Sunday Feb 22, 2026

Sunday Feb 22, 2026

Tuesday, 21 January 2020 00:00 - - {{hitsCtrl.values.hits}}

For the ninth consecutive year, MTI Consulting (via its Corporate Finance practice), in partnership with Daily FT, Daily Mirror and Sunday Times, has concluded the MTI CEO Business Outlook Study,

|

Rajika Sangakkara (Sri Lanka) |

|

Jason Cordier (New Zealand) |

|

Saima Mazhar (Bangladesh) |

|

Naush Beg (Dubai) |

|

Darshana Buragohain (India) |

collectively outlining the Sri Lankan business community’s perception for the state of business in 2020.

Supplemented by MTI’s experience as a thought leadership-oriented organisation, the annual survey collated and analysed the perceptions of over 100 Sri Lankan business leaders with regard to their business’ past and expected performance, their predictions regarding the state of the local and global economy in 2020, and the main challenges that they believe Sri Lanka and Sri Lankan companies will face in 2020.

The results of the survey, including its supplementary analysis, will assist organisations in streamlining their strategic decision making for 2020, effectively enabling them to gear their operations in accordance with the economic sentiments of their peers.

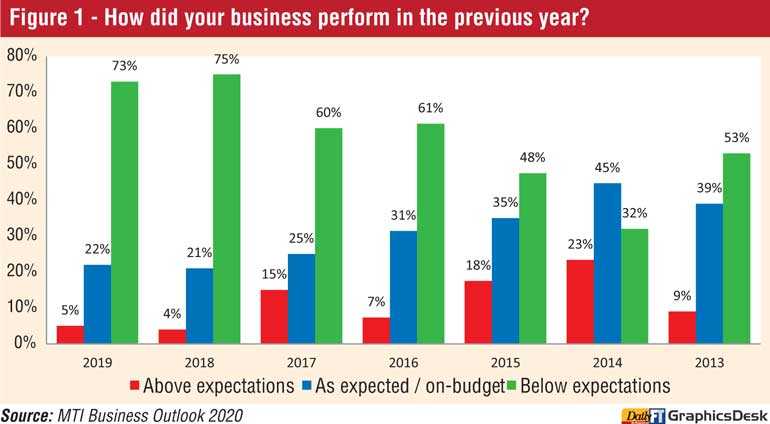

Nearly 3/4th of the surveyed Chief Executives were of the opinion that their businesses performed below expectations in 2019.

In contrast, only 5% of the surveyed CEOs felt that their businesses performed above expectations, indicating a similar trend as in 2018.

