Saturday Feb 21, 2026

Saturday Feb 21, 2026

Monday, 28 September 2020 00:00 - - {{hitsCtrl.values.hits}}

Sandbox Consultancy Services Managing Director/Lead Consultant Angelo De Silva

Sandbox Consultancy Services, a wholly Sri Lankan and entrepreneur run firm, providing performance consulting and people analytics to the top corporates in Sri Lanka, recently released a study titled “Micro Enterprise and the Sri Lankan Economy – Post-COVID insight.” Having surveyed over 54 entities the results were eye opening, and the Daily FT reproduces the Sandbox’s analysts team’s comprehensive and insightful report with the goal of facilitating better financial policy change geared towards an often overlooked sector – the Urban Micro Enterprises. This report, is a much needed insight into this sector and sheds light on the true reach of the relief schemes purportedly available to them. It also serves as a current snapshot of this sector’s impact to our economy and the ramifications of delaying support to them, given the whopping impact they have on employment and the GDP.

Foreword

2020 has been a challenging year to say the least. To quote the words of TIME magazine; “We’re headed into a global depression–a period of economic misery that few living people have experienced.” With over 26 million cases and 860,000 deaths, we are all beyond the point of moving on with respect to COVID19. Aside from the humanitarian crisis we have plunged into an ever-deepening global recession that is set to cost the world economy an estimated $ 8 trillion (ADB estimates May 2020).

Nations around the world are now feeling the ripple effects of this crisis. While larger, more robust  economies are infusing relief measures to keep the economic machinery lubricated and running, smaller developing countries are beginning to show cracks and signs of fatigue.

economies are infusing relief measures to keep the economic machinery lubricated and running, smaller developing countries are beginning to show cracks and signs of fatigue.

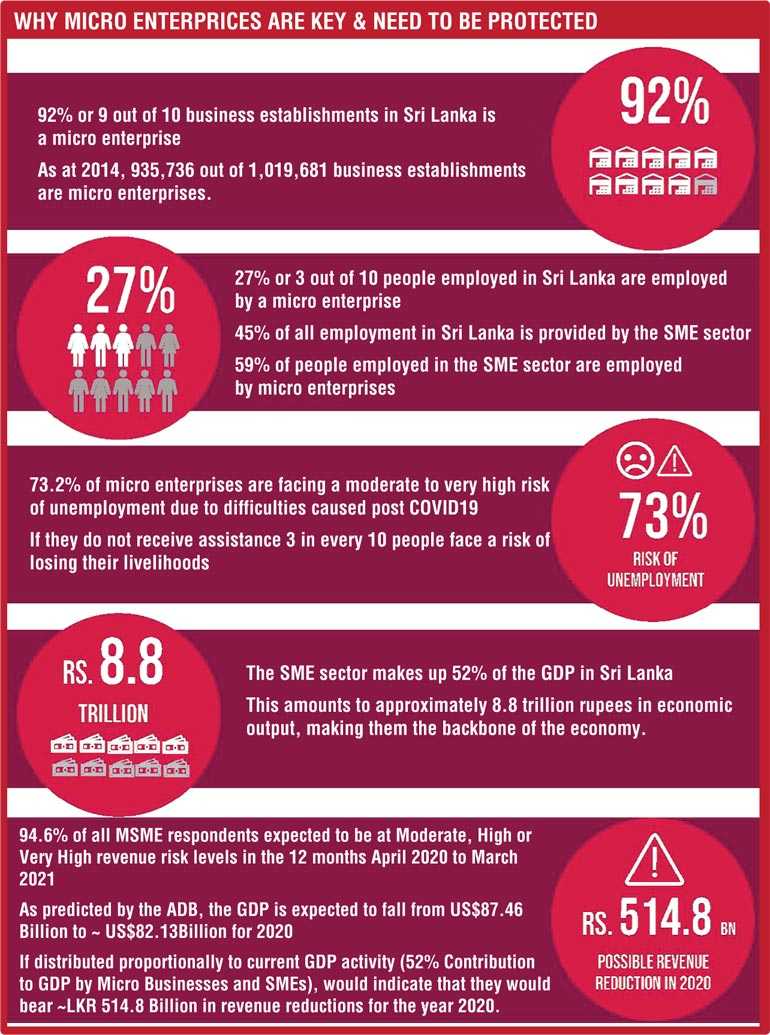

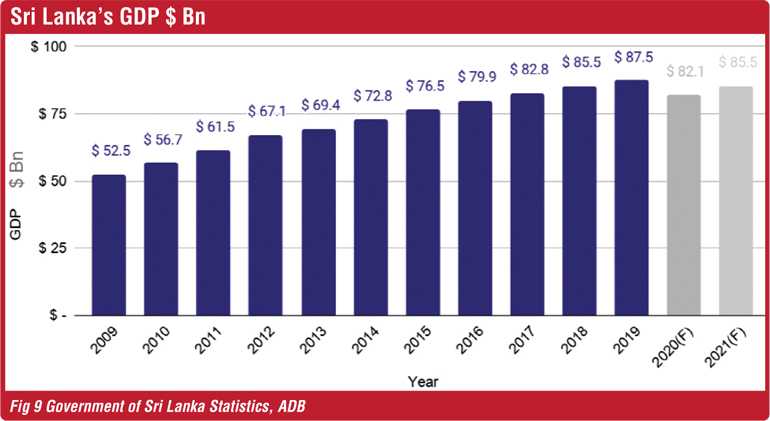

Sri Lanka is a developing economy with a GDP of $ 87.1 billion as at 2019. Our Small and Medium Enterprise sector (SME) contributes over 52% of economic activity towards this and further shoulders over 45% of the employment in the county. Yet with the post COVID slowdown looming on the horizon the GDP is expected to contract by 6.1%, as per ADB forecasts, leaving the SME sector with possible loss in revenue of 514.8 Billion Sri Lankan Rupees.

