Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 20 June 2017 08:33 - - {{hitsCtrl.values.hits}}

By Charumini de Silva

Experts believe the rapidly expanding economies of India and China present huge opportunities for Sri Lanka but they come with strong lessons of adaptation for the country if it is to make full use of the opportunities presented by the two most populous nations on earth.

Experts believe the rapidly expanding economies of India and China present huge opportunities for Sri Lanka but they come with strong lessons of adaptation for the country if it is to make full use of the opportunities presented by the two most populous nations on earth.

Addressing the Daily FT-Colombo University MBA Association organised full-day forum titled ‘Growing with Giants,’ which featured HSBC as Strategic Partner, Acting Indian High Commissioner to Sri Lanka ArindamBagchi called on the Sri Lankan business community to look at the trade opportunities objectively, insisting not to fear the ‘giant’ factor.

Commenting on the theme ‘Growing with Giants’, he said India strongly believes that Sri Lanka should take advantage of its close proximity to it, something which reflects the Indian Prime Minister’s vision of neighbourhood first, which will take everyone along the development journey.

“The Growing with Giants theme is very catchy. From the size of the two economies, India is large and economists predict that it is the fastest growing economy. However, these kindsof projections sometimes create some kind of unease. Therefore, I would like to tell the businessmen to take this opportunity objectively. Do not let that ‘giant’ part deter you from looking at the Indian market, take the most of it,” he added.

With the new Sri Lankan Government which took overon 8 January 2015, he said there was fresh dynamism and opportunities to strengthen trade ties between the two nations and assured that it would be a win-win situation for both sides.

“We understand that there are issues of no reciprocity. But unless these trade ties are a win-win for both sides, business deals do not happen. Look at this great opportunity; take advantage that most other countries are waiting to enter. Our role as a Government is to facilitate these efforts.”

Contemporary relations and the future

Acknowledging that Sri Lanka-India relations extend over two millennia,Bagchi pointed out it was important to rely on this as it does provide a great foundation for the two countries’modern day relationship.

“Sri Lanka has gone through considerable change since the end of the war and trade opportunities have improved. I am happy that in the past two to three years a lot of Indians have shown interest in doing business with Sri Lanka.”

Stating that India’s economy’s is expected to grow at 7.4%,he said that half of its population was near the age of 25 and willing to take risks and innovate and considered themselves to be more global citizens, whereas other countries are faced with an ageing population.

“This youth will be the new dynamism of India which will drive the economy. The new India change is now visible.”

Looking at these opportunities for economies to expand, he expressed that India has housed many international and multinational companies that have set up industries and the country has now become a partner of choice among global players.

“India will be more open in the future with every incentive to remain more integrated, and not less integrated, with the outside world. There is great consensus India will thrive in the global economy for many years,” he noted.

Despite its many cultural, regional and caste differences, he said India would remain a global example that one need not sacrifice personal liberties in social matters. “It will take some time, but we believe in taking everyone along. There is a Brand India and I am confident it is here to stay.”

Reflecting on some of the initiatives the Government of India has taken in the recent past to make business easier to do, he cited over 7,000 reforms to the digital economy, new laws, arbitration and custom clearance.

Geographical location, a longstanding relationship and investment and trade opportunities were highlighted as key points for Sri Lanka to benefit from this huge opportunity.

Acknowledging that India has been a strong investment partner of Sri Lanka, he stressed that over $1 billion in accumulated investments were made in the past while another $1 billion was in the pipeline.

“Indian companies ventured into Sri Lanka, set up businesses, created jobs, brought in technology, knowhow and have been a true friend through thick and thin. We hope trade between the two countries will further expand going forward,” he stated.

Bagchi also said that India was delighted to have joint ventures for port development, business partnerships androad construction as well as in the renewable energy and LNG sectors.

He said Sri Lanka has strengththrough niche products and companies have acutely understood this and if there were difficulties in setting up alone in India, he encouraged the establishment of joint ventures to enter the growing value chains.

“We would encourage Sri Lankan companies to partner and enter the value chain of large Indian companies, which will also interest Indian companies to use Sri Lanka as a source market.” Embrace India, regional trade

Foreign Affairs Minister Ravi Karunanayake informed the Sri Lankan business community and potential investors about the huge trade opportunity in the neighbourhood, noting that Sri Lanka should not fear India.

