Friday Feb 20, 2026

Friday Feb 20, 2026

Tuesday, 8 October 2019 00:00 - - {{hitsCtrl.values.hits}}

RECAP OF RECOMMENDATIONS OF JAN 2019

Jan ’19 bond market expectation – Bond rates to peak in 1Q2019 and gradually ease

Recommendation: Accuracy maintained

Proving the accuracy of our recommendation, yields dipped sharply in Mar 2019 with the raising of the $ 2.4 b Sovereign Bond which boosted reserves. Lower credit growth and soft consumer demand aggravated by Easter Sunday attacks significantly improved liquidity supporting a further decline in yields.

Further, in line with our expectations a 50bps policy rate cut was provided in May 2019, while a further 50bps cut was provided Aug 2019 slightly earlier than expected. In addition a further $ 2 b was raised in Jun 2019. With the significant improvement of economic health, we revised our yields expectations downwards by 100bps (50bps each in May and Jun 2019).

Jan ’19 real interest rates – Real interest rates to dip by 300bps to 5% by 4Q2019 with higher inflation and lower yields

Recommendation: Accuracy maintained

In line with our expectations real interest rates saw a steep dip of 300bps. However, we expected a rise in inflation which did not materialise with the depressed economic situation following the Easter Sunday attacks. Real Interest rate of 5% target was achieved by yields significantly falling over the targeted period with improved economic indicators.

Jan ’19 Real interest rates – Banking rates (AWPR) to be volatile within a 100bps band but dip to c.11% towards 4Q

Recommendation: Accuracy maintained

In line with our expectations AWPR has continued to move in line with the five-year bond and has reached our targeted 11.0%.

With the bond yield further dipping, AWPR is currently further trending downwards.

Jan ’19 exchange rates – Exchange rate 2019 target of Rs. 194.0 and upgraded to Rs. 180.0

Recommendation: Accuracy to be decided

We had a bearish target for 2019 with analyst expectations for a stronger dollar. However, the environment in the global and local context reverted weakening the dollar while the improved macro environment in Sri Lanka supported a stronger rupee leading to a steep appreciation during 1Q2019.

We’ve upgraded our outlook in Jul 2019 providing a base case target of Rs. 180.0. Currency may move towards our bearish target of LKR183:1USD amidst the current foreign outflows.

MID-YEAR OUTLOOK FOR 2019-20

Expectation of easing uncertainty post elections: Positive

Possible easing of political uncertainty: New faces have emerged as candidates for Presidential Elections which is likely to be held on the 16th Nov while the new President may take oath on the 17th Nov 2019. We believe immediately following the Presidential Election a new Prime Minister being appointed, though remote, may be a possibility depending on the developments. The Parliament could be dissolved by 17th Feb 2020 giving leeway to hold Parliamentary elections by Mar 2020. 2Q2020 is mostly likely to provide the opportunity to hold PC Council elections which will complete the election cycle for the next 5 years. The completion of the election cycle is most probably likely to resolve political uncertainty in the local front.

Most probably a hung Parliament: With the current electoral system, no single party is likely to obtain majority to form a Government. In the history a majority Government has been formed by a single party only on a couple of rare occasions where there has been extreme popularity. In such a situation, similar to previous occasions we are most likely to see multiple political parties getting together to form a Government. Though multi-party government usually leads to slow decision making. We are most likely to see President, Government and Provincial Councils controlled by a single party or single party together with minority parties which may provide some stability.

