Saturday Feb 28, 2026

Saturday Feb 28, 2026

Monday, 22 June 2015 00:00 - - {{hitsCtrl.values.hits}}

By Ajith Nivard Cabraal

Sri Lanka’s biggest-ever economic scandal, the bond scam of 27 February, created a useful platform for researchers, analysts and opinion makers to analyse, debate and comment on this unsavoury subject for over four months.

Since the primary analysis has already been done, the priority now seems to be uncover the latent aspects of this scam so that the country could cut the losses and bring the master-mind behind this scam to justice. In order to do so, it is vital that politicians, academics, intellectuals and the general public are gradually familiarised with the technical issues and economic ramifications related to this subject.

As is well known, over the past four months, various inquiries, investigations and judicial processes in relation to this scam has been carried out by different authorities. However, based on the numerous articles and statements on this subject by interested parties, it is clear that some still do not have a thorough understanding of the different aspects of this complex issue and the subsequent masterly cover-up attempt.

In addition, the magnitude of the loss arising from the bond scam has not yet been assessed in sufficient depth, and hence, at this stage of the debate, it may be useful to carry out a study of the losses from different points of view, namely the loss to the Government, the public, and the economy.

The loss to the Government is mainly due to the higher interest burden arising from the unnecessary and unwarranted increase in interest rates

Over the past few weeks, a person of high authority has embarked on a mission to stealthily brainwash people through carefully placed comments that no loss has arisen due to the bond scam. One such attempt was the suggestion that the controversial T-bond was carrying a 12.5% coupon rate in the initial offering, and therefore there was no additional cost to the Government since the controversial bond was intended to be issued at that rate!

This preposterous claim was made at a recent TV interview, which would have normally caused some amusement in the financial circles, if not for the major damage that this statement caused to the credibility of the Government, since the person making this outrageous claim would have been definitely aware that such statement was clearly false.

In that background, it is now be necessary for all persons to understand certain terms used in this subject, and in particular, the meaning of two key terms: “coupon rate” and “yield rate”. The “coupon rate”, also referred to as the “interest rate”, is the percentage rate at which investors receive interest from the Central Bank at six-monthly intervals on the “face value” of their bond investments. It is generally fixed, and is specified at the time of the initial issue of a particular bond series.

The Central Bank usually issues bonds by opening a new or an existing series at varying intervals over a period of time, until the total volume of the bonds issued under a particular series reaches an optimum level. That practice is based on the principle that the number of bond series in the market must not be too excessive, as that serves to promote a vibrant secondary market.

A rational number of series also facilitates two-way quotes among primary dealers which is a fundamental requirement for efficient trading in the secondary market. At the same time, it enables debt managers to avoid the undue fragmentation of the bonds issued. The “yield rate” of a bond is the rate of return on an investment based on the market rate prevailing at the time of the issuance of the bond, where such rate would almost always vary from the coupon rate.

When the secondary market “yield rate” is less than the “coupon rate”, an investor will have to pay more than the “face value” of the bond in order to buy the bond. E.g., if the yield rate on a 30 year Treasury bond is 11.1% (including 10% tax), and the coupon rate is 12.5%, an investor, in general, will be prepared to pay a “book value” of approximately Rs. 112 (described as “book value”) to buy the Treasury bond of a “face value” of Rs. 100. That would then provide him with the expected 11.1% for his investment over the 30 year period.

In the same way, if the secondary market yield rate is more than the coupon rate, an investor will, in general, be ready to pay only a “book value” which is less than the “face value” of the bond in order to buy the bond. E.g., if the yield rate on a 30 year Treasury bond is 13.9% (including 10% tax) and the coupon rate is 12.5%, an investor, in general, will be inclined to pay a “book value” of approximately Rs. 90 to buy the Treasury bond of a “face value” of Rs. 100, since the bond would give him the expected 13.9% with a 30 year maturity, at that price.

It is in the above background that the controversial bond of 27 February, which carried a 12.5% coupon rate with 30 year maturity must be considered. On that day, the yield rate that prevailed in the secondary market for a 30 year bond was 9.35% (net of tax) or a yield of 10.4% (with the tax).

In those circumstances, an investor would have been reasonably expected to pay about Rs. 119/30 to purchase a bond with a face value of Rs. 100. However, in a totally unexpected move, which was also contrary to the prevailing policy stance in a falling inflation environment, the Central Bank accepted T-bond bids at yield rates of 12.5% net of taxes, which worked out to a 13.9% yield rate including the tax. By doing so, certain closely connected investors were generously accommodated for issues of bonds, well beyond the originally intended issue of Rs. 1 billion, at a book value of around Rs. 90, when the expected price at that time for a bond of Rs. 100 face value was as high as Rs. 119/30.

