Friday Feb 20, 2026

Friday Feb 20, 2026

Friday, 30 December 2016 00:00 - - {{hitsCtrl.values.hits}}

By Jayampathy Molligoda

By Jayampathy Molligoda

Perhaps the most serious problem faced by the developing countries in the world today is the massive financial outflows experiencing year after year as a result of having to “service debts” which include interest and capital re-payment of the loans obtained. As in the case of Sri Lanka, much of this debt has been incurred in their attempts to undertake many development projects.

Fiscal consolidation

to avoid debt trap

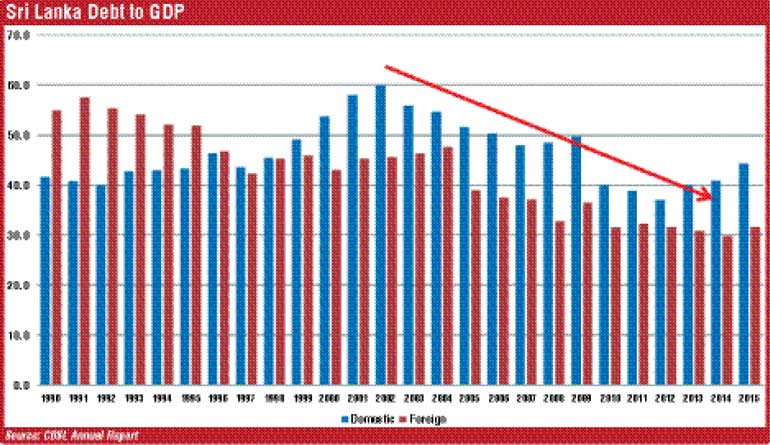

In Sri Lanka, the debt to GDP as reported by the Ministry of Finance and the Central Bank stood at 76.3% by end 2015. Since then it has further deteriorated. Sri Lanka’s debts comprise of both domestic and foreign. Domestic debt accounts for 60% of the total debt stock, while the remainder is foreign. Domestic debt as at 2015 accounted for 44% while foreign debt accounted for 32% of the total of 76% of GDP.

The positive side of the ‘fiscal consolidation’ management of the present Government is that there has been an improvement in the revenue collection as a % of GDP. It is imperative that the treasury authorities increase the tax revenue as a % of GDP under the IMF standby arrangement in order to manage the economy. It is true that these measures will further burden the general masses. That’s why the tax authorities must focus on collecting more revenue by increasing the direct taxes rather than increasing the indirect taxes such as VAT, NBT, etc.

When analysing the sustainability of the Government budget, we need to look at the balance needed between spending and revenues necessary to prevent the ratio of debt to annual GDP from rising. A “primary surplus” is needed to maintain the debt-to GDP ratio. If receipts are greater than the expenditure excluding interest payments, then a primary surplus occurs. This is needed if the effective real rate of interest payable on debt (the nominal interest rate less the inflation rate) is greater than the GDP growth rate.

Fiscal consolidation alone is not sufficient to improve the economic welfare of the people. It is therefore important to balance the macro-economic fundamentals by focussing on (a) curtailing the inflation; (b) keep a close tab on the real interest rates of the banking sector; (c) whilst improving the real economic growth rates.

