Friday Feb 20, 2026

Friday Feb 20, 2026

Tuesday, 24 October 2017 00:00 - - {{hitsCtrl.values.hits}}

By Mahendra Amarasuriya

Many articles have been written by economists and other experts analysing Sri Lanka’s economic performance in recent times, and drawing comparisons to the performance during the last regime. As a layman I thought of attempting to make an objective analysis and to suggest some ways forward.

An economy’s performance is assessed on GDP growth, unemployment rate, inflationary tendencies, the value of a country’s currency, Foreign Direct Investments (FDI) and the country’s reserves.

GDP growth

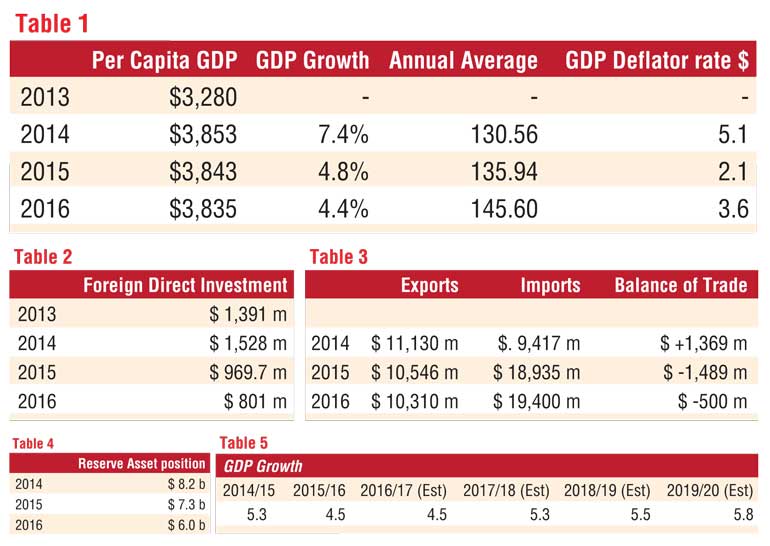

The annual reports of the Central Bank indicates the per capita GDP at net market prices at US$ prices as seen in table 1. (It should be noted that in dollar terms the GDP per capita growth has actually reduced in 2016 marginally. This is mainly due to the devaluation of the Sri Lanka rupee). GDP growth has declined over the last three years.

Sri Lanka has a relatively poor record compared to other developing countries in regard to Foreign Direct Investment (see table 2). This year too I believe there has been no dramatic improvement.

Foreign Investments in the stock market have improved substantially due to a variety of reasons that these are temporary inflows of foreign exchange which can flow out very easily depending on local and global economic trends

Balance of payments

The situation regarding Balance of Payments (see table 3) has also deteriorated over the period. However it is reported that exports have shown a resurgence in the last three to four months and that the balance of trade has improved.

The position regarding reserves (see table 4) has also deteriorated as the Central Bank has been utilising reserves for supporting the rupee and thereby holding it at artificial levels. A policy change appears to have been made not to do so and with the leasing out of the Hambantota port to a Chinese company and it is anticipated the reserve position will improve this year.

General Economic Performance

Judging by the above statistics it is apparent that there has been a gradual deterioration in the country’s performance during the last three years.

This Government inherited a debt-ridden economy from the previous administration. Basically the debt had been created by investing in numerous infrastructure projects such as the Hambantota Port and the Mattala Airport which have been carried out without proper feasibility studies and on the basis of unsolicited projects funded by debt which has resulted in a serious ‘debt trap’, to the extent that almost the entire income of the country is being utilised to service the debt. The total debt inherited by the present Government amounted to approximately 7.4 b.

The new Government which came into power on January 2015 had to fulfil a commitment given during the election campaign of increasing salaries of public servants by Rs. 10,000 each. With a total of around 1.4 million employees this resulted in an additional debt burden of Rs. 14 billion per month or Rs. 168 billion per year which will be a recurring burden, further exacerbating the total debt burden of the country, resulting in the total debt increasing to around Rs. 9.38 billion. The current outstanding debt is estimated to be Rs. 9.3 billion.

