Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 30 August 2021 03:42 - - {{hitsCtrl.values.hits}}

By Nisthar Cassim

Last week heralded perhaps the best of times for the Colombo bourse which had set a new record for annual turnover within just eight months.

Last week heralded perhaps the best of times for the Colombo bourse which had set a new record for annual turnover within just eight months.

According to the Colombo Stock Exchange (CSE), the year to date turnover as of Friday was Rs. 634.54 billion, highest for a year even though there are four more months for 2021 to finish. The previous highest was Rs. 570.3 billion in 2010. Latest figure was boosted by Rs. 55 billion turnover last week, which incidentally was higher than entirety of July amount of Rs. 53.8 billion.

Volume of shares traded last week was a staggering 2 billion powered by 326,209 trades.

CSE also said as of 27 August, investor participation had increased by 52% in comparison to 2020. This facet dismisses the return of the notion of “manipulation by a few” among some both within and outside the market.

These are apart from CSE now enjoying highest ever market capitalisation at Rs. 3.97 trillion, and the benchmark All Share Index also at highest at 8,931 points. Year to date the ASPI is up 32% and the S&PSL20 up 27%.

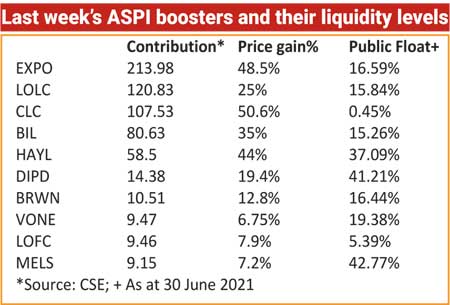

During the week, the ASPI and the S&P SL20 gained 8.39% and 9.62% respectively, whilst recording an average daily turnover of Rs 11 billion. Expolanka, LOLC, Commercial Leasing, Browns Investments, Hayleys, Dipped Products, Browns, Vallibel One, LOLC Finance, and Melstacorp were the biggest contributors to the ASPI’s gain last week. Most profitable and valued corporate, Expolanka was the centre of attraction contributing Rs. 16 billion for last week’s turnover or 29% of total with 119.4 million shares changing hands via 48,421 trades. Expolanka reached an all-time high of Rs. 164.75 before closing at Rs. 149.25, up 48.5% from the previous week. Its market capitalisation was Rs. 291.77 billion.

Browns Investments accounted for 11% of turnover or Rs. 6.2 billion and Hayleys contributed Rs. 4.9 billion or 8.9%. Hayleys saw an usually high weekly volume of 49 million shares changing hands via 15,262 trades. It closed at Rs. 113.75 up Rs. 44% or Rs. 34.75. Few blocks were transacted via crossings at Rs. 120 per share.

So far in August, Commercial Leasing has seen a 193.4% gain in its share price followed by Ambeon Capital (156%) whilst for Expolanka it was 122.7%. Of the top three Expolanka has a higher public float. The illiquidity of certain stocks (see table) has made some opine that gain in ASPI wasn’t a true reflection. Of the top contributors, higher public floats are with Hayleys, Dipped Products and Melstacorp. LOLC Group companies remain notorious for very low public float.

However, LOFC saw improved liquidity after related parties of majority owners sold their stakes. Among speculations were Saakya Capital (owning 137.4 million shares or 2.6%) and Satya Capital (52 million shares or 0.99%). LOFC saw 285 million of its shares traded last week for Rs. 3.2 billion.

After a stellar week, brokers, regular investors especially retailers and analysts are anxious to see how the market will take off today. Consensus is focus on fundamentally strong stocks with upside potential.

Separately an analyst opined that S&P SL 20 is the one to watch as it is yet to recover to its 2021 highest level of 3,514 points. It is still behind 170 points. The all-time high of S&P SL20 is 4,089 points established in 2014. “It has never been broken for the past six years and in fact prices failed twice during the famous January 2021 rally,” the analyst recalled.

Questioning whether the bulls turn in around he said “a successful close above the trend line will highlight a significant change in the S&PSL20 and signal that prices are likely to make new highs over the next few years.”

“Likely so, it also highlights the performance the companies have done and likely to do for the foreseeable future,” the analyst said, adding: “A breakout will change things for S&PSL20 which in turn will benefit the ASPI as well.”

SC Securities said the Relative Strength Index (RSI) of ASPI closed at 79.08 for the week ended 27 August. “The daily chart indicates that the index is trading above in between the daily resistance of 8,900-8,950. If the index manages to sustain above the daily resistance 8,900-8,950 the index could consolidate in between the daily support 8,550-8,600 and daily resistance 8,900-8,950,” SC Securities said.

“The index is trading above the eight Exponential Moving Averages (EMA) and 18 EMAs. This indicates the index remains to be bullish. However, there is a strong gap between the index and eight and 18 EMAs. Therefore, the moving averages need to be tested,” SC Securities added.