Sunday Feb 22, 2026

Sunday Feb 22, 2026

Friday, 12 October 2018 00:00 - - {{hitsCtrl.values.hits}}

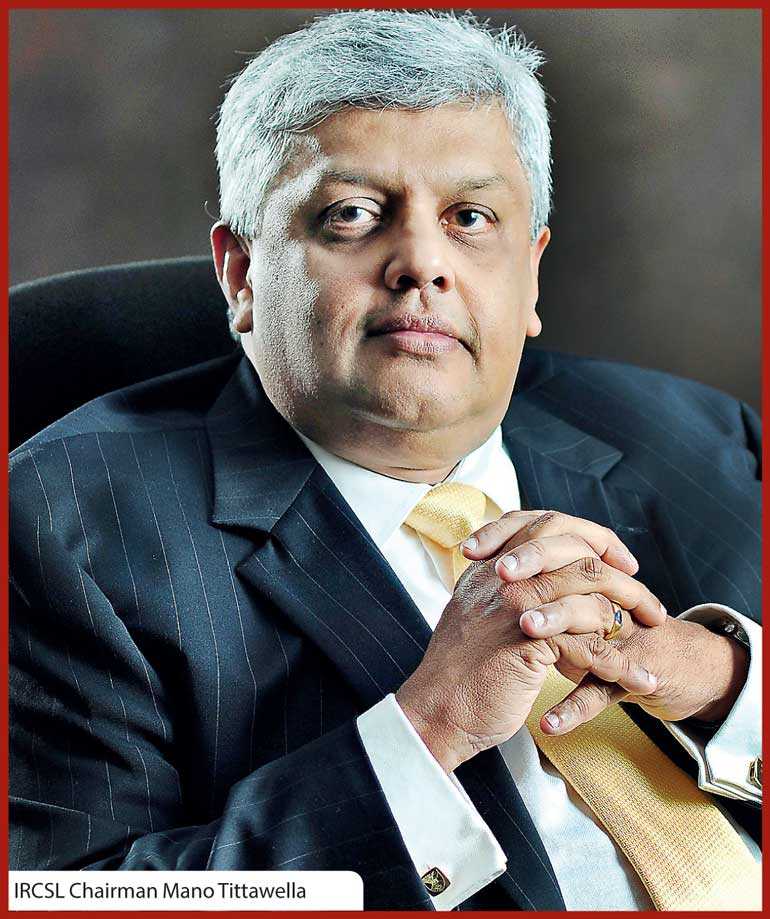

September is the month dedicated to insurance in Sri Lanka. One of the most prominent players when it comes to insurance in the country is the Insurance Regulatory Commission, the regulatory and supervisory body of the industry. Mano Tittawella was appointed as the Chairman of the IRCSL early this year and recently shared his knowledge and his opinions on a number of aspects of the insurance industry and its future. An individual with over 35 years’ experience in senior positions in the private sector and having held many key positions in the State sector, Tittawella is currently also the Secretary General of the Secretariat for Coordinating Reconciliation Mechanisms (SCRM) and is the Senior Advisor to the Minister of Finance. Following are excerpts of an interview with Tittawella:

September is the month dedicated to insurance in Sri Lanka. One of the most prominent players when it comes to insurance in the country is the Insurance Regulatory Commission, the regulatory and supervisory body of the industry. Mano Tittawella was appointed as the Chairman of the IRCSL early this year and recently shared his knowledge and his opinions on a number of aspects of the insurance industry and its future. An individual with over 35 years’ experience in senior positions in the private sector and having held many key positions in the State sector, Tittawella is currently also the Secretary General of the Secretariat for Coordinating Reconciliation Mechanisms (SCRM) and is the Senior Advisor to the Minister of Finance. Following are excerpts of an interview with Tittawella:

Q: What is the role of the IRCSL in the development of the insurance industry?

A: The Insurance Regulatory Commission of Sri Lanka is mandated by the Regulation of Insurance Industry Act to develop, supervise and regulate the industry. So development is an integral part of the role of the IRCSL. The insurance industry is supervised and regulated through a robust legal and supervisory framework.

With regard to the development aspect of our role, the IRCSL undertakes certain activities that are specified. One of our current undertakings is the formulation of a legal framework to develop and regulate the micro insurance sector, as it requires careful thought to ensure fair play for the customers.