However, hidden behind the classification of the SME sector is the unsung hero of our economy, the micro enterprise sector, which is the focal point of this report and exercise.

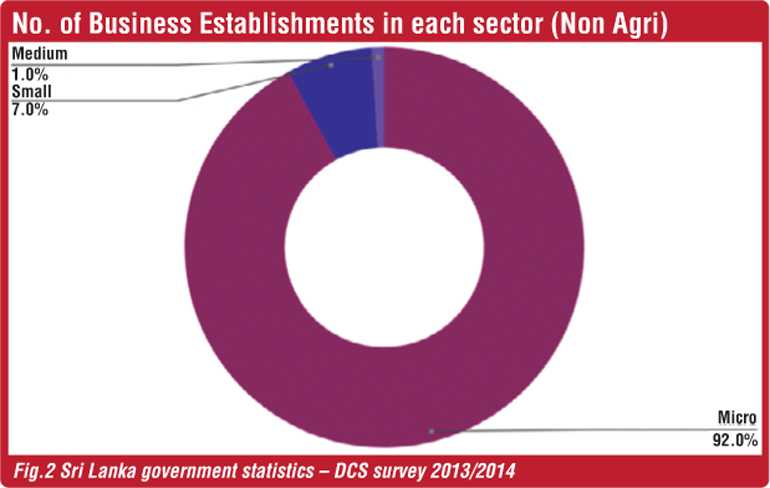

Accounting for 92% of all business establishments in Sri Lanka micro business are the foundation of the economy. Employing a staggering 27% of the entire workforce, a critical blow to this fragile eco system can devastate Sri Lanka’s chances of a satisfactory post COVID economic recovery.

With an economy so dependent on micro business Sri Lanka needs to engage in a paradigm shift towards enabling these businesses to survive, grow and thrive. The fact that the last national survey on this sector dates back to 2013/2014 is case in point that we have neglected this vital part of our economic engine.

The identity of micro businesses have up to now been largely perceived as only rural. This is evidenced in the micro enterprise lending schemes being predominantly focused in areas outside of Colombo. It is timely that we consider a much-needed shift towards urban micro enterprise, to which this report adds value.

The new generation of micro enterprise are both people light and asset light; knowledge driven businesses engaging the problems of the world. The banking sector will need to adapt faster to provide for the needs of this rapidly changing landscape with the speed and agility to complement the innovation the sector is capable of.

Collaboration will be key and with the collective strength of the micro business community, the local Government and the financial and private sector we could ensure a sustainable solution. Sandbox is pleased to present the ‘Micro Enterprise & The Sri Lankan Economy’ report, which highlights the transformative potential of the sector as well as offers insight on potential pitfalls. The report has been prepared by the analytics team at Sandbox and funded by the #sharesupportsurvive initiative.

1.0 Introduction

Sri Lanka, a land like no other. Nestled in the centre of South Asia, Sri Lanka has seen its economy rapidly develop since its independence in 1948 from colonial Great Britain. With a population of just under 22 million, Sri Lanka recently graduated to the classification of a lower-middle-income country with a GDP per capita of $ 3,853 (2019) (World Bank).

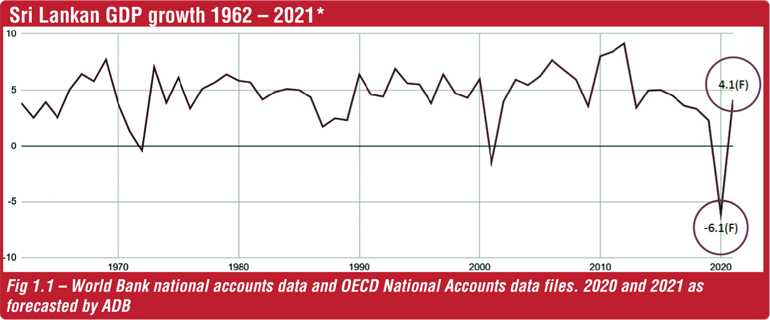

Following 30 years of civil unrest that ended in 2009, the 10 years to 2019 has seen the national economy growing at average 5.3% reflecting a determined policy thrust towards reconstruction and growth, albeit having slowed down over the past 3 years.

Growth in 2019 was estimated to have been 2.3%, an 18-year low, partly explained by the impact of the April terrorist attacks that left the nation shocked. On the back of the recent global pandemic, the ADB has forecast GDP growth to be at -6.1% for 2020 before recovering to 4.1% in 2021.

Despite the fluctuation in growth, the Sri Lankan economy is still transitioning from a predominantly rural-based economy towards a more urbanised economy oriented around the secondary and tertiary sectors. In terms of per capita income level, Sri Lanka has lost its relative position to many other countries over the years due to slower growth of the economy.

