Monday Feb 23, 2026

Monday Feb 23, 2026

Monday, 24 February 2020 00:50 - - {{hitsCtrl.values.hits}}

Recap of recommendations of January and September 2019

January and September 2019 Bond Market Expectation – Bond yields to touch our lower bands and remain low and gradually trend up from 2Q2020 onwards

Recommendation: Accuracy maintained

Proving the accuracy of our recommendation, yields dipped sharply in March 2019 with the raising of the $ 2.4 billion Sovereign Bond which boosted reserves. Lower credit growth and soft consumer demand aggravated by Easter Sunday attacks significantly improved liquidity supporting a further decline in yields.

We brought down our yield curve band expectations with the anticipation of continuous improvement in our Economic Health Score amidst the strong macroeconomic fundamentals primarily created by the early raising of foreign debt and strengthening of the foreign reserves.

In line with our expectations, yield curve gradually declined and touched our bottom bands and is currently remaining at similar levels. The shorter end of the curve overreacted but has now readjusted upwards.

January and September ’19 Bank Interest Rates – Banking Rates (AWPR) to dip below c.10.0% towards 4Q and range from 9.5%-10.5% for a further next 12 months

Recommendation: Accuracy maintained

In line with our expectations AWPR has continued to move in line with the five-year Bond and dipped below our targeted 10.0% to reach 9.5%. Currently the AWPR is hovering around similar levels.

January ’19 Exchange Rates – Exchange Rate 2019 target upgraded to a range of Rs. 180-183.

Recommendation: Accuracy maintained

We had a bearish target for 2019 with analyst expectations for a stronger dollar. However, the environment in the global and local context reverted weakening the dollar while the improved macro environment in Sri Lanka supported a stronger rupee leading to a steep appreciation during 1Q2019.

We’ve upgraded our outlook in July 2019 providing Rs. 180-183 for the currency end as at December 2019. In line with our expectations currency depreciated to our target range after our June 2019 recommendation.

January and September ’19 Equity Market Expectation – ASPI target of 6,500 by Jun 2020; Main target of 6,000 by 2019 year end

Recommendation: Accuracy maintained

Equity started the year of negative note declining by about 850 points during the first five months of the market. With the dip in the market we recommended our investors to gradually reduce cash allocation and increase investment into the equity market providing target of 6,000 for December 2019 and a target of 6,500 for June 2020.

With the heavy dip in interest rate the downward trend the market reversed surged by about 800 points in the May-July 2019 period. Following a timely correction to the market, we saw another uptick in the market from October-December 2019 period by about 450 points as the index closed for December 2019 at 6,129.2 exceeding our target of 6,000 for year end.

Strategy Report 2020; political uncertainty to further ease: Positive

General Elections possibly in April may enhance political stability: With the completion of the Presidential Elections a new Cabinet was appointed, but the new Government holds only a minority in Parliament.

The earliest possible date that President could dissolve Parliament is on 1 March following the Parliament completing four-and-a-half years. The Elections Commissioner has announced that provided Parliament is dissolved on 1 March, the earliest possible date to hold elections is 25 April. Considering the current political environment with a weak opposition, we believe that it is possible for the current Government to obtain a majority in Parliamentary Elections.

PC Elections: Following General Elections, PC Elections are likely to follow in 2H2020 which again may follow a similar suit to the General Elections.

Economic growth to pick, but 2H Govt. borrowing pressure may increase: Neutral

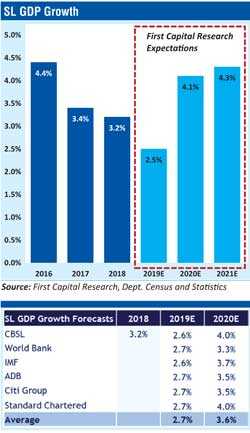

GDP growth to pick to 4.1% in 2020E: Following eased monetary policy measures we are already seeing a gradual improvement in consumer demand and credit. The heavy tax cuts and the lower interest rate regime is expected to boost consumption and investments improving GDP growth. However, the acceleration is likely to take place towards the 2H2020.Thereby, we expect growth to reach 4.1% during the year.

GDP growth 2021E at 4.3%: With significant rise in business activity and production during the 2H2020, we expect it to flow towards the 1H2021 while some slowdown may be experienced in 2H2021 amidst a possible monetary tightening measure.

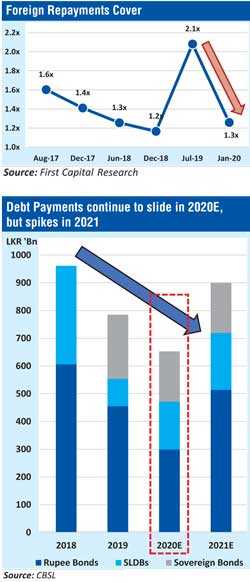

Foreign reserves show signs of depletion: Since the successful Sovereign Bond issuance in June 2019, Sri Lanka’s foreign reserves have slowly depleted, but over the last three to four months CBSL has managed to maintain it around the $ 7.5 billion mark. Government has announced plans to raise $ 1 billion via a Chinese loan.