Elections may revive economic activity: Neutral

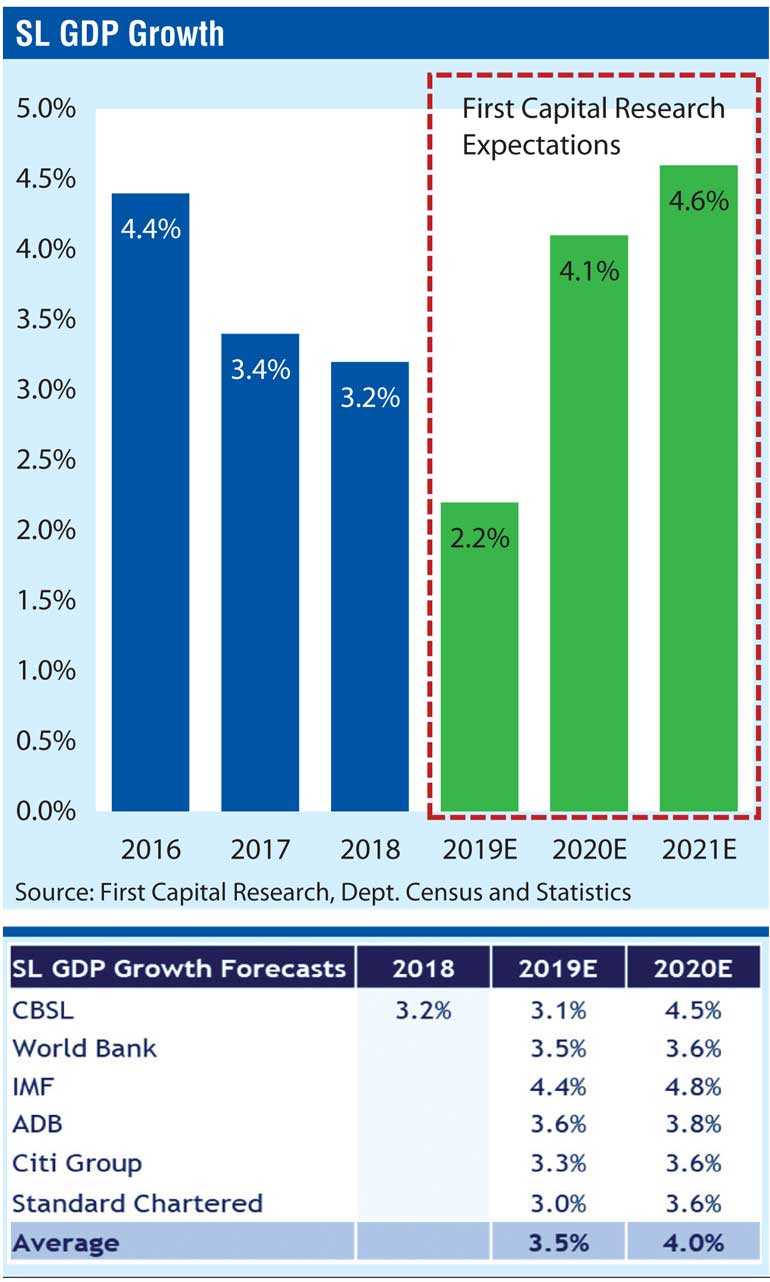

GDP growth to pick towards 4Q2019: With CBSL continuing to adopt loose monetary policy stance, we expect improvement in economic activity and GDP growth towards 4Q2019. Election during 4Q2019 is likely to provide an added boost to the economy amidst island wide election campaigning.

1H2020 growth to show strong recovery: With the election in 4Q2019 the pick in consumer demand may continue in the 1H2020 in an accelerated manner boosting GDP growth and consumer credit. We expect a significant recovery in GDP growth supported by the lower interest rate environment.

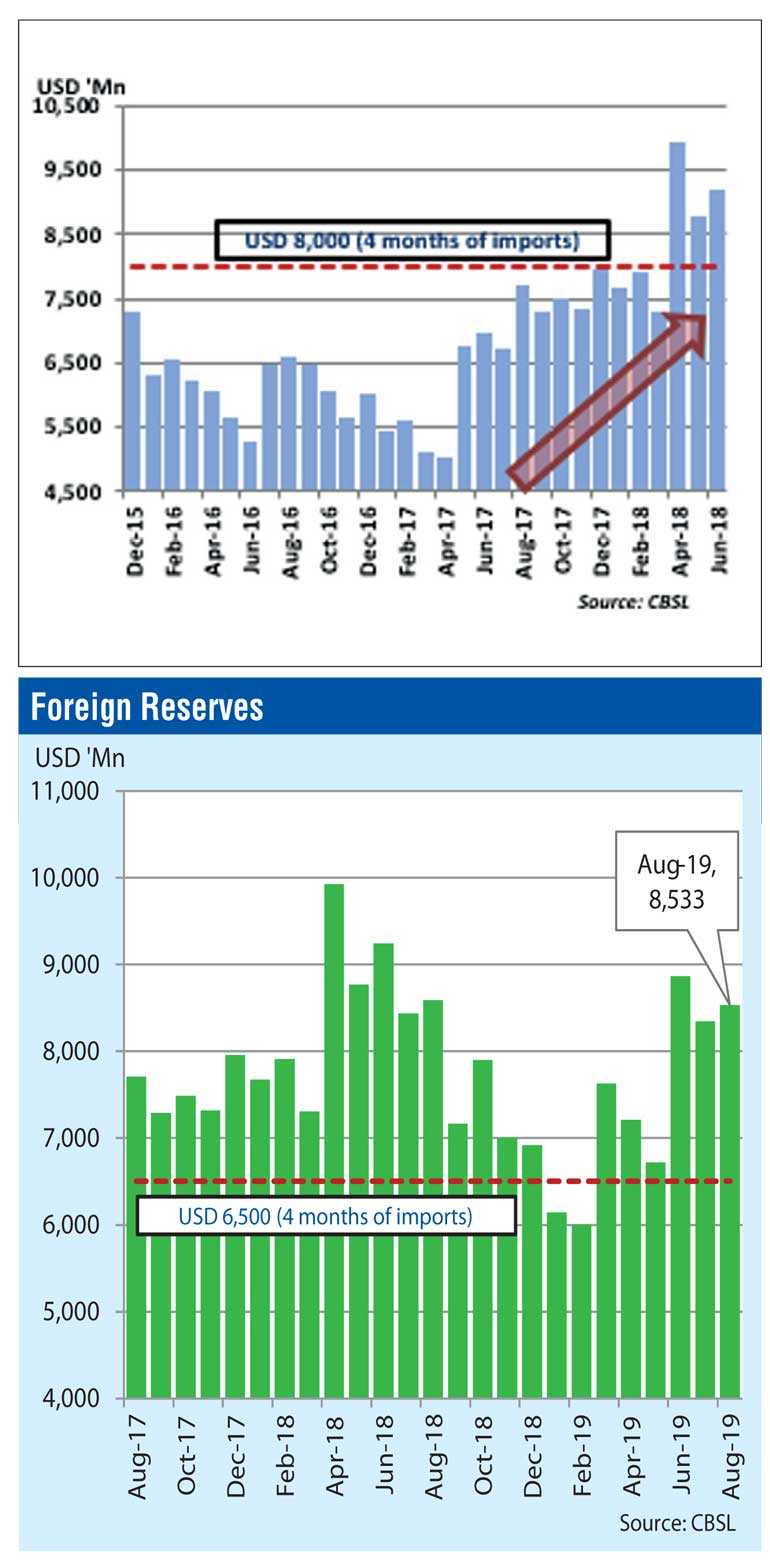

Strong foreign reserve position to bring in stability: Following the successful Sovereign Bond issuance in Jun 2019, SL’s foreign reserves soared over $ 8 b. Sri Lanka’s imports have also collapsed over the last six to eight months amidst the slowdown in the economy and tax revisions on selected consumer items that affected imports. Thereby, the current minimum threshold of four months of Foreign Reserves dropped to c.$ 6.5 b from c.$ 8 b one year ago. Central Bank has also announced the raising of $ 500 m via a Samurai Bond ahead of the election in order to support next year’s foreign repayments.