The annual average of real GDP growth for 60 years since independence in 1948 has been only 3.2% which has not been sufficient for a developing country to reach a high-income status for its population. What is implied by this is: though Sri Lanka’s GDP grew by over 50x, its population has increased nearly threefold during the same period, thereby slowing down the growth of average income per head of the population to around 20x during the last 62 years.

The economy was expected to expand rapidly due to the surge in demand resulting from the liberalised economic policies that came into force in late 1977.

The year immediately following the introduction of open economy policies saw a GDP growth of 8.4% in real terms and this growth tapered off gradually in the subsequent years until 1982 when growth rate reduced to 5.1%. With the escalation of terrorist activities and rapid deterioration of the security situation in the country, performance of the economy suffered severely for nearly three decades until mid-2009 when the conflict finally ended and long- lasting peace and political stability returned.

1.1 The Sandbox State of MSME Survey 2020

Background

The Sandbox State of MSME Survey was launched as a public online survey under our CSR initiative #sharesupportsurvive in April 2020 and remained active through July 2020.

The focus if the initiative was to create a platform for small businesses and entrepreneurs to support one another through the turbulence created by the COVID19 pandemic. At the time of its launch it was the only survey of its kind targeted at the MSME sector in Sri Lanka.

Sandbox will be extending the reach of survey on a national scale in quarter 3 of 2020.

Scope and coverage:

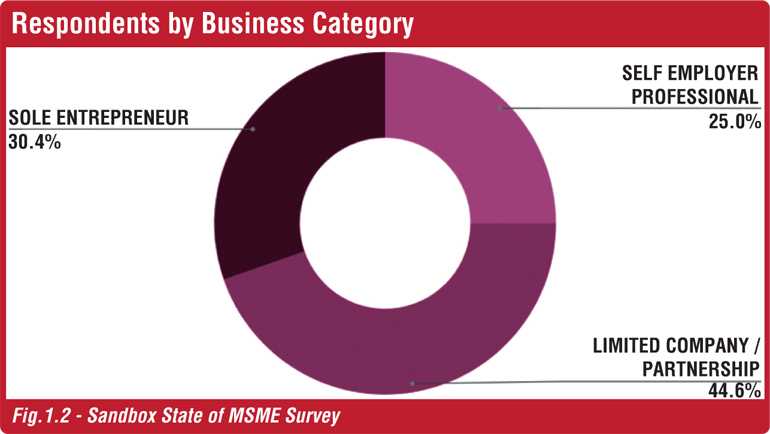

The survey captured three categories of MSMEs. Fig 1.2

1. Sole entrepreneurs

2. Self-employed professionals

3. Private limited companies or partnerships

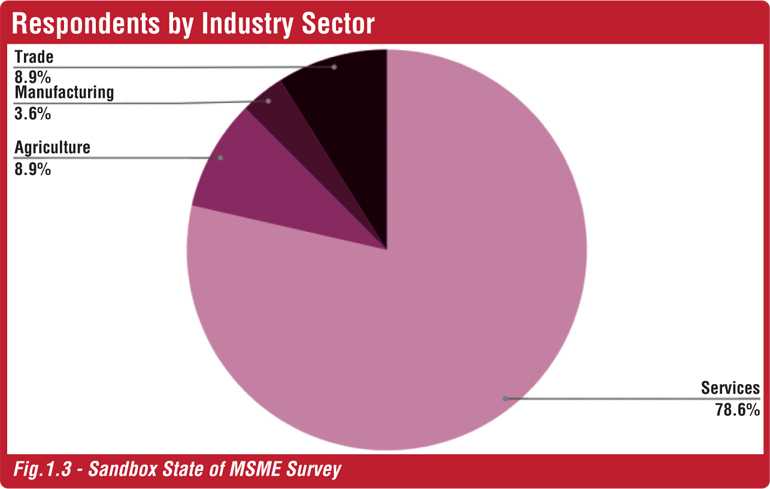

The participants were categorised into four industry sectors. Fig 1.3

1. Trade

2. Manufacturing

3. Agriculture

4. Services

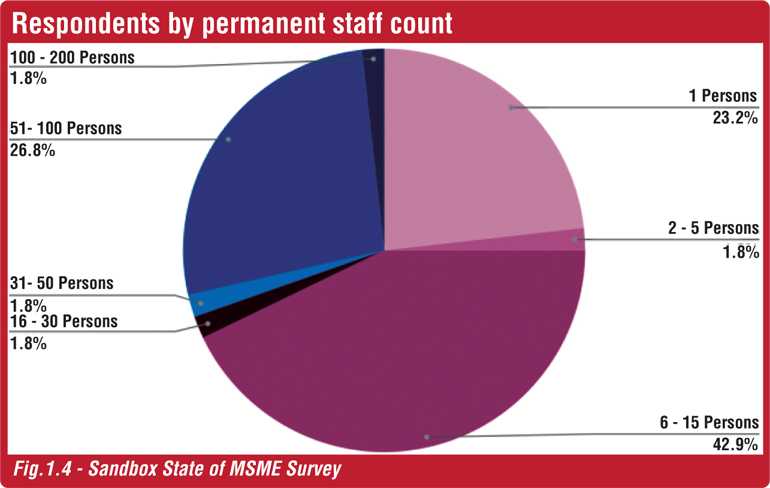

Further categorisation was done by brackets of permanent staff count. Fig 1.4

Key aspects surveyed:

The survey used a questionnaire method to collect data on key aspects

1. Direct livelihood impact

2. Indirect livelihood impact

3. Direct business impact of COVID-19

4. Estimated future risks

5. Access to Government relief and financial assistance

2.0 Impact of micro enterprises on the Sri Lankan economy

Throughout its development timeline, the Micro business and Small & Medium Enterprises sector (SME) have continued to play a vital role in the socio-economic development of the country.