Foreign Repayments cover reverts to 1.3 times as Sovereign maturities return: We believe foreign reserves, though currently remains at comfortable levels above the minimum four months of imports, foreign repayments start to slowly accelerate especially in the 2H2020.

Thereby, it becomes critical for the Government to refinance foreign loans of c.$ 6 billion, to maintain reserves at the current level. We expect reserves to fall to c.$ 7 billion by June due to the debt repayments despite the $ 1 billion Chinese loan. A large Foreign Loan or Sovereign Bond needs to be raised in order to maintain Reserves above the $ 7 billion mark.

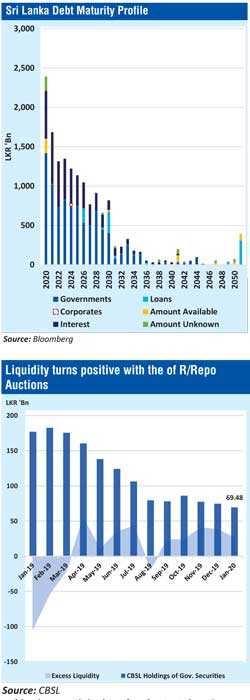

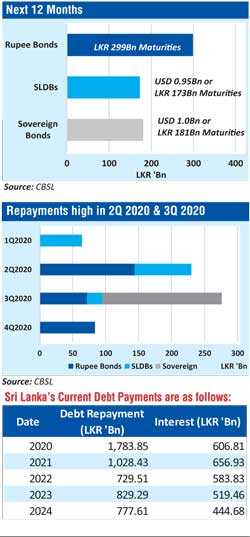

Overall bond repayments dip in 2020, but foreign debt repayments remain high in 2Q and 3Q: The year 2020 illustrates a notable reduction in repayments especially in 1Q2020 and 4Q2020.

However, we expect foreign payments in the range of $ 300-350 million to exist on a monthly basis in the form of project loan repayments while 2Q and 3Q illustrates relatively high repayments.

Total Debt payment for 2020 is at Rs. 2.4 trillion: We expect Debt to GDP to rise to 85% in 2019 while we expect it to marginally dip to 84% in 2020 partly with the acceleration of GDP growth, comparatively lower debt repayments and possible large FDIs led by the Port City.

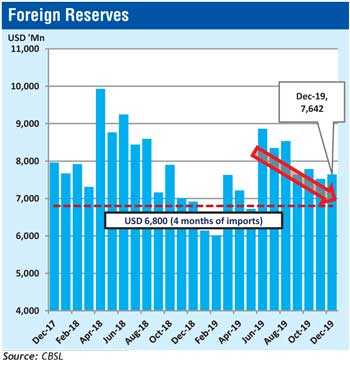

Liquidity improvement halts with foreign selling: Improvement in macro conditions and political stability saw foreign inflows into the bond market at a gradual pace which also supported to improve the liquidity position in the system possibly with dollar purchases by the CBSL. However, following the rate cut provided by the CBSL foreign selling returned to the market. Credit has also picked in the system though still at a gradual pace.

Thereby, liquidity in the system is currently positive only due to the R/Repo auctions being conducted. Excluding the said amount the liquidity remains negative. Considering the developments with the foreign selling in the market and pick in credit growth is likely to result in lower level of liquidity in the system throughout 2020.

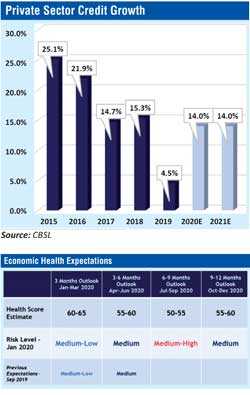

2020 private credit growth to rise back to 14%: Supported by monetary easing and slashing of tax rates, consumer demand and business activity has already started to improve resulting in improving private sector which may accelerate to 14% supported by stronger growth in 2H2020.

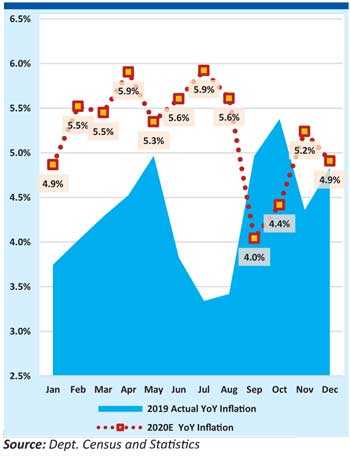

Inflation is expected rise but stay around the range of 5.0%-6.0% for most part of 2020: The floods in November 2019 has resulted in food inflation in the last few months. Despite the adjustment with the supply improving inflation is likely to be around the 6.0% mark during the 1H2019. Subsequently with the higher base effect in the previous year inflation may slightly ease off. However, the rising consumer demand is likely to keep between the range of 5.0%-6.0% during most part of the year.

