Monday Mar 09, 2026

Monday Mar 09, 2026

Friday, 23 December 2016 07:52 - - {{hitsCtrl.values.hits}}

By Forbes and Walker Tea Brokers

Tea industry 2016 in retrospect

Year 2016 began in the back drop of uncertain trading conditions. Sri Lanka’s key tea importing countries in the Middle East and to a lesser extent Russia/Ukraine continued to be burdened with economic/political issues. The decline in oil prices further aggravated the position – consequently global commodity markets continued to be depressed particularly during the early part of 2016.

Year 2016 began in the back drop of uncertain trading conditions. Sri Lanka’s key tea importing countries in the Middle East and to a lesser extent Russia/Ukraine continued to be burdened with economic/political issues. The decline in oil prices further aggravated the position – consequently global commodity markets continued to be depressed particularly during the early part of 2016.

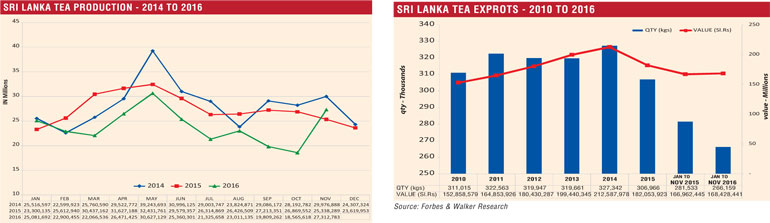

Tea production for the period of January-March 2016 totalled 70.2M/kgs vis-à-vis 79.3M/kgs of January-March 2015 showing a decrease of 9.1M/kgs. Production in all elevations during the 01st quarter of 2016 showed a decrease vis-à-vis January-March 2015.

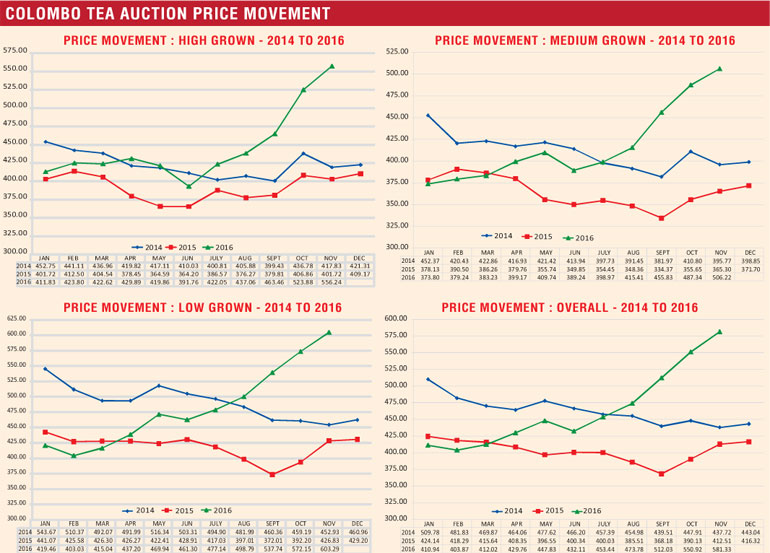

The first quarter commenced with moderate volumes totalling 6M/kgs - 6½ M/kgs of tea on offer at the weekly Tea Auctions. As is customary with the onset of dry weather during the early part of the year, Auction volumes too declined to around 5½ M/kgs to end the quarter. Low Grown prices commenced the quarter at fairly reasonable levels.

However small leaf varieties particularly the Tippy prices declined as the sales progressed to close the quarter at marginally lower levels. In contrast, leafy grades such as PEK/BOP1 and OP1s witnessed prices strengthening to close at slightly higher levels. Liquoring leafy varieties from High and Medium Growns too showed a fairly significant improvement in prices with a few brighter liquoring teas realising long prices particularly during the latter half of February and early March.

During January moderate volumes were offered from the High and Mid Grown areas. Thereafter with the onset of the quality season auction volumes from Western/Nuwara Eliya areas declined. Quality however from the High and Mid areas particularly from the Western and Nuwara Eliya regions showed an improvement.

By mid-February seasonal quality teas from the Westerns were available resulting in increased activity and a fair number of invoices attracted special inquiry. This trend however eased towards the latter of March. Uva/Udapussellawa too which met with increased demand during mid-February eased towards the end of March.

Exports during the first quarter of 2016 totalled 74.4M/kgs vis-à-vis 73.2M/kgs of January-March 2015 showing a gain of 1.2M/kgs. Total revenue realised during the first quarter of 2016 was Rs. 45.03b vis-à-vis Rs. 44.3b of January-March 2015 showing a gain of Rs. 0.7b.

Sri Lanka tea production for the period of April-June 2016 totalled 82.4M/kgs showing a substantial decrease of 11.1M/kgs vis-à-vis 93.6M/kgs of April-June 2015. High Growns recorded the sharpest decline during the period followed by Low Growns and Medium Growns.

