increased to an amount ranging between Rs. 5,000 to Rs. 7,500 per month for approximately 1.7 million currently Samurdhi receiving families. Apart from that, an assistance of Rs. 5,000 was provided per month temporarily to around 726,000 families who were in the waiting list expecting Samurdhi benefits.

The allowance paid for the elderly, disabled, and kidney patients was increased to an amount ranging between Rs. 5,000 to Rs. 7,500. Further, the temporary assistance of Rs. 5,000 was arranged for the people who are in the waiting lists in anticipation of receiving this assistance.

In addition to these concessions provided, the President said $ 110 million (Rs. 40 billion) has been allocated for the import of Urea required for paddy cultivation in the 2022/2023 “Maha” season, and fertiliser procurement is already underway. “I believe that this will enable the paddy farmers to get a good harvest in the coming season and thus will be able to get rice at a reasonable price for the rice consumers,” he said.

The Government also plans to spend an additional $ 70 million (Rs. 25 billion) to ensure continuity in the supply of LPG.

Helping farmers and boosting agriculture

Aimed at strengthening farmers and freeing them from debt burden, the President said outstanding loans amounting to Rs. 688 million (excluding interest) currently in default to the State banks will be written off.

The money to be written off will be paid back to the respective banks in two years in a phased manner so as not to put added pressure on the cash flow of the General Treasury. Accordingly, the respective banks should arrange to write off the interest relating to such loans the President said, adding Rs. 350 million will be allocated for this initiative.

He also proposed to establish Youth Agriculture Companies and link them with 331 Divisional Federation of Youth Clubs to get maximum results and Rs. 250 million will be allocated for this initiative.

He said the Domestic Agriculture Development (DAD) Value Chain Program will be further strengthened. DAD’s pilot phase is being implemented by CBSL with its own funds (Rs. 1 billion) and it is expected to expand the program in 2023 with the assistance of the development partners, while encouraging the production for the overseas market.

Rs. 400 million is being proposed to the Department of Agriculture to produce necessary seeds and planting materials. Additionally, 20 acres of land will be allotted to currently unemployed youth groups (groups of about 10 members) in the area where the identified lands are located for export-oriented agriculture ventures. A decision to revise the Agricultural Insurance Program was also announced.

The interim Budget also allocates Rs. 200 million for the development of the dairy industries and Rs. 50 million for agriculture and animal husbandry using State lands with aim to utilise them efficiently. An additional Rs. 200 million will be spent to help the transport of fresh vegetables and fruits from upcountry to Colombo through railway services. Tax relief has been proposed for food packaging factories for local agricultural products.

SOE reforms

In terms of SOE reforms, the President proposed Rs. 200 million to establish the ‘State-Owned Enterprise Restructuring Unit’ to facilitate restructuring of Government-owned business entities. He also proposed to re-activate the Statement of Corporate Intent (SCI) process for key 50 SOEs, excluding CEB, CPC and SriLankan Airlines, as they are under different efforts to restructure, to closely monitor the set targets. SCI was a feature under the last IMF program.

The President also proposed to introduce new legislation under a Public Finance Management Act (PFM Act) that will include stronger Fiscal Rules and a “Parliamentary Committee on Ways and Means” will be established to closely deal with issues and make proposals in raising Government revenue.

“These difficult but necessary measures pertaining to SOEs will no doubt be challenging to address, but failing to do so would create catastrophic risks, particularly for financial sector stability, and will entail even higher taxation burdens on the public in the future,” President said.

A comprehensive legal framework will be established to strengthen governance and fight corruption. This framework will strengthen the asset declaration system and increase independence of the Commission to Investigate Allegations of Bribery or Corruption. President proposed to promote technology infused systems to eliminate grounds for corruption and create transparency.

In order to stabilise the economy and facilitate the growth process, it was proposed to make appropriate revisions and introduce new laws to make reforms expeditiously in a short period of time as given below.

•New Laws:

i. Food Security Bill,

ii.Public Asset Management Bill,

iii.Economic Stabilisation Bill,

iv.Offshore Economic Management Bill, v. Public Service Employment Bill,

v. Public Finance Management Bill,

vi.The Recovery of Possession of the Premises Given on Lease (Special Provisions) Bill,

vii.Contributory National Pension Fund Bill and

viii.Agency for Overseas Sri Lankans Bill

•Revision of Laws:

i. Amendments to Agrarian Development Act,

ii.Amendments to Excise Ordinance,

iii.Amendments to Finance Act and

iv.Amendments to Foreign Exchange Act

Interim Budget also announced initiatives such as facilitating new jobs based on skills, expanding higher education opportunities, facilities from the Climate Fund, Research and Development (R&D), promotion of tourism industry, ensuring the employment security of the community engaged in micro-scale self-employment/livelihood occupations, private investment to improve quality and efficiency of the railway, boosting trade and investment and manufacture of electric bicycles.

President used the interim Budget speech to briefly discuss the economic crisis, the cause of the economic crisis, the solution to the economic crisis and the method of solving the economic crisis

The President said the interim-Budget, the IMF agreement and the Budget 2023 will set the framework for economic stabilisation and revival. “Within it, we will set the Road Map. Once the discussions with the IMF are concluded, I expect to provide the information on the same to the Parliament,” Wickremesinghe added.

President presents Interim Budget 2023, highlights proposals to create new economy