Friday Feb 20, 2026

Friday Feb 20, 2026

Wednesday, 25 April 2018 00:00 - - {{hitsCtrl.values.hits}}

Way back in 2009, the country’s economy was just $ 30 billion dollars and as at today, Sri Lanka is almost at three times the value touching $ 85 billion, which tells the pace of development that has happened in the last nine years.

According to trading economics, the GDP from the construction industry in Sri Lanka where quarterly the value had increased from Rs. 142,133 million in 2016 to Rs. 157,734 million gives us an indication of the quarterly growth we see in this sector which can be annualised to better understand the opportunity. By the way the construction sector remains the number one growth industry of Sri Lanka post 2009.

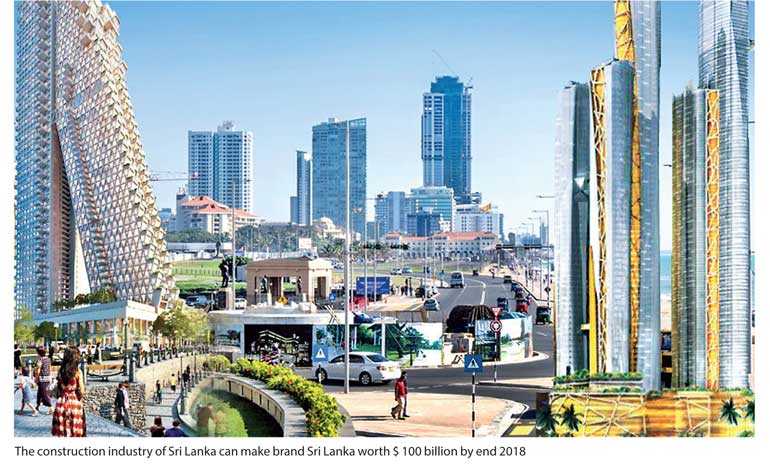

Whilst the skyline of Colombo is changing drastically with luxury apartments, hotels and retail outlets, sadly what we see is that legislation and policy guidelines have not evolved to cater to the development agenda of the private sector.

This has led to issues of sustainability and corruption creeping into the system, just like any other country that is coming out of a war. Finally the loser is the customer who has invested in an apartment, retail outlet or a boutique hotel which does not bode well for a country aiming to be a $ 100 economy by 2020.

In this background, I was happy to see the announcement that the Central Bank would step in to regulate the real estate sector. The introduction of the Financial Intelligence Unit (FIU) to combat financing of terrorism with condominium companies having to submit a compliance document monthly commonly called a ‘blue form’ is a welcome move, given that I used to champion the construction cluster development agenda under the National Council For Economic Development (NCED) under former Treasury Secretary Dr. P.B. Jayasundera.

The stipulation of the Central Bank for property building companies to appoint a ‘compliance officer’ could be only the introduction to regulate and bring in governance so that the industry just like the tea industry, apparel or the tourism sector, will set the stage to take a high ground globally.

What is important to note is that under Section 33 of the Financial Transaction Reporting Act (FTRA) No. 6 of 2006, the real estate business is categorised as a Designated Non-Financial Business (DNFB). Hence, customer identification becomes mandatory when buying or selling immovable property.

Separately, the compliance is more important given the legal and reputation risk owing to non-detection of bank accounts and other banking products, leading to laundering of money. The focus of this regulation must be on SME and family entity driven property developers is my view given the internal eco system that comes to play.

Post the above becoming systemic, from the media reports we see on the increasing customer complaints on the construction projects in the city, the next phase of the industry development is the stronger compliance of different approvals such as the preliminary approvals, building plan approvals and delivery of the features to the customers as per the content of the brochure and finally the deed being handed over.

The leadership for such must come from the local Municipal Council, UDA and other statutory organisations such the Department of Valuation and Inland Revenue Department. Once again the focus must be on the SME and family-oriented property development segments as the complaints we see is highest in this segment.

