Saturday Feb 21, 2026

Saturday Feb 21, 2026

Friday, 2 June 2017 00:00 - - {{hitsCtrl.values.hits}}

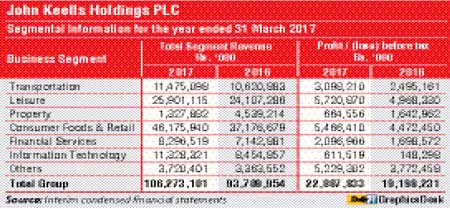

The Group profit before tax (PBT) increased by 19% to Rs.22.89 billion for the financial year ended 31 March 2017. The profit attributable to equity holders of the parent was Rs.16.28 billion, representing an increase of 16% over the Rs.14.07 billion recorded in the previous year.

The investment in the “Cinnamon Life” project which is under construction and the regular revaluation of assets under fair value accounting principles have short to medium term implications on our ROCE and ROE ratios. The ROCE and the ROE, adjusted for these impacts and other one-off non-operating incomes are 14.4% and 11.5% respectively.

We remain confident that the investments which we are making today, and the strategies we are employing, in pursuing a sustainable long term future will result in improved returns on our capital employed, and our shareholder funds, in the medium to long term.

Despite the policy uncertainty which prevailed during the period with regards to taxation and other reforms, I am pleased to state that your Group remained agile and adapted to the changing conditions, with the administration and operating expenses increasing by less than market norms despite the increased activity and the resultant 13% growth in revenue. The increased contribution from the Consumer Foods and Retail industry group to overall revenue and profitability has resulted in a more balanced portfolio. In this context, it is pleasing to note that with the exception of Leisure and Property, where monetisation of property assets have a “lag” effect, all industry groups achieved ROCE’s in excess of the Group’s hurdle rate of 15%. Given our strong balance sheet and anticipated robust cash generation, the Group is currently evaluating significant investment opportunities across its industry groups.

The Annual Report contains discussions on the macro-economic factors and its impact on our businesses as well as a detailed discussion and analysis of each of the industry groups. As such, I will focus on a high level summation of the performance of each industry group during the financial year 2016/17.

The Transportation industry group reported revenues, including the share of revenues from the equity accounted investees, of Rs.18.44 billion and a PAT of Rs.2.98 billion, contributing 15% and 16% to Group revenue and PAT respectively. The 2016/17 PAT increased by 21% over the previous year. The significant increase in profitability is mainly attributable to the Ports and Shipping, and Bunkering businesses.

During the financial year, volumes at the Port of Colombo witnessed a year on year growth of 9% whilst South Asia Gateway Terminals (SAGT) recorded an encouraging throughput increase of 22%. You will be pleased to note that SAGT was recognised as the “Best Terminal in South Asia”, awarded by the Global Ports Forum in February 2017. Since the expansion of capacity with the commissioning of the South Container Terminal, the overall capacity utilisation of the Port of Colombo is now in excess of 70%, demonstrating the strong potential for capacity led growth.

In this context, timely development of the deep-draft East Container Terminal (ECT) is critical to ensure that capacity continues to be enhanced towards attracting further volumes and sustain continued growth at the Port. Subsequent to the Expression of Interest submitted in September 2016 in this regard, the Group will look to leverage on this investment opportunity considering the overall prospects for the Port of Colombo.

Revenue and profitability of the Group’s Bunkering business improved as a result of the increase in base fuel prices during the year and growth in volumes. The Logistics business recorded a strong performance due to an increase in throughput in its warehouse facilities while DHL Keells improved its market leadership position in the year under review.

The Leisure industry group reported revenues, including share of revenues from equity accounted investees, of Rs.26.14 billion and a PAT of Rs.5.01 billion, contributing 22% and 28% to Group revenue and PAT respectively. The 2016/17 PAT increased by 15% over the previous year. During the calendar year 2016, arrivals to Sri Lanka reached 2,050,832, representing a year-on-year growth of 14%. China and India, being the two largest source markets, recorded a 24% and 13% increase in arrivals in 2016, respectively, whilst arrivals from other regions also demonstrated encouraging growth. In keeping with the present growth opportunities within the sector, better physical infrastructure such as enhanced connectivity through road networks and the expansion of the passenger handling capacity of the airport by expediting the planned new terminal, is a priority. The partial closure of the Bandaranaike International Airport to resurface and expand the runway was handled commendably by the authorities demonstrating the capability to handle the growth in the volume of traffic. The increased room inventory arising out of entrants into the 3-5 star segments of the market, and the resultant competitive pricing, exerted pressure on the city sector’s average room rates during the period under review. However, with this capacity being gradually absorbed during the financial year, overall occupancy in the city was strong and this is an encouraging trend. Despite the aforementioned increase in competition, the Group’s City Hotels sector witnessed an increase in both occupancy and average room rates compared to the previous financial year.

