Saturday Feb 21, 2026

Saturday Feb 21, 2026

Tuesday, 22 December 2015 00:02 - - {{hitsCtrl.values.hits}}

By Gagan Singh

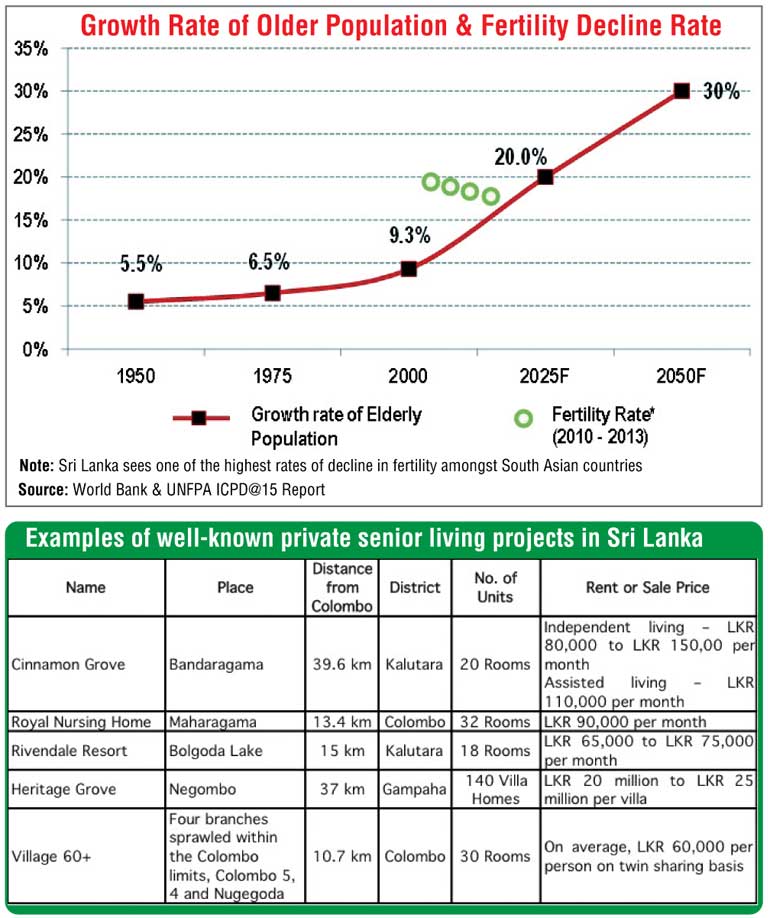

Sri Lanka is a country with a discreetly ageing population because of an increase in life expectancy and a decrease in birth rates. The demographic transition that is taking place is expected to result in the old and young representing a lopsided share of the population.

According to the Department of Census and Statistics (DCS), the elderly population of Sri Lanka makes up 12.4% of the overall population, and this figure will likely grow. The existing working population who follow the trends of nuclear families, independent lifestyle and increased job mobility is aged 35 to 55, and in coming years, will likely generate rising demand for assisted or independent living.

Emerging needs of the senior population of Sri Lanka

The fertility rate decline and growth of the elderly population indicate that the trend towards an ageing population will continue. Currently, a large section of the elderly population believes in a united family living in homes that may lack design aspects suitable for their needs. However, members of the independent and affluent working segments of the population are expected to have greater senior housing needs in the future.

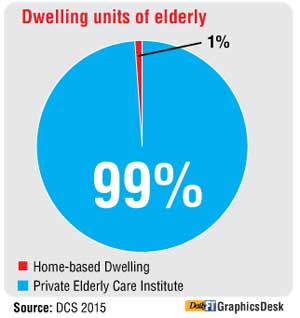

Currently, 99% of the elderly population are home based, either living with extended family members or on their own. Only 1% of the elderly population are under the care of a private institution.

Senior living trends

The majority of the senior living houses are run by religious institutions and other charities and are located in various pockets of the  country. The trend towards private institutions coming up with assisted living units or independent living homes is relatively new to Sri Lanka. The concept of senior living housing is expected to take a while to gain wide acceptance; however, the current middle-aged working generation will be accustomed to living in an assisted retirement community because they have already been through this process with their parents or grandparents. Therefore, there will be less resistance.

country. The trend towards private institutions coming up with assisted living units or independent living homes is relatively new to Sri Lanka. The concept of senior living housing is expected to take a while to gain wide acceptance; however, the current middle-aged working generation will be accustomed to living in an assisted retirement community because they have already been through this process with their parents or grandparents. Therefore, there will be less resistance.

The current projects are being developed in a very elderly citizen friendly way, with long skid-resistant hallways, no steps and no sharp edges or angles, and the dining areas look homely and welcoming. The atmosphere is very much in tune with nature, with large gardens surrounded with flowers and trees, which is very soothing.

Opportunities in the senior living space

Generally, a new concept is introduced to those who can afford it. Housing for senior living is anticipated to move in a similar value to volume phenomena. Currently, statistics show 99% are based at home and only 1% in the private sector, so it could be assumed that high-net-worth individuals, such as non-resident Sri Lankans and those who have migrated to greener pastures for employment will provide the early demand for the segment. The present senior residences on average charge between Rs. 50,000 and Rs.150,000  per month per room, which does not fit easily with the middle-income market budget.

per month per room, which does not fit easily with the middle-income market budget.

For current middle-income dwellers, the Employee Provident Fund is expected to raise awareness of senior living options at the time of retirement. This will result in the demand for affordable senior living units rising. The government and private developers should find viable, innovative solutions to tap this segment.

This segment could be benchmarked against Singapore where government authorities have approached the concept of senior living with a holistic perspective. The gradual trend in recent years is of senior citizens opting for independent living in growing numbers. The developers and government authorities have taken initiatives in constructing senior living homes by looking at the increasing demand for the segment. It is estimated that Singapore houses 6,500 to 7,500 units of such apartments charging rents of $3,000-3,500 a month on average. On a social perspective they work towards providing an elderly care help line, home help services, day care centres, counselling, care giving, senior activity centres and also befriending facilities. The idea is that this concept should be approached from a humane perspective rather than a social benefit and not just a real estate perspective either.

Potential to attract foreign senior citizens

There are no hard facts to prove that Sri Lanka is a budding destination for foreign senior citizens to come and live, although Heritage Grove is marketing its villas to senior foreigners and non-resident Sri Lankans. The climatic conditions, such as sunny beaches, the friendly people, the peaceful ambience and the future development of the city and the suburban areas, should widen the gap for this segment, as has occurred in some other South Asian countries, such as Thailand, the Philippines and Malaysia, where senior foreigners are attracted to set up second homes.

The figures and subjective aspects indicate that there is a demand for senior living, and the requirements of a widely differentiated market segment need to be met. Currently, this market is undersupplied and both the Government and private developers and relevant authorities have a responsibility to direct their attention towards developing this market.