Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 28 May 2018 00:00 - - {{hitsCtrl.values.hits}}

By Senaka Jayasinghe

Background

Financial institutions around the globe are taking proactive steps to address Environmental and Social (E&S) risks within their business operations.

Furthermore, leading financial institutions and associations are setting the agenda for local peers and regulators to create industry-wide level playing fields.

Keeping in line with local regulatory requirements, a number of financial institutions in Sri Lanka already show a solid track record in implementing Environmental and Social Management Systems (ESMS). The experience from other countries shows that adopting and adhering to such Sustainable Banking Principles usually provides benefits to all banks, their clients, the communities and to the environment.

Against this background, the Sri Lanka Banks’ Association’s Sustainable Banking Initiative (SBI) has been created, with the following aims:

To create a platform where banks can work together on sustainability issues

The SBI is promoted by Sri Lanka Banks’ Association (SLBA), with funding provided by DEG of Germany, OeEB of Austria, Proparco of France and FMO of Netherlands. Innovativkonzept Ltd. – a German consultancy company specialised in setting up ESMS at banking level and coordinating countrywide sustainable banking initiatives is providing training under the SBI. A Coordinator appointed by SLBA is engaged in the implementation of the SBI, assisted by a ‘Core Group’ consisting of representatives from Hatton National Bank, DFCC Bank, Nations Trust Bank, Pan Asia Bank, Seylan Bank, Bank of Ceylon and Commercial Bank, with active participation of the Secretary General of SLBA.

The journey

On 5 November 2015, Chief Executive Officers (CEOs) from 18 banks operating in Sri Lanka placed their signatures to a document containing the 11 Sustainable Banking Principles (SBPs) for Sri Lanka. These principles had been developed and jointly agreed upon in the months preceding this event through an E&S committee consisting of members from participating banks (Phase I of SBI).

The signed Principles of the SLBA’s SBI are:

1 Our business activities: Environmental and Social Risk Management

We will integrate environmental and social considerations into decision-making processes relating to our Business Activities to avoid, minimise or offset negative impacts.

2 Our business operations: Environmental and Social Footprint

We will avoid, minimise or offset the negative impacts of our Business Operations on the environment and local communities in which we operate and, where possible, promote positive impacts.

3 Rights of the respective stakeholders

We will respect relevant human rights principles in our Business Operations and Business Activities.

4 Financial inclusion

We will promote financial inclusion, seeking to provide financial services to individuals and communities that traditionally have had limited or no access to the formal financial sector.

5 E&S Governance

We will implement robust and transparent E&S governance practices in our respective institutions and assess the E&S governance practices of our clients.

6 Promote ethical finance

We will not finance certain “excluded” activities, we will not tolerate unethical or criminal behaviour.

7 Promote “green economy” growth

We will promote projects and other activities that contribute to a greener, cleaner economy in Sri Lanka.

8 Capacity building

We will develop individual institutional and sector capacity necessary to identify, assess and manage the environmental and social risks and opportunities associated with our Business Activities and Business Operations.

9 Collaborative partnerships

We will collaborate across the sector and leverage international partnerships to accelerate our collective progress and move the sector as one, ensuring our approach is consistent with international standards and Sri Lankan development needs.

10 Promote transparency and accountability

We will promote transparency and accountability, regularly review and report on our progress in meeting these Principles at the individual institution and sector level.

11 No “race to the bottom”

We will not compete with other banks on E&S issues, i.e. undermine our competitor on E&S requirements towards the credit taker.

What to expect

The second phase of the SBI commenced on 15 August 2017 and is focused on providing all the necessary “ingredients” for this endeavour in terms of guidance documents, training, coaching, E-learning and case studies and will last for approx. 18-24 months.

In April 2018, three days of training on implementation of Sustainable Banking Principles was conducted by Innovativkonzept Ltd. under the SBI for all banks in Sri Lanka. At present, the Implementation Guide for the 11 SBPs is being finalised, by getting inputs from all participating banks. The E-Learning module is also being prepared. These will facilitate the implementation of the SBPs, as well as the ESMS by individual banks. The official launch of the SBI is expected to take place in early 2019.

However, there are many challenges in implementing the SBPs in a developing country, such as Sri Lanka. There is a huge gap between our (local) understanding of the importance of Sustainability Aspects/SBPs, as compared to that of international financial institutions. For example, the importance given by project promoters, especially in the SME sector towards E&S aspects is poor, leading to many practical difficulties for financial institutions in implementing ESMS in their organisations.

Importance and benefits of the SBI

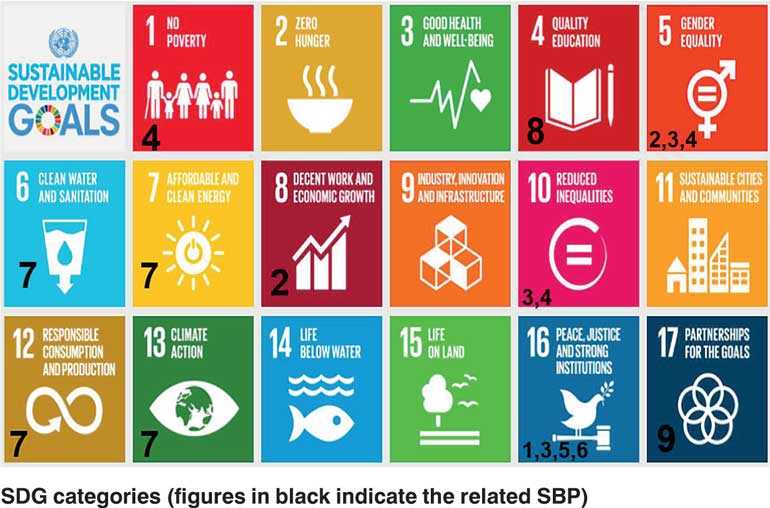

In 2016, the Central Bank of Sri Lanka (CBSL) joined the International Finance Corporation (IFC) supported Sustainable Banking Network (SBN) with a view to promote sustainable finance practices in Sri Lanka, so as to contribute to the sustainable development of the Sri Lankan economy. Thus, implementation of the eleven SBPs under the SBI has become important for all banks. SLBA’s SBI supports the implementation of the Sustainable Development Goals (SDGs). The following figure indicates the SBPs that are relevant for SDGs:

Most importantly, SBPs will help to place all banks in a level playing field on E&S aspects. This will ensure that all banks will maintain minimum standards in E&S appraisal of projects they finance, thus preventing funds being granted to projects with questionable/negative E&S aspects, as well as projects without proper E&S approvals.

(The writer is Assistant Vice President – Sustainability of DFCC Bank PLC and member of the ‘Core Group’ for the SBI.)