It was estimated in 2013/14 that SMEs contributed over 52% to the national GDP amounting to over Rs. 8.8 trillion and are hence considered as the backbone of the economy.

In 2013/14 it was estimated that Micro businesses and SMEs accounted for over 90% of the total enterprises in the non- agricultural sector and 45% of the total employment.

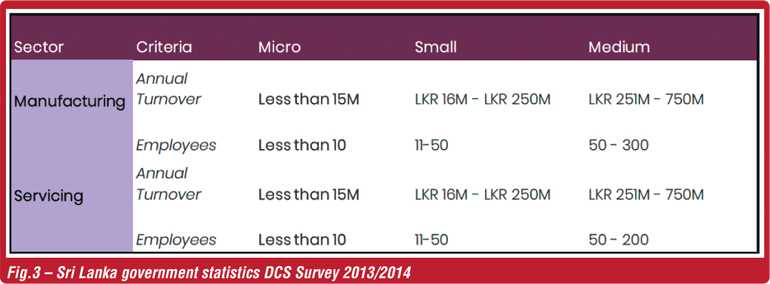

2.1 How are micro, small and medium businesses classified in Sri Lanka?

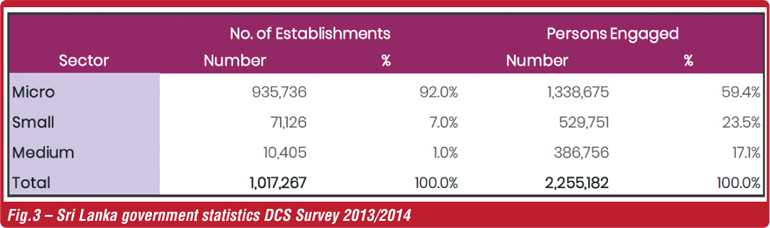

As per the Department of Census and Statistics (DCS) Economic Census 2013/14, the number of establishments in the Micro and SME sector stood at ~1 million providing employment to ~2.2 million persons in the non-agricultural sector.

Of these, the total number of individuals employed in Micro establishments stood at ~1.3 million accounting for ~45% of total employment, while representing~92% of the total number of establishments.

A notable difference between firms that fell into the categorisation of Micro businesses and SME vs. those defined as large firms was that SMEs tended toward labour-intensive operations requiring less establishment capital than larger firms. As such, growth in the SME sector has continued to offer significant potential to the economy as a means of creating new employment opportunities whilst facilitating a wider distribution of wealth across rural and regional areas.

Bearing the above in mind, it is also a conceivable fact that SMEs hold the potential to increase the Government's taxable base in terms of both, direct and indirect taxation, at a quicker pace than their corporate counterparts.

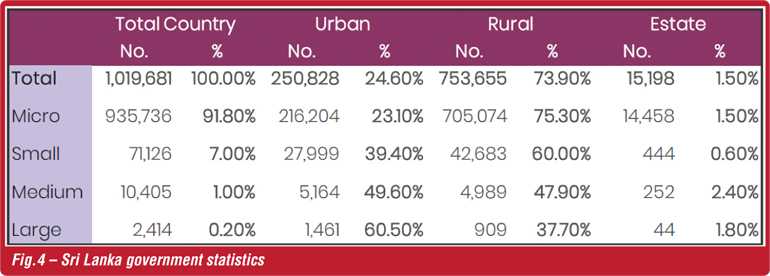

Considering the geographic spread of businesses, 73.9% were found to be the rural sector while 24.6% of all establishments were from the urban sector and a further 1.5% in the Estate sector. This primarily being the reasoning for most Governmental ministries and development authorities, focusing their attention toward developing the rural communities.

Having understood that over 73% of establishments are located in rural areas, Sri Lanka’s SME development strategy has meandered toward them, offering less consideration to the 230,000+ urban Micro and SME businesses.