This simple arithmetic shows that by accepting bonds at a deliberately bumped-up yield rate of 12.5% (net of taxes) which was significantly higher than the yield prevailing in the secondary market of 9.3% net of taxes, the Government cash flow had suffered a tremendous loss of Rs. 29/16 for each Rs. 100 bond. (i.e. Rs. 119/30, less Rs. 90/17). That loss which was suffered by the Government works out to a phenomenal sum of Rs. 291.6 million for every Rs. 1 billion, and that colossal loss was recorded in relation to the bulk of the bonds that were issued on that day, under this corrupt bond that was issued with gross impunity.

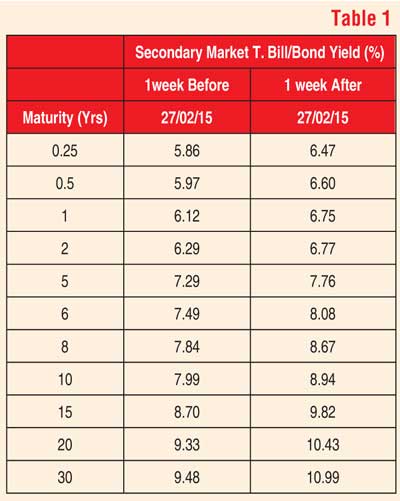

Unfortunately, the loss to the Government did not stop at that point, since the impact of the artificially enhanced interest rate on the controversial 30 year bond had an effect on all subsequent bond issues as well. As is well documented, the interest rates in the Government securities market had been on a clear declining trend from about mid-2014 onwards, and by end-February 2015, the three-month Treasury Bill rate was less than 6%, the one year Treasury Bill rate was around 6.1%, and 30 year Treasury bonds were trading at about 9.35% in the secondary market.

