Saturday Feb 21, 2026

Saturday Feb 21, 2026

Wednesday, 9 January 2019 00:00 - - {{hitsCtrl.values.hits}}

It was great to see the communique that Sri Lanka has reached $ 17 billion in exports in 2018, registering a growth of 15% in the backdrop of the Colombo Stock Exchange reporting the worst trading recorded in the last 10 years last Friday.

The 2018 export performance is commendable. The export community must be congratulated whilst we also see how the exporters are giving leadership to the country when Sri Lanka was caught up in a chaotic constitutional crisis that even saw the global community got involved.

One set of data

Whilst the $17 billion export value is commendable registering a growth of 15%, a point to note is that the export value in 2017 should have been around $ 14.7 billion to register the reported 15% growth in 2017. But the Central Bank website reports export earnings at $ 11.3 billion which is way below this number.

The communique also states that way back in 2015 the export value was $ 13.5 billion but the Central Bank website states that the 2015 export value was $ 10.5 billion. I guess the Central Bank data does not include the ‘Export of services’ component, hence the disparity. Personally I feel the higher number is right, but it is important that we report one number to the outside world. If not, the credibility of the data becomes a question.

$ 20 billion in 2019?

The communique also states that Sri Lanka is targeting $ 20 billion in 2019 which is excellent. The logic is that way back in 2005 when Sri Lanka export revenue crossed the $ 6 billion mark, many of us were elated with the performance but little did we know that after almost 10 years we as a country was struggling, with the number just doubling to $ 12.5 billion (once again this data is as per Central Bank website, which is without the export of services component).

A point to note is that way back in 1990 Sri Lanka, Bangladesh and Vietnam were all at the $ 2 billion export mark. However, as at now Vietnam has crossed the $ 150 billion mark whilst Bangladesh is touching $ 40 billion which tells us how Sri Lanka is lagging behind the region. Hence the new numbers reported on export targets are very motivating.

Quality of exports

Whilst Sri Lanka is targeting export targets, as per the National Export Strategy that was launched last year, what Sri Lanka must focus on is the quality of the exports marketed and not the value.