Exports

The chances of there being a dramatic increase in exports are very small in a global economy which is perhaps not in a growth phase. Fortunately tea prices have rebounded and we are now receiving the highest prices on record to date, making Sri Lanka tea the most expensive in the world and the sustainability of these high prices is questionable. However, due mainly to the increasing tea prices the export income has increased during the last two months compared to last year.

Production and productivity in the tea plantations have also reduced due to the drought and the ban on the utilisation of glyphosate which has been banned to be imported to Sri Lanka on the assumption that it is the cause of Chronic Kidney Disease (CKD) of unidentified origin. Though the prices have gone up the reduction in production has reduced the potential gain in foreign exchange on tea exports.

Glyphosate was a popular weedicide used extensively for weed control in the plantations and by banning it for not totally justifiable reasons the plantations have been badly affected with weeds growing out of control and the cost of manual weeding been prohibitive and also environmentally not sustainable.

There has been no substantial increase in income from garment exports despite the GSP+ facility being now available and the export income from garments appears to be plateauing.

Tourism

The only industry which seems to be thriving and growing is the tourist industry. Unfortunately the Government’s management of the industry is in question with very poor leadership at the top. It is noteworthy that arrivals have increased to 2,050,832 (14% growth) and foreign exchange earnings have also improved from $.2981 million in 2015 to $.3518 million.

Furthermore the good sign is that earnings per average room night have also increased from $.164.1 in 2015 to $.168.2 in 2016, which may be an indication that tourists are spending more and that we are attracting a higher class of tourists. The master plan for the tourist industry has not yet seen the light of day and appears to be not finalised due to differences of opinion within the Ministry.

Recently a veteran in the tourist industry who rose from the ranks and acquired years of experience and expertise has been moved out and replaced by a reputed private sector former CEO who has no experience of the industry. Ironically the veteran who has moved out is now in charge of a special unit under the Prime Minister and operating from Temple Trees and his task is supposed to be to drive the master plan. Such ad hoc changes cannot give much credibility to the activities of a ministry which appears to have neither the vision nor the foresight to drive the only growth area in Sri Lanka’s economy.

Perhaps the dilemma of the industry is whether to attract more cheap tourists or target higher spending tourists for which purpose the service levels of the industry have to improve to the levels maintained by our competitors like Thailand, Cambodia, Laos and Vietnam. Furthermore in my mind, there is another question mark as to how many tourists the island can really sustain. When you look at the prime tourist attractions like the wildlife sanctuaries, the ancient cities including Sigiriya and Dambulla one wonders whether the existing infrastructure can cope with a substantial increase without having an adverse impact on the flora and fauna of the wildlife sanctuaries and the wear and tear on the other environmental factors, with the present infrastructure.

The Prime Minister in the course of an excellent address at the ‘Future of Tourism Summit,’ projecting the future potential of Sri Lanka’s tourist industry indicated that the target for arrivals would be five million visitors by 2025. I wonder on what basis this target has been fixed because I have my concerns as to whether Sri Lanka can sustain such a high level of tourists.

One other constraint of the tourist industry is the time taken for a visitor to travel to the places of tourist attractions. The airport expressway has reduced the time to travel from the airport but once you exit from the expressway it can take as much time as 30 minutes to reach the city centre depending on the traffic. Similarly it takes only 45 minutes on the southern expressway to reach Galle and another 20 minutes to reach Matara, but to get to the expressway from the city centre can take as much as 45 minutes to one hour and so the reduction in time in travelling to the south is almost nullified.

It is my view that instead of spending enormous sums of money (getting further into debt) on building expressways which take a considerable period to be completed every tourist area should have a good domestic airport to service domestic flights. For instance Katukurunda airport for Bentota, Koggala for Galle, Weeraketiya for the deep south, an airport for the Cultural Triangle and an airport for the Passikudah-Kalkudah areas to which access takes a disproportionate time. Such airports could be developed by being tendered on a competitive basis to the private sector at little cost to the State.

