Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 15 November 2016 00:15 - - {{hitsCtrl.values.hits}}

By the Alliance

for Economic Democracy

The theme of the 2017 Budget as stated by Finance Minister Ravi Karunanayake in his speech on Thursday is ‘Accelerating Growth with Social Inclusion’. The Alliance for Economic Democracy believes that it is in fact a Budget that will lead towards crisis and social exclusion.

The IMF Agreement and the Appropriations Bill reflected an impending austerity budget. It is clear now that the objective of the Budget is to reduce the role of the State in providing essential services and distribution of resources.

The Budget, reflecting the vision of the Government, is paving the way for elites to benefit in three major areas: financial speculative investments, privatisation and trade liberalisation, while increasing the economic burden on the people.

The Budget has proposed revising the Banking Act and expanding the draconian Debt Recoveries Act, creating the necessary infrastructure to expand the financial sector and entrench loans and financing in every aspect of people’s daily lives. Not only does it seek to expedite the issuing of loans and expand micro-credit, it plans to extract rural people’s savings by amalgamating cooperative rural banks. By introducing measures such as restructuring SEC operations and consolidating and raising the capital assets threshold of banks and financial institutions, the Government hopes it will be able to attract foreign capital to invest in the country. Further, it has proposed plans to expand the real estate and insurance sectors, even extending health insurance for students. These proposals point to the worrying trend of expanding risky speculative investments we have seen around the world, leading to an accelerated financial crisis and increased inequality. The Budget is even setting a precedent by establishing a Financial Assets Management Agency and using State funds to bail out and rescue ailing financial institutions. Wealthy investors make quick profits through financial speculation and exit before a crisis. The economic costs of the crisis, however, are transferred to those in the lower strata of society, whether in the form of bank bailouts, hidden corporate subsidies or a general decline in services.

Disguised as expenditure on public services, the Government has indeed allocated amounts for privatising education and health, pensions and social welfare funds. Instead of proposing plans to strengthen public education and health, it is spending State funds to encourage setting up private institutions.

While providing large businesses with concessions and tax holidays, the Government complains that funds are insufficient to boost the production and incomes of farmers, fishermen, small enterprise owners and ensure fair wages for plantation and industrial workers.

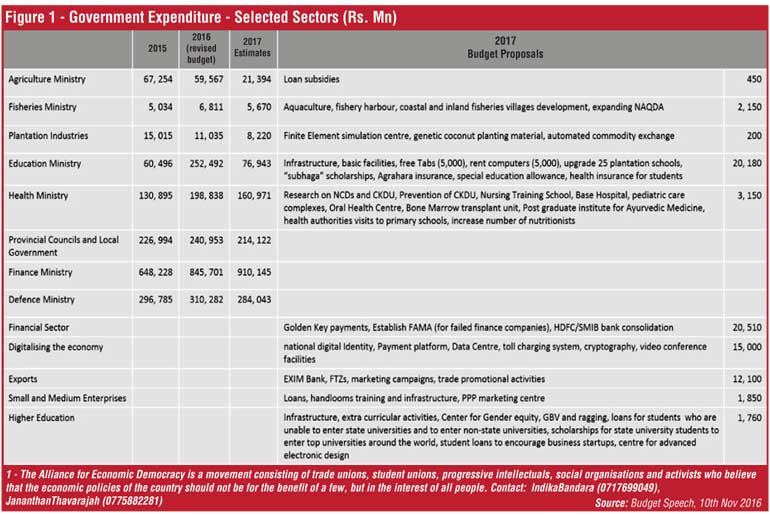

Over the years, agriculture, fisheries and small and medium enterprises have received dismal amounts in the Budget (fig 1). Yet again the Government fails to propose a plan for improving production and creating employment in these sectors.

People’s Budget?