He called on foreign and local investors to utilise the Indo-Lanka free trade agreement (FTA) to capture the large Indian market through meaningful value addition processes.

“India and Sri Lanka trade opportunity is phenomenal. Let us basically trade within ourselves. We are importing from all other countries but not within the region. Let us start trade within our region and make a lasting impact,” he added.

Karunanayake said that Sri Lanka should be what Hong Kong was for China to make a meaningful mark in the SAARC region.

“We live in an era of bilateral and multilateral trade and economic agreements with nations which broadly facilitate economic cooperation between countries. We want to leverage our trade ties with mighty economies like India and China that are driving the new world economy,” he noted.

He spoke extensively about the renewed political and economic partnerships between India and Sri Lanka after the new administration took over in 2015, where both countries’ leaders had cordial discussions and launched initiatives to strengthen cooperation.

“Indian Prime Minister Narendra Modi visits Sri Lanka to provide us with a sense of solidarity and guidance. It shows his personal interest and we know that we are in safe hands,” Karunanayake said.

Pointing out that the Government was re-examining the Indo- Lanka FTA, he asserted that “fair trade is free trade, and not that free trade is fair trade.”

The Minister promised that the Government would move to benefit from the opportunity that was before the country.

Although there was apprehension from the business community when the Economic and Technical Cooperation Agreement (ETCA) was initiated, he said what was being overlooked were the greater opportunities Sri Lanka can have with market access to 1.1 billion people.

“I want the Sri Lankan private sector to aggressively go forward to allow things to happen. We need to navigate these fears that exist to the potential that is before us. Small does not mean that we need to set ourselves out and India realises this. That is why we need to ensure the best for both countries will happen.”

Putting the house in order

With Prime Minister Ranil Wickremesinghe heading the economy, he said Sri Lanka also sets its standards high and was doing its utmost to address insufficiencies in the system.

Accordingly, the country is in a market, export and product diversification process to help boost Sri Lanka’s export earnings from $ 11 billion to $ 20 billion coupled with service sector improvements. He pointed out that it was the lack of competitiveness of Sri Lankan exporters which caused exports to drop from $ 17 billion to the current $ 11 billion.

“Asia is in a production area. The Middle East and Africa are good material sources. The West is providing consumption and Sri Lanka is wonderfully placed to cater to this,” he noted.

He said the Exchange Control Act will be debated next week and assured that the single window to approve investments will be implemented within the next two months.

“My firm belief is that in the next two months, the current 10-15 institution process will be put to rest. Whether it is local or foreign, it will be given approval within 12 working days. Led by Premier Wickremesinghe, myself, Mangala and Malik are adamant that we want to put this into place. I am sure with the committed people we are going to put together, it will be a reality,” he stressed.

Noting that there was a perception that Indian companies were not given the opportunity to invest in Sri Lanka, he stated: “Now is the best of times. Before too long you will see absolute open trade taking place, certain competition coming in, where what they produce can be used for the advantage of Sri Lanka for export, import and to be partners.”

PPPs — way forward

Acknowledging that the BOT concept was going into the future where PPPs will help irradiate unwanted expenditure in the areas with lethargic processes, Karunanayake outlined airports, expressways and the energy sector as areas for Indian companies to partner in development.

Saying that 20% of India’s aid is made up of grants, he said: “I hope that component can be increased in the future considering the high public debt we inherit.”

In conclusion, Karunanayake said the country’s new foreign policy also considered commercial diplomacy where Sri Lanka will be friends with all, but enemies with no nation.

We Sri Lankans have to think out of the box and utilise this opportunity and take a lead in the region, he declared.

India – a macroeconomic view

Delivering the keynote address on ‘Macroeconomic Perspective’, HSBC India Managing Director, Head of Commercial Banking,RajatVerma,highlighted that India has a strong balance sheet and predicted GDP growth of over 7.1% this year.

“India has got a $2 trillion economy, predicted to grow over 7% this year. Last yearIndia attracted over $60 billion worth of foreign direct investments (FDIs), which is the highest amount that any country had attracted in the world. It is also an indication that there is very significant interest in the market now.Our balancesheet is very strong,” he added.

