Monday Feb 16, 2026

Monday Feb 16, 2026

Wednesday, 29 May 2019 01:52 - - {{hitsCtrl.values.hits}}

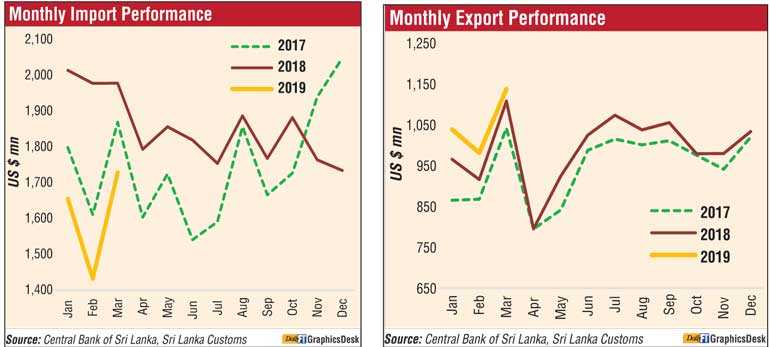

Imports drop 5 consecutive months, March sees 12.6% drop

All imports excluding fuel see drop, CB says reduction due to policies, expected change in 2Q

But exports increase 5.6% in 1Q, record highest-ever earnings of $ 1.13 b

Industrial and mineral exports grew but agricultural exports declined

Apparel records highest-ever monthly earning surpassing $ 500 m

Trade deficit contracts to $ 1.6 b from $ 2.9 b in 1Q 2018

Reserves at $ 7.6 b, rupee appreciates 3.8% to date

Imports dropped a steep 19.3% in the first quarter of 2019, even though export earnings increased by 5.6% year-on-year as the trade deficit contracted to $ 1,661 million from $ 2,982 million recorded in the first quarter of 2018, the Central Bank said yesterday.

Releasing the latest External Sector Performance Report, the Central Bank said imports had declined for five straight months, with March seeing a 12.6% drop, on a year-on-year basis, to $ 1,729 million. The Central Bank attributed the drop to policies aimed at discouraging imports and said that an import pick-up may take place in the second quarter as these policies were reversed. All imports other than fuel saw a decline as economic activity slowed.

In March 2019, the deficit in the trade account narrowed to $ 592 million, compared to $ 871 million in March 2018. The considerable reduction in the trade deficit in March 2019 was due to a notable decline in import expenditure by 12.6% (year-on-year) which was further supported by the increase of export earnings by 2.6% (year-on-year), the report said.

The financial account was further strengthened in March with the proceeds of the International Sovereign Bonds (ISBs) amounting to $ 2.4 billion and net inflows of foreign investments to the Government securities market during the month, although some net outflows were observed from the Colombo Stock Exchange (CSE).

Along with the significant reduction in the trade deficit and significant inflows to the financial account, the Sri Lankan Rupee appreciated against the US Dollar by 3.8% by end March 2019 compared to end 2018. Despite the marginal depreciation of the rupee in the aftermath of the Easter Sunday bomb attacks, it recorded an appreciation of 3.8% during the year up to Tuesday.

On 13 May, the Executive Board of the International Monetary Fund (IMF) completed the Fifth Review under Sri Lanka’s Extended Fund Facility (EFF) approving the disbursement of the sixth tranche amounting to SDR 118.5 million (approximately $ 164.1 million). The Executive Board also approved an extension of the arrangement by one year, until June 2020, and rephased the remaining disbursements.

The country’s gross official reserves stood at $ 7.6 billion, which was equivalent to 4.3 months of imports at end March 2019. The deficit in the trade account narrowed significantly in March this year in comparison to March 2018 due to record high export earnings and considerable reduction in imports.

Expenditure on imports continued to decline due to the policy measures adopted by the Central Bank and the Government. On a cumulative basis, the deficit in the trade account contracted significantly during the first three months of 2019 in comparison to the corresponding period of 2018.

Terms of trade, which represent the relative price of imports in terms of exports, deteriorated by 3.3% (year-on-year) in March due to the decline in export prices at a higher rate than the decline in import prices. Meanwhile, on a cumulative basis, terms of trade deteriorated marginally during the first three months of 2019 in comparison to the corresponding period of 2018.

“Merchandise exports recorded the highest-ever monthly earnings of $ 1,137 million in March 2019 registering a moderate growth of 2.6%, due to the higher base in March 2018. The growth in exports was driven by the improved performance in industrial and mineral exports while agricultural exports declined,” the report said.