In addition if we create a golf course in every tourist area we can attract the high net worth golf playing tourists who can take a flight directly from the BIA to the tourist area for playing golf as it is well known that in countries like Japan and Korea Golfers sometimes have to travel one to two hours to get to the nearest golf course available. It is also reported that golf enthusiasts charter flights from the developed world to destinations in developing countries to enjoy golf holidays.

There is another category of tourists we can attract and that is the sector which would like to use Sri Lanka as a conference centre. It is referred to MICE (Meetings, Incentives, Conferencing, Exhibitions). This sector requires large conferencing facilities with perhaps a conference hall which can accommodate 10,000 people together with smaller units with the same facility for break up groups. This concept has been on the drawing boards for a long time but not implemented. A suitable location can be found off the airport express highway where such a facility could be built together with a luxury hotel to accommodate the participants with relatively easy access to Colombo. A location around the Coconut Triangle may perhaps serve the purpose.

Yachting is also a popular hobby of the rich and some of them spend almost their whole life yachting around the world. Presently hundreds of yachts call over at the Galle Harbour where they are provided with basic facilities. A yacht marina using part of the Galle Harbour would attract thousands of new tourists. Such a yacht marina should be one of the priorities for tourism in the Southern Province. I observe that the new Port City also has provisions for a yacht marina which will be a further attraction for this unique class of tourists.

While we see small countries like Macedonia and Croatia in addition to extensive promotion by Thailand, Malaysia and Indonesia by advertising very effectively on CNN with alluring information regarding their beautiful tourist locations, Sri Lanka has no publicity of this nature. I wonder whether the master plan will incorporate such publicity.

Foreign Direct Investment

Sri Lanka receives foreign investment mainly from expatriate workers, many of them women who toil and labour under almost harrowing conditions to send their savings back to their loved ones’ back home. Due to the oil prices declining the employment opportunities have reduced and expatriate remittances have also reduced somewhat and does not appear to show a turnaround unless oil prices increase.

There has been considerable interest in the Colombo share market as a result of which considerable foreign investments have taken place. It is however well known that such investments can move out very quickly when more attractive destinations are identified.

The actual level of Foreign Direct Investment in the Sri Lankan economy has been appalling when comparing with the FDIs flowing into countries like Vietnam, Cambodia, Burma and Laos. There are many reasons for the shortfall in foreign investments to our country, identified as mainly due to political uncertainty, lack of a definite policy for attracting Foreign Direct Investments and no special attraction for FDIs in a country with a population of around 21 million with a per capita income of around $ 3,900. Obviously the internal market is far from attractive and we can only attract FDIs if we can operate as a stepping stone as exports to India and other South Asian and other South East Asian economies.

Export promotion strategy

An article in the Daily FT on ‘National Strategy towards Export Promotion,’ states, revival of exports needs farsighted yet practical strategies with stakeholder consensus. The link between export growth and economic growth is highly debated in economic literature. Although the common notion is that there is a bidirectional relationship between the two, this relationship has not been seen in relation to Sri Lanka. This was experienced between 2000 and 2016, wherein GDP grew by a Compound Annual Growth Rate (CAGR) of 10.4% while exports grew by only 4% (CAGR). Sri Lanka’s economic growth during the recent past has mainly been pushed by the expansion of domestic demand rather than increased exports.

The high level of economic growth witnessed during the period 2005-2012 which was mainly due to the expansion in domestic demand started to stagnate within a 4.5% band from 2013 onwards, emphasising that external demand is paramount for a sustained base of economic growth in a small economy like Sri Lanka. The widening trade and current account deficits and an increased reliance on unsustainable levels of foreign borrowings were an inevitable consequence of growth which was dependent on non tradeables and domestic demand. This provides compelling evidence that comprehensive strategies, which focus on the promotion of high value exports are essential to achieve a sustainable external current account balance and high growth.

Vision 2025

The Unity Government released its newest economic policy statement titled ‘V2025,’ the author of which was the Prime Minister.