Commenting on the Indian Rupee (INR), he said that it has recouped most of its losses since the US presidential election results and demonetisation announcements.

“We expect the INR to perform well on a relative basis and end the year at 66.”

While inflation remains a core worry for the Indian Government, he said the April Consumer Price Index fell sharply to 2.99% y-o-y up from 3.80% in March.

With reports noting that India is receiving good rainfall, which could keep a lid on higher food prices, the second round impact of the seventh pay commission housing allowance, one-off impact of the GST, fiscal impact of potential farm loan waivers, rising price power of producers and global reflation risks need to be watched.

However, he said that India’s core inflation model suggests that even if food inflation falls and oil prices remain subdued, headline inflation will not get to 4% easily.

On growth and rates, he said October-December quarter economic growth surprised on the upside at 7% y-o-y versusthe consensus expectation of c. 6.1%. Accordingly, ‘Credit Multiplier’ and ‘Fiscal Multiplier’ will be activated and could add 80bp to GDP growth.

Verma said the focus may be more on liquidity management than rate action, which is also evident in the Reserve Bank of India (RBI) inclination for “variable reverse repo auctions with a preference for longer term tenors.”

“The rate move is expected to help remove some of the distortions caused by excess liquidity at the short end of the yield curve and also make RBI’s liquidity stance consistent with its neutral rate stance.”

Greatest experiments— demonetisation and GST

He also commended the courage of the Indian Government on demonetisation and Goods and Services Tax (GST), labelling them two great experiments India has conducted in the recent past.

On 8 November 2016 India hit the headlines the world over with its sudden demonetisation. “I don’t believe an experiment of this nature, of this capacity, of this kind of boldness, can be carried out in any other country in the world.”

He stressed that although demonetisation led to GDP falling in the last quarter it also completely changed the pace of financial inclusion with technology brought to the forefront, which he termed as “really good movements.”

According to him if India follows up with a spate of reforms,the gains could be immense as the official economy absorbs the parallel economy.

In terms of GST, which is an indirect tax throughout India to replace taxes levied by the Central and State governments, he said: “The early days of the GST implementation are expected to be similarly disruptive like they were during the rollout of the demonetisation program, but it does not have an upward impact on inflation.”

He believes that over the medium term, if exemptions are kept at a minimum, by streamlining production, enhancing delivery chains and overall investment, GST could bring down inflation in a more permanent manner.

It was pointed that China is currently India’s largest trading partner, accountingfor $70 billion, followed by the US, UAE, Saudi Arabia and Hong Kong. At present India contributes 2% and ranks 14th in terms of global trade flows.

He said India aims to improve its current 2% of total trade to 3.5% over the next seven years, insisting it was a pretty ambitious task.

Commenting on Sri Lanka’s development plans,Verma said he believed India and China could coexist and there was no need to choose between them. Verma said that HSBC handles 9% of total trade and investment between Sri Lanka and India, and expects that figure to grow to over 10% in the coming years.

Noting that HSBC has been a pioneer that connects clients to global growth opportunities, he said it has over 5,300 trade professionals across the world and over $550 billion trade facilities across 53 countries.

Furthermore, he revealed that HSBChas existed in India for over 150 years with a network of 26 branches covering 12 Tier I and Tier II cities andmore than 4,000 customers banking with Global Trade and Receivables Finance (GTRF). HSBC India contributes 14% of foreign bank assets and 1% of total banking assets in India.

Doing business with ‘giants’ not easy

Outlining the private sector perspective of entering the Indian market, Ceylon Biscuits Ltd. Group Managing Director SheamaleeWickramasingha said that although it was one of the first companies to invest and start exporting to India in 1998,it still faces numerous issues despite having a free trade agreement (FTA).

“The reality of doing business with giants is not so easy, especially for companies coming from smaller countries like Sri Lanka,” she added.

She pointed out that although the Government had good intentions Indianbureaucracy was quite prevalent, thereby making it difficult for companies to tap into the one billion-strong market.

According to CBL, every consignment and SKU is examined by the Food Safety and Standards Authority of India (FSSAI), causing clearance delaysthat result in demurrage.

