Monday Feb 23, 2026

Monday Feb 23, 2026

Tuesday, 15 March 2016 00:01 - - {{hitsCtrl.values.hits}}

Chinese travelling to the ‘Magnificent 7’

In this report we look at Asian markets for which the retail scene is heavily influenced by Chinese inbound flows. These are markets where Chinese move the needle notably in luxury goods, cosmetics, and other discretionary items.

These markets represented 91m outbound trips in 2015 so about three quarters of the total. Trips to those markets were up 4.5% in 2015 and should be up another 4.5% this year but with very contrasting trends.

Asia’s ‘Wheel of Fortune’ should continue to turn in 2016, creating winners and losers

Asia’s ‘Wheel of Fortune’ should continue to turn in 2016, creating winners and losers

Strongly contrasting trends

We expect Hong Kong inbound flows to deteriorate to -7% this year despite a rough year already in 2015 (-3%) as the city suffers from FX cross rates and having become a commoditised destination. Macau should also be down but less so than in 2015 as there are signs of stabilisation. Taiwan could also suffer from visa cut backs and an already high visitation rate.

By contrast, we see Korea rebounding 25% this year after a 2015 MERS-related slump and the now all-important destinations of Japan and Thailand (up 42% and 46%, respectively for 2016e) continuing to surge, albeit with rates of growth slowing given the law of big figures and FX in Japan being slightly less supportive.

When you’re sitting on a volcano, go with the flow

We’ve been red hot bullish on Chinese outbound travel for a while as regulation eases and the appetite for discovery and social status are very supportive. Since September 2015, we’ve been talking about an Asian ‘Wheel of Fortune’ (see Panda diagram).

We look at stocks that are driven positively or negatively by Chinese flows to different parts of the region. We believe there are very few reasons to be optimistic about Hong Kong’s retail scene; hence we maintain our Reduce rating on Sa Sa.

If we are right about Macau’s visitation stabilising, we believe Galaxy (Buy) could be a good stock to focus on given its more recent focus on mass gaming. To capture the Chinese rebound in Korea, we like AmorePacific (Buy) and LGH&H (Buy). If you prefer to tap into Asian travel, Buy Spring Airlines. Finally, to play global travel more generally, we remain optimistic on Samsonite, Pandora, and Moncler (all Buys).

Our projections for 2016 and the rationale

In 2015, Chinese outbound travel was very much concentrated in the seven Asian markets listed in the table above, accounting for c75% of trips. Growth for these seven markets together was 4.5% last year and we see that 4.5% being replicated again in 2016e but with very contrasting trends and notably a steep deterioration in Hong Kong being compensated by a rebound in Korean, Japan, and Thailand strength. Here’s the rationale for our estimates for these key markets from the worst to the best prospects for 2016.

