Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 23 January 2018 00:00 - - {{hitsCtrl.values.hits}}

By Sanjana Fernando

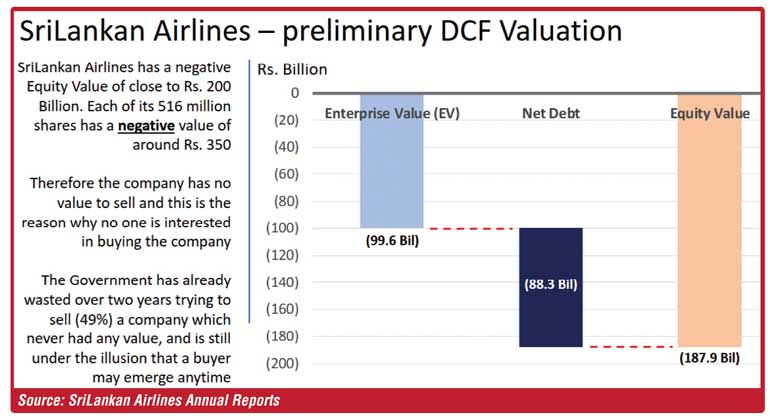

It should not take more than five minutes for a financially trained eye to conclude that SriLankan Airlines shares have no value. Proving it should not take more than another hour. Of course, no one will pay for something that has no value and it is obvious that this is the reason why they have not been able to sell it (49% stake) so far. So why has the Government wasted (and is still wasting) valuable time trying to sell an unsellable company for the last three years?Time that should have been spent on restructuring the airline. Did the expensive “advisors” they hired take them for a ride?

While it may be obvious to many that the UL shares have no value,this article focuses on proving it with the calculation of what that number maybe.

As an Investment Banker atthe HSBCheadquarters in London, most of my time was spent on company valuation. I had a Telecoms Engineering degree and therefore started my career in Investment Banking covering the Telecoms sector. The work involved working as part of a team advising CEOs of European Telecoms companies on Mergers and Acquisitions (basically advising them on buying and selling other telecom companies).

It was while I was working in the Telecoms team that one day in the winter of 2006 I was asked by the team covering Middle Eastern companies to help one of their clients (Emirates) to sell their stake (49%) in SriLankan Airlines.

That was over a decade ago, but the methodology that I am using to value the airline today is the same as what I used then.

Company valuation is both a science and an art. No two people will ever be able to come up with the same exact value. But the principle is simple. According to Prof. Aswath Damodaran, Wall Street’s Dean of Valuation,the value of an asset is the value of the expected cash flows over its lifetime, adjusted for risk and the time value of money. This is known as the Discounted Cash Flow (DCF) valuation.

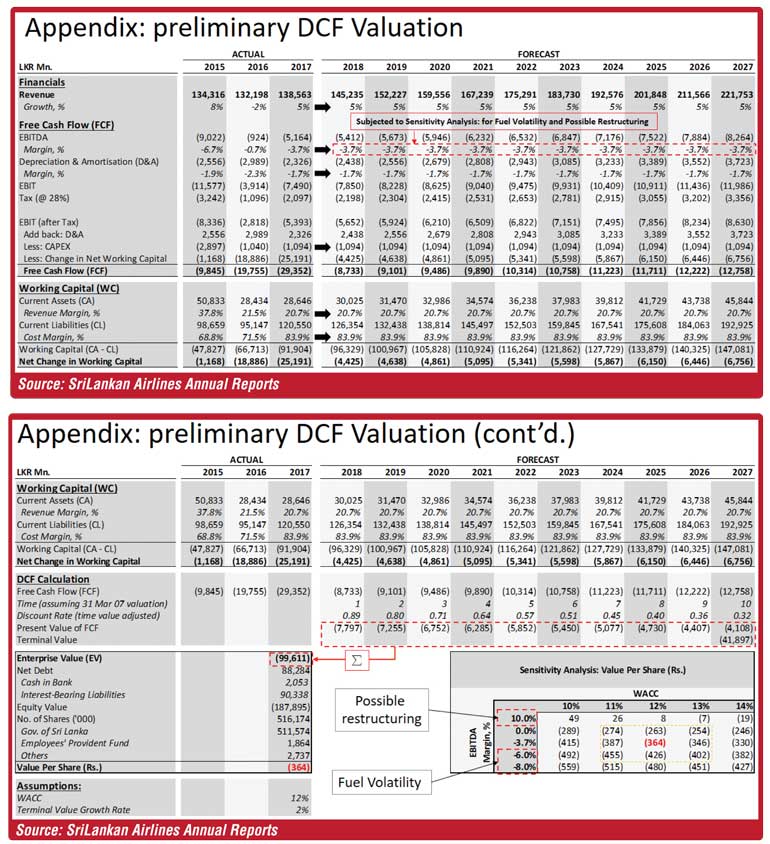

The cash flows in the DCF are the cash flows which are free (FCF) and available after any capital expenditure and working capital. It is defined as follows: FCF = EBIT(1- Tax) + D&A - CAPEX - Change in Working Capital.

But the issue with the financials of SriLankan Airlines is that the forecasted EBITDA is negative (negative Rs. 5.4 billion in 2018). Worse still, the airline has significant working capital issues and needs large amounts of cash to service the working capital requirements. Unfortunately, this means that the Free Cash Flow number is negative and given the assumptions used, is negative every year for the rest of its lifetime.

Forecasted Free Cash Flow (FCF) in 2018:

billion

Rs. 4.4 billion

billion

To find the Enterprise Value (EV) or the company value you have to discount all these future cash flows by a discount rate know as the Weighted Average Cost of Capital(WACC) and then add them up. WACC in short is the weighted averages of the cost of equity and the cost of debt to the company.

Usually to calculate the cost of equity, you would use the Capital Asset Pricing Model(CAPM) where the cost of equity = the risk-free rate + market risk premium x company beta. But in this case given that the Balance Sheet has negative equity, for simplicity I have assigned a zero weight to equity and have assumed that the cost of capital is just equal to the cost of debt and have used a rate of 12%. This gives an Enterprise Value (EV) of just under negative Rs. 100 billion. To get to the Equity Value of the company you have to deduct the Net Debt of Rs. 88 billion, thus giving an Equity Value of a negative Rs. 188 billion. Dividing that among all ofthe 516,174,355 shares gives a value of negative Rs. 364 per share.

Value per Share of SriLankan Airlines:

Of course, this not a detailed analysis but is good enough to demonstrate the negative value of the shares.

This basic financial DCF model is highly sensitive to the input assumptions used. Therefore,just to be on the safe side I have also done a sensitivity analysis to see the impact on the share price for various discounts rates (WACC) and EBITDA Margins (which you can see in the appendix below). If you want to know more about company valuation, I suggest you go and meet the master himself (Prof.Aswath Damodaran) today or tomorrow, when he will be giving a master class on valuation at the Shangri-La Hotel Colombo.

The Government must understand that no buyer will touch the airline in its current state. Even if the entire debt is taken out (practically impossible) the airline will still have an Equity Value of negative Rs. 100 billion.

At least now the Government must stop this foolish ambition to find a buyer and focus on the internal restructuring process – although I think it is now too late and too much damage has been done over the last two years by the current management. Even with the best restructuring team, the airlinewill not be sale ready for at least another two good years.

(The writer is a former Investment Banker from London with Mergers and Acquisition and Corporate Strategy experience. He has worked for a number of international companies in London including HSBC Bank and Goldman Sachs. As an Investment banker in London he was also involved in the team that advised Emirates when they were looking to sell their stake in SriLankan Airlines at the time. He holds an MSc in Engineering from Imperial College London).