“Testing takes many days at designated labs, which very often results in goods being placed at risk of being damaged and having a much shorter shelf life. Sri Lankan lab reports are not accepted.Labelling laws and weights of packs are revised without giving adequate notice to exporters. Regulations should be carried out with due notice to exporters to adapt to such changes. This has resulted in two of our containers being returned at significant cost. It also took up to nine months to have new labels approved by FSSAI.”

Although CBL exports to over 55 countries, sending over 100 containers of processed food across the world, Wickramasingha said: “Unfortunately India is not such a great market we can talk about, which is sad, having such close proximity.”

Level playing field

She said this was because it was difficult to do business with India, adding that this was not just the view of CBL but even that of some of the largest companies in Sri Lanka that confronted challenges in India.

In addition, she said the absence of a level playing field in Sri Lanka was also hampering the growth of local producers and exporters.

Given the fact that India has a large domestic market, which gives it a huge advantage in terms of economies of scale, she pointed out that it enables competition against Sri Lankan companies based on its lower cost of production.

Further, when the Government increases the levies and taxes on imported raw material from time to time, it increases the cost of production, thus making exports from Sri Lanka less competitive.

“Cable TV in Sri Lanka airs mostly channels operating out of India, where Indian products receive free publicity. Do Sri Lankan companies have the benefit of anything like that in India? We want to see a level playing field.”

Saying the dumpingof goods from large economies was difficult to monitor, she said that it was important to have a system in Sri Lanka to identify the incentives given for them.

“Dumping from countries like India is harder to identify in India, where different states can have differing incentives for manufacture. But opening out markets without really understanding what the situation with local industries is I believe is detrimental to Sri Lanka. ”

Stating that to be truly competitive Sri Lankan companies required manufacturing sites in India, she added thatfor capital intensive industries to export, one needs a strong local market to build capacity and volume to export.

Justifying why Sri Lanka should not agree to a complete removal of tariffs for goods imported from India and China, she asserted: “Over 60% of goods imported to Sri Lanka come as tariff-free imports. In our case we became a strong exporter because we were able to build up a strong local market to give us the necessary stability. I do not believe that we should be removing external tariffs especially for major economies like India and China. This is not a protectionist view.”

SL needs strong national agenda

Wickramasingha stressed that opening up, removing tariffs and negating negative list is only going to put pressure on companies in Sri Lanka trying to rise and be more globally competitive.

“If the Government is saying the companies are not competitive enough, then they should have a strong national agenda that looks at this without arbitrarily doing what India and China say. We need to look at our interests first.

“There is already a high deficit in the trade balance. If so, why encourage more tariff free imports which will further widen the negative trade gap?” Acknowledging that anti-dumping was hard to prove and monitor and would take time to remedy, she highlighted that this could drastically affect indigenous industries, some of which may find survival almost impossible. Opening out trade without adequate safeguards will only result in destroying Sri Lanka’s SME sector,which is vital for the country’s future development, she stated.

“There are over 50 biscuit companies in Sri Lanka. If there is liberalisation in the food sector, I doubt more than a handful of those 50 would survive. That is the reality,” she added.

Despite being large exporters, India and China have created barriers that limit the import of goods and services into their countries, she said.

Wickramasingha advised investing in specific Sri Lankan industries without threatening the existing local industry. Help develop our capabilities and export out of Sri Lanka, she said.

“My question is why do we need to remove our trade barrier, which remains at 40%? Why do we need to negotiate with India and China according to their agenda when already there are large barriers to trade?”

According to her, reducing import tariffs will further widen the trade deficit. “The balance of trade is already so skewed. Why are the trade agreements so focused on removing remaining tariffs when over 60% of goods enter Sri Lanka duty free?

“I believe our Government should be looking at our national needs and see what industries are relevant to the Sri Lankan economy. Based on that we should have an agenda on how we are going to liberalise our trade. Unfortunately it is not happening that way.

“There are many areas where giants can come into Sri Lanka and work in partnership to work on a win-win situation. Food security is a concern. We need to add value to agri produce which then can be exported.However, we need to look at priority areas of our industries for the development of the Sri Lankan economy,”Wickramasingha stressed.