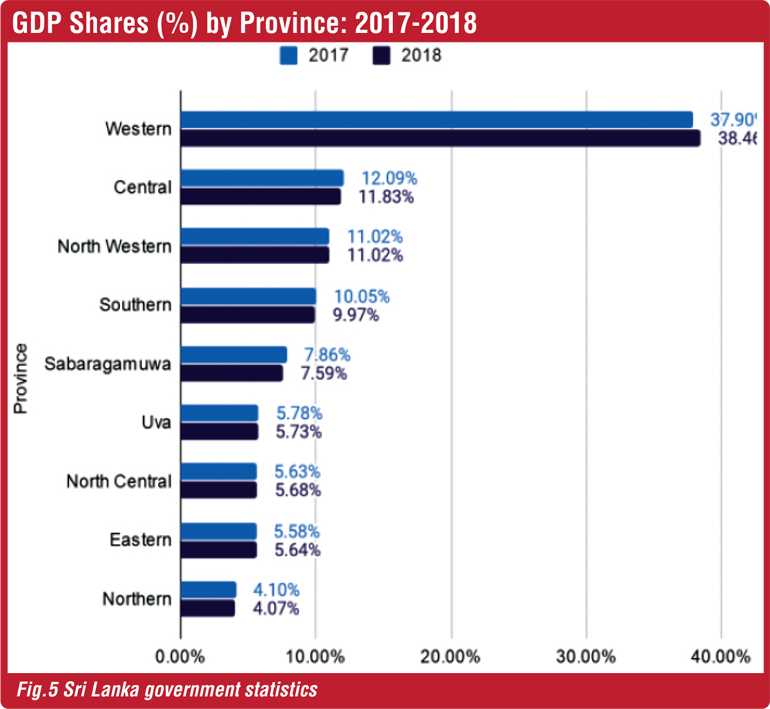

Considering the provincial contribution to GDP, the Western Province continued to be the largest contributor to the economy followed by Central and North Western Provinces, as estimated by the Central Bank. Between 2017 and 2018, the Western Province also saw the highest increase in share of Provincial GDP contribution from 37.9% to 38.5%.

Considering the provincial contribution to GDP, the Western Province continued to be the largest contributor to the economy followed by Central and North Western Provinces, as estimated by the Central Bank. Between 2017 and 2018, the Western Province also saw the highest increase in share of Provincial GDP contribution from 37.9% to 38.5%.

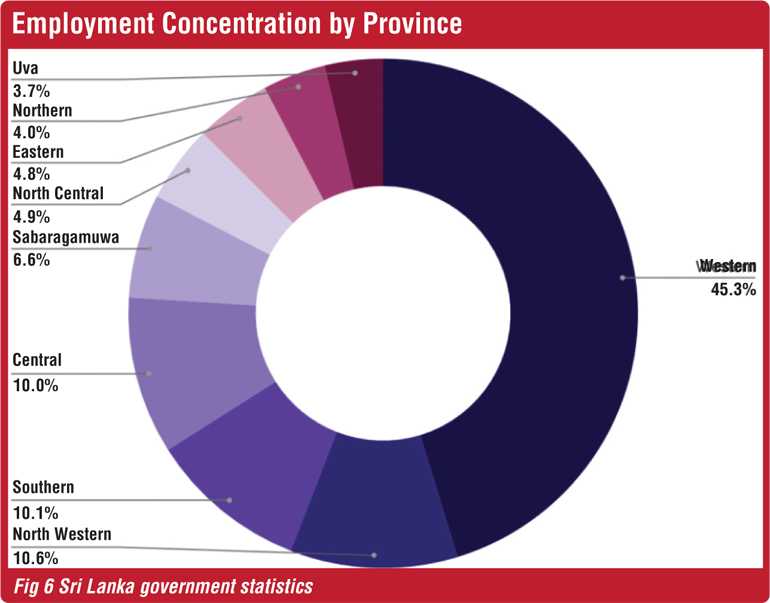

Taking a step further and analysing the employment of the urban sector, over 45% of all employment is within Sri Lanka’s Western province itself, with a further 30% split approximately equally between the Central (Kandy), Southern (Galle and Matara) and North Western Province (Chilaw).

With over 75% of employment in key urban hubs, it stands as testament to the fact that businesses in urban areas, would be in greater need of financial support during a crisis.

3.0 Credit struggle intensified by the coronavirus crisis

Access to investment credit particularly from Sri Lanka’s banking sector has continued to prove challenging for the nation’s SMEs over the years. Even with the necessary access, businesses have had to resort to a premium rate (often in excess of 10% P.A) or if denied, the alternative of being borrowing from sub-prime lenders at a still higher rate of interest. Over the past three decades, Sri Lanka’s SMEs have paid ~20% per annum as interest on their borrowings, a staggeringly disproportionate rate, when compared to other South Asian SMEs such as those in India who have paid ~half that rate.

Among the prime reasons for their high cost of borrowing are the absence of audited financial statements, limited management skills, and the lack of access to large scale collateral that can be offered to negate the lending risk that the banking system is unwilling to accept.

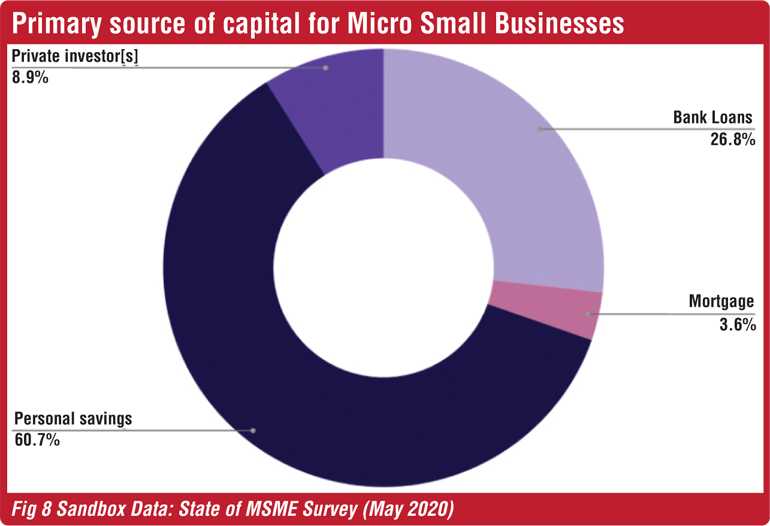

A survey conducted by Sandbox in May 2020 identified that of the 54 Micro and Small Businesses surveyed, 60.8% of responders stated that their primary source of capital investment for their business was via personal savings, as opposed to just 26.8% who were able to secure credit from a banking institution. [Fig.8]

When asked in subsequent questions regarding the reason for their choice, entrepreneurs who had submitted failed applications for credit from banks, cited their lack of access to collateral as the primary reason for their choice to proceed with personal savings and private investment capital.