Given that I have worked across the export and tourism industries which are high SME and family entity driven, the overall objective is not to police the industry but to bring in conformity and credibility to the industry that will further develop the industry so that a typical organisation can enter the regional and global market.

A new trend seen globally is where property investors are getting on to Real Estate Investment Trusts (REITs). Media reports stated that Sri Lanka followed the same and launched REITs to the country’s real estate landscape, which is interesting.

With this, serious property investors will get attracted due to the lower risk and the ability to monetise real estate assets. At a recent MBA program, a point highlighted by students was that REIT trend is making serious upsides in India where property buyers are making use of structures which reduce risk and enable debt to be structured more effectively.

The most important factor of REITs is that real estate transactions become more transparent, the logic being that most of the world’s REITs are floated on public stock exchanges that bring out the good governance criteria. Maybe Sri Lanka must fast-track this agenda.

The reason why such compliance must come into the property development industry is because this was the same ‘best practice’ that made Ceylon Tea and the apparel industry become big in Sri Lanka.

If I go back to my experience of being the Chairman and subsequently Board Director for Sri Lanka Export Development Board (EDB) for almost six years and on the Sri Lanka Tea Board – Marketing Committee for almost six years, let me track on how these two industries have become cutting edge in Sri Lanka and globally.

The apparel industry which began operations in the early ’80s and at that time was termed mere contract manufacturers and some even used to refer to the industry as ‘tailors’ but, thereafter with strategic thinking by the industry with the support of the Government, it gave leadership to the world by making Sri Lanka the world’s fashion apparel hub for ethically manufactured clothing.

This has given teeth to the industry in competing with price-savvy merchandise coming in from Cambodia, China and Bangladesh. Today, this noble industry has crossed five billion in 2017 and is targeting $ 10 billion plus by 2025 in export revenue by making Sri Lanka an apparel hub in Asia for R&D and technology sharing for fast fashion.

If we take the tea industry, Sri Lanka with strong leadership is slowly but surely taking the same route with the award for being the first ozone-friendly certified tea producing nation of the world. Starting from the times when the plantation industry was nationalised in the 1970s, when it came under Government control, it went on in the 1980s to make a bold decision to make the Colombo Auction control the global demand chain by breaking away from the great London auction system, which has held ground for many years. The Colombo Tea Auction commands the highest values for tea globally.

Thereafter in the 1990s the supply chain was privatised to management companies, which gave the opportunity for new thinking to be introduced to the industry with strong R&D power and capital infusion that resulted in Sri Lanka demonstrating the best performing country globally for value addition tea at a commanding 43%, a strong move by the industry.

Today, we see that Ceylon Tea has taken the high ground with some focused decisions by the private and Government sector on conforming to global standards on MRL levels and has gone further by developing a new standard for tea that has resulted in Ceylon Tea being the first certified ozone friendly tea globally, a certification that no other tea producer has received.

All these initiatives would not have happened unless regulation and compliance came into the system. What the country requires now is strengthen the demand chain by launching of the Ceylon Tea marketing campaign under the ethically-manufactured proposition, whilst the ozone friendly badge supporting this claim will further differentiate the mother brand.

This once again shows Sri Lanka giving leadership to the world on the ethically manufactured route just like the apparel industry of Sri Lanka.

Maybe the theme activities like Rain Forest alliances must be pursued given that Ceylon Tea must cut away from the price-savvy multi-origin teas that are creating many challenges in key markets like Russia which are under entrenched competition.

Going back to the property development sector, Sri Lanka has good medium term prospects for the product ‘apartments’ despite questions over current demand. Beach properties have seen a tenfold growth.

Way back in time Sri Lanka sold only 200 apartments annually and today there are almost 2,000 being sold, which tells us the opportunity in the market. Whilst there is speculation as to whether this trend will continue, research insight reveals that there is no reason why it will not continue unless Sri Lanka gets into a serious political crisis, which is unlikely.