“I am not a protectionist. I believe we need to be practical. We need a national agenda that looks into the priorities to uplift industries that are important for the development of our economy,”

Brandix success story in India

However, the Chief Financial Officer of $800 million apparel exporter Brandix Lanka Ltd,Hasitha Premaratne, outlined their success story in India and pointed out that it was a win-win journey for them.

“With the US quota ending in 2004, it was important to build a supply base to compete in a quota-free era and find a scalable supply chain solution. Considering the close proximity, strong Government support, large labour pool with the ability to scale up, easy access to raw materials, global retailers rebalancing the footprint to India and duty-free access to Japan, we established Brandix India Apparel City (BIAC),” he said.

Brandix commenced its initial work in a self-sufficient 1,000-acre city in 2007 with a ‘fibreto store’ concept that will bring together world-class apparel chain partners to provide unmatched value for its customers including speed, scale and the right costs, while providing 60,000 new jobs.

“We wanted to build BIAC with three key factors including a world-class vertically integrated value chain, world-class infrastructure and world-class leadership.”

He said that although the agreement was signed in January 2006 it took almost a year to break ground and start work in its own facility.

“We did not wait until all the approvalswent through. We hired a separate building belonging to the Government and commenced our work and training. By November 2006 we started manufacturing and delivered our first export shipment to Hanesbrands Inc. in December 2006.”

Premaratne said they broke ground in April 2007 to set up the world-class vertically integrated value chain in India. “We had a lot of challenges in getting the construction, but once we started we moved on.”

Sticking to the concept of ‘fibre to store’, knitting, dying, manufacturing and logistics were done swiftly, so that from the time a client places an order it will be delivered within seven days. In addition, with the acquisition of Ocean India in 2008, the company was able to have fabric next door which allowed Brandix to provide rapid solutions to customers.

“In the end we brought different sides of supply chains together and came out with one solution that got a significant advantage for us as a supplier of leading brands to export in a very short lead time.”

According to its plan, Brandix wanted to have world-class infrastructure. “We spent extra time and energy in putting that together. Today we have water treatment plants, an effluent treatment plant, rainwater harvesting pond, solar power, a power substation, internal roads, commercial services, restaurants, individual housing and executive residencies. We completed infrastructure in 2008. We have come a long way on infrastructure. We have built a strong capacity, which can even be expanded and take things to much higher levels.”

Citing the third factor as world-class leadership, he noted that the journey began with a set of partners who were experts in their own fields, while Brandix led with apparel expertise.

Growth factors

Premaratne said the expansion of the manufacturing base to India had significant success over the past 10 years. “From top-line growth, to scalable manufacturing, to customer acquisitions, to employment growth and solutions, to the customer, we have seen growth.”

It was revealed that if Brandix did not expand to Indiait would not enjoy growth of this nature.

“Our top-line growth is over $250 million of exports, annually growing at CAGR of 30%, while cumulative exports are in excess of $1.2 billion to date. Brandix is the largest bra exporter in India to the US, where 10 million bras and 150 million underwear are shipped annually. At present 66% of Indian exports to the US market are manufactured in BIAC,” he added.

In terms of customer acquisitions he said that although Sri Lanka was a very important destination to most brands like Victoria’s Secret, they did not want to have too much exposure in Sri Lanka alone considering the geographical risk spread.

He also highlighted that BIAC has the largest female workforce employed at a single location in India, where 90% of the workforce is made up of women who come from villages located within a 60 km radius of the park. “It was a win-win story for Sri Lanka and India,” he stressed.

South Asia as a hub

Premaratne asserted that South Asia as a region could become significant enough to compete with China.

“South Asia as one base has the largest population, cotton producer and textile base and talent pool. Therefore, as a region when we look at South Asia, the population and the type of scale it could create, we can fight anybody in a non-quota, non-subsidy era.”

In that context, he highlighted Sri Lanka could be a significant hub. “Sri Lanka will have a niche manufacturing base, but it will create more front-end activities such as develop, design, R&D, supply chain, finance, marketing, while India and Bangladesh have massive manufacturing. As a region Sri Lanka can play the role of a hub.”