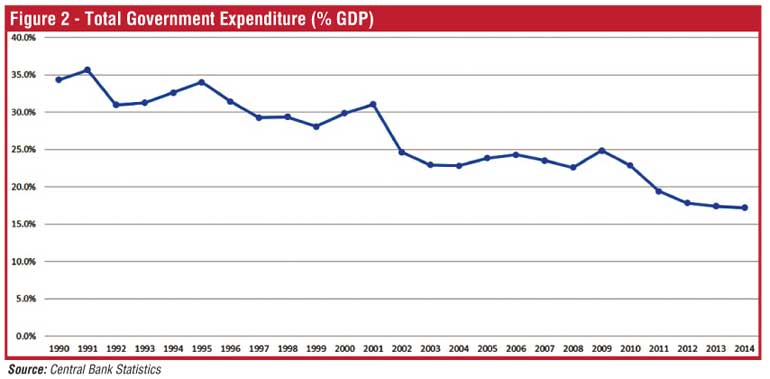

Furthermore, plans to sell off public assets by listing State-owned enterprises and through Private-Public Partnerships in the coming year are exposed in this Budget. Given that Sri Lanka’s State expenditure in relation to GDP has consistently declined over the last few decades (fig 2) and is also low compared to State spending in most other countries, these austerity measures amount to nothing less than the abdication of the State’s responsibility to its citizens.

Economic policy experts and the IMF insist on reducing the budget deficit. The Government can reduce budget deficits by increasing revenues, particularly through raising direct taxes. Instead, it is increasing indirect taxes, including VAT, which will burden the lower-middle class and poorer sections of society.

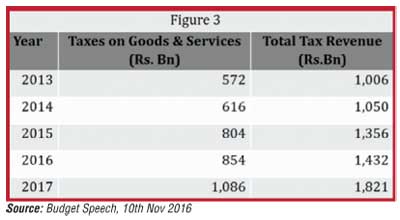

The Government’s keenness to push trade liberalisation policies inevitably contradicts efforts to increase direct taxes. The lowering of tariffs and tax concessions for the corporate sector and foreign investors becomes the norm. Although the Finance Minister said it was a “people’s Budget’’ the only instance where the people are given priority is by placing the onus on them for generating tax revenue. The bulk of the tax revenues are collected through taxes on goods and services imposed on the people (fig 3).

The increase in indirect taxes and cuts to State spending will shift the cost of essential services on to the people. Drastic increases in the costs of State services such as electricity, fuel and water can also be expected due to “cost-reflective pricing” and privatisation measures in the years ahead. The neoliberal policies of financial speculation, privatisation and trade liberalisation will have a long-lasting impact on the people’s economic life and cannot be reversed easily in the future. Finally, the Government proposes to change the “stringent and archaic labour laws” in the country to promote new jobs. However, a majority of formal sector workers are in labour-intensive industries where their rights are constantly threatened by employers who evade labour regulations.

The Government’s rhetoric about creating “flexible labour” plays into employers’ hands while undermining the role of regulatory institutions such as the Labour Department. Active demands of the workers to increase wages, provide cost of living relief, safeguard employee funds and reduce precarious labour have not been met. In contrast, the labour law reforms proposed in the Budget will increase precariousness in people’s employment. Workers hard-earned savings are put at risk by proposing private pensions and amalgamation of ETF and EPF funds. The 2017 Budget proposals are a full-frontal assault on labour. Therefore, while some have been protesting the erosion of workers’ rights, wages and working conditions, the Government’s complicity in contributing to the burdens of the workers, requires all people to protest.

The Government’s rhetoric about creating “flexible labour” plays into employers’ hands while undermining the role of regulatory institutions such as the Labour Department. Active demands of the workers to increase wages, provide cost of living relief, safeguard employee funds and reduce precarious labour have not been met. In contrast, the labour law reforms proposed in the Budget will increase precariousness in people’s employment. Workers hard-earned savings are put at risk by proposing private pensions and amalgamation of ETF and EPF funds. The 2017 Budget proposals are a full-frontal assault on labour. Therefore, while some have been protesting the erosion of workers’ rights, wages and working conditions, the Government’s complicity in contributing to the burdens of the workers, requires all people to protest.

The Alliance for Economic Democracy calls on the citizenry and the peoples’ organisations, including trade unions, estate workers, farmer and fisher organisations, and student and teachers unions, to resist the Budget, which the people cannot afford, and build a movement to reverse these policies.

[The Alliance for Economic Democracy is a movement consisting of trade unions, student unions, progressive intellectuals, social organisations and activists who believe that the economic policies of the country should not be for the benefit of a few, but in the interest of all people.)