Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 15 November 2016 00:01 - - {{hitsCtrl.values.hits}}

Ernst & Young Sri Lanka Partner Duminda Hulangamuwa kicked off his presentation stating that Budgets can’t make everyone happy and preparing a national Budget is a thankless effort.

He said the key medium term goals of 2017 Budget were to: Propel Sri Lanka to be a strong high income economy in the Asian region; generating one million employment opportunities; enhancing income levels and achieving annual growth rate of 7%; creating a strong vibrant much wider middle class via the development of rural economies, ensuring ownership of land to rural and estate sector working class, the middle class and the public sector employees and Alleviation of poverty in all manifestations.

Ernst & Young Sri Lanka Partner Duminda Hulangamuwa

Ernst & Young Sri Lanka Partner Duminda Hulangamuwa

The key medium term strategies proposed were: Making Sri Lanka as a hub in the realm of global logistics; Pursuing commercial operations, among others, economic integration agreements with regional governments – China, India, Singapore etc; Development corridors will be set up for investment in public and private sectors with the role of the private sector being duly recognised to offer additional exposure and opportunities for entrepreneurs and professionals with the focus on digital economy, tourism, commercial agriculture, as well as accelerating the process of industrialisation and creating conducive environment for investments catering to export development; and Improve competitive edge of the economy through development of processes, skills and productivity.

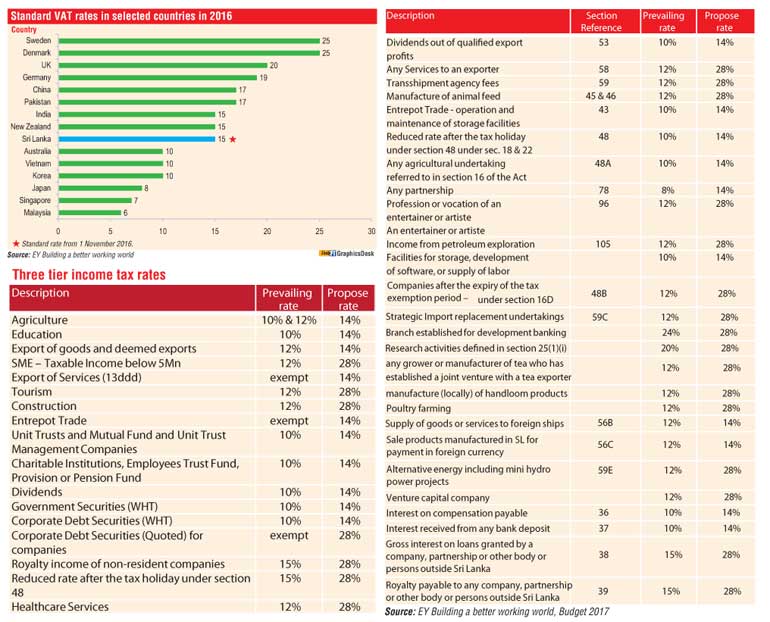

Focusing on corporate tax changes, he said that 2017 Budget has brought in a three tier structure effective from 1 April 2017 with 14% for SMEs, exports, education, agriculture, Treasury Bills/Bonds, funds and dividends; 28% as the standard rate for all other industries, including banking, finance, insurance, leasing and related services and trading and the high rate of 40% applicable to betting and gaming, liquor and tobacco.

The lower rate of 14% will be for the following sectors: agriculture, education, export of goods and deemed exports, exports of services, entreport trade, unit trust, and charitable institution and pension funds.

He pointed out that among significant sectors impacted would be tourism from 12% to 28%, construction from 12% to 28%, export of services from 0% to 14%, listed corporate debt from 0% to 28%, transhipment agency fees from 12% to 14%, services to exporters from 12% to 14%, and animal feed from 12% to 28%.

Furthermore, the Withholding Tax increased from 10% to 14% covering dividends, corporate debt securities, and government securities.

The 2017 Budget also introduced capital allowances. For plant, machinery and equipment it has been reduced to 20% from 33 1/3%, 50% & 100%; for buildings – reduced to 5% from 10%.

Hulangamuwa said the national tax credit will be abolished from 1 April, 2017 with net interest income taxable at 28% whilst the effective rate of tax on interest income from all debt securities will be 42%.

Another proposal was 5% Withholding Tax (WHT) on all payment exceeding Rs. 50,000 per month.

The introduction of Financial Transaction Levy of 0.05% on all inter-bank transactions was another major proposal of the 2017 Budget whilst this levy will be deductible for income tax purposes.

Explaining the capital allowances, he said the Budget has proposed 200% capital allowances for investment in Northern Province; and 100% capital allowances for investment in Uva and Eastern Provinces.

Key tax incentives in 2017 Budget included 100% up-front capital allowances, 5% investment as tax credit and 5% Government grant if $ 5 million, 500 new employees and 40% value addition; special incentive package for land mark investments between $ 100 million and $ 500 million investments 75% tax rebate to exporters on incremental income if export increase by 15%. The time period extended to 31 March, 2018 for listing in the CSE – 50% tax rebate and a 25% grant of tax paid.