The logic is that the Sri Lankan market is relatively small in relation to the global market. However the NPL increasing in the last three months is worrying. The prices of land outside Colombo continue to increase due to tourism prospects but it must be noted that the hospitality industry is seriously affected on the profitability of the industry given the rising costs and the increased room stock.

As per the estimate of the specialist in this area, Lamudi, the forecast of the commercial market, an outright commercial property purchase price ranges from Rs. 20 million/$ 148,150 to Rs. 30 million/$ 222,000 for mid-range commercial spaces. Land prices range from a perch (272 square feet) of land in Colombo 1, 2 and 3 ranges from Rs. 5.5 million/$40,741 to Rs. 12.5 million/$86,207, while in other areas in Colombo, prices range between Rs. 700,000/$5,185 and Rs. 10 million/$74,075.

The Lamudi report further states that in residential areas in Colombo the demand is in Dehiwala-Mount Lavinia, Battaramulla, Ratmalana, Kaduwela, Rajagiriya and Kolonnawa. High-end apartments in these neighbourhoods range from Rs. 30 million/$222,000 to Rs. 550 million/$4,074,075. High-end houses range from Rs. 40 million/$296,300 to over Rs. 1.2 billion. Mid-range homes, with two to three bedrooms in one of these areas range from Rs. 10 million/$74,075 to Rs. 30 million/$222,222 on average (according to Lamudi data), which tells us the opportunity in the market.

A recent study by a premier MBA programme revealed that property companies which are below the radar tend to create the negative image for the total industry which is actually not reflective of the total industry. Let me share the specifics with the examples mentioned.

1) Preliminary approval

A project of a 20-floor apartment in Bambalapitiya along Marine Drive, where almost 80% of the apartments sold out during the last three years, but yet the construction is at basement level as outside water is seeping in. Apparently the project is not as per the Government regulation from the coast line and the said approval has not been granted.

The project ideally should not have been launched as it will lead to eroding the confidence level of the industry and also adding pressure to financial irregularity to be administered for approval. But the reality is that selling continues even though the customers are querying why it’s not taking off on construction from the basement level. Such errant property developers must be identified and action taken so that it does not impact negatively on the industry.

2) Re-routing of funds

This is a common practice among industry players. A case in point presented by the MBA graduates was where a specific property developer had redirected almost Rs. 200 million to a project in Maldives, which was funded by other construction projects in the company (sourced by banks and customers).

In the case in point, the Maldivian property development partner had revoked the project due to slow progress. Apparently the agreement also being weak had in resulted the inability for legal action by the Sri Lankan property developer. This has dented the cash flow of the company leading to debt being taken to service debt. If this data goes to the global market it can upset the total imagery of brand Sri Lanka and the industry, which ideally should be picked up by regulatory authorities.

3) Brochure vs. delivery differ

An interesting revelation by the MBA graduate team was a project highlighted in Mattakuliya. Given that the project has been launched prior to proper approval from Government authorities, the promise to customers as stated in the project brochure varies from the delivery.

To be specific the ‘balcony’ as advertised with an apartment had to be deleted post statutory approval, as there was a roadway beside the project. In fact the size of the apartment has also changed which means that for the 40% odd customers who have already purchased apartments, the agreement had to be redrafted. This in fact is a dishonest business practices which brings disrespect to the industry and the bank that is funding the project.

The said property developer who has done a similar project in Wellawatte has completed a project and handed it over to the customers but is yet to hand over the deed (after almost one year), as the electricity and water supply is not as per stipulations. Apparently the square footage on certain apartments is lesser than the contracted area and one apartment owner had sued the property developer. Organisations like the UDA need to step in and bring in legislation to protect such dishonest practices and protect the helpless customers.

4) Financial fraud

An interesting revelation. A particular property cited once again by the MBA graduates was that a said developer had applied for a financial partnership on a project for almost Rs. 700 million. The property developer that has been existence for almost nine years has never made profits on ‘paper’ as per the P&Ls submitted.

