Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 2 June 2020 01:14 - - {{hitsCtrl.values.hits}}

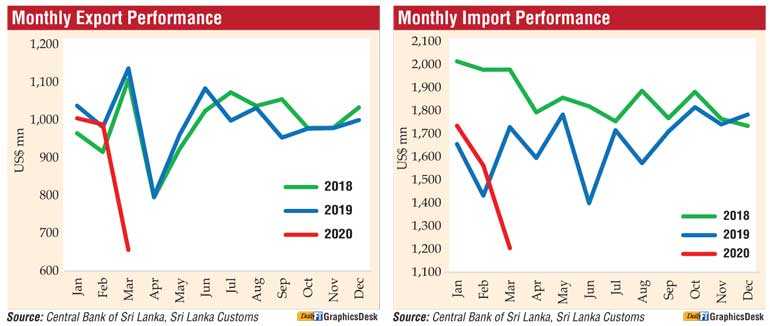

Exports dropped by a massive 42.3% in March to $ 656 million reversing the marginal gains seen in February as COVID-19 tightened its grip on Sri Lanka’s economy, latest data from the Central Bank showed yesterday but with imports also seeing a 30.3% drop to $ 1.2 billion, the silver lining was the decline in the trade deficit.

The deficit in the trade account narrowed in March to $ 549 million, from $ 592 million in March 2019, as the decline in imports in value terms exceeded the decline in exports.

However, on a cumulative basis, the trade deficit widened to $ 1,853 million during the first three months of 2020 from $ 1,661 million in the corresponding period of 2019, the Central Bank’s external performance report said.

Meanwhile, terms of trade, i.e., the ratio of the price of exports to the price of imports, improved by 25.7% (year-on-year) in March, due to the increase in export prices and decline in import prices.

“Earnings from merchandise exports declined significantly, on a year-on-year basis, by 42.3% to $ 656 million in March, reversing the marginal growth recorded in February. Disruptions to domestic production processes, disruptions to export related services due to the imposition of curfew and disruptions to both domestic and global supply and demand chains due to the outbreak of the COVID-19 pandemic were the main reasons for this sharp decline in the earnings from exports.”

Accordingly, all major exports sectors; agricultural, industrial and mineral exports, recorded significant contractions in March. Major export products such as textiles and garments, tea, rubber products, gems, diamonds and jewellery, machinery and mechanical appliances, seafood and coconut mainly contributed to the decline in export earnings. However, earnings from minor agricultural products exports recorded a growth during the month.

The export volume index in March declined by 45.1%, while the export unit value index improved by 7.3%, indicating that the decline in exports was driven entirely by lower volumes when compared to March 2019.

“Expenditure on merchandise imports declined notably, on a year-on-year basis, in March by 30.3% to $ 1,205 million, reversing the increasing trend observed since December 2019. The selective import clearing process followed by the Sri Lanka Customs (SLC), prioritising essential consumer items and the disruption to other import related services due to the imposition of curfew, disruptions to global supply and logistic chains, lower commodity prices following the COVID-19 outbreak were the main reasons for this unprecedented decline in the expenditure on imports,” it added.

In addition, urgent measures taken by the Government and the Central Bank in March to ease the pressure on the exchange rate and to prevent financial market panic due to the COVID-19 pandemic, including the suspension on facilitating the importation of motor vehicles and non-essential consumer goods, also contributed to this decline in import expenditure.

Accordingly, all major import sectors; consumer, intermediate and investment goods, declined in March. The expenditure on fuel declined, led by lower average import prices of crude oil ($ 37.7 per barrel on average in March), refined petroleum and coal. Volumes of fuel imported also declined except for crude oil.

The expenditure on machinery and equipment, textiles and textile articles, building material, fertiliser, chemical products also recorded significant declines. In addition, expenditure on non-food consumer goods such as personal vehicles, telecommunication devices and home appliances imports, which were subject to import restrictions also recorded reductions in March.

However, expenditure on the importation of essential consumer goods such as wheat, vegetables (mainly big onions and potatoes), sugar, spices (mainly chillies) and seafood (mainly canned and dried fish) increased in March. In addition, import expenditure on base metals (mainly iron and steel) and rubber and articles thereof categorised under intermediate goods also increased in March compared to March 2019.

Both the import volume index and the unit value index declined by 18.4% and 14.6%, respectively, in March, indicating that the decrease in imports was driven by both lower volumes and lower prices when compared to March 2019.

Gross official reserves stood at $ 7.5 billion at end March, equivalent to 4.6 months of imports. Total foreign assets, which consist of gross official reserves and foreign assets of the banking sector amounted to $ 10.7 billion at end March, equivalent to 6.5 months of imports.

The rupee, which remained broadly stable up to the second week of March, depreciated significantly with the outbreak of the COVID-19 pandemic during the latter part of March up to mid-April, reaching a peak of Rs. 199.75 per dollar on 9 April.

However, the rupee stabilised thereafter, and recorded a significant appreciation during May. As a result, the rupee which depreciated by 9.1% against the dollar up to 9 April, reversed this trend and appreciated significantly, recording a depreciation of 2.4% by 1 June.

Reflecting cross-currency movements, the rupee depreciated against the euro and the Japanese yen while appreciating against the sterling pound, the Canadian dollar, the Australian dollar and the Indian rupee during the year up to 1 June.