Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Friday, 12 February 2021 00:00 - - {{hitsCtrl.values.hits}}

By Nisthar Cassim

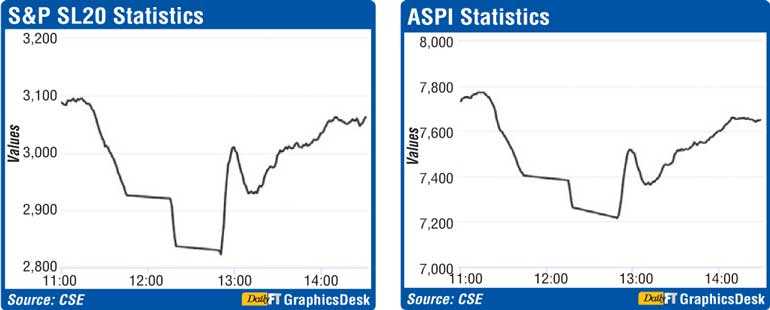

Multiple circuit breakers caused panic and a choppy ride for investors at the Colombo Stock Market yesterday, but a strong recovery enabled the indices to stem losses at close of trading.

The more liquid S&P SL20 index fell below 5% within the first 45 minutes of trading, and again 7.5%, triggering successive trading halts yesterday. The All Share Price Index (ASPI) post-hitting the intraday low of 7,219 points during mid-day market (down by 513 points from Wednesday’s close) recovered by 378 points and closed at 7,597, losing 134 points or 1.74%. The S&P ended the day down 48 points or 1.57%.

In terms of value, the late rebound is estimated to be worth Rs. 166 billion which is likely to hearten investors.

Turnover at Rs. 4.38 billion was a six-week low according to First Capital.

Vallibel One, LOLC, Expolanka, Carsons and John Keells Holdings (JKH) were leading contributors to ASPI’s fall. Expolanka topped the turnover list with Rs. 564 million worth of shares traded, followed by Browns Investments (Rs. 458.5 million), LOLC (Rs. 404.6 million), Royal Ceramics (382 million) and JKH (Rs. 352.4 million).

NDB Securities stated equities experienced sharp swings driven by force selling witnessed in the market.

It said price losses in Vallibel One, LOLC Holdings and Expolanka Holdings resulted to 24% benchmark index losses. Price losers outperformed the price gainers by 162 to 49.

Most analysts were of the view that the recent dip at CSE was unwarranted given impressive corporate earnings being released by the listed companies. The meeting yesterday between the Securities and Exchange Commission (SEC), the Colombo Stock Exchange (CSE) and the brokers helped clear the air in terms of misconceptions over recent circulars.

“With the majority of corporate results having surprised so far on the upside, we re-iterate the need to focus on companies with solid business models, are attractively valued, cash generative and belong to strong growth sectors. At what we consider could now well be an inflection point in the market, we advice investors to take advantage of the current price weakness and start accumulating positions in stocks with the aforementioned fundamental attributes,” Capital Trust Research said.

The CSE in a statement said the ASPI and the S&P SL20 index marked a recovery, despite a brief decline during trading to close trading on an upward trajectory.

“The reversal in the declining trend recorded during the end of trading ensured that the ASPI continues to maintain double-digit growth so far in 2021 at 12.16%, while the S&P SL20 also records 15.21% growth in 2021 as at the end of trading,” it said.

The ASPI closed trading on 7,597.81 points, while the S&P SL20 index closed trading at 3,039.28 points. The lowest point for the ASPI during trading was 7,219.24 points, while the lowest point recorded for the S&P SL20 index was 2822.76 points; further bringing into perspective the recovery in the indices during the latter part of the trading day to close the day in a positive trajectory, the CSE statement explained.

“The recovery in the ASPI today also places the index as one of the few primary indices that have indicated double-digit growth in 2021 globally,” it added.

NDB Securities also said high net worth and institutional investor participation remained subdued for the day. Mixed interest was observed in Sampath Bank, Royal Ceramics and LOLC Holdings, whilst retail interest was noted in Browns Investments, Expolanka Holdings and Vallibel One. Foreign participation in the market remained at subdued levels with foreigners closing as net buyers.

The Capital Goods sector was the top contributor to the market turnover (due to Royal Ceramics and JKH), whilst the sector index lost 2.42%. The share price of Royal Ceramics recorded a loss of Rs. 14.00 (4.76%) to close at Rs. 280.25. The share price of JKH declined by Rs. 2.75 (1.78%) to close at Rs. 152.00.

The Food, Beverage and Tobacco sector was the second highest contributor to the market turnover (due to Browns Investments), whilst the sector index decreased by 1.13%. The share price of Browns Investments lost Rs. 0.10 (1.82%) to close at Rs. 5.40.

Expolanka Holdings and LOLC Holdings were also included amongst the top turnover contributors. The share price of Expolanka Holdings decreased by Rs. 2.00 (4.07%) to close at Rs. 47.20. The share price of LOLC Holdings moved down by Rs. 10.25 (2.51%) to close at Rs. 397.50.

Interestingly, the market saw a small yet welcome net foreign buying of Rs. 31 million after many months. Asia Securities said estimated net foreign buying topped in CTHR at Rs. 50 million and net foreign selling topped in TKYOX at Rs. 21 million.