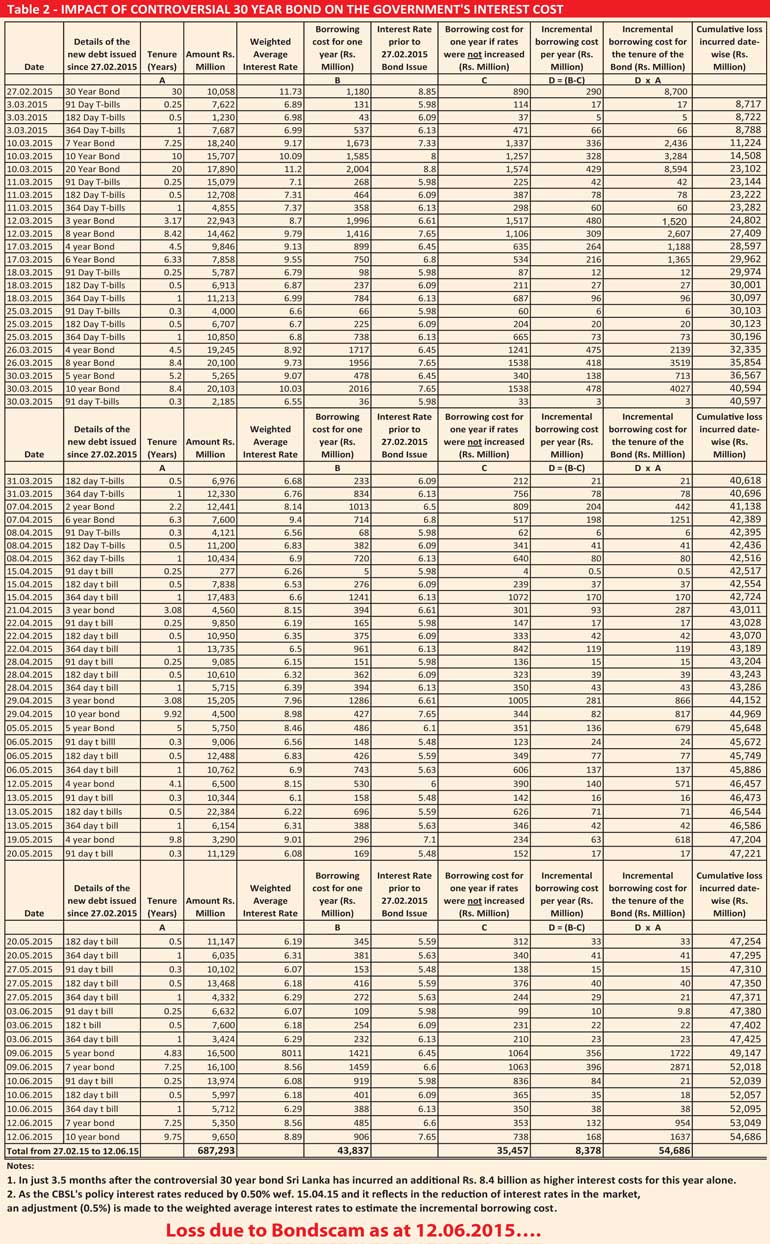

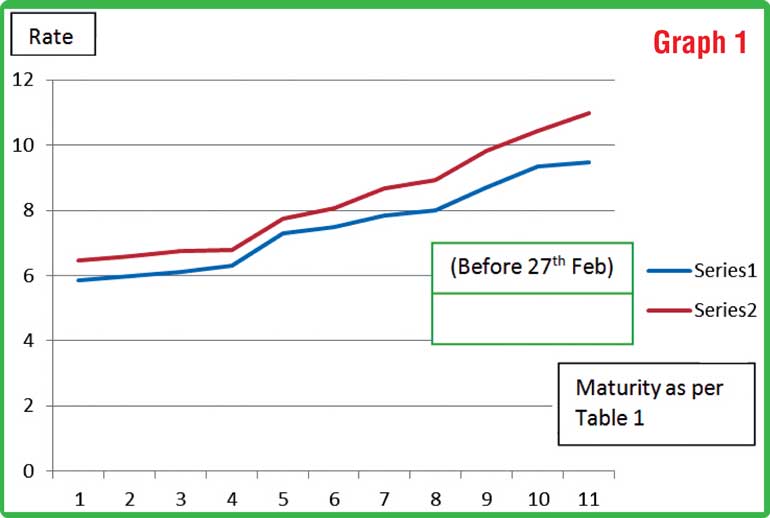

In that scenario, by accepting the 30 year Treasury Bond at 12.5% in highly controversial circumstances, the entire yield rate structure in the Government securities market underwent a significant shift upwards from 27 February 2015 onwards, leading to an unnecessary, unwarranted and unacceptable additional cost in the future interest payments in the Government budget. This situation could be seen clearly in the table depicting the Treasury bill and bond rates prevailing before and after 27 February 2015 (Table 1), as well as in the graph depicting the two yield curves, before and after 27 February 2015. (Graph 1)

Going further, a comprehensive computation based on the pre and post 27 February 2015 interest rates has already been prepared by a keen analyst who had shared it with a few national newspapers in late April. That computation had estimated the loss to the government arising from the additional interest payments in relation to the bills and bonds issued after 27 February 2015, on the premise that the interest rates had been artificially raised after that date.

That computation had been based on officially reported data and a reasonable and logical hypothesis, and is therefore worthy of being used as a guideline. Therefore, the methodology applied in that computation has been followed and applied to the issue of subsequent T-bills and bonds as well in order to prepare a complete statement up to 15 June 2015. That up-to-date computation now reveals the astonishing result that the extra commitment for the government as a result of the increase in the interest rate has now reached a staggering Rs. 55 billion! (Table 2)

The loss to the public due to the unnecessary and unwarranted increase in interest rates

In every economy, the Government securities’ interest rates set the risk-free yield rate benchmark for all other market instruments. It also provides guidance for the pricing of the entire range of financial instruments from over-night bank deposit rates to 10-year prime corporate rates to even 20-year housing loan facility rates to ordinary citizens! As a result of the bond scam, it is now evident that every borrower has had to suffer a premium on the interest payable, since the interest rate equilibrium that prevailed at that time was greatly disturbed, leading to higher costs and greater risk, both individually and as a society.

The cumulative impact and effect of such extra interest to be paid by the public is undoubtedly colossal, and would be in the range of tens of billions of rupees, although a careful study would need to be done to arrive at an accurate estimate of such losses.

The loss to the economy due to the growing erosion of confidence as a result of the scandal

It is an indisputable fact that, if the risk-free bench mark yield curve is artificially corrupted or manipulated, or does not reflect the underlying macro-fundamentals including low inflation, it creates a huge asymmetry in the functioning of financial markets. There will also be a crowding-out effect in the government budget financing, while the loanable funds available for the private sector will be drained. In such circumstances, the private sector, which is expected to make an annual investment of at least 25% of the GDP to generate an annual real GDP growth of around 7.5%, would not be able to do so, and such a situation would eventually have a highly negative impact on employment and other macro-economic variables as well. The resultant instability will lead to loss of confidence amongst investors, who then either postpone their investment decisions, or demand higher premia for their investments.

Ominous signs of such outcomes are now visible in the Sri Lankan economy, with the Sri Lankan Rupee being under pressure, exporters showing reluctance to repatriate their sales proceeds, foreign reserves falling, and a discernable trend of foreign investors leaving the Government Securities Market and the Colombo Stock Exchange. These qualitative and quantitative losses in the economy are significant and far reaching, and a considerable part of that instability could be attributed to the bondscam and massive quantum of negative publicity that had arisen as a result of the scam.

Shedding light

It is hoped that the above narrative and analysis would help shed greater light on this meticulously-planned, multi-faceted and far-reaching scam, which has badly damaged the credibility of the Sri Lankan economy and inflicted the biggest-ever loss. Armed with such information, it is also hoped that those in authority and all other stakeholders would now more confidently raise their voices as a consequence of having better understood its different aspects, components and repercussions.

(The writer is former Governor of the Central Bank of Sri Lanka.)