The question from the bank was simple: “How can an organisation that continues to make losses continue to aggressively drive business growth?” The answer is clear. It is financial fraud, said the MBA team that did the research analysis. I guess organisations like the Inland Revenue need to also bring in legislation where documents submitted to financial institutions must be copied to regulatory authorities for checking.

Apparently, the said company has sent an official communique that whilst the accounts state the window dressed account, in reality there have been profits of Rs. 30-80 million being made per project in the last nine years. These kind of malpractices must not be allowed to continue if Sri Lanka is serious about good governance and attracting global investors.

5) Kickbacks

Another case in point shared by the MBA team was where a particular property developer had invested in two land banks in Dambulla and Aluth Maratha where the respective Government authorities have been bought over to do that the valuation so that the stamp duty can be reduced by almost 75% of the real costs. Given the poor regulations in such instances, these violations go as industry-related practices.

The MBA team cited a similarity to the Australian cricket team that was recently cited for tampering the ball in the South African tour which had been a practice that was common. The graduated view was that industry players need to contribute to enhancing the industry standards. Such organisations need to punished for correction and if need be sent behind bars, for depriving the State of legitimate earnings.

6) HR cowboys

Another interesting insight. A particular property developer who had a project in Gampaha had not paid the statutory payments due to its project manager such as EPF, ETF and taxes. The said PM had left the organisation citing this to the management. When a deep dive was done there were many employees without even letters of appointment whilst there was no salary increment given to the staff for the last three years, which is against standard HR practices not only in the industry but any organisation.

Apparently the CEO of the company had not been paid EPF or ETF and a salary slip not been given for nine months and once he had reported this to the external lawyer of the company, it had been adhered to. I guess the banking partner will have to examine such basic governance factors before becoming a banking partner to such errant property developers, was the MBA graduates’ view.

These are violations of basic company procedures as per the Companies Act, which is a punishable offence resulting in a prison sentence.

7) Resale

Some of the other violations of such under-the-radar property companies are reselling apartments without the approval of the customer on the assumption that stipulated payments as per the agreement had not been done. But the fact is that the property developer has not been in line to the construction milestone that has been contracted and the customer not making the stipulated payments.

But, given that property prices escalate post the launch of a project, the developer makes supernatural profits with the asset of the already-invested customer. The MBA graduates’ recommendation was that a new Government authority must be brought to being to regulate these errant short-term-oriented property developers.

8) Dummy sales agreement

A very common occurrence. A property developer that is launching a new project in Colpetty had submitted dummy sales agreements to demonstrate the 20% pre sales so that the bank has to release the loan instalment as per the contract. Financial institutions will have to do a due diligence of such entities before executing such agreements, was the view of the MBA graduates, and if there is a violation to cancel the loan totally.

9) Money laundering

A startling revelation made by the MBA team was in the case of a particular property developer, where almost 200 million was claimed to have been invested in a project in an overseas country (Maldives) but the company has not got approval from the Central Bank or for that matter proper procedures have not been followed to transfer these monies. This in fact falls under money laundering, which is a jailable offence.

Whilst the above issues highlighted are sporadic in nature, we see that a majority of construction companies in Sri Lanka are strongly governed whilst changing the landscape of the country. The industry must now take the high ground and emulate the development agenda of the apparel and tea industries, so that it can also add to contributing the brand value of Sri Lanka.

As at now Sri Lanka as a nation brand is valued at $ 83 billion. We must make Sri Lanka a $ 100 billion brand this year. The construction industry will become a key pivot with iconic projects such as Shangri-La, Water Front, and Port City, to just name a few. But compliance is a must.

(The writer was the Head of Portfolio Development for United Nations (UNOPS) when Sri Lanka won the ‘Best Global Construction Project’. He went on to become the Chairman of Sri Lanka Tourism and Sri Lanka Export Development Board and is currently the Country Director for a US investment company whilst being on many private and public sector boards.)