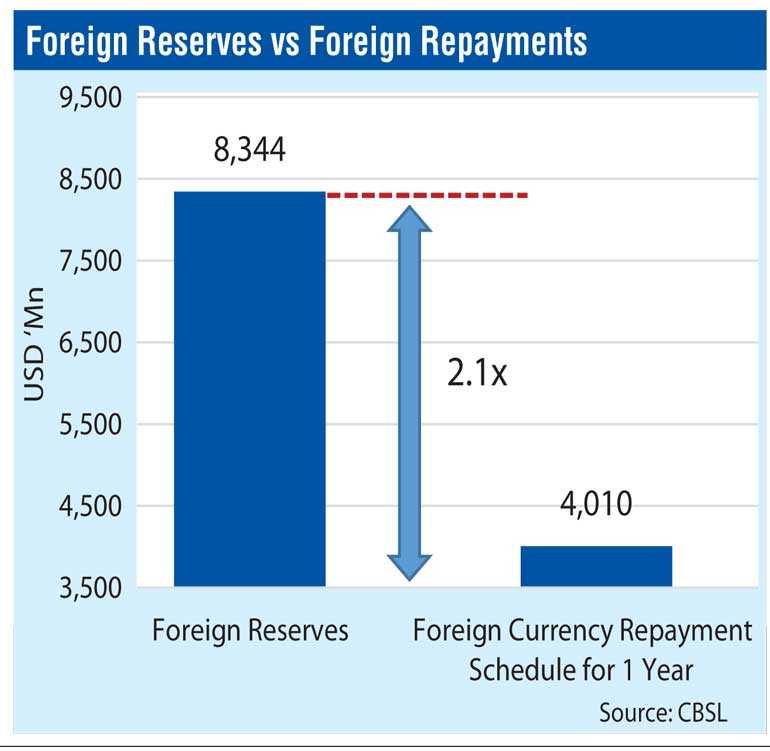

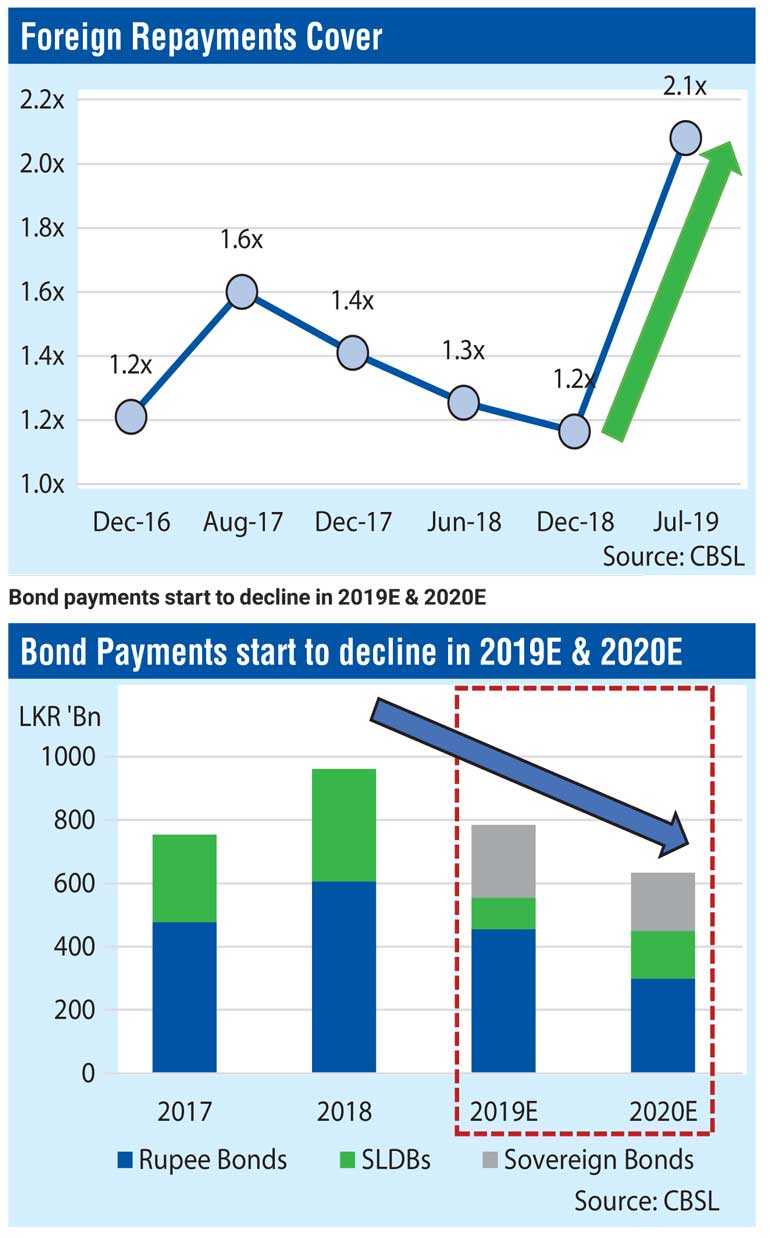

Foreign repayments cover jumps to 2.1x with Year End reserves estimated at $ 8 b: We believe foreign reserves are at a comfortable stage with the foreign repayment cover improving to 2.1x for the 12 months (Jul’19 to Jun’20) suggesting the lowest foreign currency requirement in recent years. The new Samurai Bond issue adds a further cushion to foreign reserves, as we expect reserves to be c.$ 8 b towards 2019 year end while maintaining above $ 7 b by end of 1H2020.

