Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Wednesday, 15 February 2023 01:51 - - {{hitsCtrl.values.hits}}

Sri Lanka’s most diversified blue chip Hayleys has succeeded in overtaking its best ever results posted in FY22 within the first nine months of the current financial year reflecting its resilience though higher finance cost and taxes impacted its third quarter year on year.

Sri Lanka’s most diversified blue chip Hayleys has succeeded in overtaking its best ever results posted in FY22 within the first nine months of the current financial year reflecting its resilience though higher finance cost and taxes impacted its third quarter year on year.

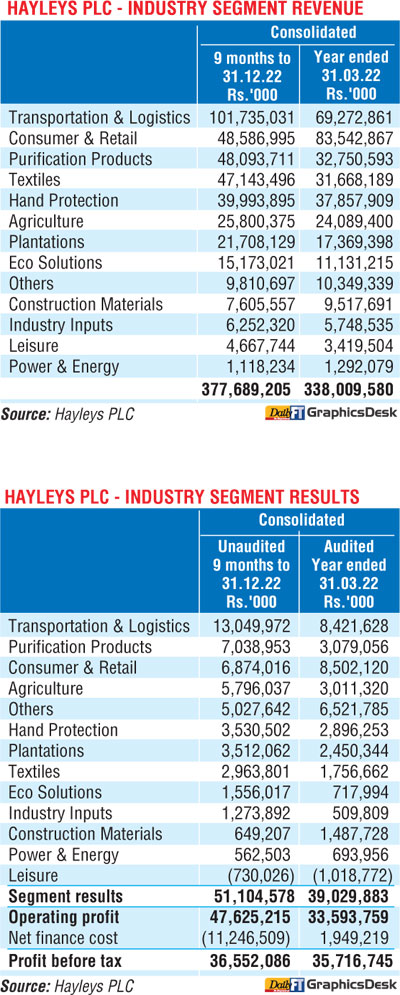

As per interim results released yesterday, Hayleys consolidated pre-tax profit amounted to Rs. 36.5 billion up by a massive 88% from a year ago and in the process overtook the best ever figure of Rs. 35.7 billion achieved in full FY22. After tax profit grew by a healthy 66% to Rs. 24.3 billion from a year ago but slightly below Hayleys’ 144 year history’s best ever figure of Rs. 28 billion posted in full FY22.

Net profit attributable to owners of the parent rose by 53% to Rs. 14.5 billion. However it is trailing behind full FY22›s performance of Rs. 18.25 billion.

Group revenue in the first nine months of FY23 was Rs. 377.6 billion, comfortably above the best ever top-line of Rs. 338 billion achieved in FY22 and up 53% from the first nine months of FY22.

Group revenue in the first nine months of FY23 was Rs. 377.6 billion, comfortably above the best ever top-line of Rs. 338 billion achieved in FY22 and up 53% from the first nine months of FY22.

Almost all sectors including leisure and excluding consumer and retail and construction material have performed better in the first nine months vis-à-vis FY22.

In the 3Q of FY23, revenue grew by 26% to Rs. 116.3 billion and result from operating activities grew by 29% to Rs. 13.5 billion. However, higher finance costs, up 196% to Rs. 8.7 billion, led to profit before tax dip by 25% to Rs. 6.5 billion and higher taxation up 171% to Rs. 5.7 billion saw after tax profit decline by 88% to Rs. 825 million in 3Q of FY23. Hayleys bottom line declined by 61% to Rs.806 million.

Finance cost in the first nine months shot up by 255% to Rs. 30 billion whilst net finance cost rose by 125% to Rs. 11.2 billion. Tax expenses on the other hand grew by 155% to Rs. 12.2 billion in the first nine months of FY23.

Hayleys had Rs. 57.2 billion interest bearing long term borrowings at Group level as at 31 December 2022 down from Rs. 63.5 billion as at end FY22. The current portion of long-term interest bearing borrowings amounted to Rs. 32.4 billion as against Rs. 27.5 billion whilst short-term interest bearing borrowings were Rs. 81.8 billion as against Rs. 80.8 billion as at end FY22. Trade and other payables was Rs. 77.1 billion, down from Rs. 79 billion in FY22.

Hayleys assets as at 31 December 2022 was Rs. 438.5 billion, up from Rs. 403 billion as at end FY22. Revenue reserves grew from Rs. 67.4 billion in FY22 to Rs. 47.7 billion as at 31 December 2022. Trade and other receivables were Rs. 112.5 billion as at end 3Q of FY23, up from Rs. 107 billion at end FY22.