Tuesday Mar 10, 2026

Tuesday Mar 10, 2026

Monday, 31 October 2016 00:01 - - {{hitsCtrl.values.hits}}

Reuters - The war of words between Tata Sons and its ousted Chairman Cyrus Mistry ratcheted up a notch late on Friday, with

Reuters - The war of words between Tata Sons and its ousted Chairman Cyrus Mistry ratcheted up a notch late on Friday, with  Mistry stating he was surprised with reasons given by the Indian conglomerate for his dismissal.

Mistry stating he was surprised with reasons given by the Indian conglomerate for his dismissal.

Mistry was sacked as chairman by the board of Tata Sons on Monday and a scathing 5-page letter he wrote to the board was leaked on Wednesday, turning a boardroom feud into a public row.

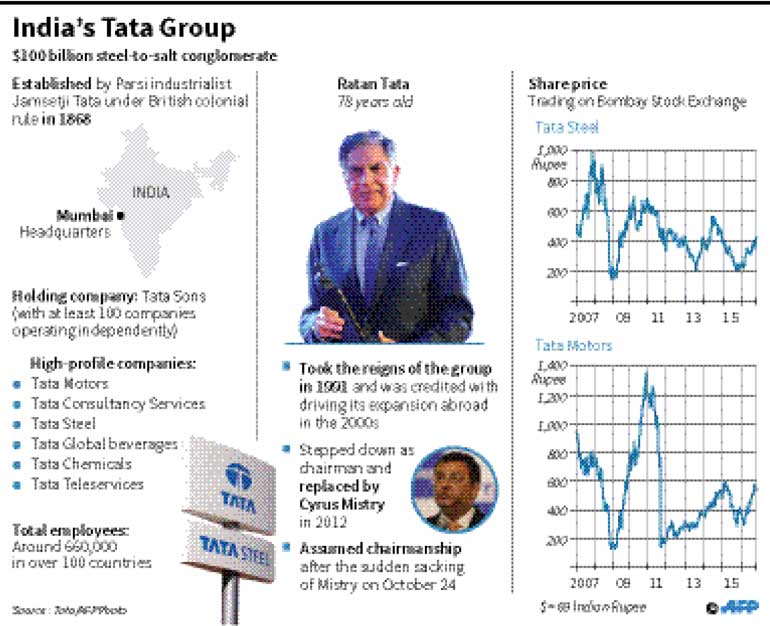

Mistry’s letter included allegations of corporate governance failures within Tata Sons, and a series of other barbs aimed at family patriarch Ratan Tata, who has returned as interim chair of the $104 billion salt-to-software conglomerate.

In a statement on Thursday, Tata accused Mistry - whose Pallonji family owns a minority stake in Tata Sons - of making “unsubstantiated claims and malicious allegations” against the conglomerate.

“It is surprising that Mr. Tata has sought to justify Monday’s conduct by making vague public statements that are contrary to his knowledge and contrary to the records of the Tata Group,” said Mistry in a response issued late on Friday.

The company has not fully explained its justification for his dismissal, and its statement on Thursday only said that Mistry’s tenure “was marked by repeated departures from the culture and ethos of the group”.

It said the Tata family trusts that own a two-thirds stake in Tata Sons were concerned by a “growing trust deficit” with Mr. Mistry. The Pallonji family, to which Mistry belongs, owns an 18.41 percent stake in Tata Sons.

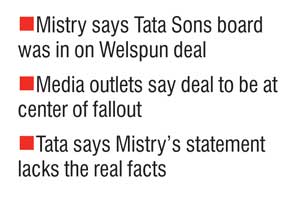

Some media outlets, citing sources familiar with the issues, have reported however that one of the issues that led to Mistry’s ouster was his failure to keep the Tata Sons board and Ratan Tata informed about Tata Power’s roughly $1.4 billion acquisition of Welspun  Renewables Energy back in June.

Renewables Energy back in June.

A source familiar with the matter also told Reuters that the Welspun deal had been a sore point with the Tata board. Tata itself has not publicly said this was behind Mistry’s ouster.

Mistry, who still remains chairman of a number of major Tata group companies including Tata Power, said in his statement on Friday that the Tata Sons’ board was informed of the deal, .

He said that Tata Power, in which Tata Sons own a roughly 33% stake, had made a presentation to the Tata Sons board on its interest in renewable energy.

It had presented the Tata Sons’ board with information on the deal, he said, and the board had approved the transaction in June.

“To even suggest that the Tata Sons board including the nominee directors of the Tata Trusts had not been adequately informed is contrary to the factual record,” said Mistry in his statement.

In a brief statement late on Friday, Tata fired its own salvo back at Mistry, dubbing his new statement “incorrect” and saying it did “not reveal the real facts.”

“We will present the real facts next week,” said a spokesman for Tata Sons.

Reuters - Two Tata group companies, Tata Steel Ltd and Indian Hotels Co last week said their financial statements present a true and fair value of their respective companies, in response to stock exchange requests for clarification.

The exchanges made the requests after the former chairman of parent Tata Sons Ltd, Cyrus Mistry, on Wednesday said the group could face an $18 billion writedown, partly related to the acquisition of its European steel business. Mistry was ousted in a surprise development at Tata on Monday.

“As part of the preparation of financial assets, the value-in-use of the assets of the Company is tested for impairment as per the Accounting Standards,” Tata Steel said in a statement to India’s bourses, the National Stock Exchange and the Bombay Stock Exchange.

Indian Hotels Co, the Tata firm running the group’s luxury hotels and resorts, later sent a similar response, saying the “financial statements of the company are prepared on a going concern basis and present a true and fair view of the state of affairs of the company”.

Following his ouster, Mistry, in a letter to directors of Tata Sons, wrote that foreign properties of Indian Hotels had been sold at a loss and termed the company’s international strategy as “flawed”.

He blamed family patriarch and the company’s current interim chairman Ratan Tata for making “emotional” decisions that have left the parent company saddled with debt.