Monday Feb 23, 2026

Monday Feb 23, 2026

Tuesday, 21 March 2017 00:00 - - {{hitsCtrl.values.hits}}

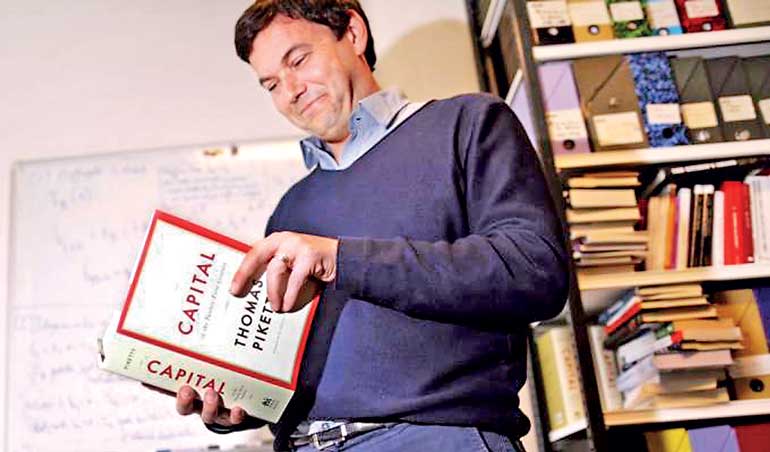

‘Capital in the Twenty-First Century’ by Thomas Piketty has given our economic policy makers enough analytical data to compare the Sri Lankan situation with global trends to enable them to take corrective measures

‘Capital in the Twenty-First Century’ by Thomas Piketty has given our economic policy makers enough analytical data to compare the Sri Lankan situation with global trends to enable them to take corrective measures

By Jayampathy Molligoda

My predictions are that the political surprises in 2016 which includes Brexit and Donald Trump’s US elections will continue in 2017 as well with elections in France and Germany. The perception is the ‘West’ turns inward with growing uncertainty over the threat of protectionism.

The votes for both Brexit and Trump last year were held up as examples of globalisation being in reverse gear. On the other hand, China is looking forward to expand its influence across the world with its ‘One Road-One Belt’ Maritime Silk Route strategy.

World will become more globalised

Chinese President Xi Jinping at the opening plenary sessions of the World Economic forum in Davos, Switzerland this January declared that Davos is an important window for taking the pulse of the global economy.

Quote: “Today, we also live in a world of contradictions. On the one hand, with growing material wealth and advances in science and technology, human civilisation has developed as never before. On the other hand, frequent regional conflicts, global challenges like terrorism and refugees, as well as poverty, unemployment and widening income gap have all added to the uncertainties of the world.” Unquote

The point he wanted to stress was that many of the problems troubling the world are not caused by economic globalisation. “Just blaming economic globalisation for the world’s problems is inconsistent with reality, and it will not help solve the problems,” he emphasised, in a philosophical sense that nothing is perfect in the world.

According to Parag Khanna, global strategist and bestselling author, contrary to popular belief, the world will become more globalised. His view is these votes were votes against London and Washington’s mismanagement of globalisation rather than against globalisation itself, from which everyone benefits on the whole.

His argument is that there will be more pressure from governments for investment into areas like energy, industry and real estate, both for (a) creating jobs and (b) the secondary economic activity it will stimulate. His studies have revealed a future growth area, investing in emerging markets based on the demographic trends of urbanisation, and investing in infrastructure in non-core districts of major cities. Nevertheless, income inequalities have become a major phenomenon in the global world.

Latest studies on

income inequality

In order to understand why inequality seems to be reaching alarming levels, it is worth reading the book written by an eminent French economist, Thomas Piketty’s (Professor at the Paris School of Economics) ‘Capital in the Twenty-First Century’ – 2014, Harvard Publication. He has collected and analysed data, including tax records, to show just how extreme the disparity in wealth between the rich and the rest of the population has grown.

The Wealth Report 2017 by ‘Knight Frank’ has also revealed latest intelligence on the world’s wealthiest people. Look at the growth of the billionaires regional wise taken from the report just released.

As can be seen from the table1, there were 2,024 billionaires (US$1,000m+) in 2016 and it will increase to 3,000 wealthiest people by 2026, which is a 48% increase from the 2016 figure. What is important to realise is that as for Asia Pacific region, the increase would be 100% and by 2026 the wealthiest people figure will rise to 1,127 out of the 3,000 in the whole world. Even according to ‘Forbes’, the number of $ billionaires (between 1987 and 2013), rose from 140 to 1,400, and their total wealth rose from 300 to 5,400 billion dollars. At country level, Sri Lanka does not have a single billionaire, however there were 10 wealthiest people (Centa Millionaires – above $ 100 million) in 2016, which is expected to increase to 26 richest people by 2026.