Bond payments start to decline in 2019E & 2020E

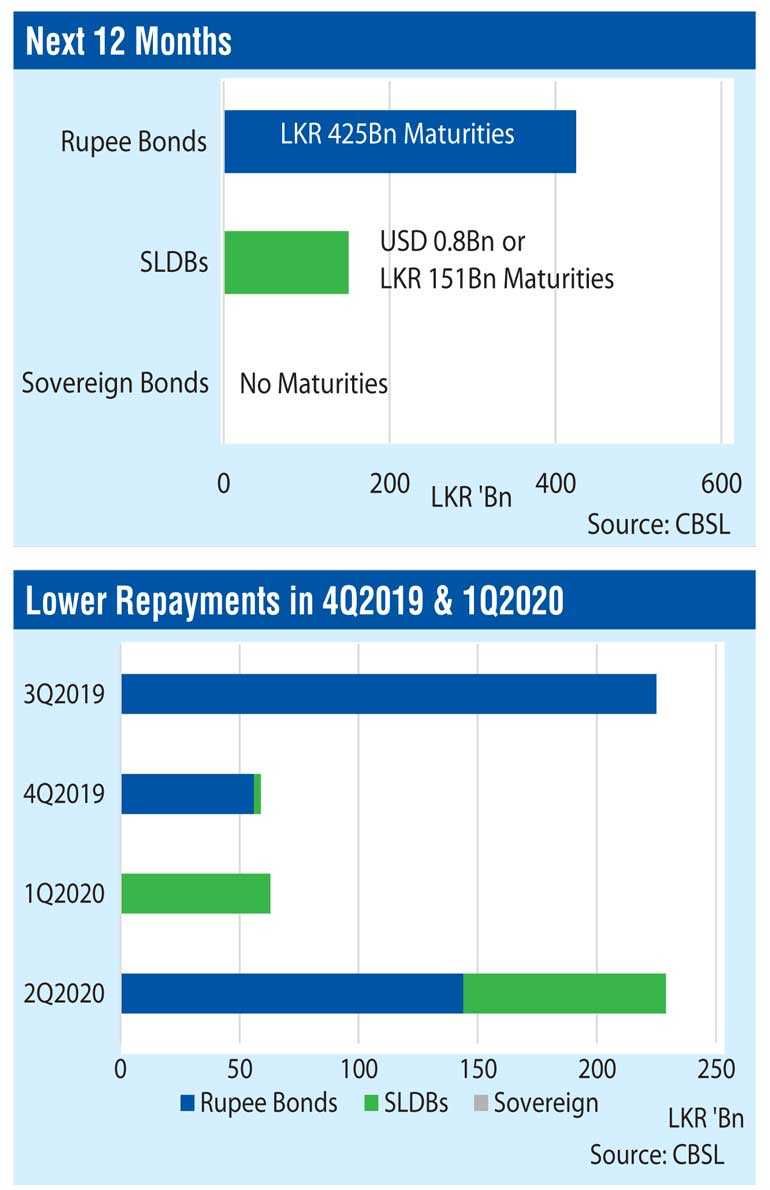

Bond repayments dip amidst the lower SLDBs and lack of sovereign payments: The next 12 months up to Jun 2020 illustrates a notable reduction in repayments especially in 4Q2019 and 1Q2020. However, we expect foreign payments in the range of $ 300-400 m to exist on a monthly basis in the form of project loan repayments.

Total debt payment for 2020 is at Rs. 2.4 t with rollovers from the rest of the year 2019: Debt to GDP as at 2018 was 83% whereas we expect it to rise to 85% in 2019 while dipping from 2020 onwards partly with the acceleration of GDP growth, comparatively lower debt repayments and possible large FDIs led by the investments into Port City.