The IRCSL is also in the process of initiating a survey with the collaboration of the World Bank. The survey is proposed to be carried out not only amongst insurance companies but also among the general public to examine some of the root causes and reasons why, despite the active presence of insurance companies and despite substantial marketing, the population still remains under-insured, especially in the life insurance sector. The development efforts of the IRCSL are supported by the World Bank and the ADB via capital market development projects.

As we begin moving above $ 4,000 per capita GDP we hope that the level of penetration will increase. But if one looks at the regional distribution of the aforementioned per capita number much of it is concentrated in the Western Province.

Unless the overall GDP begins to increase nationwide, better penetration will be a problem. So part of the reason why we are undertaking this survey is to examine the core reasons as to why the penetration is low and to strategise our development efforts accordingly, together with the Insurance Association of Sri Lanka, as well as the industry.

Q: In what manner does the IRCSL provide support to the insurance advisors of Sri Lanka?

A: There are many ways that the IRCSL provides support, as the contributions of the insurance advisors are critical to our economy. Though the role of the insurance advisor may change in the future. Their capacity and position in the industry is critical because it is a very efficient and cost effective method of increasing penetration. It is especially a cost effective arrangement for the companies, because cost is based on performance of the insurance advisor.

As the regulatory commission we have made it mandatory for the insurance advisor to pass a pre-recruitment test, which is conducted by the Sri Lanka Insurance Institute, thus there is a method by which the basic aspects of insurance are instilled in the advisor. There is also a process of training these professionals for the pre-recruitment exam. The IRCSL has also issued guidelines on good practices and approved the Code of Conduct for insurance advisors.

In addition, the insurance advisors also need to keep abreast of technological developments and products, training for which, is periodically done by the insurance companies themselves. The IASL is involved in this exercise and there is also a self-learning process. So we do support the insurance advisor in the industry and we will encourage the industry to enhance new technology as it evolves.

Q: How can insurance agencies win the trust of the general public?

A: There are many ways of doing it. Primarily, insurance advisors need to have a complete understanding of the requirements of the policy holder/potential policy holder. They must also be able to match those requirements to the various products that are being offered by the company that he/she represents. It is also important for insurance advisors to ensure that potential customers are aware of the limitations of these policies. A common complaint among policy holders is that they’ve signed up for a policy and not been made fully aware of the factors that prevent a claim being made. Therefore, it is important that the advisor is a responsible professional and provides prospective customers with all necessary details about the policy they intend to purchase, including its limitations.

Another vital rule is the maintenance of confidentiality between the insurance advisor and the policy holder. The reason for this is because an insurance advisor has to go back to the policy holder, particularly if it’s a life insurance policy, to ensure that the policies don’t lapse and that premiums are paid. It’s a long-term relationship and most insurance advisors I know continue to maintain that relationship and build a friendship with their policy holders. Policy holders must be able to trust that their insurance advisors are giving them sound advice with their best interests at heart, instead of merely selling them a product.

Q: What are the steps necessary to promote digitalisation in the insurance industry?

A: The way we currently think of digitalisation is automation. But digitalisation is not merely automation, in fact automation is a paradigm of the past. Automation is a necessity, it’s a standard element and most insurance companies have fairly sophisticated systems where the back office, front office and their policy delivery mechanisms are fully automated. I also believe that some of the insurance advisors work on palm tops and other such devices.

Digitalisation is currently going into what they call the ‘platform revolution’. It’s a matter of time before buying insurance and banking products occurs seamlessly on internet platforms. One really doesn’t need to see an insurance advisor or a bank manager all the time. In some countries one is discouraged from going into the branch, in fact they have very sophisticated online platforms where almost all transactions can be done without leaving the comfort of home or office.

Platforms have revolutionised the entire method of doing commerce. Customers can now enjoy direct access to the business. In the interim, the role of the intermediaries (in this case the insurance advisors) will become redundant if they don’t modernise and offer value added services. One needs to be smart and innovative or be bypassed by the evolving world. There will come a time in Sri Lanka when one can just log on to an insurance site and purchase a suitable insurance policy. So that’s what ‘platform revolution’ entails. Platform revolution basically means that there is value addition not only to the company but also to the customer. A company won’t have to pay commissions and those commissions can be passed on to the customer. But if the insurance advisor community can put in the value addition and get involved in the process they will be more efficient and successful.

