Thursday Feb 19, 2026

Thursday Feb 19, 2026

Wednesday, 11 October 2017 00:00 - - {{hitsCtrl.values.hits}}

When the country voted in the current Government, the private sector wanted a progressive government which is market-driven with strong governance given the issues of corruption that existed in the previous regime. Today, when we look back after almost three years, the performance is way below our expectations.

When the country voted in the current Government, the private sector wanted a progressive government which is market-driven with strong governance given the issues of corruption that existed in the previous regime. Today, when we look back after almost three years, the performance is way below our expectations.

The performance of the brand in 2016 (last year) as per Brand Finance is very positive strictly from an image perspective. The brand value has picked up to $ 73.9 billion which is a +9% growth, attributable in 2016 to good decision making on demographic, political and governance.

Brand Finance very clearly highlights the reforms that had happened especially on security, freedom of speech, financial governance and democracy with regard to Sri Lanka whilst Brand Finance CEO David Haigh voiced: “A strong brand has become a defining feature of success in the current economic climate. Worldwide hyper competition for business, combined with an increasingly cluttered media environment, means that a clear message carried by a properly managed brand can provide the crucial leverage needed to thrive. Nations can adopt similar techniques to capitalise on the economic growth that comes with proper positioning of a nation brand.”

This statement by Haigh clearly explains the future for a strong brand and Sri Lanka which was registering a +9% growth as against 2015 indicated the future potential for growth of the country.

Research reveals from empirical data that strong nation brands can add between 1% and 3% to the Gross National Product (GNP) of a country which gives an idea how important it is to drive and monitor branding as an instrument of economic development agenda.

On the above strong foundation in 2016, when we look at 2017 we find Sri Lanka losing its way. On governance from the share of voice not only in the local media but even internationally Sri Lanka has been linked to corruption allegations. We have had two ministers having to be exited from the system which included the all-important position globally of the Finance Minister which does not augur well for a country that is looking at a growth agenda of being a ‘Rich Nation’ by 2025 with a per capita income target of $ 5,000.

The bond scam highlights the issues relating to the Governor of the Central Bank having to testify to a Presidential Commission that implicates three Chairmen of the top three State banks of the country and higher authorities in the echelons of power drags the country to a level which clearly points to ‘Sri Lanka looing its way in 2017’. Some even argue that the 2016 surge was only a temporary phenomenon and most of the governance issues took place in the first two years when the Government came into power. Be that as it may, the essence is, why are we hurting the country brand that has picked up to be 74 billion dollars by the global brand value regular Brand Finance?

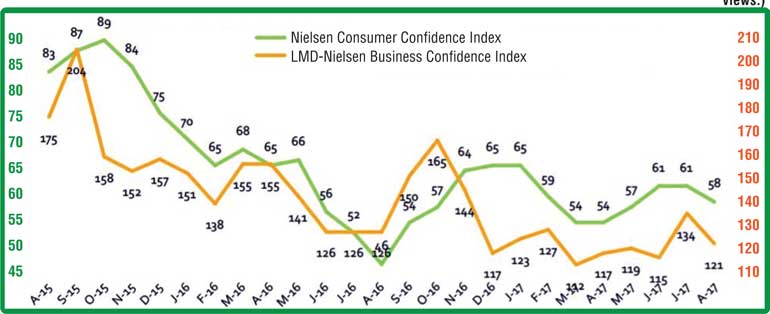

As per the latest statistics from the top research agency Nielsen, the Business Confidence Index (BCI) has dipped down to an all-time low in the last 74 months, which clearly tells the policymakers things are not going the correct way and needs course correction with immediate effect.

The problem is that whilst the data gets flashed on the media of the reality the policymakers continue to make visionary statements and the numbers don’t add up. For instance, the export target of 20 billion dollars and tourist arrivals to cross five million or for that matter the 5,000 dollar per capital income target.

Top economists like W.A. Wijewardena have highlighted the data computation based on the current trends and explained how the policy statements don’t bring out the reality, but for some reason none of them are being even addressed by the policymakers. The Q2 financial performance of the listed companies released last week reflects the above sentiments as even the banking industry is taking a dip.

As per the latest report of Nielsen, the overall consumption of the FMCG industry at a household level has declined by -3.1% in Q1 to -2.5% in Q2, 2017. This indicates either people will be moving out of the category or they will be reducing the usage of product. This will have an impact on the overall top line of a company whilst the current credit crunch that will take place due to the banks getting more stringent on the short-term loans will affect stock holding at the trade end. I guess the low business confidence is the fallout due to the core issues highlighted on consumption and credit pressure.

Media reports during the weekend say that Sri Lanka is just drifting with the total debt increasing by 776.6 billion dollars to 10,163 billion as at end June 2017. This is on a number of 9,387 billion dollars as at end 2016 which tells us the trajectory that the country is heading.

dollars to 10,163 billion as at end June 2017. This is on a number of 9,387 billion dollars as at end 2016 which tells us the trajectory that the country is heading.

The policy statements are rhetoric given that Sri Lanka’s export revenue as at end July is 6.4 billion dollars but the country is targeting a 13 billion dollar number as at end 2017, which is a number that cannot be achieved on the current 6.5% growth number.

The key exports of apparel and textile registering -3% are clear indications that it is more supply chain issue than demand chain given the GSP+ facility that Sri Lanka earned by the current administration. What Sri Lanka requires is specific actions targeting the current HR shortage and correcting the productivity spectrums rather than the media as at now highlighting alleged corruption issues.

Once again a key issue for the country is to spruce up revenue. The demand for Sri Lanka as a tourism brand is severely under pressure. In five of the nine months, the country’s arrivals are below last year. September numbers dropped once again, taking down the total growth to just 3% as at end September. The industry which is 99% private-sector driven expected a robust strategy to cash in on the opportunity that the world offered as Sri Lanka’s share of the total global tourism market is just 0.1%.

The global marketing campaign has been a nonstarter for the last three years and Sri Lanka’s share of voice in the global market in the above-the-line media is almost zero. Countries like Philippines, Malaysia and Mexico tend to launch new campaigns every three years to keep the brand contemporary.

At a recent conference in Colombo a senior WTO official commented: “Your country has one of the best products in the region on tourism but sadly no one knows about it.” This truly sums up the challenge at hand.

Whilst the rhetoric of Sri Lanka must attract five million tourists is seen in the headline news with all the top global think tanks being commissioned to develop strategy documents but the reality is that the industry is getting choked due to the rising costs and marginal increase on revenue.

Whilst it is prudent for one to have high aspirations for a country, the central issue is carrying capacity. Sri Lanka does not have the carrying capacity even to serve the two million arrivals due to inadequate infrastructure. The five million target is virtual suicide especially from a wildlife/flora fauna perspective. As stated by a MBA student at Colombo University, at the international research symposium held last week, ‘Sri Lanka is losing its way in the global stage of tourism’. A point to think about.

The 2025 national economic policy being launched by the President and Prime Minister was refreshing but we must note that this happened to be the third time Sri Lanka was exposed to a policy framework in the last three years of the current administration.

The fact of the matter is that the trade gap has increased from 8.1% in 2014 to 8.4% in 2015 and 9.1% in 2016 whist Sri Lanka has slipped back on the Corruption Index and the debt as explained has increased which does not hold in good stead for the leadership of the country.

(The writer can be contacted on [email protected]. The thoughts are strictly his personal views.)