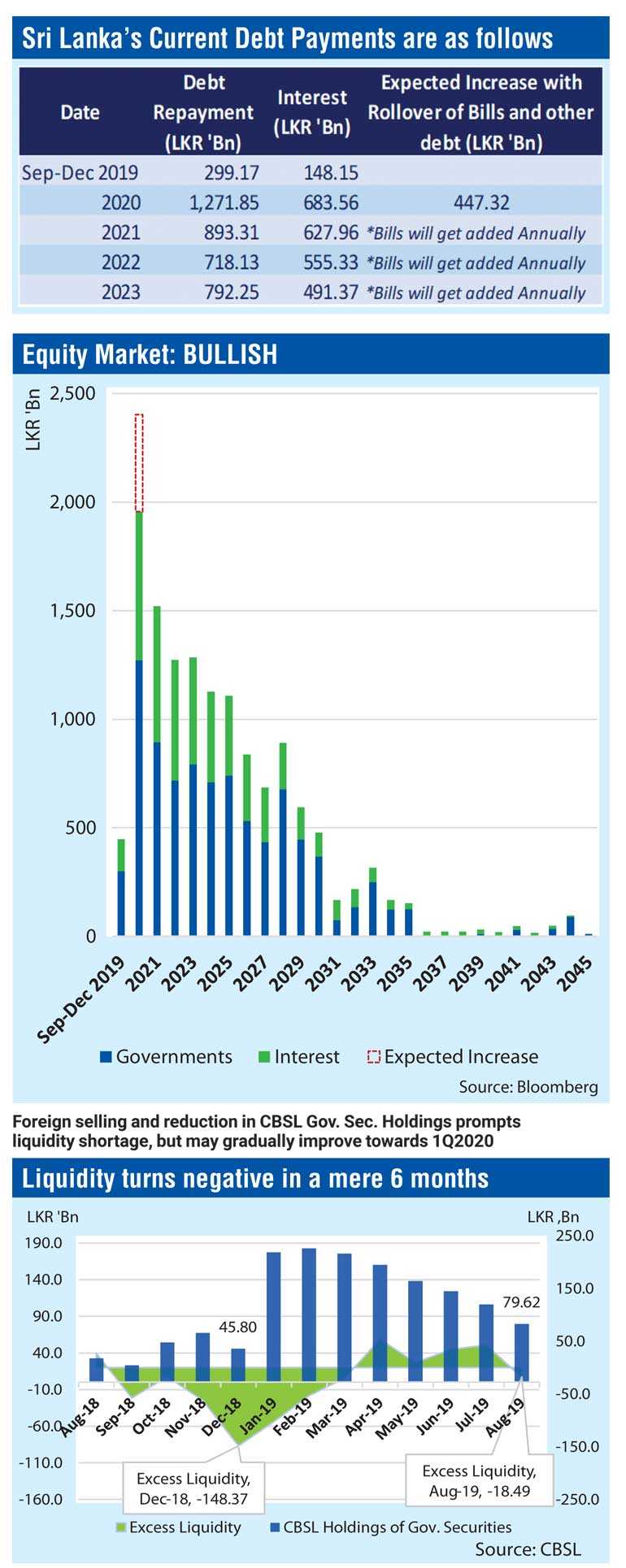

Foreign selling and reduction in CBSL Gov. Sec. Holdings prompts liquidity shortage, but may gradually improve towards 1Q2020

Reversal of foreign flows and elections may improve liquidity during early 2020: With the continuous foreign selling in the market and CBSL reducing CBSL Holdings, we believe that maintaining positive liquidity is likely to be a struggle during early 4Q2019. We believe the global trade war, political uncertainty, policy rate cut already given and Government borrowing requirement to fund the budget deficit expansion amidst the shortage in revenue may lead to liquidity in the market to be negative. Thereby lending rates are likely to remain high resulting in lower credit demand. Following the Presidential Election towards 1Q2020, with the settling of the political uncertainty to a certain extent, we expect foreign inflow into our debt market while the elections in the 4Q2019 may also improve liquidity supported by the rise in economic activity and growth.

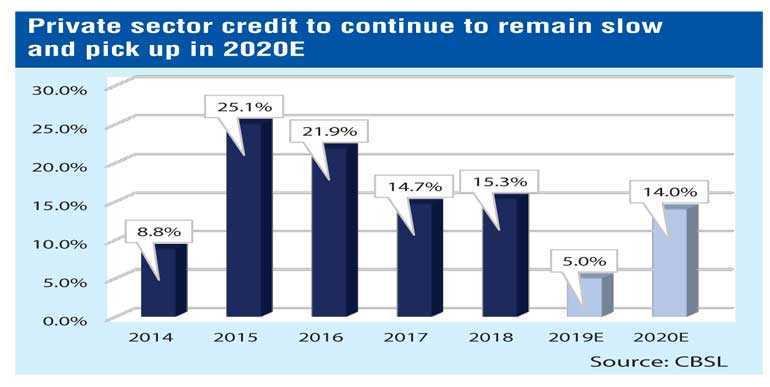

Private sector credit may remain low for the rest of 2019, but may pickup with liquidity in 1Q2020 supported by possible inflows

2019 credit growth at 5%YoY: Amidst the negative liquidity situation we expect a possible delay in the decline in lending rates resulting in low credit growth during the 2H2019 as well. Despite Central Bank cutting policy rates by 50bps in Aug 2019, the lower liquidity position in the market may hamper decline in rates and boosting of credit.

2020 credit rise back to moderate level: However, we expect liquidity position to improve towards 1Q2020 amidst possible inflows. Thereby, we expect it to lead to a decline in rates and rise in Private Sector Credit growth. We expect 2020 credit growth improve to 14%YoY.

Inflation is expected to stay within the targeted range of the CBSL with no real spikes: The heavy depreciation of the rupee during 2018, is unlikely to be a major threat to inflation resulting from crash in the consumer demand. Consumer demand saw signs of picking up early in 2019, but immediately following the Easter Sunday attacks again plunged to all time low levels supporting lower inflation levels which is likely to benefit during the 2H2019. We have downgraded our inflation targets for 2H2019, but still show signs of a slow uptrend due to the currency impact in the comparative month. We do not expect any major threat to inflation during the 1H2020 as well, with inflation likely to hover in the range of 4.0%-5.0%

External environment becomes vulnerable: Neutral

Foreign outflows may weaken currency, globally low interest rate environment favourable: World Bank expects that Global Growth may weaken to 2.6% in 2019 while they also note that substantial risks are seen. World Bank expects Emerging and developing economy growth to be constrained by sluggish investment, and risks are expected to be tilted towards the downside. Further, the trade war between the US and China has created an uncertain environment in the world with it starting to impact both economies. The environment has created uncertainty among investors as investors move back to the safe heaven either the US Dollar or Gold creating foreign outflows from countries like Sri Lanka which may be considered risky. Fed rate cut in the US is identified as just an adjustment in its tightening cycle. However, this has delayed any further hikes until economic indicators signal otherwise.