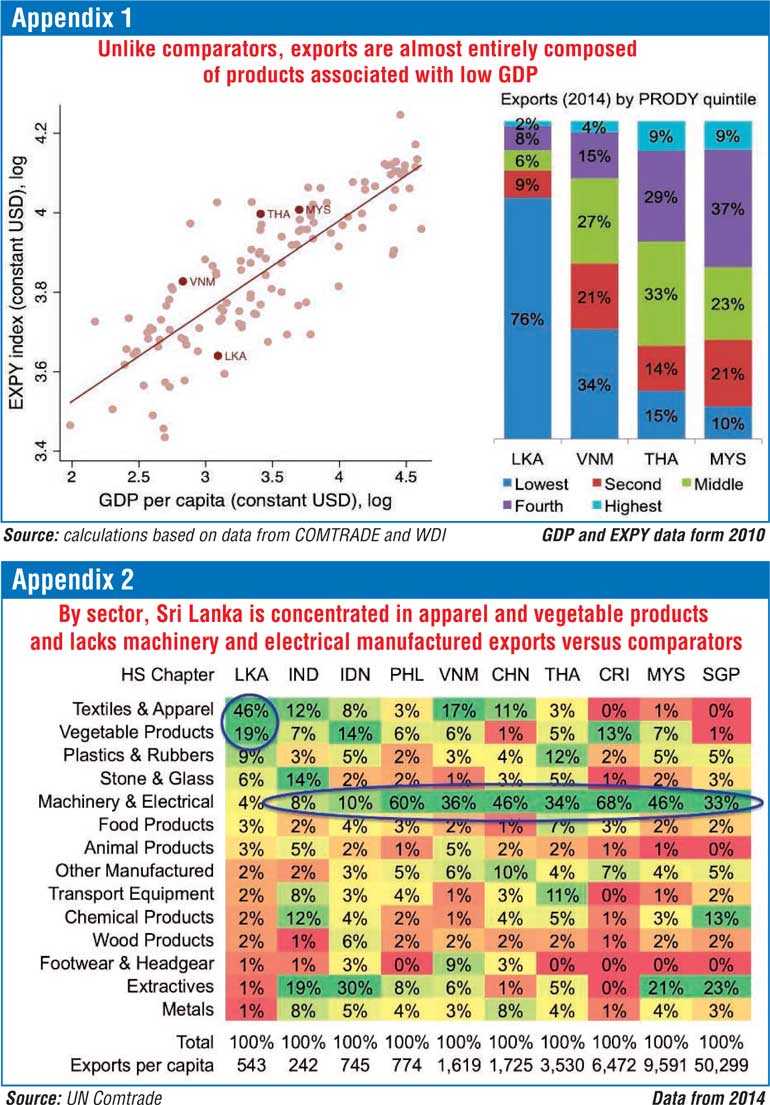

The logic is that as per the Harvard Diagnotic study done in 2018 the insight shared was that almost 76% of the merchandise exported are associated with low GDP products whilst we see a country like Vietnam has strategically developed there export product basket where low GDP merchandise account for only 34% of the business as per Appendix 1.

If one does a deep dive on the product mix, we see that countries that are moving towards industrialisation tend to move from exporting apparel to ‘Machinery and Electrical’. For instance Philippines has an export skew of 60%, Vietnam at 36% and China at 46% as per Appendix 2.

We see how Sri Lanka is lagging behind at 4% exports contributed by Machinery and Electricals, which is where reforms must happen in Sri Lanka. In simple words a stronger linkage between university and the private sector with the backing in infrastructure support by the Government is the way forward.

This is why the International Trade Center (ITC) Executive Director Arancha Gonzalez stated at the launch: “Sri Lanka needs to move away from the cosmetic side of exports to real hardware changes though policy reforms if we are to make Sri Lanka competitive in the global export arena.”

Now the challenge is how this can be driven with strong leadership.

$ 50 billion by 2025

Whilst the communique also states that Sri Lanka must target $ 37 billion in exports by the year 2025, in my view Sri Lanka must push for $ 50 billion by getting into the Trans Pacific Partnership (TPP) agreement. Whilst the FTA with Singapore and the proposed FTA with Bangladesh and Thailand can be attractive, TPP will give a stronger edge to Sri Lanka as the agreement will sure get teeth in a few years when the US and EU joins in.

As at now there are 11 member states – Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, and Vietnam. The US was a large contributor to the formation of the trade deal but President Donald Trump pulled out of the deal soon after taking office on an ethos of ‘Making US great again’. This protectionist strategy will not hold ground in the long term and when presidents change in the US, the thinking will surely change. As at now US has pursued a bilateral trade deal with Japan, the largest member of TPP, which is totally against the original spirit of the discussion.

Advice from Sivaratnam

Whilst we can be excited on the demand side number of $ 20 billion in 2019 and let’s say $ 40 billion by 2025 in export earnings I still remember the words of wisdom from the sixth Chairman of Sri Lanka Export Development Board, Sivaratnam. He said: “The problem in Sri Lanka is supply chain development.”

This echoed in my mind, from the respected ex-Aitken Spence Chief. This insight yet holds ground and I guess it’s time Sri Lanka addresses this key issue given the looming BoP crisis that Sri Lanka is up against as highlighted by Nobel Laureate Joseph E. Stiglitz recently.

In my view if we do not address this by a joint private-private partnership at this turning point of our economy, the National Export Strategy 2018-2028 will be just another piece of history.

TPP is worth $ 28 trillion

If I track back at the TPP, it was in the trade agenda of the Obama administration and the countries in the network is estimated to reach 800 million consumers and worth $ 28 trillion with the combined GDP being 40% of the world economy.

At a time when Sri Lanka’s exports are being challenged and the world demand is sluggish, this will be an ideal opportunity to link Sri Lanka’s economy with this network. However, we as a nation must be very clear on the Sri Lanka agenda and how the supply chain can be developed to be a $ 50 billion business.

TPP – Pros and cons

Just like the FTA with India and Pakistan, Sri Lanka must be cognisant that any agreement has its merits and limitations. For instance a hotly-debated feature of the TPP was the Investor Dispute Settlement feature (ISDS).

In my view for a country like Sri Lanka which is just coming out of the Chinese funded Port City saga, the ISDS will be an ideal platform to give investor confidence in the environment. This is just one of the many issues that needs careful discussion and deliberation before inking to the TPP, the other issues being increased competition, stringent quality standards and sharper IP laws.