In conclusion Premaratne stated: “Brandix’s journey in India is still growing and the Indian domestic market is an opportunity. The key to our success is that we do not compete, we complement.”

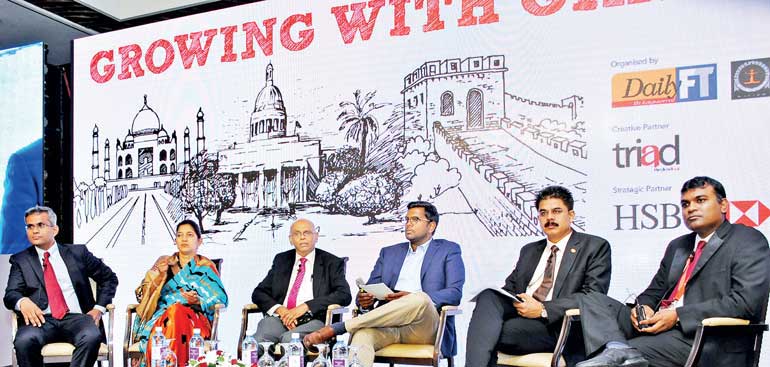

Pix by Upul Abayasekara and Lasantha Kumara

Tariff barriers for trade

The session also saw a Q&A discussion moderated by former Central Bank Deputy Governor W.A. Wijewardena, which included eminent panellists such as Ceylon Chamber of Commerce Chief Economist Anushka Wijesinha, Ceylon Biscuits Ltd. Group Managing Director Sheamalee Wickramasingha, Piramal Glass Ceylon Plc Managing Director and CEO Sanjay Tiwari, Brandix Lanka Ltd. Chief Financial Officer Hasitha Premaratne and HSBC India Managing Director and Head of Commercial Banking Rajat Verma. Following are excerpts of the session:

Could you tell us about the increased trade deficit, whether it was due to FTAs or tariffs and non-tariff barriers, and how can we overcome this situation?

Wijesinha: I think we need to do a lot more to understand firm level strategies in order to advice the Government on what to pursue with Indian Government.

We know that India is one of the largest growing economies, consumer spending is on the rise, and its middle class alone is 250 million people, over 10 times of Sri Lanka’s market. We also know that trade with India has grown under the FTA. But we must understand that the FTA is now old. The FTA has become bulky, not so modern, which is why I am a big proponent; whatever name you give it, the fact is we need an updated agreement.

As pointed out by Sheamalee, there are a lot of issues that Sri Lankan businesses face when doing business with India, especially in terms of non-tariff barriers and trade facilitation.

ETCA is going ahead whether the private sector likes it or not. It is a fact. We must aggressively tackle the non-tariff barriers and trade facilitation issue. This is no longer a cosmetic issue. This is one of the most critical issues that both the private sector and the Government sector need to fight on as it is a big constraint.

The good news is that all these are coming as a top priority in the ECTA negotiations; we are told by the negotiating team that they are pushing for this hard even to the extent of asking India for ‘early harvest,’ where a lot of things are going to be resolved either at the signing of the ETCA, or in the immediate aftermath.

Now we have to push that, it should not be optional and it should not be cosmetic. At this point it is not easy to turn around and say that the private sector has to deal with it. These are things that have to be dealt with at Government to Government level, Government to State level, Foreign Ministry level, while the private sector can provide only good inputs and real examples of the issues.

The second practical point is knowing the Indian market and its scale and growth potentials; we need to look how aggressively we are going to commit. India has its own campaign called ‘Make in India’ and I would like to call on Sri Lankans to launch a ‘Break into India’ campaign. The campaign should include a few ideas, the Export Development Board, a dedicated India trade desk, a set of champions helping trade into India, and a huge focus on the Government institutions.

Commercial attachés in India needs to be doubled and the number of locations increased so they can be our point of contact in India and fight from within. Setting up a market intelligence unit – this is where the Government should take the lead with the private sector to set out a stellar marketing intelligence initiative. Also, dedicated banks to facilitate Indian trade. As pointed out by Sheamalee it is important to uplift competitiveness of local companies as it is being held back.