The profitability of the City Hotels sector for the year under review included a full year of operations for Cinnamon Lakeside, which was partially closed for refurbishment for six months in 2015/16. Cinnamon red continued to perform beyond expectations. The Group will seek to optimise the returns of its Leisure business by re-evaluating the effective capital deployed in its existing hotel portfolio, and, where relevant, following an asset light investment model in new projects. With new capacity expected to come in over the next few years, especially into the city, there is an urgent need for the country to enhance its product and entertainment offering to attract the higher spending tourists.

The Sri Lankan Resorts segment recorded an overall improvement in occupancy and average room rates, despite the increase in competition within the sector, particularly in the coastal areas of the island. Tourist arrivals to the Maldives displayed signs of a recovery with an increase of 4% during the calendar year 2016. Despite increased activity in the informal sector, the Maldivian Resorts segment experienced growth on the back of improved occupancy, which was well above the industry average, and improved average room rates. Bentota Beach by Cinnamon will be closed for construction of a new hotel. Construction is planned in a manner to conserve the original structure designed by Geoffrey Bawa. This, together with the partial closure of Cinnamon Ellaidhoo and Dhonveli for the refurbishment of rooms, will impact profitability in 2017/18.

The Property industry group reported revenues of Rs.1.12 billion and a PAT of Rs.623 million, contributing 1% and 3% to Group revenue and PAT respectively. The 2016/17 PAT decreased by 61% over the previous year. The decline is on account of the revenue recognition cycle, where the majority of the revenue of the “7th Sense” on Gregory’s Road residential project was recorded in the previous financial year. The Group is cognizant of the fact that revenue recognition in the Property industry group has shown volatility in the past years due to the lack of a robust pipeline of projects. Given the opportunities arising from landmark infrastructure projects such as Port City Colombo and the Western Region Megapolis Planning Project, the Group will seek to establish a continuum of projects, in both commercial and residential spaces. In this light, land parcels in the city and the suburbs have been identified and negotiations and due diligence exercises are currently under way. More specifically, the Group has entered into a Memorandum of Understanding with a partner in relation to one such prospective property development project in central Colombo. Subject to the finalisation of the concept, cost parameters and other approvals, the project is expected to be launched in early 2018. The construction of the “Cinnamon Life” project is progressing with encouraging momentum, where much of the complex sub structural work has been completed. The construction of the six lane bridge, which will be the main access point to the project, was commissioned during the year, and work is in progress. The demand for the residential and commercial buildings of the project remains encouraging. The second residential building, “The Suites at Cinnamon Life”, comprising of 196 units, was launched in September 2016.

The Consumer Foods and Retail industry group recorded revenues of Rs.45.81 billion and a PAT of Rs.3.90 billion, contributing 38% and 22% to Group revenue and PAT respectively. The 2016/17 PAT increased by 21% over the previous year, with both the Consumer Foods sector and Retail sector contributing to the improved performance. However, a tapering of demand was witnessed in the last quarter, and continues so, in the face of subdued consumer discretionary spending arising from the increases in value added tax, interest rates and inflation. Profitability of the Beverage and Frozen Confectionery businesses was driven by robust volume growth combined with the expansion of the product portfolio in line with evolving consumer tastes and preferences. Continued focus on the distribution network, production efficiencies and cost control further contributed towards this growth. In order to cater to the envisaged demand and address existing capacity constraints, an investment of approximately Rs.3.80 billion in a new frozen confectionery plant was approved and construction is currently underway with expected completion in the first quarter of 2018/19. Similarly, the installation of a new bottling line at a cost of approximately Rs.2.50 billion is expected to commence shortly.

The Retail sector recorded a strong performance on the back of significant growth driven by contributions from newly opened outlets and an encouraging growth in footfall. The continued emphasis on improving the service quality, and product offering, is contributing towards enhancing the overall shopping experience. It is pleasing to note that the outlets opened in recent years are performing above expectations. The penetration of modern Fast Moving Consumer Goods (FMCG) retail in the country is still low, compared to more developed regional countries, and this presents a significant opportunity for growth. With a number of new locations having been already identified, the sector will continue to strategically expand its store network and distribution capabilities in gaining market share. It is with a view to complementing its growth plans and further improving its productivity and product offering that the sector plans to shortly commence construction of a new distribution centre, which is expected to be operational in the first half of the calendar year 2019. This distribution centre will be operated in collaboration with the Group’s logistics arm, John Keells Logistics. The

Nexus mobile loyalty program, which enables the business to identify key trends in customers and shopping lifestyles using data analytics, proved to be a key tool in retaining and attracting customers and in enhancing customer experience. During the year under review, the loyalty program membership exceeded the 650,000 mark.