However, from a pragmatic perspective it is a sure thumbs-up provided that we pick up the lessons from the FTA with India that was signed within just a space of two years. Some attribute the flaws to the speedy signing of the agreements with the much-hyped issue being the Vanaspati fiasco which resulted in 27 companies closing down and thousands of Sri Lanka workers losing their livelihood. In this background let me share some of the key benefits of TPP for Sri Lanka.

1. Marginal short-term impact

Sri Lanka has two Free Trade Agreements – India and Pakistan – and two trade partnership agreements – US and EU. There is also a possible technological economic partnership with India coming to play with ECTA, so additional benefits from the TPP may be incremental. TPP countries represent a large market for Sri Lanka, accounting for around 50% of its total trade in goods and considerable FDI contribution. Exporters in categories such as frozen fish can benefit immensely.

2. Indirect benefits

While the direct benefits might be few, Sri Lanka could be an indirect beneficiary of increased trade between other TPP nations. Companies which provide services such as BPOs and KPOs and partnerships with ASEAN countries could benefit from increased trade between the big players.

3. ASEAN springboard

Developing regional economies, such as Malaysia and Vietnam, will benefit strongly from the trade deal, and there will be payoffs for Sri Lankan from the growth in activity. Many Sri Lankan companies operate in Vietnam like in apparel, Malaysian partnerships with fruit and vegetable companies will benefit. Vietnam could see a 10% boost to its economy by 2025, while Malaysia could experience a 5.5% expansion in the same period, based on a Peterson Institute for International Economics study.

(Dr. Rohantha Athukorala was the seventh Chairman of the Sri Lanka Export Development and continued to serve the EDB for six years as a Board Director. Writing is a hobby he pursues and the thoughts are strictly his personal views. He is the Country Head for a US-based investment company.)

4. Opening up new markets

New markets can open up for companies operating in Ceylon Sapphire, Ceylon Cinnamon and Ceylon Tea. Private sector companies must invest in consumer insight research so that once the TPP is signed, we can spruce up exports immediately.

5. Removal of foreign equity restrictions

The TPP will lift curbs on foreign ownership of companies in private healthcare, telecommunications, courier, energy and environmental services in Brunei, Malaysia and Vietnam. While this will benefit Sri Lankan investors keen on those markets such as Sri Lankan oil palm companies that have restrictions in the domestic incumbents, it remains to be seen how much headway foreign firms will be able to make.

6. Provisions for cross-border

Trade deals have, traditionally, focused on easing the flow of goods between countries, but the TPP is one of the few with comprehensive provisions for the services trade. The pact will open up markets in TPP countries for Sri Lankan firms offering services such as consultancy and urban planning.

7. Government procurement opening up

The TPP will enable Sri Lankan companies in the IT, construction and consultancy sectors to bid for Government procurement projects in markets such as Malaysia, Mexico and Vietnam, which were previously closed to foreign bidders.

8. Reducing non-tariff barriers

The TPP will reduce “behind-the-border” or non-tariff regulatory barriers to ease the flow of trade and investment. This means countries will be required to make Customs laws, regulations and procedures more transparent, and also tackle hidden costs impeding business operations, such as corruption which will help policymakers of Sri Lanka move to swift reforms.

9. A 21st Century agreement

The TPP addresses emerging concerns faced by businesses and consumers, such as intellectual property and the growth of the digital economy. It sets in place rules on e-commerce to ensure that government regulations do not impede cross-border data flows, or impose requirements that force businesses to place data servers in individual markets as a condition for serving consumers in that market.

TPP governments have agreed to put in place laws protecting consumers from fraudulent and deceptive commercial activities online. The deal also commits countries to implement common standards across major types of intellectual property, including patents, copyrights and trademarks which can be beneficial for Sri Lankan companies operating this space.

10. Accessibility to SMEs

With its special provisions for Small and Medium-sized Enterprises (SMEs), the trade deal aims to make it easier for these companies to participate in regional production and supply chains. The TPP countries will set up websites with information targeted specifically at SMEs. They will also develop capacity building programmes for SMEs, to help firms take advantage of the provisions in the deal.

SMEs make up 73% of companies in Sri Lanka and are a key government focus as the SME sector accounts for more than two-thirds of the GDP of Sri Lanka.

Conclusion and next steps

Whist Sri Lanka should look at TPP positively, it must be mentioned that firstly we must correct the anomalies of the current FTA especially with India as many exporters have experienced real life issues that is very demotivating.