Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Monday, 27 June 2016 00:00 - - {{hitsCtrl.values.hits}}

AFP: Britain’s shock vote to pull out of the European Union wiped $2.1 trillion from global equity markets Friday as traders panicked in the face of a new threat to the global economy.

Investors fled to the safety of gold, the yen and blue-chip bonds as the seismic shift in the structure of Europe left many huge questions hanging, including who will lead Britain following the resignation of Prime Minister David Cameron.

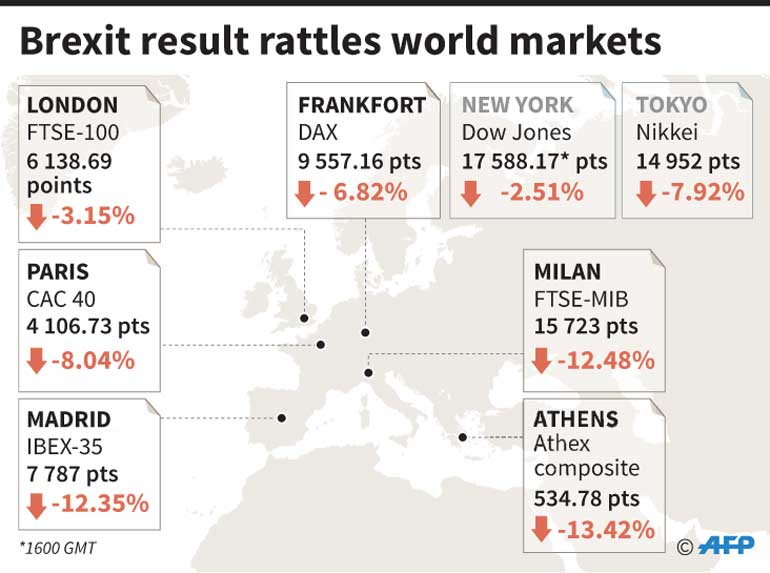

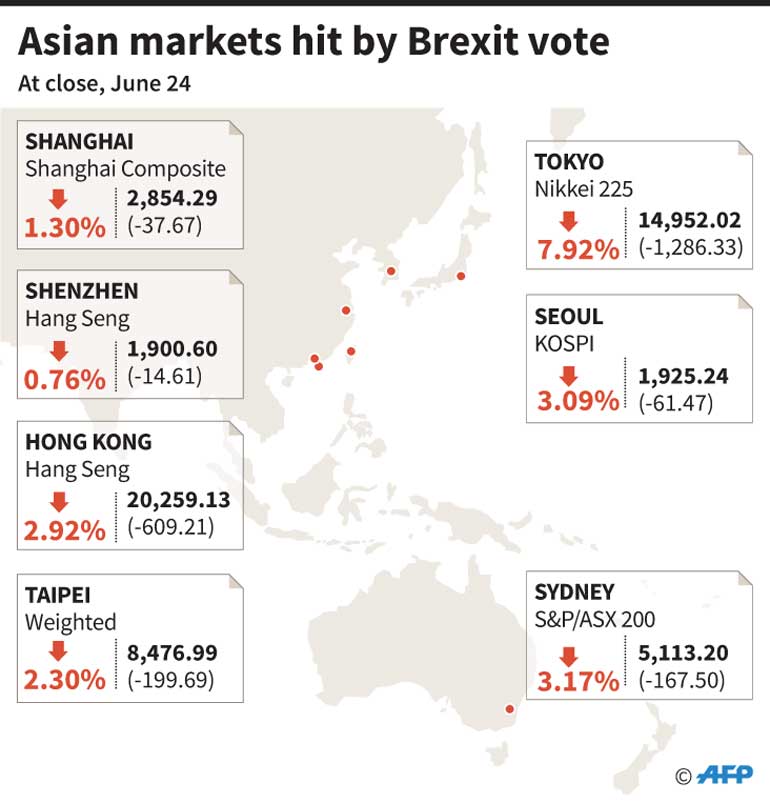

The Brexit vote sparked eight% losses in the Tokyo and Paris bourses, nearly seven% in Frankfurt and more than three% in London and New York.

Central banks stepped in to bolster confidence, promising to inject liquidity where needed and appearing to mitigate some of the sharpest losses.

Still, the pound crashed 10% to a 31-year low at one point, before rebounding slightly for a 9.1% loss against the greenback in late trade.

The euro also plummeted, dropping 2.6% on the dollar.

Benefitting from a massive safety selloff, gold jumped nearly five% and the yen surged 4.2% against the dollar and 7.0% on the euro. The dollar at one point fell below 100 yen for the first time since November 2013.

US 10-year treasury bond yields hit their lowest since 2012 at 1.42% before edging higher, while the German 10-year bund fell into negative territory for the second time in history.

Massively wrong bet

Analysts say the split of Britain with the EU could slow trade and investment in the country and hit its key financial industry, possibly pushing the economy into recession.

“The vote is creating a tremendous amount of uncertainty. Uncertainty often freezes expansion decisions... it means that the global economy will grow more slowly,” said James Chessen, chief economist at the American Bankers Association.

The extent of the market damage across Asia, Europe and the Americas attested to how wrong investors were to bid up prices ahead of the referendum, convinced Britons would vote to remain part of the 28-nation European Union.

“This was really an event that caught most global investors flat-footed,” said Jack Ablin, chief investment officer at BMO Private Bank.

“It is clear that the broader markets went into this critical vote with too much comfort,” echoed George Goncalves of Nomura Securities.

The losses were of a magnitude unseen since the dark days of the global economic crisis.

In all $2.1 trillion in value was wiped off of equities worldwide, according to S&P Dow Jones Indices.

London’s benchmark FTSE 100 index plummeted 7.5% at the open, but recovered partially after British Prime Minister David Cameron said he would step down and central banks pledged support.

“The liquidity support promised by the Bank of England – and subsequently the ECB and Federal Reserve – appears to have been the main catalyst for the turnaround,” said Spreadex analyst Connor Campbell.

The Dow Jones Industrial Average registered its largest single-day point fall since 2011, losing 610 points.

Milan slumped 12.5%, and Madrid lost 12.4% on jitters ahead of Spanish elections on Sunday.

Banks hard-hit

With London’s claim to the world’s leading finance center on the line with the EU divorce, banks were heavily sold Friday. Many global banks say they expect to relocate staff to elsewhere in the European Union in anticipation of the breakup.

Among top European banks, Lloyds lost 21% and Societe Generale plunged 20%, while losses at others ran 14-18%.

In New York, Citigroup, JPMorgan Chase, Morgan Stanley and Goldman Sachs all lost between seven and 10%.

The travel industry was also battered by worries that the Britain-EU divorce will hit business. Hotels, travel agencies and airlines all fell sharply, with Air France down 10.0%, Lufthansa 9.2% and American Airlines 10.8%.