Plagued by the ongoing coronavirus pandemic, on the back of what is expected by the IMF to be the worst global recession since the Great Depression in 1929, the global economy is expected to contract by 4.9% in 2020.

While individual countries across the globe are expected to feel the effects of this exogenous shock in inverse proportion to their response in controlling the pandemic, Sri Lanka has been pegged to see its economy contract by 6.1% by the end of 2020 (ADB).

At this predicted rate, the GDP is expected to fall from $ 87.46 billion to ~$ 82.13 billion for 2020. The contraction of $ 5.33 billion (~LKR 990 billion) if distributed proportionally to current GDP activity (52% contribution to GDP by Micro Businesses and SMEs), would indicate that they would bear ~LKR

514.8 billion in revenue reductions for the year 2020. ($1 = LKR 185.7400)

Following global counterparts, the Government of Sri Lanka took stern action, by mid-March imposing island wide curfews and social distancing measures, activating numerous testing and quarantine procedures, delivering food and maintaining essential services, and suspending incoming passenger flights.

While the Government has done well to curtail the outspread of the virus, a potential surge remains a risk as curfews ease. Although these measures significantly curbed the spread of the contagion, as compared to more developed countries around the globe, the inevitable consequence of these measures to Sri Lanka’s economy was felt by SMEs across the island.

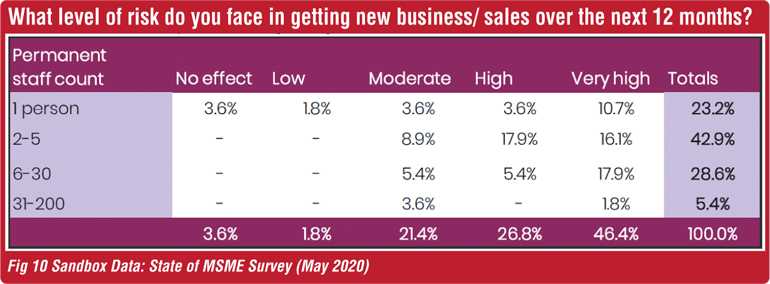

When asked about the expected risk from respondents to the Sandbox – State of MSME Survey, in receiving new revenue over the forthcoming 12-month period (May 2020-May 2021), 94.6% of all respondents expected to be at Moderate, High or Very High revenue risk levels.

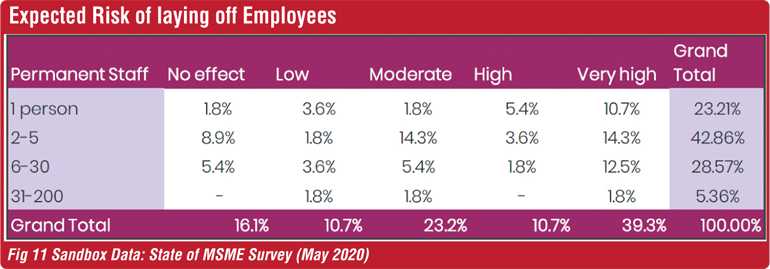

In bracing for the expected impact, 73.2% of business owners surveyed admitted that as their revenues dwindled and their pipelines for new orders/contracts dried up, they would have to consider layoffs, in order to provide their businesses with a chance to survive an ‘impending economic blizzard’. (Owners that claimed moderate to Very High Risk = 73.2%)

4.0 Benchmarking international response

While governments the world over relied on stimulus packages, the US has made the largest commitment (in financial terms) with the three phases of congressional stimulus poised at $ 8.3 billion, $ 192 billion and $ 2.5 trillion.