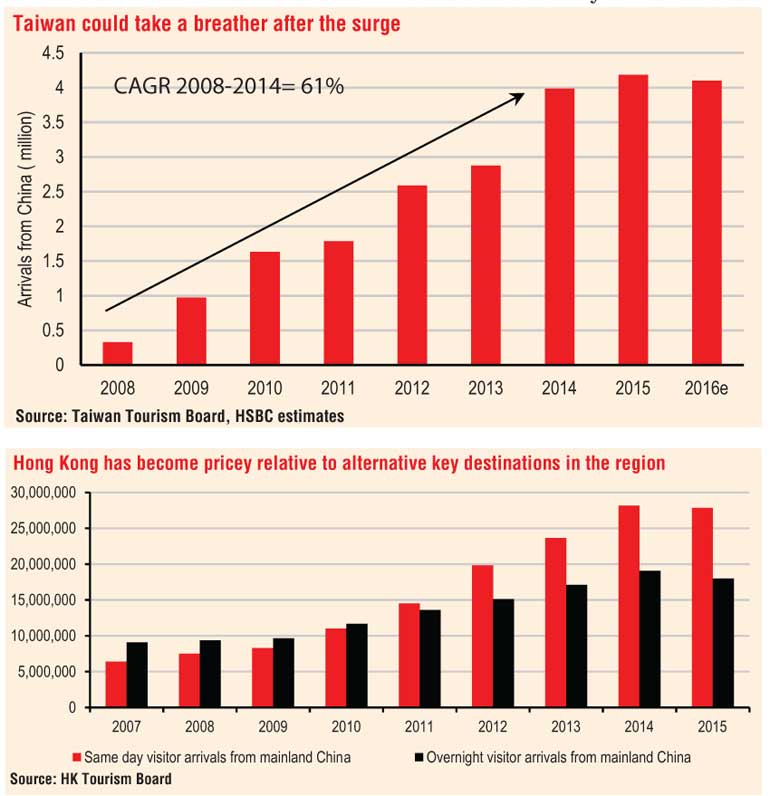

1. Hong Kong inbound flows to deteriorate further this year

As highlighted in many of our luxury goods reports, Hong Kong has become a somewhat commoditised destination for shopping, as there is a lack of diversity in the shopping experience itself, but more fundamentally because HK does not offer much variety outside of shopping. With Chinese travellers looking for more entertainment and fresh experiences, Hong Kong is losing out. More recently, FX has started to become a real issue as Hong Kong is now a more expensive destination for many goods than Tokyo or Seoul, and obviously much more expensive than Singapore, not to mention Europe. In other words, as highlighted in our recent Luxury Price Barometer (see Luxury Postcard, 1 February), price arbitrage is hurting Hong Kong today whilst it boosted sales in the city historically.

Look at the chart of HKD vs. the weighted average of JPY, KRW, and SGD and it becomes clear that Chinese will think twice about where they go shopping. Whilst the Hong Kong Tourism Board believes inbound flows in 2016 should be down 3.2%, we project inbound Chinese flows (75% of total) will deteriorate from -3% last year to close to -7% this year. While retail growth started to take a hit two years ago, actual inbound flows from China only turned negative in July 2015. In other words, the 2015 figures were a tale of two halves with Hong Kong losing 1.4m Chinese visits and December 2015 alone losing 700k visits from China. As explained recently in our Postcard from Hong Kong, we see few positive catalysts in the short term for a rebound of growth in the city.

Another issue for brand managers, especially in the premium and luxury categories, is that declines in overnight visitors (39% of total visits) are much more important (-6% in 2015) than same-day visitation. Whilst there is evidence that the average ticket has come down over the past three years, this also means that overall spending on higher ticket items is under pressure. While same-day visits started to be a majority as early as 2010, the gap has recently increased.

2. Taiwan may see fewer mainland visits in 2016

After years of very strong growth, it seems that inbound flows have peaked for the time being and talks about potential visa cut backs – limiting direct flights possibly from only the bigger mainland cities – could be unsupportive. Besides, 4m inbound tourists for a country of Taiwan’s size is already a lot. Bulls will argue though that the more wealthy visitors mostly go to Taipei for Taipei 101, shopping and the food markets and have not discovered much of the rest of the country yet where tour groups are more prevalent. We expect inbound flows to take a slight breather in 2016 with mainland tourists down c2%.

For the luxury part of our coverage, we often mention the emergence of a “new TST” (Tokyo/Seoul/Taipei), replacing the traditional TST neighbourhood in Hong Kong where many Chinese did their luxury shopping. While Tokyo and Seoul are still vibrant, Taipei may now be taking a pause.

3. Macau showing signs of stabilisation

With the Macanese Pataca being pegged to the HKD, Macau is suffering from the same woes as Hong Kong in terms of not looking as affordable as in the past. However, it seems that the negative impacts of the anti-graft campaign have started to temper somewhat and we have seen signs of a stabilisation in inbound visitation from China despite arguments from some in the markets that further capital controls are a risk for this destination. Whilst the Macanese administration is expecting inbound flows to be flat y-o-y (Chinese are 67% of flows), we see Chinese visitation being very slightly down (at -1%).

4. Singapore staging a comeback?

As explained at length in our Asia’s Wheel of Fortune report, published 28 September 2015, we believe Singapore has overcapacity in terms of luxury shopping as high hopes of new infrastructure developments and notably the emergence of gaming have not sufficiently translated, in our view, into shopping per se. However, following a decline in the currency, we have seen a rebound in trends.

Also, Singapore being on the “Sinmathai” (Singapore/Malaysia/Thailand) tour operator list led to many trip cancellations following the Malaysian Airlines incident (MH370 disappeared on 8 March 2015) and the Thai coup (22 May 2014). Clearly, concerns have now eased. The number of Chinese visitors to Singapore rebound 20% last year and we see further low to mid-teens growth this year.

