Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Friday, 16 December 2016 00:00 - - {{hitsCtrl.values.hits}}

The Continuous Professional Development Committee (CPDC) of the Association of Professional Bankers of Sri Lanka organised a Discussion on the Budget on 25 November at the BOC Auditorium.

Aravinda Perera, former Managing Director of Sampath Bank, Duminda Hulangamuwa, Senior Partner E&Y, and Shiran Fernando, Lead Economist – Frontier Research, participated in the discussion moderated by Dilshan Rodrigo, COO – HNB.

Rodrigo giving the introductory remarks stated that although the knowledge on the Budget 2016 is mature now, the aim of this discussion is to look at the bankers’ perspective.

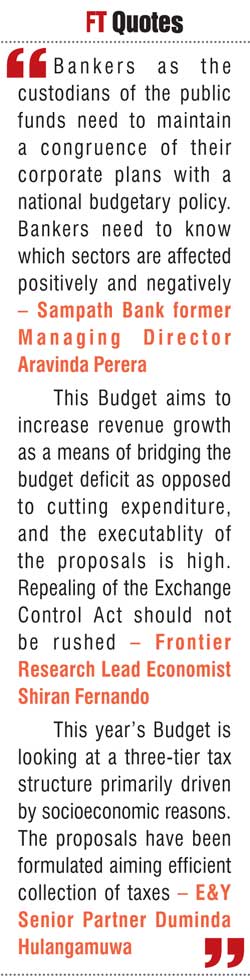

Perera speaking insisted that bankers as the custodians of the public funds need to maintain a congruence of their corporate plans with a national budgetary policy. Bankers need to know which sectors are affected positively and negatively. Speaking of the merits and demerits of this year’s proposals, he said that SME credit guarantee proposal is commendable and further he questioned the necessity of a specialised EXIM Bank when there are banks to serve the needs of the importers and exporters.

He commended the proposal to implement key performance indicators to State-Owned Enterprises as a measure that will yield huge benefits to Sri Lanka. He further stated that whilst the proposal to make NBFIs eligible to use the special debt recovery legislation currently available only to the banks, the proposal to delete the CRIB reports of value less than Rs. 500,000 may not be a wise move for the financial services industry.

Fernando commented on the good, the bad and the weird aspects of Budget 2016. He mentioned that this Budget aimed to increase revenue growth as means of bridging the budget deficit as opposed to cutting expenditure, and the executablity of the proposals is high. He said that the repealing of the Exchange Control Act should not be rushed and has to be done carefully with consultation with all stakeholders. He also stated that the Government needs to watch out for the changes taking place in the external sector. He acknowledged that the proposals somewhat reflect that the Government has taken these risks posed by the external sector into account. Hulangamuwa stated that this year’s Budget is looking at a three-tier tax structure primarily driven by socioeconomic reasons. The lowest tier of 14% is for the sectors of agriculture, education, export of goods and services and SMEs. The tier of 28% is allowed for other businesses such as the banking sector and 40% is allowed for alcohol tobacco and gaming. He also noted the some of the hitherto exempted services such as IT services, unit trusts and enterpot trade will be brought into the tax net. Also some of the sectors enjoying lower tax rates such as tourism sector and construction sector will move into a higher tax band. He also stated that the proposals have been formulated aiming efficient collection of taxes.

The session concluded with a hearty question and answer session where many clarifications were received by audience.