Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 13 February 2023 00:00 - - {{hitsCtrl.values.hits}}

Private sector borrowing in 2022 has been lacklustre due to prevalent high interest rate regime as well as downturn in the economy.

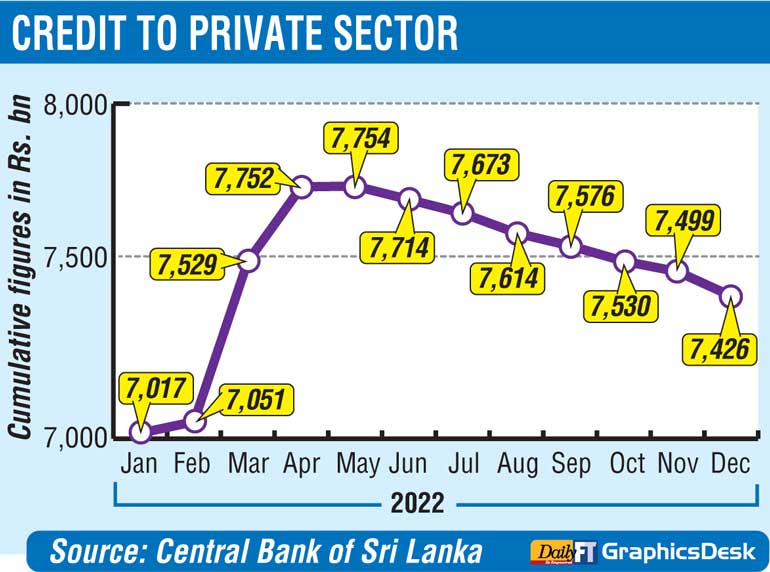

Cumulative private sector credit outstanding as at end December 2022 was Rs. 7.42 trillion, up by 6.4% from a year ago. In 2021, private sector credit saw a robust 13% growth.

December 2022 marked the seventh month-on-month decline from June.

Cumulative private sector credit stood at Rs. 7 trillion at the beginning of 2022 and spiked to Rs. 7.7 trillion in April following the re-pricing after the rupee suffered a 40% devaluation.

There is growing criticism over the high interest rate environment from private sector as well as micro and SMEs even though the Central Bank has maintained the stance that finance costs work out to less than 10% of the overall cost.

The CBSL has also insisted that the bigger factor high inflation needs to be reined in first before dealing with interest rate.