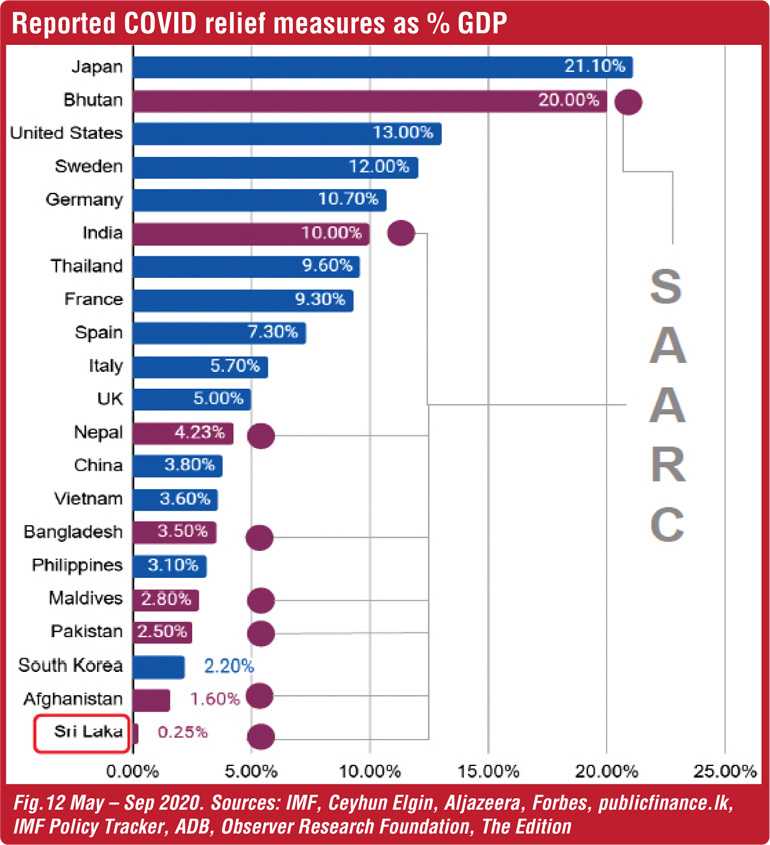

Although this response is the largest in purely financial terms, it is not the most aggressive stimulus in relation to its economic size, equating to approximately 13% of GDP. Japan’s response included a pledge of ¥117.1 trillion (~21.1% of 2019 GDP), covering (i) health-related measures, (ii) support to businesses, (iii) support to households, (iv) transfers to the local governments, and (v) raising the ceiling of the COVID-19 reserve fund. Support pledged by European counterparts varied between 5% (UK) and 12% (Sweden), with France, Spain and Italy, falling within that range.

Among Sri Lanka’s closer geographic peers, India offered a combined package valued at INR 20 trillion (~10% of GDP), Vietnam announced a package valued at VND 279 trillion (3.6% of GDP) to support its economy and Thailand dealt out a package valued at 9.6% of GDP while Philippines proposed a total of 3.1% of GDP to sustain the economy

In comparison with the member countries of the SAARC region Sri Lanka ranks last in terms of COVID relief measures as a percentage of GDP totalling approximately to 0.25% of GDP. Bhutan led the comparison with 20% of GDP ($ 397 million), followed by India at 10% of GDP ($ 265 billion).

Nepal ($1.26 billion), Bangladesh ($ 8.5 billion), Maldives ($ 162 million), Pakistan ($ 7.2 billion) and Afghanistan ($ 300 million) contributed 4.23%, 3.5%, 2.8%, 2.5% and 1.6% respectively.

In stark contrast to peer efforts, the Sri Lankan Government allocated ~0.1% of its GDP for containment measures, as well as $ 5 million (0.01% of GDP) to the SAARC COVID-19 Emergency Fund. The President has announced cash payments totalling around 0.25% of GDP for vulnerable groups along with an extension of 2020 payment deadlines for income tax, VAT and payables to the state. Income tax arrears of SMEs were partially waived off, more relaxed payment terms were approved while legal actions against non-payers were temporarily suspended. The reasoning, however, behind a lack of bailout support can directly be derived from the Ministry of Finance’s expectation of a national revenue loss of $ 440 billion, due to recent tax cuts and concessions.

While fiscal support has been limited, in terms of magnitude, the Government of Sri Lanka has relied more heavily on monetary policy to support businesses though the economic crisis. The Central Bank of Sri Lanka (CBSL) has reduced monetary policy rates by 200 basis points since March. The required reserves ratio of commercial banks has been lowered by 3%, the liquidity coverage and net stable funding ratios have been reduced to 90% and the interest rate on CBSL advances to banks has been lowered by 650 basis points.

Commercial banks have been prohibited from declaring dividends for the year 2020 and have been instructed to refrain from share buy- backs or offering increased payments to directors until end-2020. The president also announced a debt repayment moratorium, including a six-month moratorium on bank loans for the tourism, garment, plantation and IT sectors, and SMEs, with CBSL providing refinancing and concessional lending facilities of 1% of GDP, partially supported by a CBSL guarantee.

In addition, the construction sector has been made eligible to borrow from banks with Government guarantees. A three-month moratorium on small- value personal banking and leasing loans was put in place and the interest rate on credit cards will be capped, for transactions up to a certain amount, with a reduction in the minimum monthly repayment. Financial institutions were requested to reschedule non-performing loans, while capital conservation buffers and loan classification rules were relaxed.

The status of relief

5.0 Saubhagya COVID-19 Renaissance Facility

To further support the economy through the crisis, the Central Bank introduced a Rs. 50 billion refinance loan scheme in March to overcome working capital issues faced by small and micro businesses. In June, the Central Bank further topped up the scheme by another Rs. 100 billion and later introduced an interest subsidy scheme while undertaking to underwrite loans up to 80% of their value.

By August, the Central Bank reported that a total in excess of Rs. 100 billion had been approved under the ‘Saubhagya COVID-19 Renaissance Facility’ via selected banks to ~36,500 applicants. Of the Rs. 100 billion the Central Bank revealed that by 22 August, Rs. ~70 billion had already been disbursed among over 25,300 businesses and individuals.

Of the approved Rs. 100 billion, the Central Bank reported that 50% has been allocated to services sector-based firms, led by trade services, while 34% had been allocated to the industrial sector and 16% to the agriculture sector.

While many businesses have already benefited from the loan scheme put forward by the Central Bank, the fine print of the conditions under which the loans are disbursed has left others, particularly the micro business sector, empty handed.

Among the key features of the working capital loan schemes implemented by RDD, PFIs are provided the option to “obtain suitable collateral to mitigate the credit risk relating to credit facilities granted”–(CBSL). The concern by lenders with the credit schemes that have been announced by the Central Bank is that the risk of default by borrowers has to be borne by the banks and their depositors.