Depletion of foreign reserves and debt

servicing burden

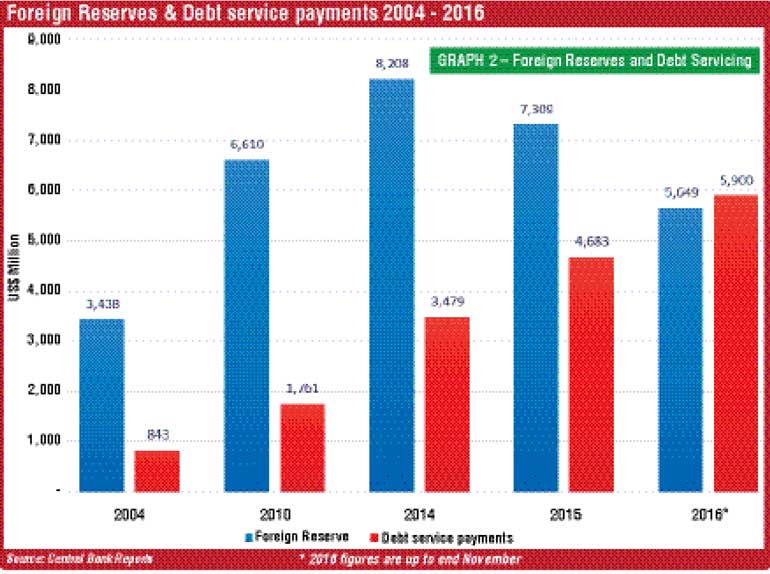

In addition, the policy makers must try and avoid a further deterioration of the “balance of payments” situation and the external reserves of the country. The country’s balance of payments account records all the flows of money between residents of that country and the rest of the world. Despite arranging the IMF package and additional borrowings from the World Bank and ADB in the recent past, the external financial situation of the country has not improved and one can argue that it’s deteriorating further. As can be seen in graph 2, the foreign reserves have come down drastically and the debt servicing payments have risen during the year 2016.

Aligning with geo-economics – One Road-One Belt strategy

We live in an interdependent world. Countries are affected by the economic health of others and as a result the problems in one part of the world can spread to other parts of the world. There was a saying: If America sneezes, the rest of the world catches a cold. Just look at what happened when the US sub-prime mortgage market collapsed. The USA illness turned into the world’s flu.

One example is worth mentioning. Greece has been struggling for the last seven to eight years with the burden of a huge budget deficits for some years, high unemployment rates, high cost of debt-servicing etc. We have seen how the IMF has been helping Greece to finance rescue packages without success. Greece was finally unable to meet some $ 2 billion repayment to IMF by 2015. The current scenario is the USA interest rates are going up and that affects the Sri Lankan Economy as there has been withdrawal of foreign funds both from the Colombo stock market as well as from the debt market by foreign investors.

It is likely that either India or China will assume economic dominance on the world stage. Who will eventually emerge as the top economic power by the year 2030? On the basis of several economic indicators, China’s economic performance is extraordinary. By the end of last year, China has overtaken USA to become the world’s largest economy when measured in terms of Purchasing Power Parity (PPP). However, it is expected that the Chinese economic growth will also come down to around 6.5% in the year 2017.

Nevertheless, Sri Lanka can rely on the Chinese investments to propel our troubled economy. The credit goes to the former President having realised the importance of aligning towards China for assistance. However, it is now clear that MR administration has failed to dispel India’s concerns about growing tie up between Sri Lanka and China and how it impacts India’s national security.

Indian factor cannot

be ignored

The writer has previously published a number of articles in the print media, drawing reference to the importance of aligning with the ‘One Road-One Belt’ Chinese strategy. Recently, Professor Cheng Enfu, Chairman of the World Association of Political Economy, in a symposium held in Sri Lanka said that with the Indian Ocean being the lifeline of China’s foreign trade, energy and raw material transportation, Sri Lanka will undoubtedly play a crucial role in the strategy of the 21st Century Maritime Silk Road with its unique geographic advantage. However, the critical issue here is ‘Indian interests’.

Indian foreign policy is based on a fundamental principle of “in diplomacy, there were no permanent friendships, but permanent interests”. Sri Lanka is compelled to follow this principle, governing Indian foreign policy to further strengthen the bilateral relationship with India. Sri Lanka needs to emphasise the importance of forming a strategic alliance with China and come to some kind of a tri-partite agreement to safeguard the Indian Ocean forward defence line and promoting the ‘Maritime Silk Route’ strategy for greater economic benefits for the three nations.

