Friday Jan 23, 2026

Friday Jan 23, 2026

Friday, 10 March 2017 00:00 - - {{hitsCtrl.values.hits}}

No policymaker will deny the fact that Sri Lanka, at present, is facing an extremely precarious economic situation. The looming challenge, if not prudently managed, will drive the country into negative territory in international ratings, making it extremely difficult to attract foreign portfolio and direct investment.

No policymaker will deny the fact that Sri Lanka, at present, is facing an extremely precarious economic situation. The looming challenge, if not prudently managed, will drive the country into negative territory in international ratings, making it extremely difficult to attract foreign portfolio and direct investment.

Of late, the critical nature of the situation has been highlighted by many prominent and respected economists. The following headlines that appeared in the media recently is a clear indication of this fact: ‘Coming out of economic crisis: timing is running out for Sri Lanka,’ ‘Sri Lanka is on the doorstep of a public debt driven crisis,’ ‘The impact of the global financial crisis on Sri Lanka,’ ‘Financial crisis in Sri Lanka’.

It is not uncommon for politicians and policymakers to engage in wishful thinking and to be cautious when it comes to highlighting serious economic challenges to their citizens. However, it is important that think tanks and policy research organisations act impartially and work to create a healthy environment for constructive public debate on the critical economic choices facing our country and society today.

Sri Lanka’s present economic predicament has manifested itself in many ways such as the downward pressure on the Rupee, outflow of foreign exchange while the inflows are insufficient, domestic spending induced imports and public debt – both foreign and domestic – is reaching uncontrollable levels. Furthermore, with the introduction of the so-called 100-day program to fulfil presidential election promises, the Government inter alia raised public sector salaries by Rs. 10,000, slashed petroleum prices locally and managed external reserves to maintain an artificially-strong exchange rate. The compounded impact of these ad hoc decisions have left the country with an extremely weak macroeconomic framework.

It is often said that good economics makes good politics. Sadly, most governments in Sri Lanka have ignored this dictum and today the population at large is about to pay a heavy price for this irresponsibility.

Our foreign debt has increased from Rs. 3113 b in 2014 to Rs. 4,070 b at end September 2016. During the same period, domestic debt too has increased from Rs. 4,278 b to Rs. 4,959 b. Pressure on the exchange rate in spite of the futile attempts to defend the rupee is reflected by the depreciation of the rupee from Rs. 132 in 2005 to the current Rs. 153.

The strategy of the current Government is to address the demand side of the equation. This is partly arising out of the understanding reached between the Government and the International Monetary Fund (IMF). It appears that the IMF and the Government has agreed upon a set of macroeconomic targets such as budget deficit, Government revenue, both from direct and indirect taxation, and non-debt official reserve build up, etc.

In spite of attempts to address revenue shortfalls through the increase of taxes, it appears that the desired results have not been achieved. According to reports reserves have fallen drastically to $ 5.5 billion. If the short-term borrowings are excluded from the declared reserves, the net official reserves will be further reduced. The gross official reserve computation has been presented without allowing a provision to settle the $ 2.5 billion of swap arrangements with foreign and local banks.

Due to short-term political considerations and strong opposition from the trade-unions, successive governments have made little effort at reducing the budget deficit through the pruning of government expenditure. This should have been the first line of recourse in any budgeting exercise.

Over the past two years the Government has continued to expand in many areas for example, the already over-bloated and inefficacious public service is continually being fed with thousands of unskilled workers. Similarly, overstaffed Government institutions, such as ministries, departments, and other statutory bodies have continued to spread their wings.

The Government has maintained unrealistic administered prices on petrol, diesel, electricity, water, etc. in spite of the fact that global oil prices have increased to $ 55/bbl and the exchange rate has depreciated from Rs. 132 to 153/USD. The increased import of motor vehicles and petroleum products and the increased use of a high cost power generation mix have raised deficits in large State-Owned Enterprises as well. An early shift to a market-based petroleum pricing formula would have been the most responsible way to condition the public towards managing the uncertainties of commodities markets.

Hard choices:

The current predicament places the Government in a difficult situation. The most urgent need for the Government is to restore the fast-eroding confidence in the Rupee and raising foreign exchange to ensure the availability of sufficient funds for meeting foreign debt repayment obligations.

