Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 29 November 2021 02:39 - - {{hitsCtrl.values.hits}}

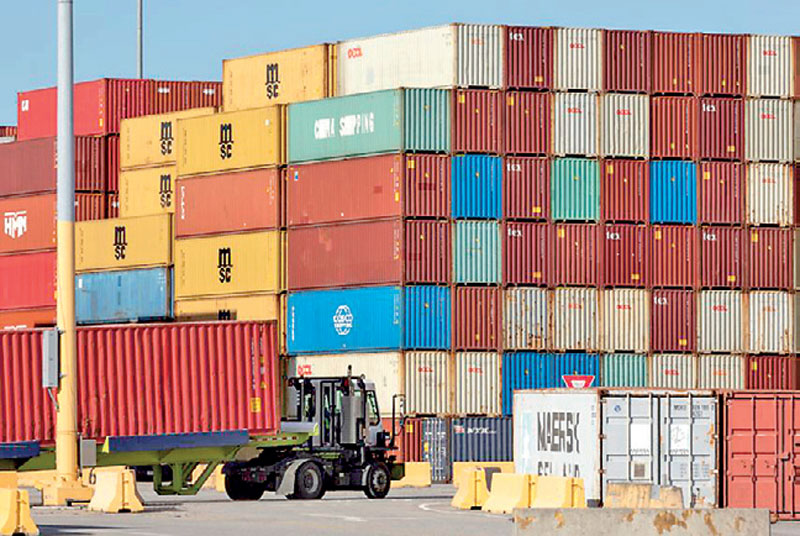

Almost 27 per cent of the 862 million crates measured in 20-foot equivalent units that pass through the world's ports this year will be empty

Bloomberg: Few tools of the global economy have survived without major innovations as long as the shipping container. The supply ructions around the world are presenting an opportunity to test that incumbency.

As ports, rail yards and warehouses get clogged up with the standardized metal boxes both empty and full of goods, the stars are aligning for a product that was a hard sell before the pandemic: shipping containers that fold up accordion- or collapsible-style to as much as one-fifth their usual size. At least, that’s what their backers are hoping.

Almost 27% of the 862 million crates measured in 20-foot equivalent units that pass through the world’s ports this year will be empty, according to Drewry estimates. The cost to the shipping industry to get them to places where they’ll be loaded is about $20 billion, Boston Consulting Group has calculated. Many will spend days or weeks taking up space in already-jammed holding areas and depots, compounding delays along supply chains.

All this has executives everywhere from Amazon.com Inc. to pop culture-inspired bobblehead maker Funko Inc. and milk-alternative producer Oatly grappling with how to get the necessary shipping containers to transport their wares.

“We can solve part of this imbalance, or at least the inefficiency of transporting air,” said Hans Broekhuis, chief executive officer at Holland Container Innovations Nederland BV, known as 4Fold.

In 2013, 4Fold’s 40-foot metal boxes became the first foldable units to get certification from the Container Safety Convention and International Organization for Standardization, among others, meeting standards required by shipping lines, terminals and rail companies. More than 15 carriers and shippers navigating 60 ports worldwide are testing the Delft, Netherlands-based company’s environmentally friendly containers that can be folded into a quarter of their volume, taking up less space on trucks, ships and docks.

These benefits saw Jim Hagemann Snabe, Chairman of the world’s largest shipping line, A.P. Moller-Maersk A/S, refer to foldable containers as the “dream of the shipping industry” last year. At the same time, consumer-goods producers including Procter & Gamble Co. are also testing the technology.

Despite sparking hope among carriers and shippers, higher upfront costs and hesitancy to turn to a new business model have kept foldable containers from becoming mainstream.

As companies find themselves more pressed to find answers to supply-chain snarls, the trade-offs of investing in a new technology might become smaller, said Santtu Seppala, Chief Strategy Officer at the foldable-container company Staxxon LLC. After its 20-foot containers gained full certification at the height of the pandemic, the Montclair, New Jersey-based firm is planning to put them on the market next year. The company has dozens of potential buyers who’ve indicated interest, he said.

“Our solution would not only help greatly to alleviate the current crisis, but we’d also go a long way in preventing a similar crisis from occurring in the future,” Seppala said.

Shipping containers have remained mostly unchanged since the International Maritime Association standardised them about five decades ago. In a sector that McKinsey & Co. refers to as “deeply conservative” where “change comes only slowly,” their foldable counterparts have struggled to gain momentum.

Carriers could save up to 57% in inland transportation costs by relying on foldable containers, according to Shao Hung Goh, a logistics and supply-chain lecturer at the Singapore University of Social Sciences. Despite higher purchase and annual maintenance costs, foldable units would still be a more cost-beneficial option, his research found.

The question remains to define what the optimal mix of foldable and regular containers carriers should maintain in their inventory is, he said. If too few or too many foldable boxes are deployed, the purchase costs could offset the benefits. “You would need to find three other foldable containers to go on the same journey,” he said.