According to the well-known Economist W.A. Wijewardena, quote, “This was the fourth of such statements which it placed before the people during the last two-year period. The first statement was incorporated in the manifesto of the UNP when it sought power at the general elections in August 2015. Then three months after the elections a comprehensive policy statement was delivered by the PM in early November 2015 two weeks before the 2016 Budget by his Minister of Finance. Almost all the promises relating to the economy which were made in the manifesto were represented in the first policy statement in addition to some new policies supposedly needed for elevating Sri Lanka to reach middle income country status over the years. However the Budget presented two weeks later was out of alignment with the goals set in the statement. A third policy statement was presented in October 2016 by the PM which focused on how Sri Lanka should get itself integrated into the World economy in a bid to expand its export base. Now after about 11 months another policy statement has surfaced two months before the presentation of Budget 2018. This policy statement once again appears to be an over optimistic one with hardly realisable optimistic growth targets.”

An article by Prof. Srimevan Colombage in another newspaper of 18 September, it is argued that these targets appear to be far too optimistic: “According to him the Vision 2025 states that the aim is to raise per capita income per year in three years’ time to $ 5,000 per year, create one million jobs, increase FDI to $ 5 billion per year and double exports to $ 20 billion per year. These inter mediate targets are supposed to lay the foundation for Vision 2025; Sri Lanka to become an upper middle income country.

“Presently the country’s per capita income is around $ 4,000. In order to reach the projected per capita income of $ 5,000 as envisaged in V2025, the GDP growth rate should be at least 8% a year in the next three years, compared with growth rate of 4.4% realised last year and 4.7% estimated for this year. In other words GDP growth rate should all most double from the present low growth trajectory. The country will reach upper middle income category by 2025, according to this document. This means that per capita income should be over $. 2,000 by that year implying a fourfold increase from the present level. In order to attain that target, GDP should grow by at least 15% annually during the next eight years. This is more than a threefold increase of the present GDP growth rate which is running at around 4.5%.

“It is miraculous to expect such swift growth within a short time span of three to eight years. The average GDP growth rate achieved throughout the last four decades following the liberalisation of the economy in 1977 is only 5.1% a year. The country’s potential growth remains only around 4 to 5%. The reason is that Sri Lanka has failed to move from its traditional factor driven growth model to technology driven growth model unlike the fast-growing East Asian economies. Hence, raising the GDP growth to 8% as envisaged in the new document does not seem to be feasible.

“More importantly the GDP growth predictions implied in the Vision document are far above those that can be found in the staff report of the IMF for the second review of the Extended Fund Facility concluded in June 2017. The annual growth projection presented in that report (compiled in consultation with local authorities) for the period 2018 to 2021 is only 5.0% which appears to be more realistic. If we use these figures the maximum per capita income that could be reached in 2020 will be around $ 4,600 which is lower than the level envisaged in the Vision.”

Prof. Colombage goes on to state: “The export projections are over-ambitious. Doubling of annual export earnings from the present level to $ 20 million as expected in V2025, will require an annual export growth rate of at least 25%. Again it contradicts with the official projections given in the IMF report which forecasts an annual export growth of only about 5% for the next four years. It is illusive to expect doubling of export earnings, considering the dismal performance of the export sector in recent decades.

“Although industrial exports account for nearly 80% of export earnings, Sri Lanka still depends on low value added, low tech and labour intensive basic industries, mainly garments, which account for almost one half of total export earnings. Other industrial exports consisting of food and beverages, rubber and leather products, machinery and transport equipment and petroleum products too are primary level industries.

“The East Asian countries by contrast, phased out such primary industries decades ago and diversified their industrial structure towards high tech products such as electronic and electric equipment, vehicles, computers, ships, medical apparatus and optical and scientific equipment.

“Given our traditional and static industrial structure, a miraculous growth in exports cannot be expected in the next few years. The much talked about achievements such as GSP+ or the planned Free Trade Agreements like the Economic and Technical Corporations Agreement (ETCA) with India, can do very little to boost the export sector. The reason is that export constraints arise mainly from domestic factors rather than from limited marketing opportunities abroad.

“Foreign Direct Investment (FDI) is expected to rise to $ 5 billion per year during the next three years according to the intermediate targets of V2025. This seems to be a gross exaggeration as the official projections given in the IMF report indicates FDI inflows of only around $ 1 billion per year over the period 2018-2021.