Currently, save for a recent announcement for contractors of Government schemes on 16 June, which is to be backed by a Government guarantee on contracts given, the entirety of the lender’s credit risk is borne by the lender, hence the reason behind the CBSL prompting banks to obtain ‘suitable collateral’.

6.0 Stranded on high seas

What next?

This has in turn led Micro businesses and SMEs back into a vicious circle whereby without access to immovable property or evidence of cash flow, they remain at a loss in terms of refinancing support via the proposed CBSL loan scheme.

While over ~36,500 applications have been approved, it remains uncertain regarding the number of applications that were disapproved, owing to lack of collateral in terms of immovable property. Considering a total of over one million non-agricultural Micro and SME establishments, it is highly conceivable that applications from over 50% of these businesses may not have been approved by the PFIs.

Data relating to the overall disbursement of funds on a business scale (size of business), requirement of collateral and geographic distribution, is yet to be published by the awarding authorities. A multitude of Micro Business owners have voiced their concerns claiming to have been denied any facilities by banks owing to a lack of immovable financial assets to place as collateral against the two-month working capital facility, as they struggled to stay afloat.

With the GMOA of Sri Lanka warning the public of the impending risk of a second wave of the Virus, and an impending Economic crunch, a clear expectation of the ramifications of the absence of Government bailout support to Micro Businesses, is that many of them may not be able to see out the end of the year.

While business owners have thus far done their best to sustain their establishments with the limited resources at their disposal, a spike in business closures toward the end of Q3 and Q4 can be expected to cause an uptick in unemployment and potentially lead to a negative multiplier effect, thus worsening a national crisis.

Footnotes

1. All references to Sri Lanka Government Statistics include a combination of data sources from the below listed sources

2. Historical GDP Growth Growth Rates for Sri Lanka – https://data.worldbank.org/indicator/NY.GDP.MKTP.KD.ZG?locations=LK

3. Economic overview and forecast - Economic indicators for Sri Lanka – https://www.adb.org/countries/sri-lanka/economy

4. Growth multipliers since Independence - Recent Trends in the Emerging Economy of Sri Lanka https://www.cbsl.gov.lk/sites/default/files/cbslweb_documents/publications/otherpub/60th_anniversary_recent_trends

_in_the_emerging_economy_of_sri_lanka.pdf

5. Statistics of SMEs - National Policy FrameworkForSmall and Medium Enterprises (SMEs) Development – http://www.industry.gov.lk/web/images/pdf/gg.pdf

6. Statistics of SMEs - Development of SMEs in Sri Lanka: Are we serious about SME classification? – http://www.ft.lk/columns/Development-of-SMEs-in-Sri-Lanka---Are-we-serious-about-SME-classification-/4-658337

7. National Policy FrameworkForSmall and Medium Enterprises (SMEs) Development – http://www.statistics.gov.lk/Economic/Non_agri/Non%20agri.pdf

8. Provincial Gross Domestic Product – 2018 – https://www.cbsl.gov.lk/sites/default/files/cbslweb_images/press_20190925_Provincial_Gross_Domestic_Product_-_2018_e.pdf

9. Strategies to revive Sri Lankan SMEs amidst Covid-19 – https://economynext.com/brand_voice/strategies-to-revive-sri- lankan-smes-amidst-covid-19/

10. How Global Coronavirus Stimulus Packages Compare – https://www.forbes.com/sites/niallmccarthy/2020/05/11/how-global-coronavirus-stimulus-packages-compare-infographic/#204661f6ca52

11. Policy Responses to COVID-19 (Global Comparison) – https://www.imf.org/en/Topics/imf-and-covid19/Policy- Responses-to-COVID-19

12. Saubagya COVID-19 Renaissance Facility – https://www.cbsl.gov.lk/en/saubagya-covid-19-renaissance-facility 13.Key Features of the Working Capital Loan Scheme implemented by Regional Development Bank – https://www.cbsl.gov.lk/sites/default/files/cbslweb_documents/covid_19_key_features_of_working_capital_loan_scheme_implemented_by_rdd_e1.pdf

14. Working capital support for COVID-hit gathers pace - http://www.ft.lk/top-story/Working-capital-support-for-COVID- hit-gathers-pace/26-703042

15. Sri Lanka central bank approves Rs100bn re-finance credit, deadline extended – https://economynext.com/sri-lanka- central-bank-approves-rs100bn-re-finance-credit-deadline-extended-73362/

16. Funding for COVID-hit biz tops Rs. 100B – http://www.ft.lk/top-story/Funding-for-COVID-hit-biz-tops-Rs-100-b/26- 705012/

17. Economic policy responses to a pandemic: Developing the Covid-19 economic stimulus index - Ceyhun Elgin, Gokce Basbug and Abdullah Yalaman

18. How Bangladesh is addressing the Covid19 pandemic - https://www.orfonline.org/expert-speak/how-bangladesh-is-addressing-the-covid19-pandemic-65601/

19. Policy responses to COVID-19 – IMF - https://www.imf.org/en/Topics/imf-and-covid19/Policy-Responses-to-COVID-19

20. COVID-19: EIB grants EUR 20 mil loan for Maldives' economic recovery – https://edition.mv/news/17278 21.http://publicfinance.lk/2020/06/11/sri-lankas-covid-19-relief-compared-to-selected-regional-peers/ 22.Bhutan’s response to COVID-19 - https://covid-19chronicles.cseas.kyoto-u.ac.jp/post-039-html/