Thursday Feb 19, 2026

Thursday Feb 19, 2026

Thursday, 20 May 2021 03:57 - - {{hitsCtrl.values.hits}}

|

| Chairman and Chief Executive Mohan Pandithage |

|

| Co-Chairman Dhammika Perera

|

Top diversified blue chip Hayleys Plc yesterday announced historic results in FY21 with consolidated post-tax profit up by near 400% to Rs. 14.05 billion whilst pre-tax figure was a staggering Rs. 19.2 billion, up 250% from the previous year.

The latter places Hayleys at number one among the companies which have announced results to date.

Expolanka, which has so far reported the highest-ever after tax profit of Rs. 14.8 billion, had only Rs. 16.58 billion in pre-tax profit in FY21.

FY21 full year results were boosted by a strong fourth quarter performance as well. Turnover shot up by 40% to Rs. 69.3 billion whilst pre-tax profit rose by seven-fold to Rs. 7.7 billion. After tax profit shot up by 750% to Rs. 5.8 billion, while 4Q bottom line soared to Rs. 3.5 billion from Rs. 234 million a year ago.

In a statement, Hayleys Plc said the Group “delivered the highest revenue and profit in its 143-year history”.

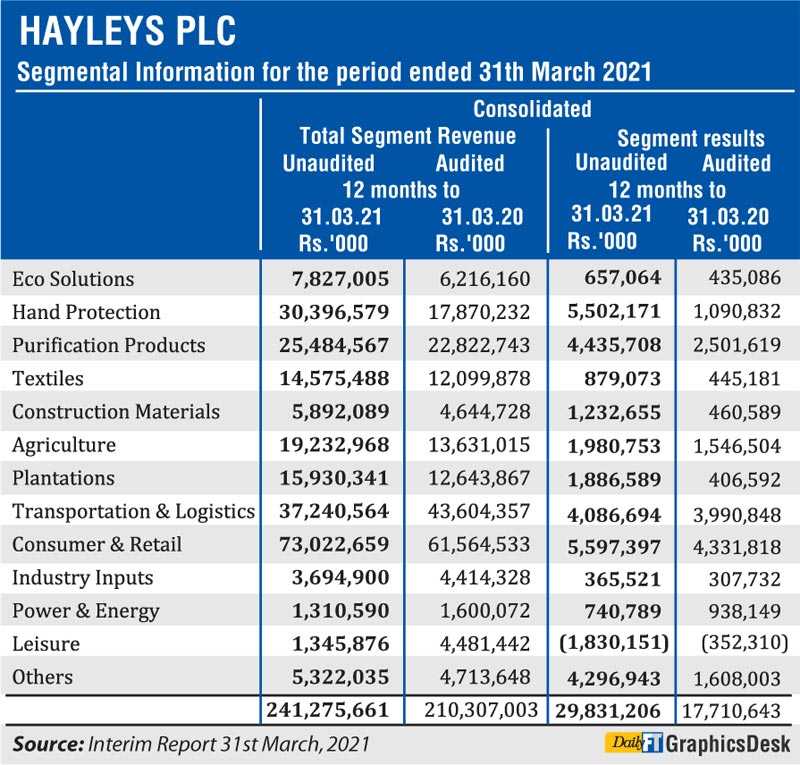

Revenue increased by 15% to Rs. 241.28 billion whilst net profit of Rs. 14.05 billion amounted to 6% on revenue.

Profit attributable to shareholders recorded a healthy growth to Rs. 7.64 billion, compared to Rs. 372.42 million the previous year.

Hayleys said the performance was underpinned by significant growth in the core performance of the Group’s export-oriented businesses, ongoing focus on resource optimisation and cost management through the ‘Haysmart’ program and the Group’s strategic agility in navigating the numerous complexities presented by the outbreak of the COVID-19 pandemic during the year.

The Group’s revenue reflected strong growth in export-oriented business including Hand Protection, Purification and Textiles.

With foreign currency earnings exceeding $ 600 million, Hayleys emerged as the largest value-added-exporter among public listed entities.

It said gross profit increased by 22% supported by improvements in core profitability-primarily in export-oriented businesses.

“Concerted efforts at driving organisation-wide cost rationalisation have generated significant savings, with the increase in Administrative and Distribution expenses contained at 5% and 2% respectively, despite a considerable increase in activity levels,” Hayleys added.

Earnings before interest, tax, depreciation, and amortisation (EBITDA) recorded a strong growth of 42% to Rs. 33.21 billion and the Group’s Consolidated Earnings before Interest and Tax (EBIT) increased by 58% to Rs. 25.95 billion during the year. Net finance cost declined by 38% reflecting the Group’s efforts to rationalise borrowings and the continued decline in market interest rates during the year.

The Hand Protection, Purification and Textile sectors delivered remarkable growth supported by robust demand, proactive efforts to increase capacity utilisation, effective supply chain management and increased contributions from value-added products.

The Agriculture and Construction Materials sectors also recorded good profit growth, demonstrating strong resilience amidst the innumerable challenges that prevailed. The Transportation sector recorded strong rebound in the second half of the year delivering commendable earnings growth.

Meanwhile, the Consumer and Retail Sector delivered its highest ever profitability, reflecting robust demand for IT products and the Singer Group’s strategic focus on optimising distribution channels to increase customer penetration. Understandably the Leisure sector continued to generate losses.

The Board of Directors of Hayleys PLC comprises Mohan Pandithage (Chairman and Chief Executive), Dhammika Perera (Co-Chairman), Sarath Ganegoda, Rajitha Kariyawasan, Dr. Harsha Cabral PC, Ruwan Waidyaratne, Hisham Jamaldeen, Aravinda Perera, Jayanthi Dharmasena, Rohan Karr, Gamini Gunaratne and Kawshi Amarasinghe (Alternate to Dhammika Perera).