Already India and Sri Lanka have a Free Trade Agreement (FTA). The writer has argued previously that the proposed FTA between China and Sri Lanka will allow Chinese companies to set up large-scale industries in Sri Lanka so that they could make use of the Indian FTA to accelerate trade with India and at the same time re-export products back to China. Here we are talking about tapping 2.5 billion target market customers in both countries. Sri Lanka will stand to gain more.

During former President MR’s visit to China in 2013, both countries agreed to a strategic cooperative partnership and in September 2014 Chinese President Xi Jinping visited Sri Lanka and announced the FTA negotiations. It seems that the present Government has now realised the importance of this three-pronged approach and is so keen to finalise the proposed FTA with China.

Joint ventures without selling family silver

Harold Macmillan, you may remember, was once claimed by David Cameron as his role model, had a photo of Macmillan, not Thatcher, on his desk. The selling of the family silver: that was the accusation against Margaret Thatcher, when Harold Macmillan condemned her at that time. “The sale of assets is common with individuals and the state when they run into financial difficulties. First the Georgian silver goes, and then all the nice furniture that used to be in the saloon. Then the Canalettos go.” He ventured “to question the using of these huge sums as if they were income”. Our view is, the Sri Lankan Government would have to look for foreign joint ventures to attract direct investments whilst keeping the ownership of certain strategically important valuable assets remained with Sri Lankan entities.

We at ‘RTD forum’, a network of professionals, have undertaken a study few months back especially on the port development and mega polis projects. It is noticed that the Government is keen to develop ‘port city’ in Colombo and a strategic partnership in developing Hambantota port, allowing more concessions to Chinese companies whilst promoting trade and investments with India through ECTA.

However, the writer was of the opinion that Hambantota port project could have been done through a Joint Venture company having, say 40% shares be owned by SLPA. Unfortunately the Government has signed a framework agreement recently with China Merchants port co Ltd. giving a ’99-year lease’ to a Special Purpose Vehicle (SPV) with 80:20 shareholding only. This is merely to obtain an upfront payment/s of $ 1,080 million next year. The rationale behind this move was to arrest (focussing only on short term) the depletion of foreign reserves and ever increasing debt servicing as shown in the graph. Whilst it is true that an internationally reputed strategic partner is needed to drive the project from the marketing perspective, it should not be construed as selling ‘family silver’.

We have written to the Minister of Ports and Shipping requesting to consider an alternative option without alienating Hambantota Port from SLPA. Our view is that it is still not late to re-negotiate under more favourable terms and conditions (either with China Merchants or even with China Harbour) as the net present value of the future revenue accrues to Sri Lanka from Hambantota Port project would be much more than $ 1,080 million. There seems to be no finality reached on the development of the East Container Terminal (ECT) of the Colombo Port, although tenders have been called for.

Conclusion

As stated above, the positive side in relation to the ‘fiscal consolidation’ of the Government is that there has been an improvement in the revenue collection as a % of GDP. Also, the present Government has realised the importance of adopting the ‘three-pronged approach’ for future infrastructure development projects and is keen to finalise the proposed FTA with China whilst working closely with India. However, the Government has not been able to negotiate from the position of strength with these two countries to derive maximum benefits to Sri Lanka. Also it seems that they have so far failed in tackling the ‘social unrest’ created by pressure groups, thus keeping the issues affecting the ordinary people unresolved. The negative side of the current state of affairs is a further decline of the country’s economic growth down to 4.0%, serious ‘balance of payment’ issues and ever-increasing inflationary tendencies mainly due to lack of long-term view and policy incongruities at the implementation level.

It is high time the policymakers focus on creating a conducive environment for the private sector entrepreneurs and the local and foreign investors to create more businesses and employment opportunities. The Government must work hard to improve the Doing Business Index in order to attract investors. It seems that the present Government is trapped between domestic politics and geo-economic considerations, especially the internal conflicts between China and India. The conclusion here is the so-called ‘National Government’ concept doesn’t work in Sri Lanka to drive economic growth on a sustainable basis.