I also feel that doing business with India we tend to only consider the businesses of today. The investors see Sri Lanka as a nice springboard to leverage. With greater integration with India, products that don’t even exist in our categories can be exported to India. My final point is that, for too long we have constantly taken the back-foot. Instead of taking back-shots, we need to start coming out of the track and taking full tosses to the boundary line. To do that we need to shift our mindset aggressively on practical steps.

Could you share challenges in coming to Sri Lanka and advise us on trade with India?

Tiwari: First I must say that ‘growing with giants,’ whether it is with India or China, it should not be ownerships but partnerships. It is true, whether it is China or India, all have challenges. I run companies in India and Sri Lanka. When we landed here it was a Rs. 600 million company, a loss-making company. Today after 15 years, we have tripled the capacity, have over 800 employees and converted it into a Rs. 7 billion company.

In our factory 99.6% employees are Sri Lankan workers. Piramal India studied the company, the market and we infused capital, technology and training to convert it to a global company. Today we see how it has grown over the years. We trained people with healthy partnerships and invested heavily. It is easy to talk about the negative elements of investments, but we should also look at the bright side.

The quality requirement of Sri Lanka is way ahead of India. With a capacity of 14,000 tons in India, and 300 tons per day capacity in Sri Lanka, companies still prefer Sri Lankan made. They prefer the quality and it is the key reason why we have been able to hold on to our Sri Lankan companies. In 2007, we made a $ 40 million investment in Sri Lanka to increase capacity which was not significant like Brandix, but the benefit of that was felt by India, Sri Lanka and customers.

Indian banks are introducing a lot of innovations to customers. In this India-Sri Lanka relationship, what kind of technology transfers can be introduced to the financial sector of Sri Lanka?

Verma: I think the biggest shift in the Indian economy was the innovation of a global payment system, where all transactions can be done via a single platform, irrespective of the bank. This system reduces the cost of cash movement. What India can teach the world is to have an absolute open source network for its transactions. It may sound quite scary, but it has transformed the Indian market. I don’t know if India is in a position to export this knowledge.

Prime Minister Narendra Modi is also taking personal interest in introducing new platforms via technology and initiatives which help corporates to move. I think it is also something that the Government of Sri Lanka and the Central Bank of Sri Lanka need to look at to improve the financial sector infrastructure.

What kind of assistance can HSBC provide to Sri Lanka?

Verma: Technology does not take long, it can be implemented within a short period of time. But what matters is the implementation and understanding. Technology is something that evolves pretty fast. It is necessary for companies also to adopt and evolve accordingly.

CBL pointed out your experience in India. What else can you tell us apart from that?

Wickramasingha: We are a company that is in a good sector and building a brand in a massive market is challenging. It is not like setting up a plant or a supply chain. Our company operates on a different platform. We are a complete unique supply chain manufacturer. Given the close proximity and opportunity to India, I think we should be able to do much more. We had a very tough time with India and we lost a lot of money; but we didn’t stop exporting to India. I think it is vital for us to reflect on why these giant economies China and India are pushing on the non-tariff barriers.

Would you like to comment on that?

Wijesinha: In my opinion, tariffs are not the game-changer in a trade agreement, but the non-tariff measures. I think we need to get a lot smarter in getting rid of this. As the private sector, we need to provide specific, quantifiable and legitimate information to our Government to get these things and be able to take it up at the negotiation levels of the important trade agreements.

You heard Sheamalee and Sanjay sharing their Indian and Sri Lankan experiences, while Brandix has used India as a springboard to expand. Do you think this can happen to Sri Lankan companies aspiring to enter India?

Premaratne: Our success lies in the fact that we did what we went for, which is manufacturing. There were challenges, which is a fact of life. However, the opportunity is far bigger for you to ignore these little things and structure your model accordingly like we did, it wouldn’t be a great concern. We continued to be on a cost plus model structure, so that there is a limited credit path and profits get back.

It is sad that we are not trying to take Sri Lanka as an investment vehicle. If the proposed financial centre takes place, Sri Lanka could be the next Mauritius to India. Unfortunate a lot of people think that Mauritius and Singapore are the only investment vehicles to get to India. We need to get there. When we initially entered the Indian market, there were many barriers in the apparel market. We entered the market with a vision to unlock India and we looked at entering in that aspect.