The second quarter commenced with April Auction volumes maintaining around 5M/kgs – 5.5M/kgs and reached 7M/Kgs by May. Thereafter by June, volumes declined to around 6M/kgs. During the 02nd quarter, Low Growns particularly the small leaf varieties together with tippy varieties showed a fairly significant increase in prices. Most grades i.e. FBOP, FF1, FBOPF and FBOPFSp recorded a progressive improvement in prices. Further leafy grades i.e. PEK/PEK1 and BOP1s too followed a similar trend whilst OP/OPAs together with OP1s did not show any appreciable change with the prices remaining steady.

Leafy teas from the High and Mid Grown areas too continued to realise reasonable levels particularly for small leaf/tippy varieties at the commencement of the quarter, by May-June the leafy varieties too witnessed price gains.

Meanwhile, BOP/BOPF from the Western region realised price levels achieved during the latter half of March. However, by May with the general deterioration in quality, prices too declined and did not show any appreciable change till the end of the quarter. Uva/Udapussellawas too followed a similar trend to the Western counter parts with quality during May and early part of June showing no significant change. Thereafter, by end June a few invoices from the Uva/Udapussellawa district showed some improvement.

Sri Lanka tea exports during the period of April-June 2016 totalled 72M/Kgs vis-à-vis 78.3M/Kgs of April-June 2015 showing a decrease of 6.3M/Kgs. Meanwhile, total revenue of Rs. 44.2b realised during the period of April-June 2016 showed a decrease of Rs. 2.1b vis-à-vis Rs. 46.3b of April-June 2015. However, it is relevant to note that April - June 2016 FOB value realised of Rs. 614.54M vis-à-vis Rs. 592.16M of April-June 2015 shows a gain of Rs. 22.38M.

The third quarter commenced with moderate volumes been offered from High and Mid Grown elevations whilst Low Grown volumes maintained around 3.8 to 4M/kgs. Thereafter Auction quantities of all three elevations showed a fairly significant decrease. Low Grown prices continued to strengthen both Tippy/Leafy grades from the inception and by the end of the quarter most grades were selling at substantially higher levels to the previous quarter.

Meanwhile, liquoring leafy teas from the High and Mid Grown elevations maintained price levels that were realised during the latter half of the previous quarter. However, towards September most liquoring leafy prices saw a significant increase to close the quarter at fairly attractive levels. Prices for Western BOP/BOPFs improved from around July with BOPs in particularly gaining significantly towards the end of the quarter. BOPFs too gained but to a lesser extent.

Teas from Uva/Udapussellawa Regions showed an improvement at the commencement of the quarter and prices continued to show progressive improvement. By early August a substantial increase in prices were witnessed and continued till early September. Thereafter, a decline in prices for better teas were witnessed consequent to the drop in quality.

It is noteworthy that by September with all three elevations maintaining attractive price levels total Auction average reached Rs. 512.03 thus establishing the highest average for a month. Sri Lanka Tea Production for the period July-September 2016 totalled 64.1M/kgs vis-à-vis 79.9M/kgs of July-September 2015. This reflects a fairly substantial decrease of 15.8M/kgs compared to the corresponding period of 2015. This deficit impacted the cumulative position hence January-September 2016 total production of 218.6M/kgs recorded a decrease of 34.07M/kgs vis-à-vis 252.6M/kgs of January – September 2015. All elevations recorded decreases with Low Growns followed by High Growns showing the biggest deficit.

Total exports too for the third quarter of 2016 totalled 76.2M/kgs vis-à-vis 74.5M/kgs of July-September 2015. This records a 1.7M/kgs gain YOY. It is also relevant that revenue generated from tea exports during the 03rd quarter of 2016 realised Rs. 48.2b when compared to Rs. 43.9b recorded during the third quarter of 2015 thus showing a growth of Rs. 4.3b YOY. Meanwhile, the total FOB value of Rs. 632.60 too, shows a gain of Rs. 42.90 YOY vis-à-vis Rs. 589.70 of July-September 2015.

The fourth quarter commenced with total quantities recording moderate to lower levels. This situation was aggravated by November and Auction volumes declined to 4-4.5M/Kgs with only the last sale in December recording 7M/kgs. Low Growns continued to attract good demand in the back drop of restricted volumes and recorded fairly significant increase in prices. This also resulted in the month of October average reaching the highest ever Low Grown average of Rs. 574.63 and subsequently this too was improved upon in November with November Low Grown average reaching Rs. 603.29.

Similarly Medium and High Growns too established all-time records during October and November. Total High Grown averages for October realised Rs. 523.88 and in November it realised Rs. 556.24, thus improving further on the October average. Mediums too which recorded Rs. 487.34 in October realised Rs. 506.22 in November, recording the highest-ever average for Mediums.

By the early part of December, High Grown prices, particularly BOP/BOPFs, saw a correction and declined marginally yet maintaining fairly reasonable levels. Meanwhile, liquoring varieties too during the early part of December declined marginally. Nevertheless, it is reasonable to conclude that prices realised during this quarter thus far have been the highest ever for any quarter.

Sri Lanka Tea Production January-November 2016 totalled 264.7M/kgs vis-à-vis 305.5M/kgs during the corresponding period in 2015 recording a significant decline of 40.8M/kgs (13%). High Growns declined 13.2M/kgs (19%), Medium Growns declined 6.2M/kgs (14%) and Low Growns declined 20.5M/kgs (11%). Consequently, annual tea production is unlikely to surpass the 290M/kgs.