Under industrial exports, earnings from textiles and garment exports increased notably in March 2019, recording the highest-ever monthly earnings which surpassed $ 500 million for the first time. This growth was mainly due to higher demand for garment exports from traditional markets, namely the USA and the EU, as well as non-traditional markets such as Canada, Australia and China. Export earnings from textiles and other textile articles also increased in March.

Earnings from petroleum exports increased in March, reversing the declining trend observed during the past three months, led by an increase in both volume and prices of bunker and aviation fuel. Export earnings from base metals and articles increased driven by iron and steel articles and aluminium articles. Export earnings from food, beverages and tobacco increased during the month owing to the improved performance in all sub categories except vegetables, fruit and nuts preparations.

Printing industry products, and chemical products also contributed towards the increase in industrial exports in March. However, earnings from machinery and mechanical appliances, gems, diamonds and jewellery, rubber products, leather, travel goods and footwear, and transport equipment exports declined in the period concerned.

Earnings from agricultural exports declined in March, mainly driven by subdued performance in tea, minor agricultural products, natural rubber and unmanufactured tobacco exports. Although the volumes of tea export increased in March, export earnings from tea declined due to lower average export prices. However, earnings from coconut exports increased due to the increase in export of both coconut kernel and non-kernel products. Earnings from spices, seafood and vegetable exports also rose marginally during the month.

Export earnings from mineral exports, which account for about 0.4% of total exports, rose mainly driven by export of titanium ores.

The export volume index in March 2019 increased by 10.6% while the export unit value index decreased by 7.2%, implying that the growth in export earnings was solely driven by the increase in volumes. Expenditure on merchandise imports declined considerably in March 2019 by 12.6%, on a year-on-year basis, to $1,729 million, recording a decline for the fifth consecutive month.

This reduction was mainly due to the effect of the policy measures implemented by the Central Bank and the Government to discourage certain non-essential imports and the significant depreciation of the currency. However, considering the favourable developments in the external sector and measures introduced in Budget 2019, such policy measures were withdrawn in March 2019. Low expenditure on intermediate and consumer goods contributed to the decline in imports during March 2019, while expenditure on investment goods increased. Total imports, excluding fuel, also declined significantly.

Import expenditure on intermediate goods declined in March 2019 mainly driven by gold imports which continued to be stagnant following the imposition of customs duty on gold in April 2018. Expenditure on wheat and maize declined owing to the lower import volume of wheat. Plastic and articles, food preparations and vehicle and machinery parts imports also contributed to the decline in intermediate goods.

In contrast, expenditure on fuel imports increased in March owing to higher import volume and prices of crude oil despite a reduction recorded in refined petroleum and coal imports. In addition, expenditure on fertiliser imports increased in March 2019 mainly driven by higher import volumes when compared with March 2018. Further, import expenditure on textiles and textile articles led by fabrics, base metals led by iron and steel and mineral products led by cement clinkers increased during the period concerned.

Reflecting lower imports of most items in both food and beverages and non-food consumer goods, import expenditure on consumer goods declined significantly in March. Expenditure on personal motor vehicle imports declined significantly in March, continuing its year-on-year declining trend observed since December 2018. However, imports of personal motor vehicles recorded an increase in comparison to the previous month.

Policy measures on motor vehicle imports were changed with the withdrawal of margin requirements against letter of credits (LCs) and upward revision of excise duties on motor vehicles. In addition, import of rice declined with lower import volumes as there was sufficient domestic production of rice in the market while sugar and confectionery imports reduced due to lower import volumes and prices.

In addition, expenditure on most non-food consumer goods such as clothing and accessories, telecommunication devices, home appliances and household and furniture items declined during the month. However, expenditure on dairy products, cosmetics and toiletries, printed materials and stationery imports increased in March.

Import expenditure on investment goods increased in March, driven by higher imports of building material and machinery and equipment. Reflecting higher imports of cement and articles of iron and steel, import expenditure on building material increased. Import expenditure on machinery and equipment increased during the month, mainly due to imports of cranes. In contrast, expenditure on transport equipment declined in March due to lower expenditure incurred on the importation of tankers and bowsers and buses compared with the corresponding period of 2018.

Import volume and unit value indices decreased by 8.9% and 4.1%, respectively, in March, indicating the decline in import expenditure during the month was driven by the reduction in both volumes imported and price, in comparison to the corresponding period of 2018.

Along with the proceeds of the ISBs, as at end March, gross official reserves were estimated at $7.6 billion, equivalent to 4.3 months of imports. Total foreign assets, which consist of gross official reserves and foreign assets of the banking sector, amounted to $ 10.5 billion as at end March, equivalent to six months of imports.