“A five-fold increase in FDIs cannot be expected given the unfavourable domestic conditions and the global capital market developments. Domestic factors such as macroeconomic disarrays political instability, poor business confidence and corruption have made severe dents in the country’s image in front of foreign investors. Meanwhile inward remittances from migrant workers have been declining in recent months worsening the balance of payment situation.

“In the circumstances the Government will be compelled to depend on foreign borrowings on commercial terms to carry out the huge infrastructure projects such as the Central Highway. In the circumstances the reduction in the debt burden as envisaged in V2025 is doubtful.”

Conclusion

1.Reduction of unnecessary wasteful expenditure by the State by:

a)Pressurising the Minister of Agriculture who is a powerful personality in the SLFP and in the Yahapalana Government to occupy forthwith the large building on Parliament Road constructed by D P Jayasinghe & Company which I believe he has leased out around two years ago at an enormous lease rent but not yet occupied the building

b)According to newspaper reports the budget of the President has been increased by 50% and the budget of the Prime Minister by 30% compared to last year. In my opinion such increases in expenditure cannot be justified in a debt-ridden economy which is showing hardly any signs of progress

c)While top brands of cars and vehicles such as Mercedes Benz, BMW, Range Rover, Volvo, etc. are idling in Government yards supposedly due to lack of repairs, the State is spending valuable resources in importing luxury vehicles for the Cabinet Ministers and other members of Parliament. Instead a proper survey should be made of the vehicles in the Government yards by requesting the Agents and Distributors to inspect the vehicles and provide estimates for repairing and making them road worthy. As Finance Minister you can even make a request for these vehicle agents to repair and make these discarded vehicles road worthy to be used for State purposes without cost to the State

d)Take strong measures to reduce losses in SOEs where uncontrolled expenditure is further increasing the monumental losses incurred by many of them

2.The World Bank’s latest prediction states that Sri Lanka is to grow slowest among key South Asian Nations; see projections in table 5.

3.The latest Central Bank data showed remittances from Sri Lankan expatriates particularly falling by about a record 10% to $ 556.6 million compared to 2016. Further remittances declined by 6.3% cumulatively for the first eight months to $.4.5 million year on year. Unfortunately this is an indication of the potential for inward remittances from the Middle East showing a declining trend.

4.A ministerial spokesman very close to the PM has stated that “things are happening”. He has claimed that the revamped BOI has been tasked to raise FDIs to $ 1.6 million in 2016 and over $ 2 billion in 2019. The tourism sector has been challenged to have earning of $ 7 billion by 2020. These are indeed bullish projections, which if achieved will be very beneficial to our economy. However it is necessary “to walk the talk”.

5.This Government criticised the previous one for carrying out infrastructure projects like Hambantota Port and Mattala Airport on borrowed money with hardly any return. However they are going ahead with another huge infrastructure project, the central expressway once again borrowing perhaps on commercial terms. This will only further exacerbate the monumental debt burden without providing returns to service such debts especially in the context of the total Government revenue being hardly sufficient to service the debt burden.

6.The Government has claimed recently that they have increased revenue by increases in indirect taxation. This has unfortunately burdened the poor masses who have to pay the price in their daily living which is unbearable. The Government strategy to widen the tax base is timely as there are many individuals like doctors, lawyers, tuition masters, traders and many entrepreneurs who are not declaring their correct accessible income and evading taxes. The strategy to register the national Identification number on every invoice and transaction will hopefully bring into the tax net this high earning non tax paying wealthy individuals.

7.Although a top Government spokesman recently claimed that the Government has overcome the debt trap and is on the way to ushering an era of growth, this I believe is an unproven and dangerous fallacy unless the Government is trying to reduce the debt burden by selling the “family silver”.

8.Unless the Government focuses on the immediate future to increase production and productivity, bring down the cost of living, reduce the luxurious lifestyle of the huge Cabinet and get down to working at grass root levels there can be no salvation from increasing the debt trap further.