At the same time, the day-to-day foreign exchange requirement to meet import expenditure needs to be ensured. Without meeting the immediate requirement for foreign exchange, any discussion on short-term or medium-term adjustments or strategies becomes meaningless.

The options available to the Government need to be considered based on the time period available for implementation.

1.In the short run it is important that the Central Bank discontinues selling its foreign exchange reserves. The Central Bank irresponsibly burned reserves to maintain an artificially-high rupee in 2015 and 2016. This has continued in January 2017 wasting hundreds of millions of dollars to defend the un-defendable rupee. The Pathfinder Foundation has consistently and strongly criticised the Central Bank’s selling of reserves even during the tenure of the previous Government. Selling State enterprises and attracting foreign inflows make no sense if the Central Bank keeps selling its reserves. At the current scale of Central Bank interventions, even if the Chinese investors pay $ 1.1 billion for the Hambantota Port, that amount will be enough for the Central Bank for only two months and the country will be back again in the same crisis situation. The market should be allowed to determine a true rate for the rupee. Further delay will be nothing but precursor to a more drastic adjustment of the rupee.

2.Similarly, the Central Bank must refrain from rupee market operations by not increasing in Treasury bills. The Central Bank and the Government must appreciate that there are no soft options for a middle income country’s macro-economic problems. High interest rates, a depreciated currency and corresponding domestic price adjustments are unavoidable in the short run. Price controls will never bring about the desired economic stability.

3.Provided that the above points are recognised and operationalised, in the immediate term the requirement will be to generate at least $ 1 billion plus non-debt creating foreign exchange earnings to reduce the existing pressure on the balance of payments. Unless that immediate requirement is fulfilled the country will be forced to borrow from short-term bond markets at increasingly higher interest rates further entangling the country in a debt trap. Regrettably, the Government has decided to raise $ 2.5 billion from international markets at a time global interest rates are on the rise and Sri Lankan market conditions are unstable.

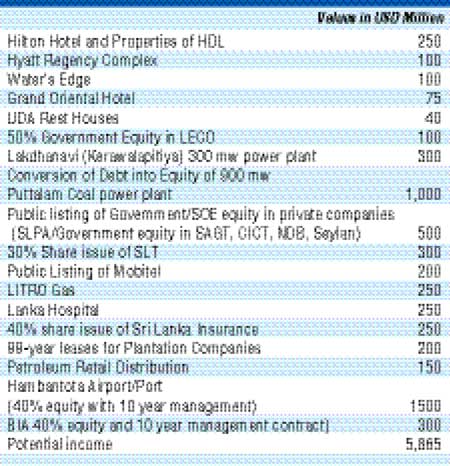

4.The fastest way in which foreign reserves could be raised in an economically prudent and in an efficient manner would be through the sale of State assets. Foreign and local direct investment could be attracted to State-owned business enterprises leading to privatisation or converting them to Public-Private Partnerships. Privatisation could take the form of direct sales, corporatisation and listing them in the share market or any other form of transaction which could result in the full or partial transfer of ownership and management. The Pathfinder Foundation in the recent past has identified potential candidates for attracting FDI for State-owned business enterprises as indicated in the table.

5.Outlined above is one set of State businesses for privatisation. The other would be the assets of local private enterprises and businesses taken over by so-called socialist/progressive governments since independence including through land reforms. The time has come to give these assets back to the respective owners to recommence proper domestic investments in agriculture. The 50 acre land ceiling is a major barrier to investments in agriculture, forestry, livestock, poultry, eco-tourism, grain, sugar, spices, fruits and vegetables, etc. In the context of a middle income country context, the prevailing land ceiling should be raised to at least 500 acres for investments by domestic investors.

6.In the medium and long-term, the Government has to implement economic policies that will provide greater incentives to export-oriented sectors, removing the currently existing import substitution bias and restoring incentives for domestic producers instead of traders who are transferring funds abroad through over invoicing and transfer pricing. Constraints to foreign as well as local investors should be eased through the removal of regulatory and bureaucratic delays. The practice of granting tax and import duty concessions to BOI projects is a necessary condition to increasing sustainable investment provided a level playing field is created. Policy consistency too needs to be ensured in the medium term, if the flow of FDI and exports of goods and services is to be sustained.