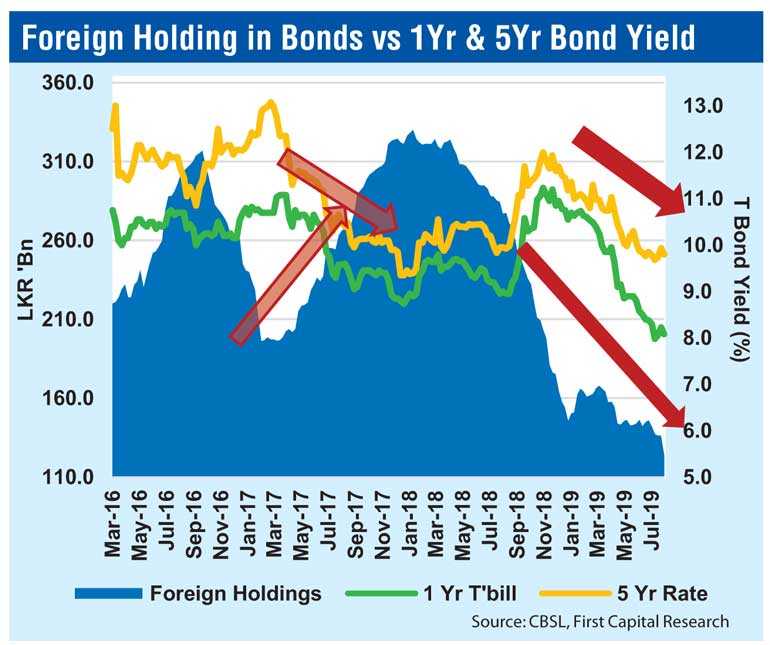

Possible inflows once political uncertainty settles: Continuous foreign selling in SL capital markets has shown signs of a weak currency. Despite the negative impact, significantly low level of foreign holdings reduces risk of outflows. Further, local buying has been strong, backed by significant improvement in macroeconomic outlook and easing of global interest rates across most frontier markets amidst Fed rate cut and lower US rates. With the political outlook likely to improve post elections, we expect a reversal in trend leading to potential inflows.

Overall impact is Neutral: Political environment is likely to be stable possibly providing policy stability. Despite the slower outlook on the economic front there is room for a certain amount of acceleration coupled with possible support from the external front with foreign inflows which makes the overall impact at a Neutral stage.

FIRST CAPITAL RECOMMENDATIONS

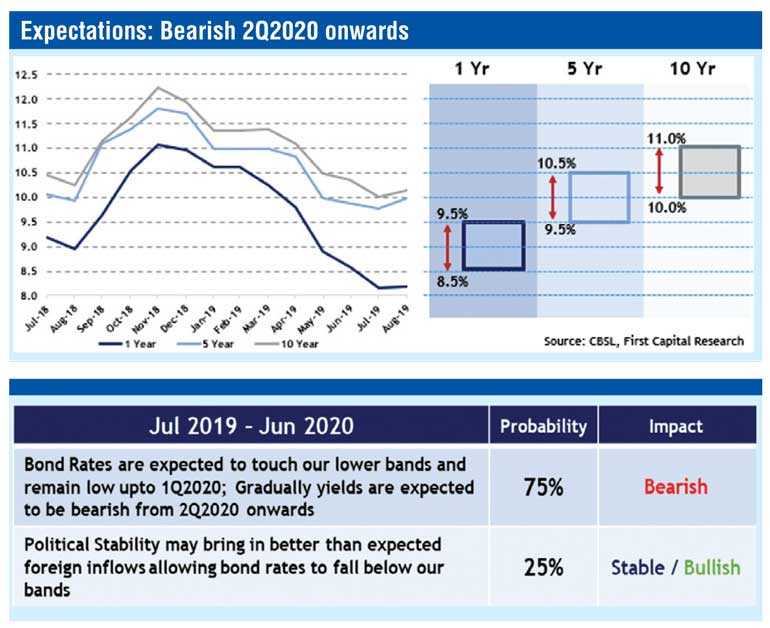

Bond market: Bearish 2Q2020 onwards

Bond yields to be low and gradually trend up from 2Q2020 onwards: With the strong macro fundamentals, possible foreign inflows and low credit growth, we expect yields to trend downwards touching lower bands towards the 1Q2020. Despite a positive period in 1Q2020, during 2Q, we expect a gradual rise in bond yields towards our targeted upper bands, supported by the possible rise in consumer demand and credit, coupled with the anticipated rise in debt repayment towards 3Q2020.