Positive external environment; however, affected by rating outlook downgrade: Neutral

Foreign inflows reverse back to outflows with further monetary easing; But lower holding reduces risk: Supported by rise in investment and private consumption, World Bank Group expects South Asia’s growth to jump to 6.3% in 2020 and 6.7% in 2021 compared to 5.9% in 2019. Despite Sri Lanka feeling some foreign outflows, the significantly low level of foreign holding reduces risk of outflows.

However, hefty tax cuts have prompted rating agencies to downgrade outlook of Sri Lanka to ‘Negative’ indicating a possible rating downgrade in the future. It is likely to negatively impact when raising funds in the international market. In the US front Fed has indicated an end to its latest monetary easing cycle suggesting that they would stay on hold with policy rates through 2020.

Overall impact is Neutral: Political environment is likely to be stable possibly providing policy stability. On the economic front though we remain bullish in an uptick in the economy in terms of growth, but the expansion budget and trade deficit may weaken outlook for 2H2020 increasing pressure on borrowing.

On the external front also, the outlook is positive with growth expected from the South Asian region but the negative outlook by the taking agencies are a worry. With positives and negatives equally balance we believe that the overall outlook stands Neutral.

First Capital recommendationsBond Market: Bearish 2Q2020 onwards

Pressure on Bonds yields to rise from 2Q2020 onwards: Foreign debt repayments are high during 2020, with a $ 1 billion Sovereign Bond maturing in September. Though rupee debt repayments remain low in 2020, potentially high budget deficit is likely to be created with the hefty tax cuts.

The high budget deficit is likely to push the rupee debt borrowing requirement also higher. Trade deficit may also grow wider towards 2H2020 amidst the possible rise in consumer demand possibly leading to a high level of consumer imports pressuring the foreign reserves and the rupee.

Bond yields to be low and gradually trend up from 2Q2020 onwards: With the rise in borrowing pressure we expect a gradual increase in pressure on bond yields throughout 2020 excluding the 4Q where debt maturities are onto the lower side. We have moved up our target bond yield bands and expect the yields to enter the bands by 2Q and afterwards gradually move up further during 2H2020.

Policy Rate Expectations: On a base case First Capital Research expects a single policy rate hike/SRR hike over the next 12 months.

Banking Rates: AWPR to remain low c.9.5% in 1H and range from 9.5%-10.5% over next 12 months

2H2020 may record a slight increase in AWPR, but range between 9.5%-10.5%: Banking rates are usually reflective of the bond rates with a six-month lag. AWPLR usually had a six-month lag effect for the five-year bond.

However, more recently, CBSL has initiated lending rate caps with the intention of forcefully pushing interest rates down. In line with the five-year Bond, we expect the AWPR to have bottomed out around 9.5% and remain around c.9.5% during 1H2020. During 2H2020 we expect a slight increase in AWPR but is likely to remain within the band of 9.5-10.5%.

Expect a 4.6% depreciation in 2020: With the potentially stable external environment, we expect the dollar/rupee rate to remain stable in the 1H2020. As consumer demand accelerates towards 2H, we expect to witness a possible weakness in the currency.

Equity Market: ASPI target maintained at 6,500 by June; December ASPI target raised to 7,500 (from 7,000) with the tax cuts.

Increase equity exposure to 100% from 90%

Political Outlook stabilises: Following the Presidential Elections and appointment of the new Cabinet the political uncertainty which prevailed for an extended duration has eased providing stability and policy certainty for investors. It has also given a major boost to business confidence as the LMD-Nielsen business confidence index jumps to a 51-month high of 186 for December 2019.

Hefty tax cuts followed by policy rate cut: On 27 November 2019, Government announced hefty tax reliefs including reducing VAT to 8% (from 15%), abolishing NBT and revising PAYE tax with the expectation of increasing the consumer spending while boosting the economic growth of the country.

As an extension to the stimulus package, Government took measures to remove DRL on banks and NBFIs and revise downwards the corporate tax rates across all sectors. Further, supporting Government’s efforts to revive growth CBSL on 30 January took to cut policy rates by 50bps despite credit growth accelerating in November and December 2019.

Equity Exposure increased to 100%; ASPI target for December raised to 7,500 from 7,000: With the recovery in economic activity and company earnings, we expect an upward trend in the market supported by stronger market multiples.

The heavy tax cuts and the policy rate cut is likely to be an added boost for company earnings. Considering the mid-term positive impact, we upgrade our equity exposure to 100% while maintaining our ASPI expectations for June at 6,500, assuming Market PER to be in the range of 8.5x-9.5x. However, we upgrade our ASPI target for December to 7,500 from the previous 7,000 amidst the added boost to the economy.