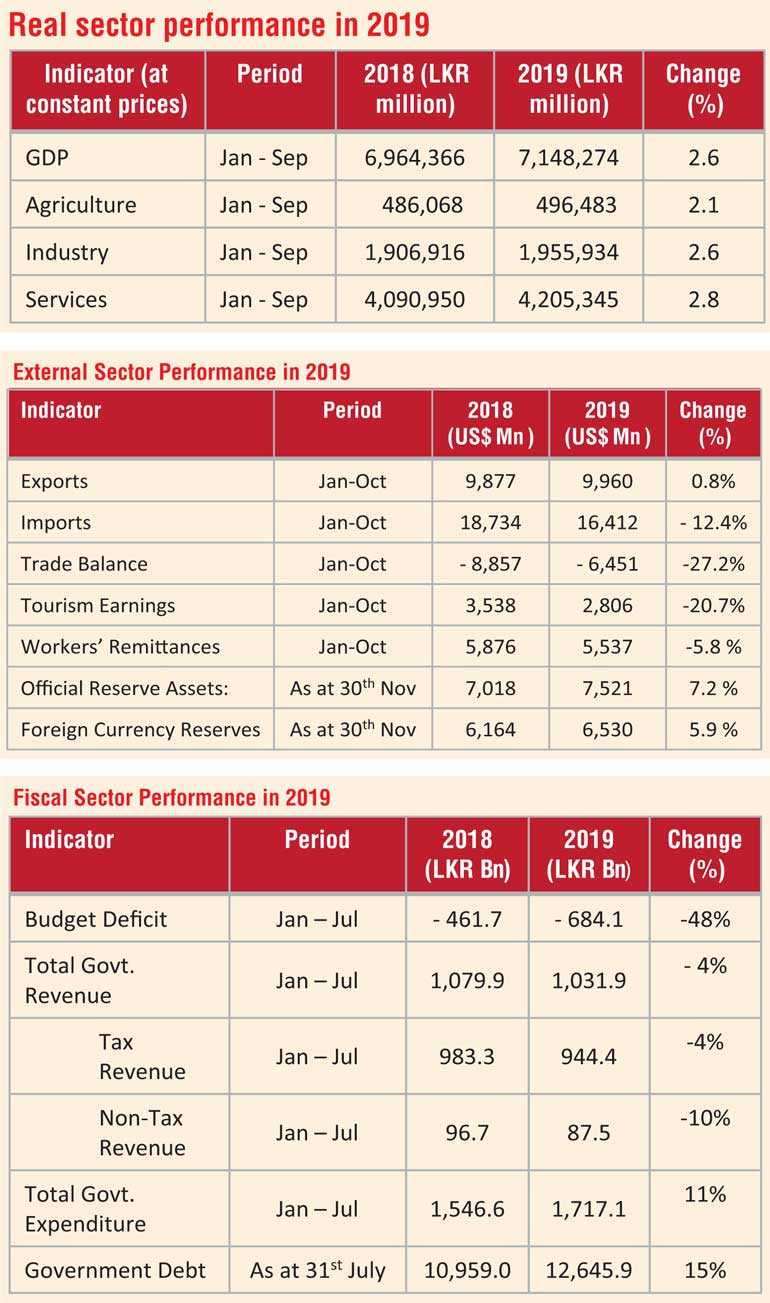

During Jan-Sep of 2019, the Sri Lankan economy recorded a subdued growth of 2.6% compared to the growth rate of 3.3% in the corresponding period of 2018. The IMF expects the real GDP growth of Sri Lanka to rebound to 3.5% in 2020 driven by the recovery in the tourism sector.

According to the World Bank, the Sri Lankan economy grew at a rate of 2.7% in FY 18/19 (ended June 2019) indicating Sri Lanka as one of the poorest performing countries in the South Asian region. Bangladesh leads the South Asian region in terms of economic growth by posting 8.1% GDP growth in FY18/19.

Agriculture, forestry and fishing activities registered a moderate growth of 2.1% during Q3 of 2019, compared to the 4.3% growth in the same period of the preceding year.

Industrial activities and service activities also showed soft growth rates of 2.6% and 2.8% during Q3 of 2019 respectively, in comparison to growth rates of 1.8% and 4.4% in the same period of 2018. Growth in industrial activities was primarily driven by the recovery in construction and mining and quarrying activities during the period, while the service sector was largely supported by the expansion in financial services, wholesale and retail trade activities and other personal services activities.

During January-October 2019, a marginal growth of 0.8% was recorded in exports attributing to the growth of industrial exports (accounting for 80% of total exports) which expanded by 2.3% compared to the same period in 2018. Agriculture (-4.4%), Mineral (-6.3%) and all other export segments (-3.6%) recorded negative growth rates during the same period leading to an overall trade deficit in the same period.

Import expenditure during the first ten months of 2019 declined by 12.4%, largely driven by lower imports of gold (-99.5%), personal vehicles (-53.2%), rice (-90.1%), fuel (-5.6%) and transport equipment (-17.8%).

Tourism earnings recorded a drop of 20.7% owing to the Easter Sunday Attacks which led to a decline in tourist arrivals. Workers’ remittances improved YoY in October 2019, although a cumulative decline was recorded.

According to the Central Bank of Sri Lanka, gross official reserves increased to $ 7.5 billion by Nov 2019 mainly due to the receipt of the International Sovereign Bond (ISB) proceeds, purchase of foreign exchange by the CBSL from the domestic market and the receipt of the sixth tranche of the IMF-EFF.

Due to the challenges which arose from the slowdown in economic activities due to the Easter Sunday terror attacks and the delay in implementing certain revenue proposals announced in the 2019 budget, the fiscal sector of Sri Lanka displayed a poor performance during the first seven months of 2019.

Government revenue as percentage of GDP declined to 6.7% in the first seven months of 2019 from 7.5% in the same period of the preceding year driven by the lower tax and non-tax revenue collections. The decline in tax revenue was mainly due to the underperformance of revenue collection from excise duties on motor vehicles and petroleum products, and VAT on domestic goods and services.