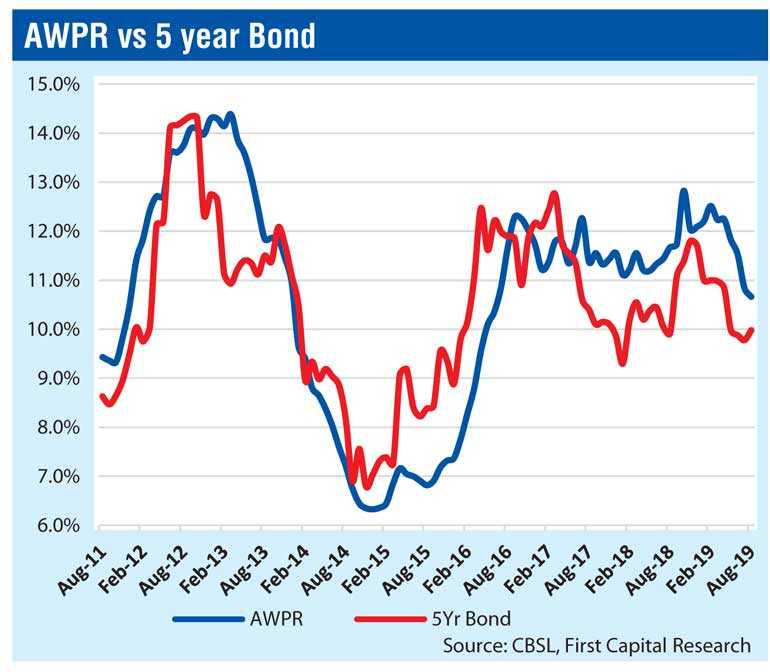

Banking rates: 9.5%-10.5% over next 12 months

Banking rates (AWPR) to dip below c.10.0% towards 4Q and range within 9.5%-10.5% over next 12 months: Banking Rates are usually reflective of the bond rates with a 6-month lag. AWPLR usually had a 6-month lag effect with the 5-year bond. However, more recently, (as it illustrated in the graph) the banking rates have become more responsive to market interest rates while also having an impact due to the increased capital adequacy issues arising out of BASEL III requirements. The 5Yr bond yield peaked marginally below 12.0% during 2019 and declined marginally below 10.0%, dipping by 200bps. We expect AWPR to follow a similar trend over the next 6 months dipping below 10.0% towards the end of 4Q2019. As 5Yr bond yield is expected to pick only after the 1Q2020, in a broader sense during the next 12 months, we expect AWPR to stay within the 9.5% - 10.5% band.

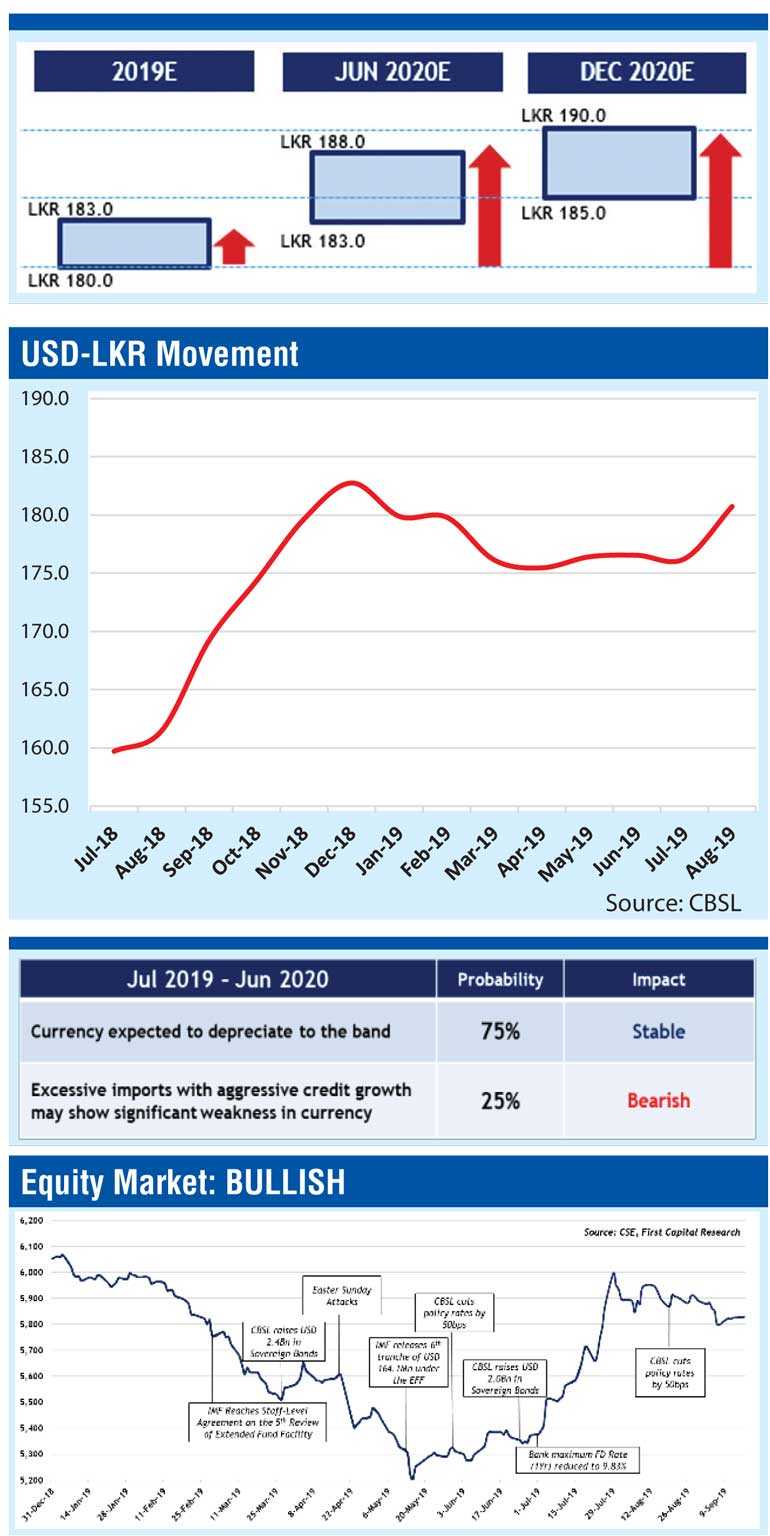

Exchange rate: Exchange rate to record moderate depreciation with Jun 2020E target at Rs. 183.0-188.0

Dollar index is expected to remain strong with the fed rate cut considered to be just an adjustment in the uptrend. The volatile global environment is supporting the USD to stay strong in the mid-term. As the economy picks towards 4Q, we expect to witness a possible weakness in the currency, though it may be counterbalanced by possible inflows in the 1Q2020.