Digital platforms are not a danger to the insurance advisor community, it is an opportunity of growth, innovation and development.

Q: How has the declaration of 1 September as National Insurance Day improved the status of the insurance industry thus far?

A: I think it’s too early to say. All these national and international days are good because they focus attention on the industry. It offers two major benefits. First, it sends out a clear message that the insurance industry is an important player in our country’s economy and that insurance enables other businesses to mitigate risks. Secondly, when it comes to life insurance it also advocates the need to save and the need for protection. So when we have a dedicated day, it tells the public that the country recognises the insurance industry as an important entity. Many activities are planned and carried out to focus attention on this fact. It’s a good move and carries potential for development. It is really about drawing the attention of the public and the policy holders, etc.

Q: What is your opinion of this year’s Insurance Awareness Month campaign and what type of outcome do you hope to witness?

A: As I mentioned before, the penetration of insurance in Sri Lanka is low, especially in the case of life insurance. Awareness must be improved because it is my belief that the culture of protection has yet to spread its roots in Sri Lanka. After all insurance is all about protection against foreseen and unforeseen misfortunes. People at low income levels don’t have the financial capacity to think of protection, thus they don’t have the space to contemplate what the future will bring and in most cases remain exposed to such risks.

In the Sri Lankan culture people don’t like to talk about calamities and tragedies as they are not very pleasant aspects and because they fear that to talk about such things will bring about bad luck. Thus we need to build awareness that it is the responsibility of people to provide for such eventualities, for the sake of their children, spouses and other family members.

During the month of September, we try to build awareness about the necessity of insurance. The IRCSL and IASL organise and carry out various activities that we hope will encourage people to ask themselves questions such as “Are we fully protected?”, “Should we not have comprehensive insurance?”, “Should we only rely on a third party?” or, “Is our house covered?”

Building awareness is useful because when people are aware, and they reach the point of being able to afford it, they will accept the product. It’s like a saving, putting something aside for an eventuality that one has not foreseen.

Q: What is your opinion on the current status of the insurance industry and what do you foresee for its future?

A: It is my opinion that the insurance industry as a whole is a fairly robust one, and the companies and the IASL have played major roles in this outcome. All the players in the industry from brokers to insurance advisors have contributed and thus the financial stability of the insurance companies are generally quite good. We have some smaller insurance companies as well and they are progressing well. As a result of an open market we have seen at least two or three major international players coming in. The encouraging part is that there are players who are purely Sri Lankan who have shown that they can also compete in this business. So it’s a fairly levelled playing field where there are little protectionism elements. The insurance industry is one where foreign investment is welcome, and local companies can compete and are competing, and they are doing very well.

It’s a healthy industry but we need to work together and achieve the necessary penetration. For instance, there is a lot of potential and as the per capita incomes in the next three to five years start moving up to 6,000-7,000 dollars, the industry will do very well. Competition will also increase and the margins will probably come down. It’s also an industry that heavily depends on good service. The industry is currently restructuring itself by setting new standards and benchmarks, making the field competitive.

As the industry grows we have to be conscious of the fact that we have to ultimately look after the policy holders and ensure that strict rules are maintained. We have now moved into risk based capital for the Insurance companies and we have managed to desegregate 90% of Life and General Insurance businesses. We are also looking at the further enhancement of accounting standards particularly IFRS 17, which is currently being discussed, and as we did with the segregation and the introduction of the Risk Based Capital regime, the IRCSL will actively engage the industry in IFRS 17.

It will be a discussion that we as an industry will have together and we will come to a consensus on when we are going to implement it. It’s not a decision the IRCSL will make on its own and we will give companies enough time to adjust so that it doesn’t disrupt business. It may take three to five years to implement. These are stringent standards that are coming in the future and when these are applied, the industry will have to become more efficient, as it will have an effect on their balance sheets.

The insurance industry, particularly the life insurance sector, is a very valuable pool for extracting long-term investments, because at the moment the investments that insurance companies can make are somewhat restricted for reasons of prudency. As we proceed the Commission is also looking at ways of giving the companies a little more freedom to invest their money in areas they think are profitable, which are of course subject to risk based analysis, etc. I think there is a good platform for us and the IRCSL is generally happy with the way the companies have improved, but there are challenges in the future and hopefully we can meet them together.