During the first seven months of 2019, total government expenditure as a percentage of GDP rose up to 11.1% in comparison to 10.7% in the corresponding period of 2018 supported by the increase in recurring expenditures.

Government debt rose to Rs. 12,646 billion as at end-July 2019 from Rs. 10,959 billion at end-July 2018, warranted by the expansion in the budget deficit.

The Central Bank of Sri Lanka (CBSL) adopted a relaxed monetary policy by reducing the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) with a view of fuelling economic activity that was challenged by a high interest rate environment in 2018.

As a result of subdued economic activity and high interest rates, credit to the private sector decelerated to 4.4% by end November 2019 compared to a growth of 16.2% in the same period in 2018.

With a view of stabilising inflation to mid-single digit levels over the medium term, the CBSL moved to a Flexible Inflation Targeting (FIT) regime in 2019 in order to sustain price stability and strengthen financial sector oversight.

How have the major industries performed?

Banking

As a result of the moderation in loans and advances, total assets of the banking sector recorded a soft growth rate of 2.4% in the first eight months of 2019 compared to 7.3% in the same period in 2018. The growth rate of total assets was largely supported by the increase in investments. Consequently, the YoY growth in assets declined to 9.3% in August 2019 from 14.6% registered at the end of 2018.

Driven by the lower credit growth due to the adverse business environment observed in the first eight months of 2019, YoY credit growth declined to 9.7% as at the end August 2019 from 19.6% at the end of 2018. As at June 2019, banking sector credit was mainly extended to the consumption (18.4%), construction (15.4%), wholesale & retail trade (15.2%), manufacturing (11.0%) and infrastructure (8.6%) sectors.

Tourism

The tourism sector was adversely affected by the Easter Sunday attacks in April 2019, leading to a noticeable decline of 20.5% in tourist arrivals to 1.3 million in the first nine months of 2019. In terms of region, tourists from Western Europe who accounted for 18.0% of total tourists arrivals declined by 17.5% YoY during the first nine months of 2019 while tourists from South Asia recorded a YoY decline of 20.0%.

In May 2019, an economic relief package was introduced on both capital and interest payments of the loans taken by registered businesses in the tourism industry which is valid till 31 March 2020. Lonely Planet and Travel+ Leisure magazine highlighted Sri Lanka as the number one destination in the world to visit in 2019 which likely contributed to the slow recovery in the tourism industry at the close of 2019.

Tea

During the first half of 2019, tea production grew marginally by 0.2% as a result of the 1.2% decline in tea production witnessed in the first quarter of 2019 due to trade union action coupled with the 1.4% growth in tea production shown in the second quarter of the year supported by favourable weather conditions.

During the first half of 2019, the average tea prices at Colombo Tea Auction (CTA) declined by 7.3% from the corresponding period of 2018. The highest YoY decline in average tea prices at the CTA was recorded for medium grown tea (10.4%), followed by high grown tea (8.1%) and low grown tea (6.3 %).

Construction

Construction activities grew 4.7% in the first half of 2019 in comparison to the contraction of 0.8% recorded in the corresponding period of 2018. As reported by the Central Bank of Sri Lanka, construction activities are expected to grow at a higher rate with the acceleration of Government-initiated development projects such as the continuation of the Central Expressway and the first phase of the proposed Light Rail Transit System.

In addition to the buildings to be constructed in the Colombo Port City, infrastructure developments within and outside the city of Colombo, including an elevated road from the New Kelani Bridge and an underground road connecting Port City to the rest of the Colombo commercial district, are expected to be positive developments in the construction sector for 2020.

Apparel

During the first eight months of 2019, export earnings from textile and garment recorded a growth of 8.3% supported by benefits arisen from the restoration of the European Union’s Generalised System of Preferences Plus (EU - GSP+) facility despite trade diversion due to the US-China trade tensions.

The increased production of printing of fabric mainly contributed to the positive developments in the textile industry. The manufacture of wearing apparel subsector registered a growth of 2.8% during the first half of 2019 in comparison to the growth of 3.9% recorded in the corresponding period in 2018.

Supported by higher demand from Germany, Netherlands and the UK, earnings from garment exports to EU market increased by 5.9% in the first eight months of 2019, while garment exports to the USA increased by 7.7% in the same period.