Equity Market: Bullish

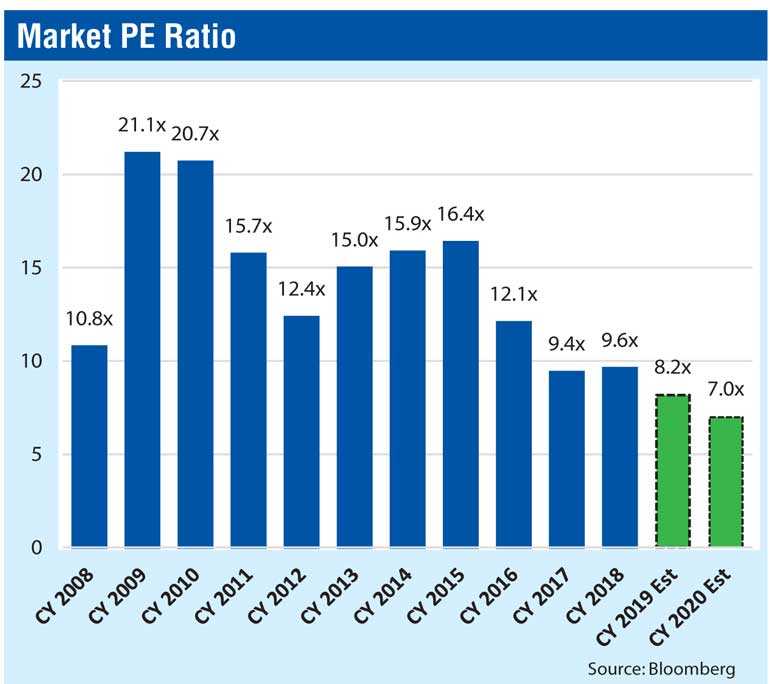

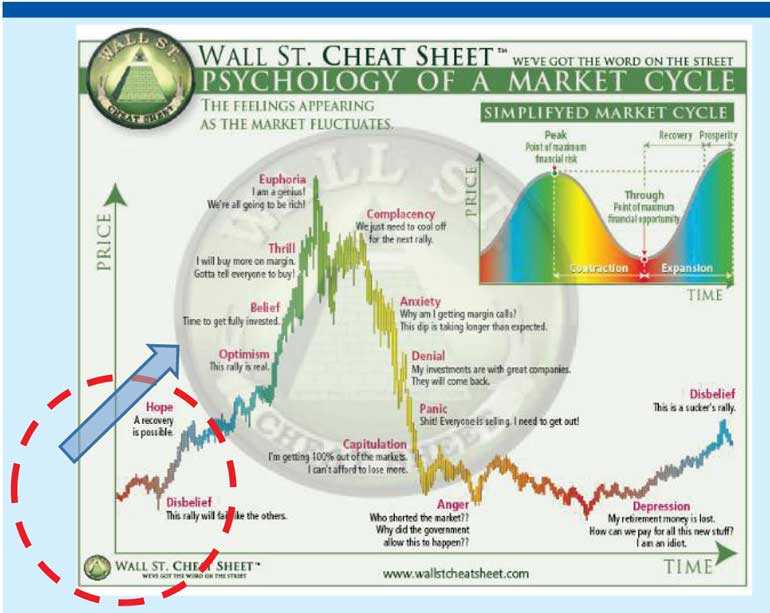

Stock markets usually passes through many phases as indicated in the chart. It very rarely reaches fair value, as a result, markets either overshoot or over-correct. The ASPI, we believe has recovered to Disbelief Stage from Depression stage following the decline in interest rates. Decline in interest rates is likely to record heavy dip in finance cost for most companies while possible rise in consumer demand and credit growth may grow earnings of bulk of the listed companies. We expect market to adopt an upward trajectory over the next 12 months as we expect the ASPI to reach the next stage of the market cycle “Hope” stage and the Optimism stage.

Political outlook may improve post elections: With Presidential Election to be held in 4Q2019, we believe political uncertainty is likely to settle gradually bringing in policy certainty to the system. Presidential Election may be followed by General and Provincial Elections where a similar trend is likely to follow in line with the past trends.

Dip in interest rates and possible rise in consumer demand to boost earnings: We expect the lower interest regime to continue over the next 9-12 months resulting in most companies recording lower finance cost from 3Q2019 and beyond. We also expect the lower interest rate environment and the upcoming elections to boost consumer demand and economic activity resulting stronger topline growth for most companies. It would also provide opportunity to improve credit demand as well. We expect a considerable improvement in listed company earnings over the next few quarters.

Exposure increased to 90%; we are bullish: With the reversal in economic activity and company earnings, we expect an upward trend in the market supported by stronger market multiples. Considering the mid-term positive impact, we upgrade our equity exposure to 90% while maintaining our ASPI expectations in the range of 6,000-6,500, assuming Market PER to be 8.5x – 9.5x. With the expected uptrend we target ASPI to reach 6,000 by 2019 Year End and 6,500 by Jun 2020.