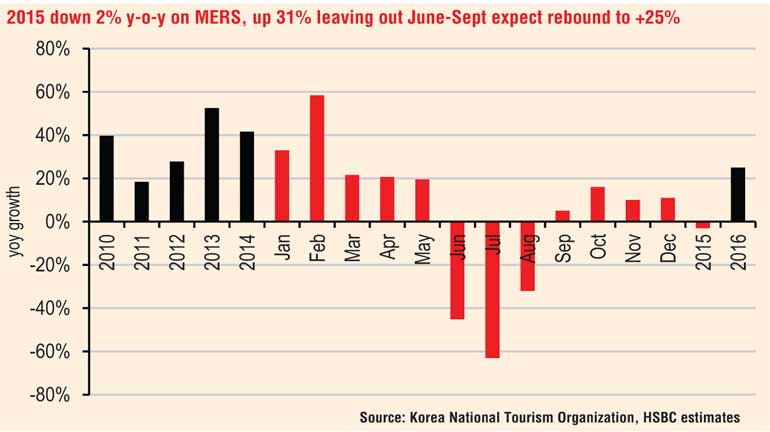

5. Korea staging a comeback?

The outbreak of MERS in late May 2016 weighed on inbound travel from China, which lasted for four solid months last summer, the most important period for tourism. The downturn also led some investors to wonder if, after years of fascination with K-pop culture, the interest had started to wane. We believe many outlook comments have been too negative and, indeed, after some months late last year of muted growth, the number of Chinese trips to Korea was up a healthy 32% in January 2016 year-on-year.

We forecast inbound flows to increase 25% for the whole of 2016, bringing the total number to close at 7.5m and having Korea still slightly outpace Japan. As new duty free concessions open in Korea and with the island of Jeju welcoming Chinese tourists with visa-free access, we feel the Chinese should continue to support businesses in cosmetics, cosmetic surgery, and handbags and accessories, which was the case prior to the MERS slowdown.

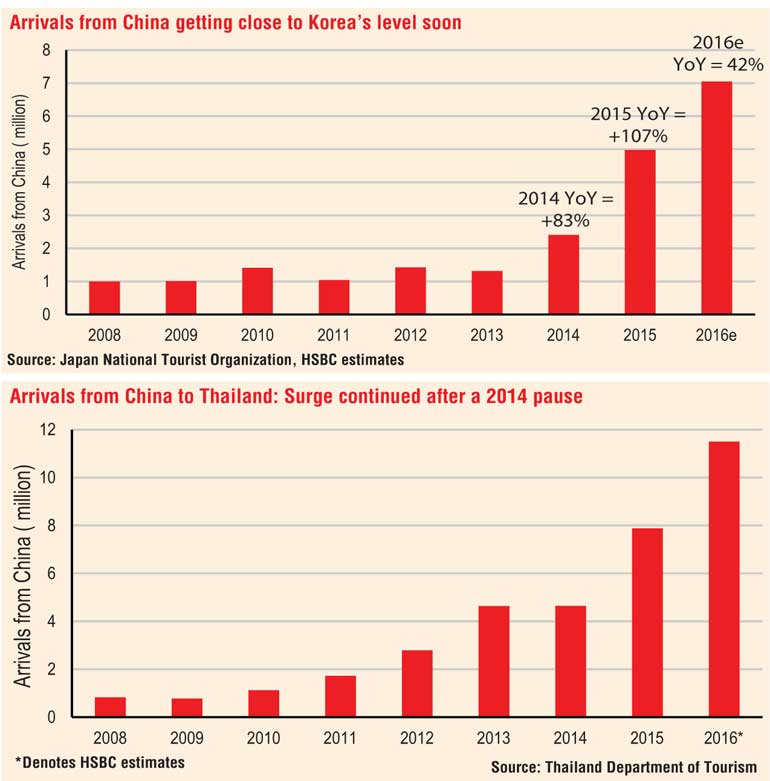

6. Japan: No tree grows to the sky!

The very fast development of Japan as a key destination for Chinese tourists really occurred in 2014 at a time when the JPY was declining fast and many items looked cheap for tourists. Since then, the Japanese administration has made visa requirements easier and has implemented reimbursements for VAT in downtown stores whilst also starting to work on fully fledged downtown duty free zones for tourists in the Ginza neighbourhood of Tokyo.

By 2015 the number of Chinese trips to Japan quadrupled, reaching almost 5m visitors. The law of big numbers, as well as the recent strengthening in the JPY, makes it difficult to imagine that growth rates can continue unchanged from recent high levels.

7. Some uncertainty but very strong fundamentals

After years of very strong growth, inbound travel was interrupted in 2014 as Chinese tourists grew weary of the May 2014 military coup as well as having likely been put off by the Malaysian Airlines incident (MH370 disappeared over the South China Sea on 8 March 2014 with more than 150 Chinese citizens on board). This affected travel in the Southeast region.

In 2015, despite a Bangkok bomb-related hiccup in the back half of the year, Chinese tourists surged again by 69% year-on-year. With better accommodation and shopping infrastructure than ever, we believe good growth should continue this year. While the movie is more than three years old, you still hear many Chinese tourists mention that “Lost in Thailand”, one of the highest grossing Chinese movies of all time, was their inspiration to come and discover the country.