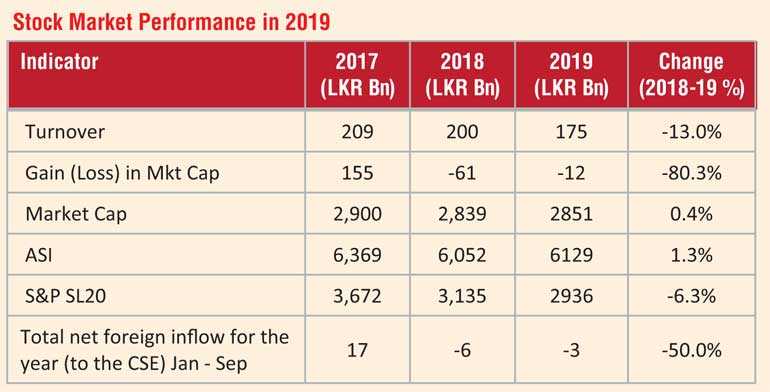

The Colombo Stock Exchange (CSE) experienced a decline in its yearly turnover and market capitalisation in 2019, primarily affected by the Easter Sunday attacks followed by political volatility.

Notably, on account of the Easter Sunday attacks, the All Share Price Index (ASPI) and S&P Sri Lanka 20 index recorded a single day drop of 3.6% and 4.4% respectively on 23 April 2019.

In addition, policy uncertainty, together with the subdued performance of corporate sector further fuelled the negative performance of the market which was amplified by foreign outflows.

Further, the CSE raised Rs. 0.4 billion through one Initial Public offering (IPO) in 2019, a decline from the Rs. 2 billion raised through two IPOs in 2018.

World in 2019

Global economy and trade 2019

Global GDP grew at a subdued rate of 2.5% from Jan-Sep 2019, affected by US-China trade tensions and slow growth in Japan and Europe. Trade tensions eased in December, as the United States and China agreed on a Phase One agreement on 13 December 2019.

China agreed to sharply increase its purchases of US agricultural products in exchange of cancelling planned tariff increases and reducing the tariff rate on approximately $ 120 billion worth of Chinese imports to the United States. In addition to tariff reductions, China agreed to reportedly make concessions in areas of intellectual property, technology transfer, agriculture, financial services, and foreign exchange.

Global financial conditions and commodity market 2019

Following the announced Phase One agreement, equity markets recorded a positive performance, with the S&P 500 rising 2.6% since the start of December in 2019.

An upward momentum in oil prices was witnessed on account of the OPEC further limiting oil supply from the previous limit of 1.2 million barrels to 0.5 million barrels a day in late 2019.

Driven by the output shortfalls in some edible oils (especially palm oil), agriculture prices increased by 3.7% in November 2019. In addition, as gains in aluminium prices were balanced by declines in nickel, lead, and iron ore prices, the metal price index changed up to a certain degree.

Global economy: Expected to recover in 2020

The World Bank forecasts economic growth in emerging markets and developing economies (EMDEs) to reach 4.6% in 2020, up from 4.0% in 2019. The uptick in the forecast is primarily on account of the waning impact of the financial pressure faced by the EMDEs on the back of the benign global financial conditions of 2019.

The World Bank also expects oil prices to average at $ 65 per barrel in 2020 down from the price point of $ 64.04 per barrel in 2019 and $ 69.78 per barrel in 2018.

Global trade is expected to stabilise to an average of 3.2% in 2020 and 2021 due to subsiding of manufacturing weaknesses.

IMF expects the growth of advance economies to soften to 1.7% in 2020 while US economy is expected to expand by 2.1% in 2020. Further, UK and EU economies are expected to grow at a rate of 1.4% in 2020.

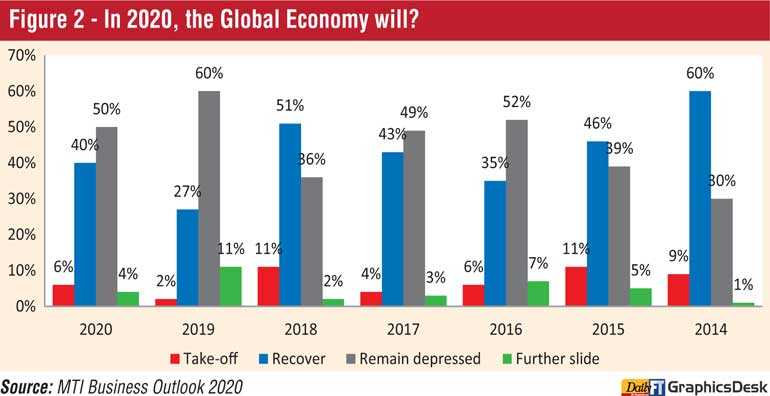

On average, business leaders in Sri Lanka expect that the global economy will remain subdued in 2020. While nearly half of the surveyed CEOs have noted a negative sentiment towards global economic growth in 2020, 46% of the surveyed CEOs have taken an optimistic view that the global economy is expected to recover or take off in 2020.