Coming back to Thomas Piketty’s great work, the prestigious Economist magazine hailed ‘Capital in the Twenty-First Century’. ‘Economist’ says it is the economics book that took the world by storm. Quote: “The pile of data allows Piketty to sketch out the evolution of inequality since the beginning of the industrial revolution.” Unquote

Growth of social states and investing in people

Thomas Piketty has done a detailed research covering a period 1870 till 2010. As per his studies, total tax revenues were less than 10% of national income in rich countries until 1900-1910; now they represent between 30% and 55% of national income during the period 2000-2010. The taxes were less than 10% of national income in US, Britain, France and Sweden during the nineteenth century and up to World War I. This reflects the fact that the state at that time had very little involvement in economic and social life (police, courts, army, foreign affairs, etc.) In just half a century, the share of taxes in national income increased by a factor of at least 3 to 5: just over 30% of national income in the United States, around 40% in Britain, and between 45 and 55% on the European continent (45% in Germany, 50% in France, and nearly 55% in Sweden).

In Sri Lanka, the situation is totally different. As seen above, those rich countries tax collection is around 50% of GDP and they in turn invest 16%-18% on health and education, whereas in Sri Lanka our tax revenue is around 18% and how much we spend on education and health? It is true that those developed countries public debt to GDP are high compared with Sri Lanka (over 100% as opposed to Sri Lanka’s figure of 79% debt to GDP by 2016). But their people are rich whereas in our country more than 25% of our people are living below the poverty line.

We preach that Sri Lanka is a democratic socialist republic and practice social-market economy. The real issue here is we have very low national savings, resulting in a gap between investments and savings. We need to either create a conducive business environment to attract foreign investments or borrow money in order to make investments on infrastructure development projects including improvements in health and education.

FDIs have come down to less than $ 500 per annum. Some experts say our country is faced with a huge debt trap but other intellectuals/professionals say it’s not that critical. However, the external account performance is fast deteriorating. Despite continuous borrowings, our foreign reserves are declining and debt servicing is ever increasing. These statistics and graphs are not sufficient to explain the real downturn. All the sectors are fast deteriorating. Most of the top business leaders/analysts are of the view that the quality of life of not only poor, even the middle class are drastically reducing. The income inequality and social unrest are fast spreading across the regions, sub-districts and cities.

The bottom line is that the successive governments have failed in bringing social justice and much needed economic welfare to the people.

Social market economy and his grand theory of capital and inequality

One of the measures to see the change in the role of government in the social sector is to look at the total tax collection from the rich and the subsidies afforded to the less-privileged people in the society. As can be seen from the above, the growing tax collection has enabled the developed countries (US, Britain, France and Sweden) to take on social welfare functions. A major portion goes to health and education.

Spending on education and health accounts for 12-18% of national income in all the developed countries today. Primary and secondary education are almost entirely free for everyone in all the rich countries, but higher education can be quite expensive, especially in the United States. In all the developed countries, public spending covers much of the cost of education and health services: The goal is to give equal access to these basic goods: every child should have access to education, regardless of his or her parents’ income, and everyone should have access to health care.

From his comprehensive historical analysis, Piketty derives a grand theory of capital and inequality. As a general rule wealth grows faster than economic output, he explains, a concept he captures in the expression: r>g (where r is the rate of return to wealth and g is the economic growth rate). Quote, “The issue here is faster economic growth will diminish the importance of wealth in a society, whereas slower economic growth will increase it, meaning there will be more inequality.” Unquote

According to Piketty, the rate of return to capital has always been higher than the world growth rate, but the gap was reduced during the twentieth century, and might widen again in the twenty-first century.

Conclusion

‘Capital in the Twenty-First Century’ by Piketty has given our economic policy makers enough analytical data to compare the Sri Lankan situation with global trends to enable them to take corrective measures. Dr. Razeen Sally, Chairman, Institute of Policy Studies, who was especially brought in by the Prime Minister to provide advice to the Government on economic policy matters, in his article in Daily FT on 17 March titled ‘Sri Lanka: Three scenarios for the future’ stated that Sri Lanka would remain a backwater and the Colombo chattering class would continue to predict stellar future achievements which would always remain unachieved.

Quote: “If the present pattern continues, Sri Lanka will drift into the future with an ossified political and business elite, highly politicised, third rate institutions, corruption and nepotism, an underperforming economy, always verging on crisis, simmering ethnic tensions, and overdependence on China” Unquote

‘Economist’ magazine has concluded its write-up by saying that whether or not Professor Piketty succeeds in changing policy, he will have influenced the way thousands of readers and plenty of economists think about these issues. Whether Dr. Sally, Advisor on Economic Policy, will continue to criticise the country’s policies, just offering ‘future scenarios’ instead of succeeding in transforming the economic pattern of Sri Lanka, is yet to be seen.

(Jayampathy Molligoda is a Fellow Member of the Institute of Chartered Accountants of Sri Lanka. He has obtained his MBA from the Postgraduate Institute of Management, and has also successfully completed an Executive Strategy Programme at Victoria University Melbourne. At present, he serves as the Executive Deputy Chairman of a leading Public Quoted Company. He can be contacted on [email protected].)