Thursday Feb 19, 2026

Thursday Feb 19, 2026

Wednesday, 16 February 2022 00:00 - - {{hitsCtrl.values.hits}}

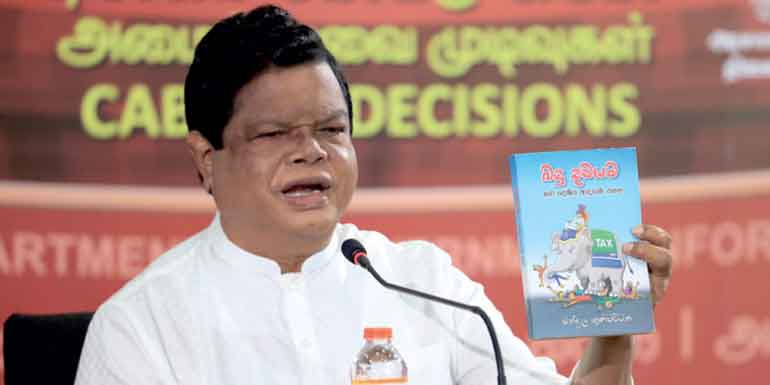

Trade Minister Bandula Gunawardena at the post-Cabinet meeting media briefing yesterday shows off the book he wrote in 2017 condemning the Yahapalanaya regime tax changes including bringing pension funds under taxation

By Charumini de Silva

The Government yesterday confirmed that the superannuation funds are not included in the coverage of the 25% one-off surcharge tax and expressed confidence of raising over Rs. 100 billion entirely from the

|

|

Finance Minister Basil Rajapaksa

|

private sector.

Finance Minister Basil Rajapaksa yesterday referred to his 2022 Budget presentation and recalled that only companies were mentioned in the proposal and not any funds pension or otherwise.

“In my 2022 Budget speech on page 68 under 7.9 subheading, I proposed to impose a one-off 25% Surcharge earning taxable income of over Rs. 2 billion for the assessment year 2020/2021. The Government objective was to collect a tax income of Rs. 100 billion,” he told journalists yesterday.

Rajapaksa also said they have identified 69 individuals and firms which will generate Rs. 105 billion to the Government via the proposed Surcharge Tax thus far.

“I have neither mentioned the EPF nor the ETF for the Surcharge Tax at any given time and the 11 State funds that the Opposition is claiming about are included in the proposal,” Rajapaksa affirmed.

The Finance Minister’s assertion comes despite the Surcharge Tax Gazette published last week (7 February) including pension and gratuity funds in the definition of companies. “Company” shall have the same meaning assigned to such expression under the Inland Revenue Act No. 24 of 2017; S.195 of the Inland Revenue Act No. 24 of 2017.

“Company” – (a) means a corporation, unincorporated association or other body of persons; (b) includes – (i) a friendly society, building society, pension fund, provident fund, retirement fund, superannuation fund or similar fund or society.”

The controversy and confusion came under heavy questioning by journalists yesterday at the post-Cabinet meeting media briefing as well.

Trade Minister Bandula Gunawardena said the Finance Minister has assured the Cabinet that a total of 11 funds will be removed from the proposed Surcharge Tax when the Bill is taken up during the committee stage of the Parliamentary debate.

“The Gazette is not required to be reversed, but amendments to the Surcharge Tax Bill will be tabled in Parliament at the committee stage debate,” the Trade Minister said in response to a query during the post-Cabinet meeting media briefing yesterday.

Gunawardena called on the public not to doubt the pledge made by the Finance Minister to remove the EPF and the ETF from the Surcharge Tax Bill.

The Trade Minister also charged that it was the Yahapalana Government that created all the unnecessary complexities in the tax system, following the International Monetary Fund (IMF) program.

“The previous regime sought a facility of $ 1.5 billion from the IMF and one of their conditions to release the tranches was to lower the budget deficit. To reduce the budget deficit the Government had to impose new taxes and reduce the expenditure to obtain the facility,” claimed Gunawardena, who came to the briefing with a copy of his book written in 2017 on the same issue.

As a result, he said in 2017 then Finance Minister Ravi Karunanayake removed all tax concessions granted by former President Mahinda Rajapaksa administration to all businesses.

The Trade Minister said the Opposition and others raising concerns on the 25% Surcharge Tax are the culprits of including EPF, ETF and other State funds in the Inland Revenue Act of 2017.

“The Yahapalana Government declared EPF and ETF as companies in the Inland Revenue Act, passed in 2017. These are the main causes for the confusion created around the proposed Surcharge Tax and that is why they know the details of it so well. Today, the Opposition is trying to brainwash the entire nation claiming Government is going to loot their hard-earned money, but the truth is that it was their brainchild to include those funds in the Inland Revenue Act,” Gunawardena claimed.