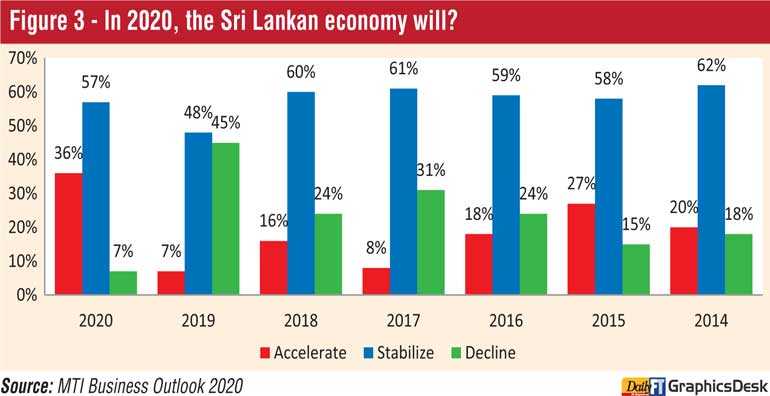

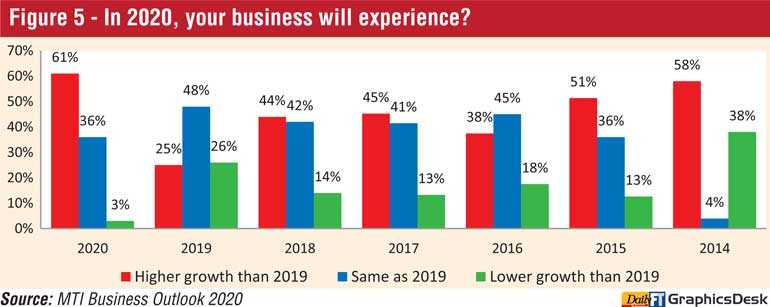

The survey results reveal a growing confidence among business leaders for the Sri Lankan economy in 2020 as the statistics supporting acceleration of the Sri Lankan economy is at its highest when analysing survey results with the past years. This is further confirmed with the dramatic drop (from 45% to 7%) in the number of surveyed CEOs who have cited that they expect a decline in the local economy.

More than half of the surveyed CEOs expect the local economy to stabilise in 2020, indicating an overall optimistic view in terms of the Sri Lankan economy in 2020.

Sri Lanka in 2020

The IMF expects the real GDP growth of Sri Lanka to strengthen to 3.5% in 2020 as the country is on the path to recovery from the negative impact of the Easter Sunday terrorist attacks in April 2019.

According to the World Bank, local economic growth is expected to reach 3.3% in 2020 and 3.7% in 2021 supported by recovering investment and exports.

According to the ADB’s Country Operations Business Plan (COBP) 2020-22, the proposed lending program for Sri Lanka for the three-year period is estimated at $ 2.46 billion. The Lending program is expected to focus on transport focus on transport (39% of the total lending), followed by water and other urban infrastructure and services (16%); agriculture, natural resources, and rural development (14%); energy (12%); education (8%); multisector (6%); and finance (5%).

Projects implemented under the program will include railways, roads, secondary education, power system reliability, irrigation, water supply, urban development, and rural livelihoods.