The Financial Services industry group recorded revenues, including the share of revenues from equity accounted investees, of Rs.14.06 billion and a PAT of Rs.2.04 billion, contributing 12% and 11% to Group revenue and PAT. The 2016/17 PAT increased by 19% over the previous year. During the year under review, Union Assurance PLC (UA) continued to record encouraging double digit growth in Gross Written Premiums (GWP).

The banking industry recorded healthy growth driven mainly by the strong credit demand stemming from both the private and public sectors. However, performance was dampened, to an extent, by the increased pressure on net interest margins due to rising funding costs and intensified competitive pressures. Notwithstanding the challenging operating environment, Nations Trust Bank (NTB) recorded a double digit growth in both deposits and credit, which trended above the industry average.

The Information Technology industry group recorded revenues of Rs.11.11 billion and a PAT of Rs.468 million, contributing 9% and 3% to Group revenue and PAT respectively. The 2016/17 PAT increased significantly over the previous year. The Office Automation (OA) business improved its market share in both the mobile and copier markets, driven by increased volumes and revenue from new products. The increase in consumer purchasing power, particularly in the early part of the financial year, coupled with the increased substitution of feature phones with smart phones drove volumes in the Mobile Phone segment. The OA business’s extensive dealer network also enabled a growth in the market share of the Copier segment.

The Plantation Services sector recorded revenues of Rs.2.80 billion and a PAT of Rs.245 million, contributing 2% and 1% to Group revenue and PAT respectively. The 2016/17 PAT increased significantly over the previous year. The Plantation Services sector recorded an improvement in profitability as a result of improved tea prices and other operational efficiencies. Other, comprising of the Holding Company and other investments, and the Plantation Services sector, together, recorded revenues of Rs.2.95 billion and a PAT of Rs.3.10 billion for 2016/17, contributing 2% and 17% to Group revenue and PAT respectively. The 2016/17 PAT increased by 32% over the previous year. The increased PAT is mainly attributable to the interest income generated on the Group’s Rupee and US Dollar portfolios and exchange gains recorded at the Company on its foreign currency denominated cash holdings.

The year under review marked a significant development for John Keells Research (JKR), the research and development arm of the Group, which was established to drive science based innovation in the Group with a view to creating a portfolio of projects with intellectual property. In this light, JKR filed for its first patent for a novel energy source material that was developed through a research project undertaken in collaboration with the National Metallurgical Lab of the Council for Scientific and Industrial Research (CSIR-NML) in India, based on an idea generated by JKR. The patent application which was filed at the Indian patent office in December 2016 is in respect of a composite nanomaterial which could be used in energy storage. The composite material has the unique advantages of biocompatibility and a lower cost per unit of power stored. JKR is in the process of building a prototype energy storage device that utilises the patented technology to enhance the Technology Readiness Level (TRL) of the intellectual property and assess the commercial viability of a prototype product.

During the year under review, the Group made a concerted effort to drive a culture of disruptive innovative amongst our employees and businesses. To this end, the Group launched “John Keells X: An Open Innovation Challenge 2016”, to create a conducive ecosystem for young entrepreneurs to thrive, and to encourage businesses at JKH to engage in a model of open sourced innovation. An award on Disruptive Innovation was presented for the inaugural time at the JKH Chairman’s Awards 2016, to recognise businesses which have made disruptive innovation an integral part of their operating culture and have formulated successful responses to address current, and emerging, business disruption.

Your Board declared a third and final dividend of Rs.2.00 per share to be paid on 16 June 2017. The first and second interim dividends for the year of Rs.2.00 per share, each, were paid in October 2016 and February 2017, respectively. The Company increased its dividend per share to Rs.6.00, paid out of profits for the financial year 2016/17, from Rs.3.50 per share (excluding the special dividend of Rs.3.50 per share which was paid on account of the cash inflow of Rs.4.14 billion to the Company from the share repurchase of Union Assurance PLC), paid out of profits in the previous year. The Group believes that a higher dividend per share is warranted given the current, and anticipated, robust cash flows of the businesses. From a cash flow perspective, excluding the special dividend paid in the financial year 2015/16 (Rs.3.50 per share), the total dividend payout in the financial year 2016/17 (Rs.5.50 per share) increased significantly by 88% to Rs.7.28 billion from Rs.3.88 billion recorded in the previous year.