On the tax administration side, key proposals were time bar provision reduced from 18 months to nine months; and Appeal hearing period reduced from 24 months to six months for both CGIR and TAC

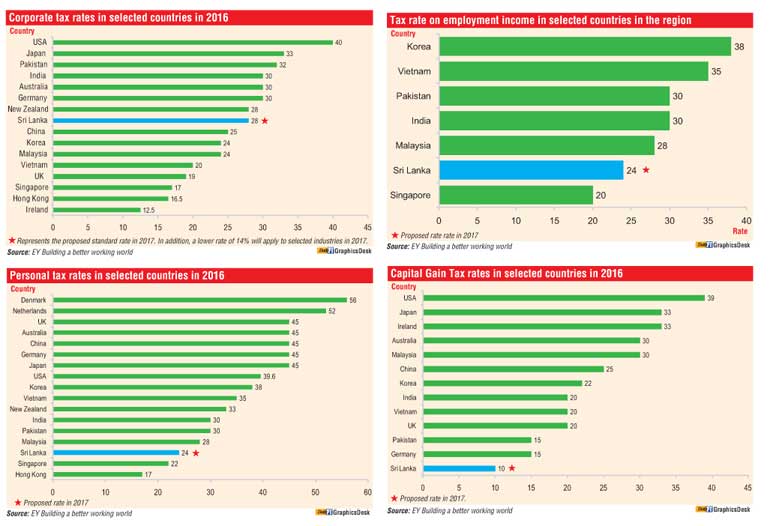

Hulangamuwa said despite changes introduced in 2017 Budget, in terms of standard corporate tax rate Sri Lank remain relatively low among select countries such as 40% in the US, 33% in Japan, 32% in Pakistan and 30% in India, Australia and Germany. However, countries such as China, Korea, Malaysia, Vietnam, UK, Singapore and Hong Kong have lower rates than Sri Lanka.

With regard to employment income taxation, 2017 Budget had several changes.

They included: Maximum rate increased from 16% to 24%; tax free allowance and qualifying payment increased from Rs. 750,000 to Rs. 1.2 million per annum; exemption on all allowances including travelling allowances removed; tax slab increased from Rs. 500,000 to Rs. 600,000 and tax rate on second employment revised from 16% to 10% for payment less than Rs. 50,000 per month and 20% if payment exceeds Rs. 50,000 per months. At the standard rate of 24% Sri Lanka was one of the lowest with Singapore at 22% and Hong Kong at 17% being better. In terms of taxing employment income, in comparison to Sri Lanka’s 25% in Singapore it was 20% and 28% in Malaysia and 30% in India and Pakistan and 35% in Vietnam and 38% in Korea. With 2017 Budget seeing the reintroduction of Capital Gains Tax at 10% on disposal of immovable properties from 1 April 2017. This rate according to E&Y is among the lowest. Other countries have rates as high as 39% (US) and 30% Malaysia.

With regard to ESC, the 2017 Budget proposes to reduce the threshold of Rs. 50 million will reduce to Rs. 12.5 million; advance WHT of ESC on import of vehicles; removal of exclusion on profit making businesses; removal of maximum liability of Rs. 120 million per annum; ESC carry forward to claim against income tax reduced to that Y/A and two years thereafter; petrol, diesel and kerosene retail trade liable if aggregate turnover exceeds Rs. 50 million (will reduce to Rs. 12.5 million after April 1, 2017). Tax will be calculated on 1/10th of the liable turnover of the trade; advance payment of ESC on persons liable for the Special Commodity Levy and motor vehicles. Listing other changes, Hulangamuwa said NBT exemption has been removed in construction contractor including sub-contractor; sale of residential accommodation – project cost below Rs. 10 million and services of travel agent for inbound tours. Furthermore, the Telecommunication Levy increased was from 10% to 25% for internet services.

Finance Minister Ravi Karunanayake on Friday said that taxation policies in 2017 Budget have focused on bringing those who can pay taxes, but to date haven’t, into the system.

“We didn’t want to burden the people but brought into the tax system those who should and could pay but haven’t to date,” Karunanayake said explaining the rationale of some of the taxation changes announced in 2017 Budget at the Ernst & Young  Forum.

Forum.

He said that given legacy of previous regime’s heavy indebtedness inherited by the current Government, it was imperative to raise higher revenue. He added that the Government has been successful in increasing the revenue to GDP to 15% from 12% under the previous regime.

However, Karunanayake assured such revenue will be spent wisely by the Yahapalanaya Government. “The 2017 Budget has focused a lot on financial and fiscal discipline,” he stated.

He also said that 2017 Budget wasn’t a knee-jerk reaction but a well planned out medium term exercise to improve fiscal management and bolster inclusive growth.

In response to questions on implementation at the E&Y forum, the Finance Minister assured that several new measures have been announced to ensure success of the 2017 Budget. This included a proposal to set up committee constituted of members from both the private and public sectors to oversee Budget implementation and execution.

Development Strategies and International Trade Minister Malik Samarawickrama on Friday described the 2017 Budget as “progressive” and urged the private sector to make full use of many proposals.

“It is a progressive Budget and as the Government pursues a private sector led growth strategy, it is up to the businesses to take  the ball and run,” Samarawickrama told the Ernst & Young’s post-2017 Budget seminar.

the ball and run,” Samarawickrama told the Ernst & Young’s post-2017 Budget seminar.

The Minister also said the 2017 Budget has unveiled a host of incentives as part of the Government’s support to the private sector. He lamented that Sri Lanka suffers from lack of entrepreneurship and the next generation must take the lead. “It can’t be business as usual and that mindset won’t get us anywhere,” Samarawickrama said pointing to old CEOs and old businesses. He said the next generation of leaders in firms must be encouraged and such a strategy will bring about much needed innovation within private sector. In response to a question during the panel discussion, the Minister said that the Government is working to expand the market for Sri Lankan private sector by forging FTAs with China and Singapore and enhanced trade and economic cooperation agreements with India and Pakistan. “These initiatives will give Sri Lanka a preferential access to a 3 billion market,” he said emphasising the country will be attractive for global firms to use Sri Lanka as a hub to serve these markets.

Samarawickrama also expressed confidence that the GSP+ will be regained by March or May next year.