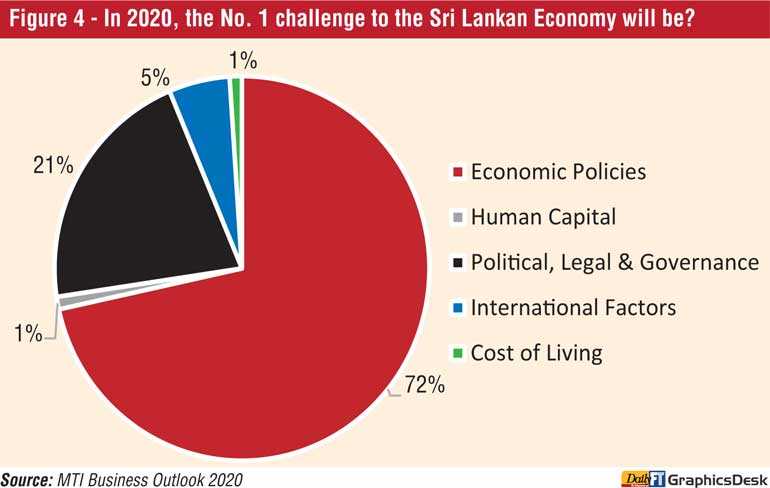

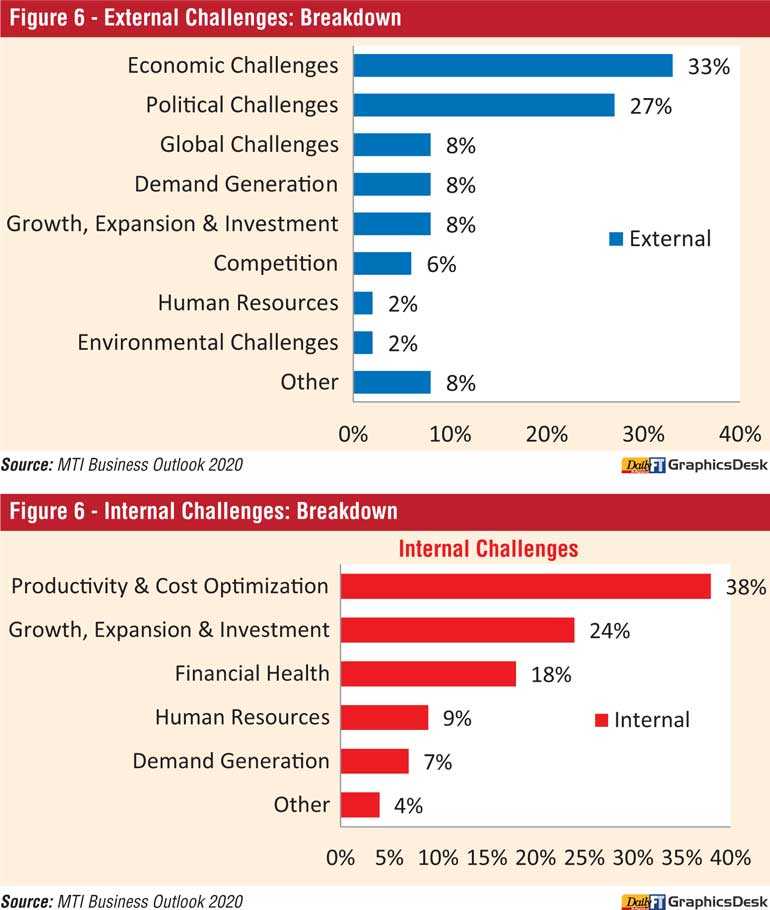

72% of the surveyed CEOs have identified that Economic Policies will be the biggest challenge to their businesses in 2020, followed by Political, Legal and Governance issues – which were a concern for 21% of the respondents.

The concern for Political, Legal and Governance issues as well as Economic Policies in 2020 remain unchanged when compared to the previous year survey, as political and economic tensions witnessed in 2019 continued to hinder business and investor sentiment in 2020. Other issues cited as business challenges in 2020 were Human Capital, Cost of Living and International factors which amounted to 7% of the overall challenges.

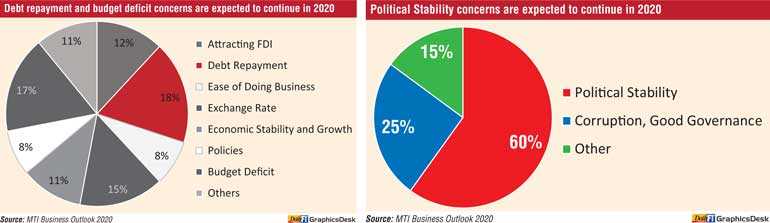

Debt repayment and budget deficit were cited as key economic challenges in 2020 as the overall budget deficit was financed largely through domestic sources leading to a significant increase in Government debt stock in 2019.