Sri Lanka tea exports

Exports too for the period of January-November totalled 266.1M/kgs vis-à-vis 281.5M/kgs of January – November 2015. This reflects a decrease of 15.4M/kgs (a decline of approx 9%). The total revenue of Rs. 168.4b too reflects a gain of Rs. 1.5b vis-à-vis Rs. 166.9 for the period January-November 2015. Similarly total FOB value for the period of Rs. 632.81 shows a gain of 39.76 vis-à-vis 593.05 of January-November.

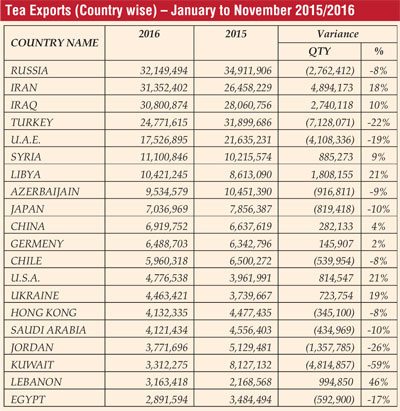

In spite of the on-going conflict, Iraq continued to retain the prime export destination for Ceylon teas even up to end October 2016. However, with the winter purchases getting in to full swing in the month of November, Russia has once again secured the position as Sri Lanka’s prime importer followed by Iran and Iraq. Due to the Mersin in-transit trade dwindling because of the border restrictions, re-export of tea from Turkey to the neighbouring countries have come down drastically.

Thus, the Ceylon Tea imports by Turkey have declined by 20% from 31.0 million kilos to 24.0 million kilos. Despite all odds, Syria has continued to patronise Ceylon Teas and has imported almost 11 million kilos up to end of November which is 1.8 million kilos more than last year. Re-exports from Kuwait to Iran and from Jordan to Iraq has dried up due to the strained relations and terrorist’s activities tightening the cross border trading. Thus, Kuwait and Jordan both restricted their imports mostly to the domestic requirement. Libya with a marginal restoration of normalcy and enhanced sale of crude oil to the world market has become active at the Colombo Tea Auctions in the recent months.

Accordingly, Egyptian role of re-exporting Ceylon Tea to Libya as a temporary measure to cover the deficit came down drastically. Saudi Arabia is expected to perform a similar role to 2015 and maintain their inventory.

Market outlook 2017

In the backdrop of an impressive performance recorded in the fourth quarter of the year 2016, predicting tea prices for the ensuing year requires careful consideration and a rational basis would be to evaluate the supply and demand scenario that exists and are likely to emerge during the year.

Global supply and demand

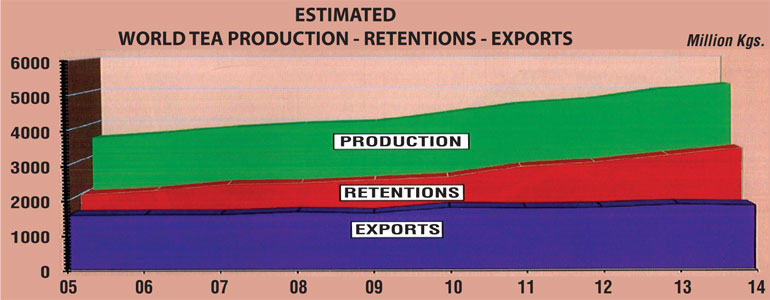

In analysing the global tea production statistics, it is evident that with the exception of Sri Lanka, all other producer countries have shown growth year on year. Production statistics available up to end November 2016 indicate a gain of approx 58M/kgs year on year. The significant feature however, is that almost all of these increases comprise of CTC origin.

Amidst this trend, up to end November Sri Lanka records a deficit of 40.8M/kgs. Unconfirmed records indicate that Orthodox tea production from Vietnam also records a negative variance. Taking in to account the carried forward deficit in the Orthodox tea production, it would be reasonable to conclude the total shortfall to be in the region of 50M/kgs (Orthodox tea) a considerable deficit and therefore, the year 2017 would begin with a distinct shortfall of Orthodox teas globally whilst the net position (Orthodox/CTC combined) recorded a marginal increase.

With this background the following factors should be considered when forecasting the tea market for 2017.

Considering these market conditions and in particular the supply restriction of Orthodox teas, it would not be too optimistic to project a buoyant market for the first half of 2017. The market demand for teas thereafter would greatly depend on how the global tea industry would progress during the first half.

Whilst tea prices are projected to be buoyant during the first half of 2017, for long term sustainability the industry needs re-engineering to achieve global competitiveness. Sri Lanka’s cost in producing a kilo of tea is amongst the highest in the world.

Rising input costs, declining productivity, uneconomic age profile in tea bushes and high social costs have led to declining profits. Perhaps, higher productivity and cost reduction will have to be achieved for enhancing competitiveness of ‘Ceylon Teas’ in the world market in the medium to long term. The global competitiveness of ‘Ceylon Teas’ will hence largely depend on how quickly the industry addresses these vital issues.