Sunday Feb 22, 2026

Sunday Feb 22, 2026

Thursday, 5 August 2021 00:00 - - {{hitsCtrl.values.hits}}

If, as an apparel manufacturer, ‘sustainable fashion’ was far from your mind, this USA Today article from June 2021 should be a wakeup call. “Post-pandemic fashion is looking green,” it begins. Here’s the gist of it:

“Don’t underestimate hand-me-downs. Buy secondhand clothing. Stray from fast fashion. Invest in sustainable brands. If tired of your wardrobe, try clothing swaps with friends. Restyle and reimagine clothes you already own or rent formalwear. It’s OK to have unsustainable clothing—but make the most out of it.”

This offers an insight into the minds of global fashion consumers that the Sri Lankan apparel sector caters to. The advice is practical and environmentally-friendly. But what did you feel as an apparel sector operator?

Crises and opportunities go hand-in-hand

This is such an instance. If a majority of consumers follow this advice, what happens to your business model and profits? Think about it.

Trends like these are driving global fashion brands to adopt initiatives that encourage best practices and support green growth in their supply chains. When change happens, they use the greening success stories in their marketing.

Fashion brands are funding innovative research, minimising synthetics and encouraging manufacturing countries to adopt green energy sources. Many are designing out waste, encouraging the circular economy and investing in garment recycling.

What is circular fashion?

‘Circular fashion’ refers to clothing and accessories that have been “designed, sourced, produced and provided with the intention to be used and circulated responsibly and effectively in society for as long as possible in their most valuable form.” When no longer of human use, they should be returned safely to the biosphere. That was how Anna Brismar articulated the idea in Green Strategy in 2017, when coining the term. Recycling is a big part of it.

What is designing for the environment?

Design for environment (DfE) seeks to reduce the environmental and human health impact of a product at the design stage. DfE guidelines consider the product life cycle along five aspects: material and their extraction; production processes and technologies; transport, distribution and packaging; during use; and at the end of life. The latter includes design for disassembly and recycling.

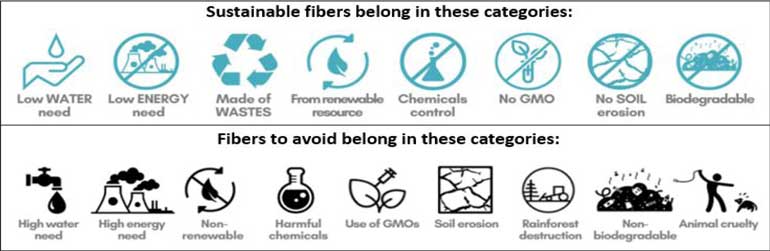

On the materials side, this means looking at more sustainable yarn and fabrics and less hazardous materials in processing. No one can be a purist. The best approach is to use the least harmful materials.

Collaboration with buyers necessary

Today, Sri Lanka imports most fabrics that go into our garments. Manufacturers need their buyers’ commitment to choose circular fashion, DfE and sustainable fabrics. One long-term national goal should be to increase local inputs like nature-based fibres from banana, bamboo and kithul.

An all-of-government-and-industry approach needed

Manufacturers can invest in green buildings and sustainable energy. They can adopt cleaner production, zero discharge of hazardous chemicals and science-based targets. These require substantial investments in technology, expertise, testing and certifications to get them off ground and to sustain over time. Most small and medium apparel sector operators are unlikely to invest in them without access to affordable funds.

Sustainable financing for the apparel sector

Setting up a sustainable financing mechanism is a pressing need to help exporters win in the post-pandemic normal. Once established and scaled for the apparel sector, financing mechanisms and support services can be extended to other manufacturing industries and services including hospitality and tourism.

(HSBC and IUCN have been working together to formulate a strategy to build a more resilient apparel industry through adoption of greener practices. ‘A Road Map Towards a Greener Apparel Sector’ report is the result of an extensive research conducted by the project team in partnership with the Joint Apparels Association Forum, Board of Investment Sri Lanka, National Cleaner Production Centre and Sri Lanka Bankers’ Association.)

To access the full report visit www.hsbc.lk/ApparelSectorResearch