In addition to the above-mentioned policy actions, a substantial flow of FDI and domestic investment will depend on the country’s image of having a corruption free economy. Sri Lanka’s ranking in the Transparency International Corruption Index has further worsened during the 2015/2016 period. According to the Heritage Foundation Economic Freedom Index, Sri Lanka has dropped in its ratings owing to a perception of corruption. Serious and tangible measures should be taken to change this situation.

The privatisation of State-owned business enterprises has been a subject of debate since the liberalisation of the economy which was introduced in 1977. Most, if not all the arguments against privatisation have been based on ideological and parochial political grounds.

Nevertheless ideologically-driven academics and intellectuals with the blessings of politicians base their arguments against privatisation on the presumption that these State-Owned Enterprises are ‘National Assets’ and therefore, should not be offered to the local or foreign private sector. But the history of State ownership of business enterprises in Sri Lanka goes back to the days of the colonial rulers before the ‘so-called’ socialist or nationalist ideologies supporting State ownership took root in the country. Therefore, it appears that the modern rhetoric based on patriotism inadvertently support the ‘socialist actions’ introduced by the colonialists.

Other than colonialism induced State-owned business enterprises, there are a large number of commercial ventures which were appropriated in the name of socialism, but in practice most often it was for political victimisation. From the mid-1950s several privately owned businesses were ‘nationalised’ including mass transportation, insurance, petroleum distribution, etc., creating an anti-private sector environment with an increasing bias towards capitalism and oligarchies.

During the period of 1970-77, nationalisation of private business enterprises (small, medium to relatively large) took place under the declared objective of driving Sri Lanka towards socialism. At the end of this period even the Buhari hotel ended up in State hands! When the then Government chose to sell this asset, political pressures were such that it had to be sold to the ruling party’s trade unions. Of course, now assets back to the private sector which created these enterprises to begin with is also argued as giving away national assets. In the recent past assets that were forcibly taken from the original private owners are Waters Edge, Sri Lanka Insurance and Lanka Hospitals. Why is the Government reluctant to give back or sell these properties? At least they should be corporatised where necessary and shares sold in the stock market.

Other than nationalised business enterprises, there are also a set of projects created through foreign financing — among them are the Hambantota Port, Mattala International Airport and the Norochcholai Coal Power Plant. Privatisation of Norochcholai coal power plant and negotiating a power purchase agreement similar to the AES Kelanitissa Power Station and other private power supply agreements will certainly be beneficial to the CEB and the country. Proper power purchase agreements should be worked out taking into past experience. A credible regulatory framework should be put in place without Government interference. The privatisation of these enterprises will attract not only much needed investment, both foreign and local, but it will also enhance the efficiency of management, introduce cost efficient procurement systems, eliminate corruption and, in the final analysis provide Sri Lankan consumers with better choices. This process in turn will increase the overall efficiency and competitiveness of the economy.

The best example in this regard is the privatisation of Sri Lanka Telecom by inducing foreign capital, management and technology. The entire mobile telephone sector (except Mobitel) is currently owned and managed by foreign capital which has become a blessing to successive governments and customers. This sector contributes handsomely to Government revenues.

However, lessons should be learnt from the bad experiences of certain privatisation, e.g. plantations sugar, transport, etc. In order to prevent corruption, malpractices or simply policy mistakes, an independent privatisation task force with eminent professionals must be set up to undertake fast track privatisation.

Sri Lanka is currently facing the enviable challenge of rejuvenating the economy while maintaining measures for fiscal consolidation, stabilisation of the economy and repayment of foreign and local debts. The privatisation of enterprises and thereby attracting much needed non-debt creating foreign capital is a necessary requisite. However, this is not sufficient to maintain Sri Lanka at a higher growth trajectory. In order to ensure that the country maintains solid and stable growth, the privatisation of State-owned business enterprises is a necessary condition, but may not be a means to an end.

Prudent economic policies, consistency in maintaining such policies, uplifting our position in the World Bank Doing Business Index as well as the further improvement of infrastructure has to be vigorously pursued in the medium term. Privatisation devoid of economic reforms, structural change, prudent economic management and the elimination of corruption will not result in the desired outcome.

(This is the 71st Economic Flash published by the Pathfinder foundation. Readers’ comments are welcome at www.pathfinderfoundation.org.)